21st Century Business Herald reporter Ni Yuqing reported in Guangzhou

On June 30, the 21st Century Business Herald reporter was informed that recently, Yuexin Semiconductor completed the latest round of financing of 4.5 billion yuan.

This round of financing was jointly led by Guangdong Semiconductor and Integrated Circuit Industry Investment Fund managed by Yuecai Holdings and GAC Capital, a subsidiary of GAC Group, and introduced industrial capital from auto companies such as SAIC and BAIC, as well as Yuexiu Industrial Fund, Yingke Capital, China Merchants Bank International, Shengyu Industrial Holdings Fund and other strategic investment shareholders.

At the same time, it has also obtained a number of follow-up investments including Walden International, GF Securities, Science City Group, Lanpu Venture Capital, etc. Existing shareholders subscribed for more than 60% of this round of financing.

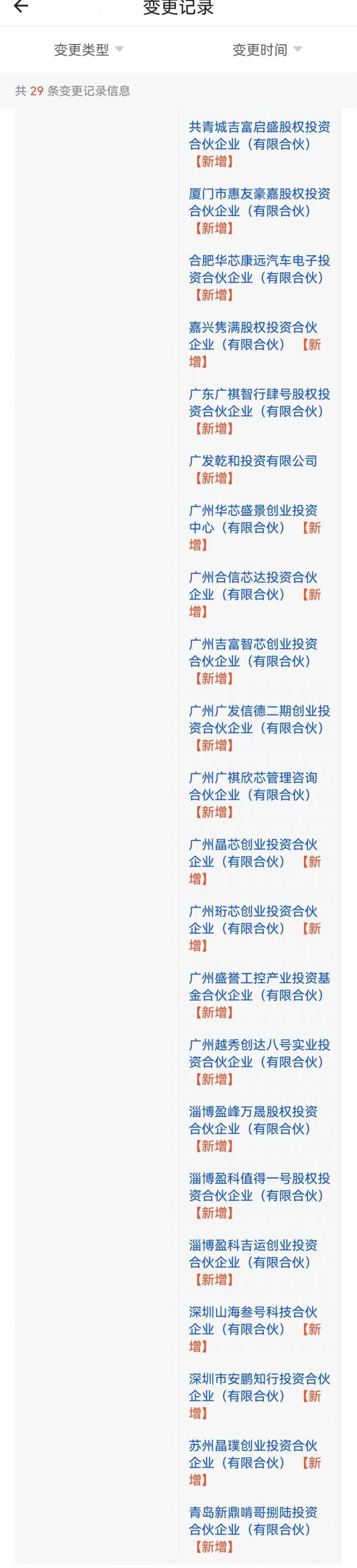

According to information from Qixinbao, on June 28, Yuexin Semiconductor’s registered capital was changed from 1.667 billion yuan to 2.151 billion yuan, and 22 new shareholders were added.

This financing will be mainly used for the construction of the new phase of Yuexin Semiconductor. Yuexin Semiconductor will continue to focus on the 12-inch analog characteristic process, focus on the industrial-grade and automotive-grade mid-to-high-end analog chip market, and further increase production capacity.

According to the plan, Yuexin Semiconductor is in the construction of the third-phase project, and the third-phase technology node is further extended to 55-40nm, 22nm process, to achieve the scale effect and quality benefit of analog chip manufacturing.

From the perspective of investors in this round, a lot of industrial capital has been added in the automotive and industrial fields, which will help to strengthen the industrial-grade and automotive-grade chip business for Yuexin Semiconductor.

At the same time, according to the 21st Century Business Herald reporter, Yuexin Semiconductor has been closely cooperating with GAC, and is currently conducting joint research and development in automotive chips, which is also a typical case of upstream and downstream cooperation in the terminal and manufacturing industry chain.

