On the evening of March 3, Beijing time, Bilibili (hereinafter referred to as “Bilibili”) announced its unaudited financial reports for the fourth quarter and full year ended December 31, 2021. According to the financial report, the total revenue of Station B in fiscal 2021 will reach 19.38 billion yuan, a year-on-year increase of 62%. Among them, revenue in the fourth quarter increased by 51% year-on-year to 5.78 billion yuan.

In the fourth quarter, the average monthly active users of station B reached 272 million, and the average monthly active users of mobile terminals reached 252 million, an increase of 35% over the same period in 2020. The average daily active users reached 72.2 million, an increase of 34% year-on-year. The average monthly paying users of station B increased to 24.5 million, an increase of 37% year-on-year, and the payment rate increased to 9.0%.

From the perspective of revenue structure, in Q4 2021, the revenue of mobile games, value-added services, advertising, e-commerce and other businesses of Station B will be 1.295 billion, 1.894 billion, 1.587 billion, and 1 billion, accounting for 22% and 33%, respectively. , 28%, 17%.

However, station B still lost money. The financial report showed that the net loss of station B in the fourth quarter was 2.09 billion yuan, an increase of 147% year-on-year and a decrease of 22% month-on-month, showing a narrowing trend.

In the earnings conference call, Fan Xin, Chief Financial Officer of Station B, said: In 2022, Station B is confident that, on the premise of maintaining healthy user growth, by increasing the monetization rate of a single MAU and controlling operating expenses, it will start the full-year non-profit in 2022. -GAAP (non-GAAP financial measure) operating loss ratio narrowed year-on-year, with a mid-term target of non-GAAP breakeven in 2024.

In the financial report, Station B made an outlook for the revenue in the first quarter of 2022, which is expected to reach 5.3 billion to 5.5 billion yuan.

Growth and profitability are difficult

In the fourth quarter, the average monthly active users of station B reached 272 million, a year-on-year increase of 35%. Combing through the financial reports of station B in the past three years, it can be seen that the average monthly active users of station B have been increasing steadily, but since the first quarter of 2020, the monthly average of station B has been increasing. The growth rate of living has begun to slow down, but the overall growth trend remains above 30%.

In terms of revenue, the revenue of station B in Q4 reached 5.78 billion yuan, an increase of 51% year-on-year and a month-on-month increase of 10.9%. In addition, the number of paying users of station B in Q4 increased by 37% year-on-year, exceeding the growth rate of MAU. The quality of customer acquisition is good. As of December 31, the number of large members of station B reached 20.1 million, a year-on-year increase of 39%.

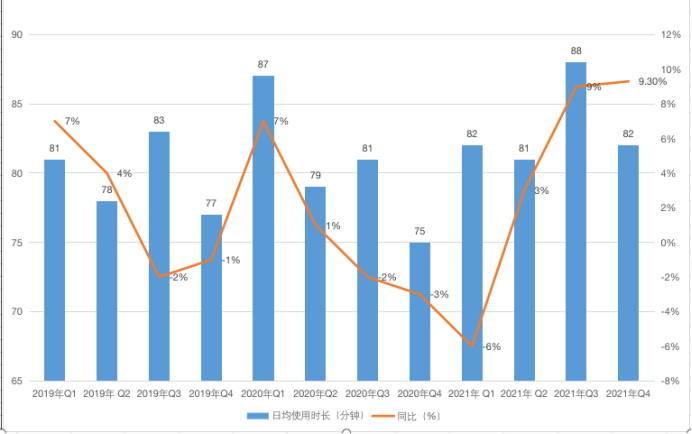

Looking at user stickiness, the fourth quarter financial report of Station B shows that the average daily usage time of users is 82 minutes. Looking at the average daily usage time of users of Station B in the past three years, Station B has walked out of a “W”-shaped broken line, and the entire 2021 showing a steady upward trend. In addition, in the fourth quarter, the average monthly active UP masters of Station B reached 3.04 million, a year-on-year increase of 58%, and the average monthly contribution reached 10.88 million.

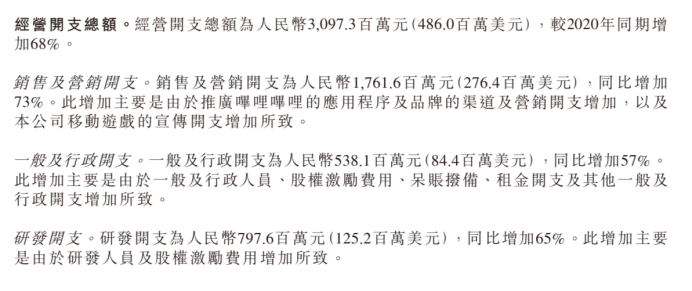

However, in order to maintain growth, station B also paid a “price”. The financial report shows that in Q4 2021, the total operating expenses of station B will be 3.097 billion yuan, of which sales and marketing expenses are still 1.76 billion yuan, accounting for 57%. Station B explained that the main purpose of this expenditure is to promote its applications and increase its brand marketing expenses, as well as the promotion expenses of mobile games.

Although the net loss in Q4 in 2021 has narrowed month-on-month, it is still as high as 140% year-on-year. And only in 2020 and 2021, the cumulative net loss of station B will reach 9.844 billion.

As a content interest community, to maintain user stickiness and growth, it is necessary to increase investment in content. According to Qichacha, there will be about 30 investment events in Station B in 2021, including the wholly-owned acquisition of You Yaoqi and Dream Animation.

Regarding the 600 million acquisition of a demonic original comic platform at Station B, many people questioned that it was “not worth it”. Because the demon spirit at that time has been “delayed” by Aofei Entertainment for 6 years, although it has popular IPs such as “100,000 Cold Jokes” and “Soul Street”, due to the lack of operational capabilities, before being acquired by station B, there was a demon spirit. It has lost millions of dollars year after year.

