Jiangsu Jicui Yaokang Biotechnology Co., Ltd. (abbreviation: “Yakang Bio”, stock code: “688046”) was listed on the Science and Technology Innovation Board today.

The issue price of Yaokang Bio was 22.53 yuan, 50 million shares were issued, and the total amount of funds raised was 1.127 billion yuan.

The opening price of Yaokang Bio was 20 yuan, down 11.23% from the issue price; since then, the stock price has fallen further. As of now, the company’s market value is 7.7 billion yuan.

Founded in 2017, Jicui Yaokang is an enterprise specializing in the research and development, production, sales and related technical services of experimental animal mouse models. Based on the experimental animal creation strategy and genetic engineering genetic modification technology, it provides customers with independent intellectual property rights. Commercial mouse model.

At the same time, Jicui Yaokang provides one-stop services such as model customization, customized breeding, and functional drug efficacy analysis to meet customers’ needs in basic research and new drug development fields such as gene function cognition, disease mechanism analysis, drug target discovery, drug efficacy screening and verification, etc. related needs of experimental animal mouse models.

The company has sold about 60 mouse models in the past year, mainly involving immune-deficient mice, humanized mice, and mouse diseases such as diabetes, atherosclerosis, and Alzheimer’s that can be used for tumor efficacy research. Model.

According to the prospectus, Jicui Yaokang’s revenue in 2018, 2019, and 2020 was 53.29 million, 193 million, and 262 million, respectively; the net profit was -6.0355 million, 34.734 million, and 76.43 million respectively; It is 10.3967 million yuan, 33.725 million yuan and 66.46 million yuan.

Jicui Yaokang’s revenue in the first half of 2021 was 178 million yuan, and its net profit after deduction was 38.269 million yuan.

During the reporting period, the government subsidies confirmed by the company as current profits and losses were 9.55 million, 21.908 million, 37.3489 million and 8 million respectively, and the cumulative amount accounted for 40.65% of the total profit during the reporting period.

Yaokang Bio’s revenue in 2021 is 394 million yuan, an increase of 50.35% over 2020; the net profit attributable to shareholders of the parent company is 125 million yuan, an increase of 63.45% over 2020; non-net profit deducted is 77.56 million yuan, compared with 2020 Annual growth of 16.70%.

Yaokang Bio’s revenue in July-December 2021 was 215 million yuan, an increase of 38.84% compared with July-December 2020; the net profit attributable to shareholders of the parent company was 78.5861 million, an increase of 93.61% compared with July-December 2020; The deducted non-net profit was 39.29 million yuan, a decrease of 9.25% from July to December 2020.

CDH Hillhouse Sequoia is a shareholder

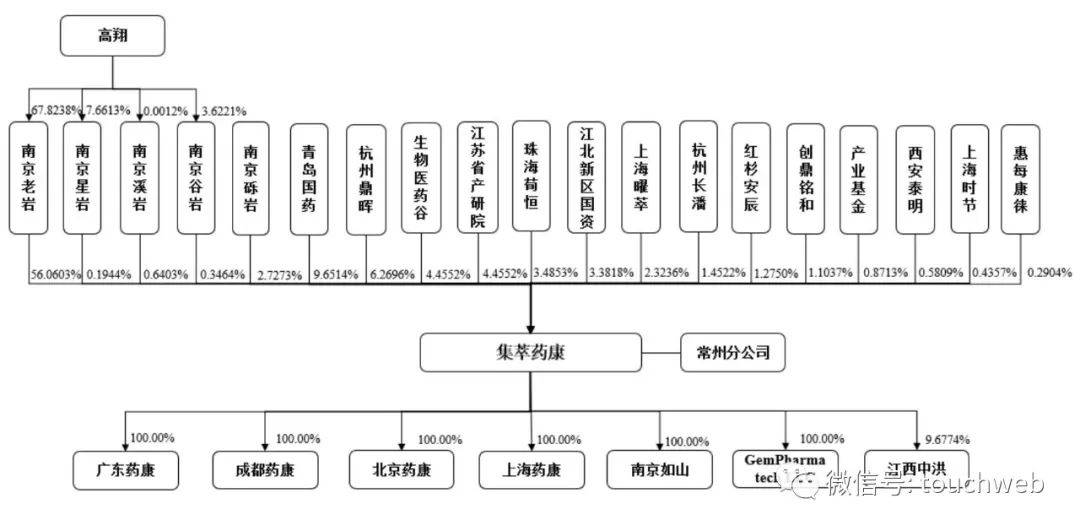

Before the IPO, the controlling shareholder of Jicui Yaokang was Nanjing Laoyan. As of the signing date of this prospectus, Nanjing Laoyan held 56.0603% of the shares of Jicui Yaokang.

The actual controller of Jicui Yaokang is Gao Xiang. During the reporting period, Gao Xiang has been the chairman of Jicui Yaokang and the executive partner of Nanjing Laoyan, the controlling shareholder.

Gao Xiang through the controlling shareholders Nanjing Laoyan (holding 56.0603% of the shares of Jicui Yaokang), Nanjing Xiyan (holding 0.6403% of the shares of Jicui Yaokang), Nanjing Guyan (holding 0.3464% of the shares of Jicui Yaokang), Nanjing Xingyan (holding 0.1944% of the shares of Jicui Yaokang) indirectly holds 38.0497% of the shares of Jicui Yaokang.

Gao Xiang also serves as the managing partner of Nanjing Laoyan, Nanjing Xiyan, Nanjing Xingyan and Nanjing Guyan. In summary, Gao Xiang indirectly holds a total of 38.0497% of the shares, and controls a total of 57.2414% of the voting rights of the shares.

Qingdao Sinopharm holds 9.6514%, Hangzhou CDH holds 6.2696%, Biomedical Valley and Jiangsu Institute of Industry and Research hold 4.4552% respectively, and Zhuhai Xunheng, a subsidiary of Hillhouse, holds 3.4853%;

Jiangbei New Area state-owned assets hold 3.3818%, Nanjing Conglomerate holds 2.7273%, Shanghai Yaocui holds 2.3236%, Hangzhou Changpan holds 1.4522%, and Sequoia Anchen holds 1.2750%.

Sequoia China is the B-round investor of Jicui Yaokang. Cao Yibo, managing director of Sequoia China, said: “Through the efforts of 1,578 days after its establishment, Jicui Yaokang has developed nearly 20,000 different animal models to help source innovation. And successfully IPO today. I hope that the company will have more abundant resources from this, so that its products and services can further help future research and development.”

After the IPO, Nanjing Laoyan holds 49.2237%, Qingdao Sinopharm holds 8.4744%, Hangzhou CDH holds 5.5050%, and Biomedical Valley and Jiangsu Institute of Industry and Research hold 3.9112% respectively;

Zhuhai Xunheng holds 3.0603%, Jiangbei New Area state-owned assets hold 2.9694%, Nanjing Conglomerate holds 2.3947%, Shanghai Yaocui holds 2.0402%, Hangzhou Changpan holds 1.2751%, and Sequoia Anchen holds shares is 1.1196%.

———————————————

Lei Di was founded by senior media person Lei Jianping. If you reprint, please indicate the source.Return to Sohu, see more