Elon Musk, the world‘s richest man and Tesla CEO, is in a lawsuit after announcing the termination of its acquisition of Twitter.

The latest report says that Twitter has hired a heavyweight M&A law firm to sue Musk in response to its unilateral announcement to terminate its acquisition of Twitter. According to sources, Twitter will file a lawsuit against Musk in the U.S. Supreme Court of Delaware earlier this week to enforce the deal.

From Musk’s “strong buy” to Twitter’s “strong sell”, the deal has gone through many twists and turns in the past three months, making the acquisition look like a “farce”.

Feng Yueping, a senior partner of Beijing Jingshi Law Firm, said in an interview with Sohu Technology that Twitter has a good chance of winning, and the Bo court is just a means for Twitter to counter Musk, and the final result is still The two sides need to sit down and talk, and the core is whether Twitter is willing to sell at a lower price.

On Friday, local time, Musk officially announced that he would terminate the acquisition of Twitter, citing “Twitter made false and misleading statements and materially violated multiple terms of the agreement.”

In a letter to Twitter’s chief legal officer Vijaya Gard, Musk’s lawyers explained the specific reasons for the termination of the acquisition. The lawyer said Twitter played down the number of bots and spam accounts on the platform, but the available information proved that the number of fake Twitter accounts now far exceeds the number of the company’s external claims.

“For nearly two months, Twitter has not provided the information that Musk requested.” Musk’s lawyer said that the inaccurate information provided by Twitter in a disclosure document to the SEC could become the termination of the merger agreement. additional basis.

Musk also called Twitter’s failure to conduct normal business operations, with hiring freezes, firing of senior leaders and other major departures, a “major move” to the merger agreement that the company did not have parent company consent to its business changes. violation”.

With the announcement of the termination of the acquisition, it means that Musk needs to pay a “breakup fee” of $1 billion. According to a previous acquisition agreement between Musk and Twitter, the breaching party would pay the other $1 billion if the deal breaks down. In the acquisition agreement signed by the two parties, there are clauses that allow Twitter to force Musk to execute the transaction.

Therefore, Twitter also has the confidence to fight back hard. Twitter’s board chairman, Bret Taylor, said that Twitter’s board still hopes to complete the transaction on the previously determined acquisition and terms and plans to take legal action to enforce the merger agreement, adding that it is “confident that it will prevail in the Delaware Supreme Court.” .

Feng Yueping analyzed that it is necessary to lose money if the business cannot be negotiated. This clause is actually unreasonable, but since the two parties have reached an agreement, it means that the acquisition must be completed, and the various behaviors of Twitter this time show that it has been done. Plan to sell the whole thing. Therefore, the lawsuit is just an illusion, and its real purpose is to raise the price.

He said the wording in the Twitter deal would not allow Musk to back out due to deteriorating business conditions, such as declining ad demand, or a slump in Twitter’s stock price. Musk also waived his right to conduct due diligence in negotiations to get him to accept his “best and final” offer as much as possible, making it harder for him to argue Twitter in court. misled him.

According to the report, Twitter hired a powerful American law firm Wachtell, Lipton, Rosen & Katz to “challenge” Musk. The law ranks first in the US law firm list all the year round, and the famous “poison pill plan” was invented by its founding partners.

Musk didn’t sit still either, hiring Quinn Emanuel Urquhart & Sullivan to deal with it. The law firm helped Musk successfully defend a defamation charge in 2019 and is representing Tesla in a failed take-private lawsuit.

If the two sides eventually go to litigation, it will be a protracted tug of war. Regardless of the end result, Musk clearly can’t get away with it. Feng Yueping believes that under the current circumstances, Twitter and Musk are almost certain to go to court against Bo and ask him to pay at least $1 billion. “At the moment, Twitter is more likely to win.”

The focus of the controversy is the proportion of fake users

The proportion of Twitter’s fake user data was at the heart of the dispute over the acquisition. Musk said the number of fake and spam accounts was critical to Twitter’s business and financial performance, had a “material adverse effect” and therefore intended to terminate the acquisition.

“Musk has repeatedly asked Twitter to provide data on fake and spam accounts, and the relationship between these accounts and mDAU (the number of realizable users), with the purpose of making Musk and his advisers responsible for the existence of fake and spam accounts on Twitter. Twitter has failed to provide extensive data and information to respond independently,” Musk’s lawyers said.

This controversy will go back to 3 months ago. In April of this year, after becoming the largest shareholder, Musk proposed to buy Twitter for $54.20 per share. “My offer is my best and final offer, and if it is not accepted, I need to reconsider my position as a shareholder,” Musk said at the time.