On the second day after the public acquisition, Station B held the “2021-2022 Guochuang Animation Works Conference”, and released 49 films including “Three-Body Problem”, “Five Elements in Wushan, Xichuan Magic Purple Forest”, and “Blessings of Heaven Officials 2”. Animation, and announced that there will be continuous new adaptation and development of 13 comic works such as “Street of the Soul”, “One Hundred Thousand Bad Jokes” and “Terminal” under the banner of Yaoqi.

It can be seen that the acquisition of IP adaptation and creation rights is an important reason why the acquisition of Bilibili has a demonic spirit.

In addition to the layout of animation, in the past three years, station B has also produced 18 variety shows, of which “Dancing Millennium”, “90 Dating Agency” and “Summer of the Eaves” will all be produced and broadcast in 2021. In November last year, Station B held the first documentary press conference, announcing that 21 documentaries would be launched.

These investments are necessary at least in Station B’s view. However, the investment in OGV content may also increase losses due to the high cost.

Chen Rui once made a plan for station B to reach 220 million monthly activities in 2021 and 400 million in 2023, but as of the fourth quarter of last year, the monthly activity of station B has not exceeded the 300 million mark.

At yesterday’s financial report meeting, Chen Rui once again said that in 2022, the company’s strategy will still revolve around growth, including user growth and revenue growth. “In the past, a balance of our energy allocation between user growth and revenue growth was seven to three, that is, user growth accounted for 70%, and revenue growth accounted for 30%. In this year’s work plan, we will adjust the allocation ratio, we will five 50% means that 50% of the energy is spent on user growth, and 50% of the energy is spent on revenue growth. Revenue growth will become a more important task this year than it has been in the past.”

This statement is to a certain extent to maintain market confidence. Due to long-term losses, since March last year, the stock price of Station B has begun to fluctuate. As of yesterday’s close, the US stock price has dropped from a high of more than $100 to $30.16 per share.

The game business relegated to the third place, and advertising has become a new growth engine

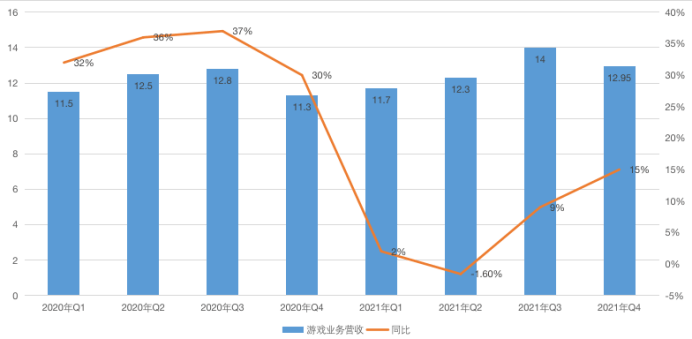

The proportion of game revenue of station B has dropped from over 80% at the time of listing to 22% today, and its contribution rate to revenue has dropped to third. This is the result of year-by-year adjustments at station B. With the tightening of the game version number in the big environment, it is also a wise move to reduce the reliance on the game business.

But running out of the original comfort zone and maintaining growth is not easy. Throughout the past two years, the growth of some businesses at station B has been weak. Throughout 2021, the revenue of the game business at station B will hover around 1.2 billion. Among them, the game business revenue in the Q2 quarter of 2021 decreased by 1.6% year-on-year.

Station B is naturally aware of this problem and has increased the development of self-developed games. In August last year, 16 games were released in one go at the launch of new games at Station B, 6 of which were self-developed games.

In addition, in the past year, station B has also continuously invested in the game business. It has successively invested in nearly 20 game companies such as Xinxin, China Mobile Games, and Celadon Digital. Among them, the total investment in Xinxin and China Mobile Games cost about 1.6 billion yuan. Hong Kong dollar.

Now it seems that these measures are worthwhile. In Q4 2021, the game business revenue of station B will increase by 15% year-on-year.

As for why it attaches so much importance to games, according to Chen Rui, “Bilibili does not use it as a means of monetization when making games, but when the content of the game is done well, it will naturally be able to be commercialized.” He gave an example. For example, games have always been the top three categories in the video field, and have always been the number one category in the live broadcast field.

That is to say, games are an important content supplement and source of inspiration for the video ecosystem of Station B.

Compared with games, the advertising business has become a new engine for the growth of Bilibili. The prospectus shows that in 2021 Q4 Bilibili’s advertising business revenue will reach 1.587 billion, a year-on-year increase of 120%. The annual advertising business revenue reached 4.52 billion yuan, a year-on-year increase of 145%.

Among the four carriages of revenue at station B, although the advertising business is not the biggest contributor, it is the fastest growing, with a growth rate of over 100% for 7 consecutive quarters. The form of advertising is mainly content advertising. The official logic of station B is “good content can also be good advertising, and good advertising can also be good content.”

In December last year, Station B launched a commercial middle-office system called “Brand Bank”, which includes a commercial traffic management system, an advertising system, and the UP main commercial cooperation platform Huahuo.

At the financial report meeting, Chen Rui reiterated the role of breaking the circle, “As users break through the circle, more and more industry advertisers will find us. For example, it used to be games, 3C, and later became food and beverages, and became Beauty and beauty, in the last year and this year, industries like automobiles will also become key advertisers. Last year, in Q4, automobiles became the top five advertiser industries at station B, which is closely related to the process of users breaking the circle. “

However, as an interest community, the scale of advertisements is limited. At present, the Ad load (ad load rate) of Station B is about 5%. In February last year, Chen Rui said that Ad load would not be increased in 2021. In the future, Bilibili still needs to strike a balance between user experience and advertising scale.Return to Sohu, see more