In 2021, the automotive industry is suffering from a lack of cores, but the new domestic car-making forces seem to have not been so miserable, and the electric car market is still selling hot.

Recently, new domestic car manufacturers have successively released delivery data for 2021. The top three companies’ annual delivery volume exceeded the 90,000 mark, and the total delivery volume reached 280,000. Xiaopeng replaced Weilai with 98,155 and became the number one. The market order changed from “Wei Li Xiao” to “Xiao Wei Li”.

Nezha, Weimar, and Zero Run also performed well in the second tier. Among them, Nezha’s annual delivery growth rate exceeded 360%, which is the most eye-catching among the new domestic car manufacturers and has become the first tier. Challenger. This also indicates that the new domestic car-making forces are expected to achieve the milestone of annual delivery of 100,000+ in 2022, and these companies are holding “big moves.”

However, for the new domestic car-making forces, 2022 will also face “internal and external troubles”. On the one hand, traditional forces and new forces are intertwined, and market competition will become more intense; on the other hand, in the post-subsidy era, problems such as superimposed costs and lack of cores will usher in a wave of price increases in the industry.

Judging from the data released by new domestic car manufacturers, most companies will continue to show rapid growth in sales in 2021, but the difference in growth rate between them is still quite obvious, and the industry seating position has also changed.

Among the first-tier companies, Xiaopeng ranked first with 98,155 deliveries in 2021, which is 3.6 times the deliveries in 2020, a year-on-year increase of 263%, and the growth rate is more than twice that of 2020. With the three old models of EC6, ES6 and ES8, Weilai delivered 91429 units throughout the year, an increase of 109% year-on-year, and the growth rate was slightly lower than the previous year. Ideal relying on an Ideal ONE also achieved delivery of over 90,000 vehicles, reaching 90,491 vehicles, an increase of 177% over the same period last year.

In comparison, Weilai, Ideal and Xiaopeng delivered 43,728, 32,624, and 27,041 new cars in 2020, respectively. Weilai ranked first with a clear advantage, and Xiaopeng was at the bottom. By 2021, Xiaopeng will usher in a counterattack. With its main models such as the Xiaopeng P7 and P5, it will achieve rapid growth, replacing Weilai as the number one new domestic car manufacturer; the recognized “big brother” Weilai is at the bottom of the growth rate, only Holding the second position with a slight advantage, the head pattern changed from “Wei Li Xiao” to “Xiao Wei Li”.

Delivery volume (vehicles) and growth (%) of 6 new domestic car manufacturers in 2021

In the second echelon, Nezha Automobile, which received nearly 3 billion investment from Zhou Hongyi, led the delivery of 69,674 vehicles in 2021, an increase of over 360% year-on-year, and the fastest growth among the new domestic car manufacturers. It is worth noting that Nezha was also among the top three in monthly delivery volume, and the delivery volume in the last two months has exceeded 10,000. It can be said that it is launching an impact on the first camp.

In 2021, the delivery volume of Weimar and Zero Run both exceeded 40,000, with 44,157 and 43,121 respectively, an increase of 96% and 279%. Although there is a significant gap with Nezha, Weimar’s delivery volume in 2021 is close to the total of the past three years. Zero Run also hit a new high in December, with 7807 vehicles delivered, a year-on-year increase of 368%. With the main sales volume of Zero Run T03 And the mid-size SUV zero-run C11 is expected to become a new force in car-making with a delivery volume of over 10,000 in the next month.

However, from the perspective of cumulative delivery, Weilai is still the leader of new car-building forces. As of the end of last year, the cumulative delivery of nearly 170,000 vehicles, Xiaopeng and Ideal have exceeded 130,000 and 120,000 respectively; Nezha and Weimar The number of vehicles reached 95,77 and 88,686 respectively, which is about to hit the 100,000 mark, and the echelon differentiation will be more obvious.

In 2021, the automotive industry is facing severe chip supply problems. Xiaopeng Chairman He Xiaopeng said in an interview at the end of last year that the most anxious issue recently is the supply chain issue. “Xiaopeng’s latest P5 model is the most disturbed by the shortage of chips, and I often go to drink and find chips.” Therefore, Weilai also suspended production at the end of March last year on the 5th. Xiaopeng and Ideal also offered a reduction or allocation in the fourth quarter. Delayed delivery plans such as reinstallation of radars.