The acquisition didn’t initially appeal to Twitter, and Twitter’s directors considered a “poison pill” counterattack. At the time, market analysts believed that Musk’s offer to Twitter was too low, and it was doubtful whether it could raise enough cash for the acquisition. But less than two weeks later, Musk finally reached an agreement with Twitter’s board of directors for a deal valued at about $44 billion (still $54.2 per share) and expected to close within this year.

Subsequently, the deal did not progress smoothly, and the proportion of false users of Twitter became Musk’s knot. Musk has mentioned many times that the acquisition of Twitter is to eliminate the spam, spam accounts and zombie army on Twitter, and to make Twitter better.

Musk acquires Twitter core node

Twitter’s earlier financial report showed that its mDAU (the number of realizable users) in the first quarter reached 220.9 million, a year-on-year increase of 15.9%. After the company’s internal review, it is estimated that false accounts account for less than 5% of the overall mDAU. But Musk insisted that the proportion of Twitter users with fake accounts is higher than the data published by Twitter.

He once said at a conference that fake users account for at least 20% of all Twitter users, and as high as 90%. It is understood that Musk’s calculation method is to randomly select 100 fans as a research sample, which has been criticized as “stupid” and not scientific.

To this end, the Twitter CEO also released more than a dozen tweets detailing how Twitter calculates the number of bot accounts, and said that he shared the estimation process with Musk. This did not persuade Musk, but instead repeatedly said that it would put the acquisition of Twitter on hold. “Unless Twitter provides evidence of the proportion of its fake users, the deal cannot go forward.”

Twitter had previously intentionally made concessions after being threatened to cancel the acquisition. It was reported earlier that Twitter is considering giving Musk access to the full original database “Firehose”. The database is able to display information about the more than 500 million tweets posted on the platform every day, including account information, real-time records of tweets, and the device users are using to tweet.

In just three months, Musk’s attitude has changed many times, from taking Twitter firmly, to threatening to suspend the transaction, to finally abandoning the acquisition, which made Twitter finally resort to the law. As for the proportion of fake users, the two sides have not reached an agreement after many times of tug-of-war.

Musk is playing tricks and wants to negotiate low prices?

Many people believe that Musk has been holding on to the problem of the proportion of fake accounts on Twitter, which is “the drunkard’s intention is not the wine.” Columnist and former Goldman Sachs investment banker Matt Levine believes in an interview with the media that the junk account is not the reason why Musk pulled out of the deal, because solving the junk account is the reason why he bought Twitter.

“He has produced no evidence at all that Twitter’s estimates are wrong, or that they are materially wrong or deceptive.” So it may be difficult for Musk to take advantage of the issue to get out of an acquisition, while So far, Delaware courts have heard only one case involving a “material adverse effect.”

In an interview with Sohu Technology, Jiang Han, a senior researcher at Pangu Think Tank, said that the core reason for Musk’s continuous release of “smoke bombs” or negative news was that he had previously offered Twitter a higher purchase price in order to persuade investors to sell Twitter to himself. However, after having a certain acquisition foundation in the market, Musk, as a very shrewd businessman, these actions cannot be simply understood as an excuse to find fault or say that he does not want to acquire, but to reduce market expectations through a series of strategies, thereby reducing acquisition costs.

At the end of May this year, after Musk announced the suspension of acquisitions, Twitter shareholders also said in a class-action lawsuit against Musk that its actions, such as the inaccurate number of Twitter spam accounts, were designed to raise suspicions about the platform and lead to Twitter The stock price fell to create leverage that Musk hopes to pull out of the acquisition, or renegotiate the purchase price, which could be cut by up to 25%, ultimately reducing the purchase price by $11 billion.