GAC Capital has made two consecutive rounds of strategic investment in Yuexin Semiconductor. Yuan Feng, General Manager of GAC Capital, said: “Guangzhou Automobile and Yuexin, as the two major industrial chains of Guangzhou Automobile and Semiconductor respectively, have carried out in-depth coordinated development and jointly promoted the core technology of automotive chips. And the independent and controllable product supply, starting from the application scenarios of automotive chips, opening up key links such as chip design, manufacturing, verification and industrial applications, accelerating the rapid transformation and upgrading of domestic automotive chips from the source, and promoting the automotive manufacturing industry to high value. chain development.”

Although the pace of domestic semiconductor investment has slowed down this year, upstream manufacturing and equipment are still the focus of investment. Among them, Yuexin Semiconductor, as the only 12-inch chip manufacturing enterprise that has entered mass production in the Guangdong-Hong Kong-Macao Greater Bay Area, is an important part of the regional industrial chain and an important bearer of the “Strong Core Project” in Guangdong Province, which has attracted much attention from the industry.

Looking back at the financing process, in July a year ago, Yuexin Semiconductor completed the second phase of project financing. The investors were Guangdong Semiconductor and Integrated Circuit Industry Investment Fund, SDIC Venture Capital, Lanpu Venture Capital, Walden International, Jifu Ventures, GAC Capital, Huiyou Investment, Agricultural Bank of China Investment and other institutions are jointly formed. In the new round of financing, many of them continue to follow the investment.

Looking at the production capacity, the first phase of the Yuexin project has been completed and put into operation in September 2019, and will be fully operational in December 2020, with a product yield rate of over 97%. The second phase of the project has an additional monthly production capacity of 20,000 pieces, and the third and fourth phases are in full swing.

At the 2022 China Nansha International Integrated Circuit Industry Forum hosted by Xinmou Consulting recently, Wu Yongjun, vice president of Yuexin Semiconductor, said: “60% of China’s chip consumption is in the Pearl River Delta, but before the Pearl River Delta, there were only large-scale wafer manufacturing plants in the Pearl River Delta. SMIC’s 8-inch fab, Yuexin fills the gap of 12-inch wafer manufacturing in the Guangdong-Hong Kong-Macao Greater Bay Area. At present, the production capacity of Yuexin’s first and second phases is 40,000 wafers. We are planning for the third and fourth phases, and it is expected that this year In the second half of the year, piling can be quickly driven, adding up to about 120,000 wafers.”

From the very beginning, Yuexin Semiconductor chose a pragmatic path to enter the analog chip track based on market demand. At present, the company is continuously expanding the scale of manufacturing capacity to meet the needs of power discrete devices, power management chips, mixed-signal chips, image sensors, radio frequency chips, microcontroller units and other chips in the Guangdong-Hong Kong-Macao Greater Bay Area manufacturing industry.

At the customer level, Yuexin Semiconductor has entered the supply chain of first-class enterprises. Wu Yongjun introduced that Yuexin Semiconductor’s customers include the world‘s largest mobile phone chip company, the world‘s largest fingerprint recognition chip company, the world‘s largest camera chip company in terms of shipments, China’s largest power management chip company, and China’s largest signal chip company. Chain chip companies also include China’s largest MCU company, which is why Yuexin has achieved certain development in the past four years.

“We think that customized foundry is a trend. Generally speaking, the development cycle of image sensors takes two years. Under the background of out-of-stock, Yuexin and strategic customers completed mass production in five months, shortening the development time by about 80%,” Wu Yongjun said, “At this stage, we choose the direction to cut in from mature manufacturing process and simulation process. In terms of application, we hope to gradually evolve from consumer to industrial control and automotive electronics. We conduct self-research + cooperation. The iteration of technology ultimately hopes to better play the strategic role of the fab through market-driven and industrial chain collaboration.”

From the perspective of the global wafer industry structure, Wu Yongjun said that the wafer foundry market structure is around 100 billion US dollars, and TSMC occupies about 53% of the global market, while the largest wafer foundry in mainland China, SMIC, only has a market share of only $100 billion. 5%. From a regional perspective, Taiwan, China accounted for 64%, and mainland China accounted for 7% in total. The foundry itself is huge, and for mainland Chinese companies, there is huge room for development.

For more information, please download the 21 Finance APPReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.