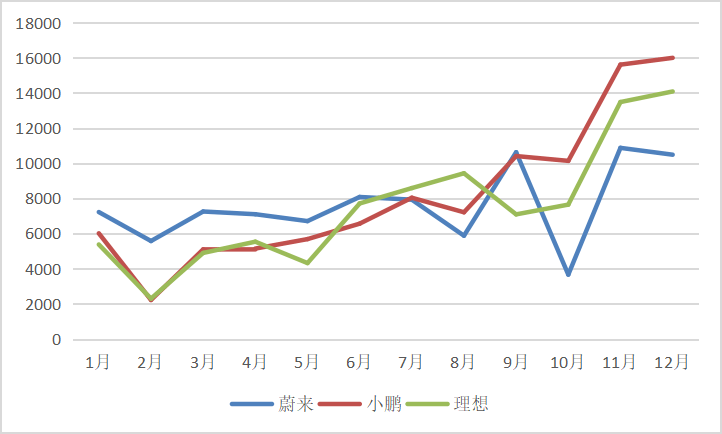

Wei Xiaoli’s monthly delivery in 2021 (vehicles)

Wei Xiaoli’s monthly delivery in 2021 (vehicles)

This also affected the steady growth of deliveries to a certain extent. Judging from the monthly delivery situation last year, these three companies all showed a fluctuating trend, with Weilai fluctuating more obviously (October was mainly affected by the transformation of the production line). It is worth mentioning that in the last two months, these three companies have been rushing to achieve performance, and the delivery volume has continued to exceed 10,000. Xiaopeng has exceeded 10,000 in a single month for four consecutive months, and has successively exceeded 15,000 and 16,000. The annual delivery volume counterattack has become the key driving force for the number one new force in domestic car-making.

Stimulated by positive data, on the first trading day of 2022, the Hong Kong stocks new energy sector bucked the trend and strengthened. Xiaopeng soared by more than 5.8%, ideally by 3.5%, and Weilai’s US stocks also rose by 5.65%.

Hit the 100,000 mark, and the new car enters mass production

The rapid increase in deliveries of new domestic car manufacturers means that the popularity of electric vehicles is accelerating. According to data from the Travel Association, the penetration rate of domestic new energy vehicles from January to November 2021 was 13.9%. In November, the penetration rate of new energy vehicles exceeded 20%. Compared with the penetration rate of less than 6% in 2020, the penetration rate has increased significantly. The penetration rate of energy passenger vehicles is expected to exceed 20%. BYD Chairman Wang Chuanfu was even more optimistic before that the penetration rate of new energy vehicles could reach as high as 35% by the end of this year.

After the initial market catalysis, new energy vehicles will usher in a period of accelerated development in the next few years. With the delivery volume of “Xiao Weili” breaking through the 90,000 mark, it also indicates that the new domestic car-making forces will enter the era of 100,000+ in 2022, and their cumulative delivery volume will also hit 200,000. This picture may be Things that the new car-building forces who fell into the dark around 2018 cannot imagine.

These new car-building forces are also preparing to continue to release “killer features” and “big moves.” “Dangerous” NIO will mass produce 2 new models this year, including the first flagship sedan ET7, and the medium-sized smart electric coupe ET5 with the lowest price of 260,000. It is also the benchmark for NIO’s BMW 3 Series and Tesi. Pull Model3, a model that undertakes the task of walking. In addition, Weilai’s ES7, which is positioned as a pure electric SUV, has also been exposed recently, and delivery may start in the third quarter of this year.

Xiaopeng will officially launch the medium and large flagship SUV Xiaopeng G9 to the market this year. According to market news, there is a high probability that the P7 will also have a facelift. The “3579” family will become Xiaopeng’s support for 200,000 impacts. The ideal with only one product also plans to launch the new model X01 in 2022, and Weimar also plans to deliver the mass-produced pure electric sedan M7 in the second half of the year.

However, as the penetration of new energy vehicles accelerates and players continue to increase, new car manufacturers will also usher in a new round of “internal and external troubles”. The market competition in 2022 will undoubtedly become more intense.

Although the sales of new domestic car manufacturers have maintained high growth, they have found their own advantages in product positioning and market segmentation, and have gradually formed a certain brand power through accumulated user experience, but this market has not yet formed a stable or oligarchic pattern, whether it is Traditional car companies, foreign brands, or Internet companies such as Baidu and Xiaomi that are in the process of deployment still have the opportunity to share their food.

Tesla is obviously a strong foreign brand competitor. Its annual delivery volume in 2021 reached 936,200 vehicles, approaching the 1 million mark, a year-on-year increase of 87%, exceeding market expectations. BYD is the local representative. Its sales of new energy passenger vehicles in 2021 reached 597,700, a year-on-year increase of 232%, far exceeding the total deliveries of the aforementioned six new domestic car manufacturers.