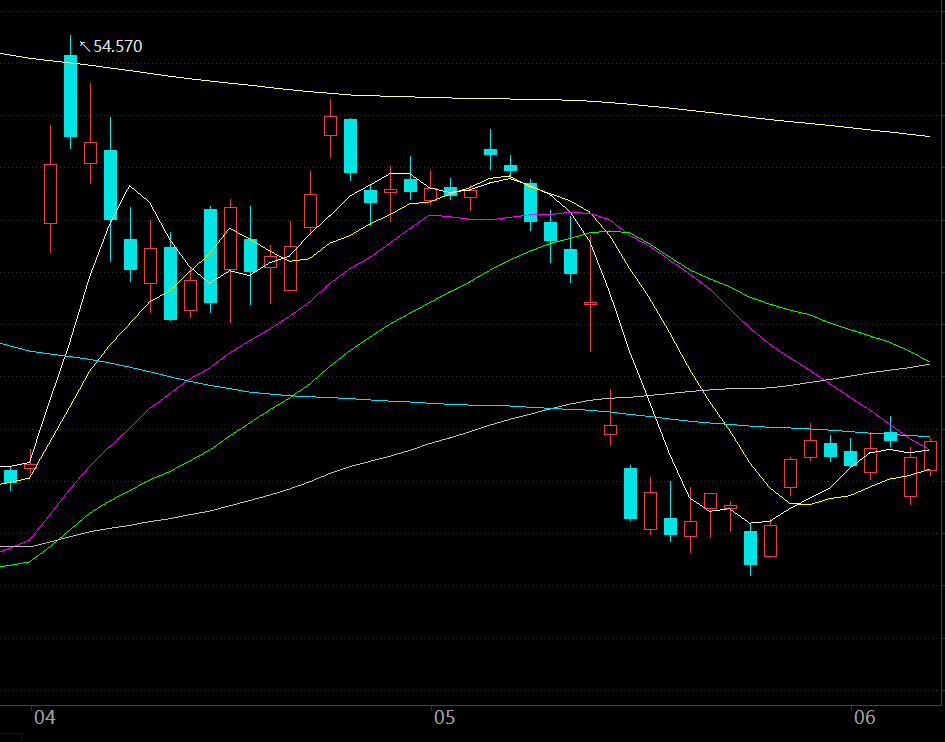

Since it was revealed that Musk had become Twitter’s largest shareholder in early April this year, Twitter’s stock price has risen rapidly, from $38.69 at the end of March to $54.57, and the stock price was at a high level before and after Musk announced the acquisition, but with Ma Shares of Twitter have been lower since May due to Skr’s capricious attitude.

As of the latest trading day, Twitter’s stock price was at 36.81 yuan, 32% lower than Tesla’s acquisition offer, and its market value had evaporated by more than $11 billion compared to when the acquisition agreement was reached (April 25). The latest market value was $28.1 billion.

In fact, Musk has previously admitted that his $44 billion acquisition of Twitter may fail, but lowering the price is “not impossible.” When Musk questioned the veracity and accuracy of Twitter’s public documents at an event in mid-May, he also said that if the deal was to go through, it would have to be done at a lower price.

Feng Yueping mentioned in the interview that, legally speaking, the loss of Twitter’s market value cannot be a valid reason for Musk to abandon the transaction, regardless of whether the “breakup fee” is paid. “If Musk walks away from an acquisition simply because he feels he’s paying too much, then under U.S. law, Twitter would be able to sue and demand billions of dollars in damages in addition to a $1 billion reverse termination fee. .”

Eric Talley, a law professor at Columbia University in the United States, said in an interview with the media that this is likely to be part of a bargaining tactic that Musk is trying to threaten, which will make the lawsuit a painful process, they may wish to accept a settlement or lower the price.

Feng Yueping said that it is inevitable that this case will form a tug of war. The real focus is whether Twitter is willing to sell at a lower price, because Musk has the dominance of public opinion and it is in his interests. In the end, the two sides need to sit down and talk.

Many market views also believe that the two sides are more likely to renegotiate to complete the transaction in the future than a protracted lawsuit, but the price may be much lower. Similar situations have occurred before, with Tiffany suing French luxury goods group LVMH in 2020 for trying to withdraw from an agreed deal. The lawsuit was settled when Tiffany agreed to reduce its sale price from $16.2 billion to about $15.8 billion.

However, Zhang Xiaorong, dean of the Deepin Science and Technology Research Institute, believes that at present, this transaction is unlikely to continue, because Musk is bearish on the future economic situation of the United States and continues to spend 44 billion US dollars to acquire huge amounts of money. It also has many problems, and it cannot prove that it is worthy of a $44 billion acquisition. It is reasonable for Musk to be dissatisfied.

Zhang Xiaorong told Sohu Technology that under the game between the two sides, this transaction may continue to ferment for a period of time, and the court is the first step. If the transaction is completely terminated, it will be a major blow to Twitter’s brand and goodwill, which will affect operating income, and Twitter will not easily allow Musk to retreat.

It could also be a disaster for Twitter investors. Truist Securities estimates that Twitter shares will fall into the low $20s or $30s. CFRA analyst Angelo Zino was even more pessimistic: “If a deal doesn’t happen at all, we see significant downside risk to Twitter as we value the company independently at around $26.”

After closing down 5% in the previous trading day, Twitter fell nearly 8% in pre-market trading today. Has Musk’s goal been achieved?Return to Sohu, see more