GAC E’an, Volkswagen ID family, etc. are also strong competitors, Geely Jikrypton, Dongfeng Lantu, etc. are also fast-tracking, and Huawei recently launched Wenjie M5 to continue selling cars. At the moment when traditional forces and new forces are intertwined, the track of new energy vehicles will become increasingly hot and crowded. In the future, it will only become more and more mad.

Entering the post-subsidy era, or ushering in a wave of price increases?

At the same time, the “discount” of new energy vehicles has also changed. According to the “Notice on the Promotion and Application of Financial Subsidy Policies for New Energy Vehicles in 2022” issued by the Ministry of Finance and other four departments at the end of 2021, the subsidy standard for new energy vehicles will decline by 30% on the basis of 2021, starting from January 1, 2022 Implementation, and the new energy vehicle purchase subsidy policy will be terminated on December 31, 2022, after that, no subsidy will be given to licensed vehicles.

The subsidy decline has become the number one challenge facing the new energy vehicle track in 2022. This also means that according to the aforementioned subsidy standard, the subsidy amount for pure electric models with a range of 300km to 400km will be reduced by 3,900 yuan this year (subsidies will be reduced from 13,000 yuan in 2021 to 9,100 yuan), and subsidies for pure electric models larger than 400km will be reduced. 5,400 yuan (subsidies dropped from 18,000 yuan in 2021 to 13,600 yuan), and new energy vehicles will no longer enjoy subsidies after the end of 2022.

Affected by this, many auto brands have indicated that they will increase the prices of their new energy models. Earlier, Volkswagen announced that the prices of its models will be increased from January 1, 2022. The two pure electric models ID.6 CROZZ and ID.4 CROZZ will increase by 5,400 yuan as a whole, and the adjusted starting prices will be 242,200 respectively. Yuan and 205,300. The sales staff of GAC Ion also said that Ion LX will increase the price by 4,000 yuan, and the starting price will reach 230,000; Nezha Motors and Feifan Motors also said that they will adjust their prices.

On January 1 this year, NIO announced the 2022 car purchase subsidy program, stating that users who pay a deposit to purchase ES8, ES6 and EC6 before December 31, 2021 and have cars before March 31, 2022, will still The subsidy can be enjoyed in accordance with the national subsidy standard in 2021, and the difference will be borne by Weilai.

Xiaopeng has also introduced a similar “time-limited price insured” policy, that is, from January 1 to January 10, customers who complete the deposit payment will enjoy the comprehensive subsidy. The suggested retail price will remain unchanged from 2021, that is, 2022. The difference between the state subsidy and the decline of the state subsidy in 2021 will be borne by Xiaopeng. Xiaopeng also lowered the car purchase rights of three models, which is considered to be a “disguised price increase.” The two new models of Xiaopeng G3i have also increased in price by 2,000 yuan.

Unlike Weilai and Xiaopeng’s “subsidy difference” and “time limit price guarantee” strategies, Tesla will directly increase prices on the last day of 2021. The rear-wheel drive versions of the domestic models Model 3 and Model Y have been increased by 10,000. 21,000 yuan, and Tesla China has confirmed that the price increase is related to the decline in subsidies for new energy vehicles. Statistics show that since August 2021, Tesla has raised prices five times in China.

Some analysts believe that under the superimposed impacts of subsidized decline, soaring upstream costs such as power batteries, and the lack of cores that are still difficult to completely solve, new energy vehicles may set off a wave of price increases in 2022, and end consumers will bear the burden. More expenses may have a certain impact on the sales of new energy vehicles. For new energy car companies, as policy support weakens, products and brands will need to be spoken in the future.

Cui Dongshu, secretary-general of the Travel Association, also believes that the 30% subsidy decline will have a certain impact on the growth rate of new energy vehicles, especially the annual subsidy limit is about 2 million vehicles. The actual scale is significantly reduced from last year, regardless of the subsidy for bicycles. The total amount is still relatively low. Therefore, all car companies are facing the challenge of the post-subsidy era and will inevitably adjust their prices.

However, Cui Dongshu remains optimistic about the outlook for new energy vehicles. He believes that the detailed indicators of the policy have not been adjusted at all. It is an overall stability that exceeds expectations and is very conducive to a strong increase in low-end models. With the substantial increase in domestic consumers’ recognition of the new energy market and the stability of policy subsidies, the total sales of new energy vehicles in 2022 will inevitably increase. The sales of new energy passenger vehicles will be adjusted from the original expected 4.8 million. For 5.5 million vehicles, it is even expected to exceed 6 million vehicles.

Whether it is the dividends brought about by the continued increase in the penetration rate, or the pressure brought about by the fierce market competition, subsidy decline or even cancellation, for the new car manufacturers that are leaping over the threshold of 100,000+, it means more and more With more and more challenges, this golden track competition is far from over.Return to Sohu to see more

.