Zhang Yaoxi: The data highlights the economic slowdown, the US minutes may be difficult to suppress the rebound in gold prices

Last trading day on Tuesday (May 24): International gold London gold continued to rebound and closed up, closing positive for the fifth consecutive trading day.

In terms of trend, the price of gold opened at US$1853.95 per ounce since the Asian market. After a brief continuation of the overnight fall, and the fact that the US index and US bond yields stopped falling compared with the previous day, the price of gold first walked lower and recorded an intraday low of 1849.27. Dollar;

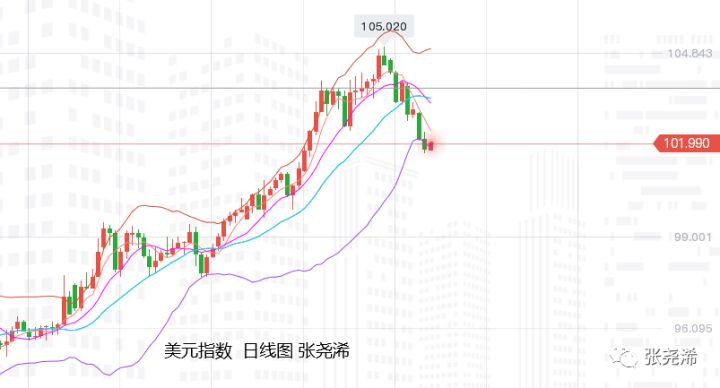

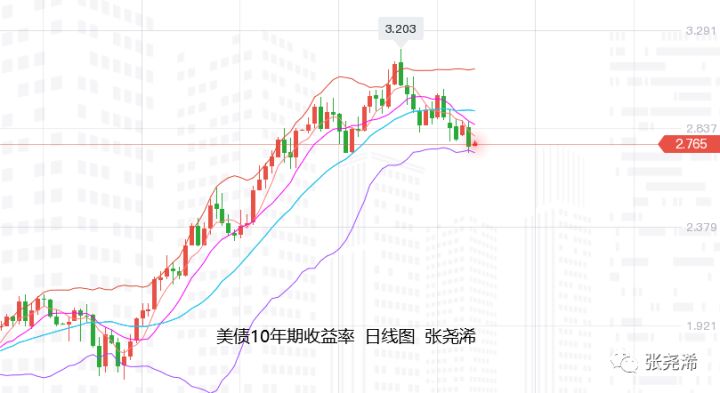

Afterwards, the market went out of obvious shocks, but the overall trend was still upward, and continued all the way to the intraday high of US$1869.35 at around zero in the US market. In terms of influence, the US index returned to weakness after a short period of strength, and further refreshed and fell back to a low point. U.S. bond yields also fell sharply and closed down. In addition, U.S. new home sales fell to a two-year low in April in the U.S. market, etc., which also supported gold prices;

But it finally encountered resistance and closed at $1866.26, with a daily amplitude of $20.08, and closed up $12.31, or 0.66%.

Looking forward to today’s Wednesday (May 25th): The opening of international gold was once again affected by the relatively overnight stoppage of the US index and US bond yields, and was under pressure and weakened, but the overall momentum of the current rebound in gold prices has not changed, and the bulls are still There is expectation and room for continued strength.

Fundamentally, recent U.S. economic data show that high inflation has adversely affected the economy. European Central Bank President Christine Lagarde said that interest rates in the euro zone may reach positive values by the end of the third quarter, which will boost the euro and put pressure on the dollar. Expansion, suggesting that there is still a lot of room for downside, and the 10-year U.S. bond yield tends to follow the Bollinger Band’s downward spread and there will be a risk of further decline;

Therefore, on the whole, the market outlook is biased towards the continuously lower US bond yields and the US index will continue to support the price of gold. The market seems to have digested the hawkish tendencies of the Federal Reserve. In addition, Russia is in a full-scale attack in the east of Ukraine, trying to surround the Ukrainian army, and Canada will provide Ukraine with additional supplies. 20,000 rounds, and the tense geopolitical situation also provides support for the price of gold, so the price of gold will maintain its rebound and continue to rise.

In terms of data, U.S. economic growth has slowed since peaking in March, and May data shows that the recent U.S. economic growth momentum has weakened further. Demand is under pressure due to rising costs of living, the Federal Reserve raising interest rates and concerns about an overall economic slowdown. Manufacturers also noted that capacity continues to be constrained by supply shortages.

Therefore, the U.S. market will release the initial monthly rate of durable goods orders in April. The market is expected to drop from 1.1 in March to 0.6, which is expected to continue to provide support for gold prices.

In addition, the focus will be on the minutes of the Fed’s meeting to be released at 2:00 a.m. the next day in the U.S. session, which will keep an eye on discussions on near-term policies, such as the path of interest rates, expected economic conditions, and what policymakers want from data before slowing the pace of tightening. what to see.

The possibility of hawks is relatively high, and it is expected to limit the upside of gold prices in the short term, and will not cause obvious pressure to fall, but still need to pay attention to the possibility that the hawks are less than expected, which will further promote the rebound of gold prices.

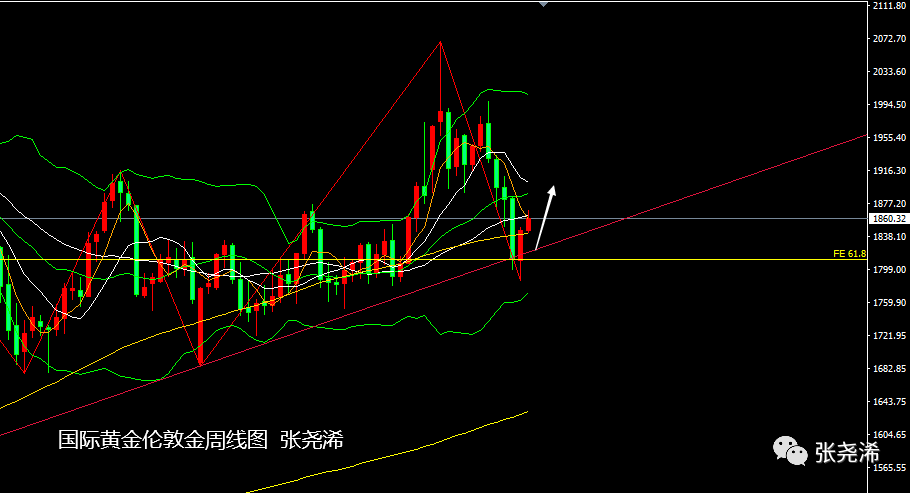

Technically: On the monthly chart level, after the gold price bottomed out and rebounded, it was further rebounded overnight, and increased the strength to stand on the middle rail, and also formed a long lower shadow line. If this momentum is maintained this month, the line will be closed. , the market outlook will be difficult to produce further declines, or continue to rebound and rise, or maintain a certain range of shocks, but the overall upward trend will remain, and the trend line will run above the support. If it can stand above the resistance of the May line, it will increase the bullish strength.

At present, affected by the interest rate hike in June-July, the overall trend is to remain above the trend line support.

In terms of operation, the top is concerned about the resistance near the May moving average and the upper rail of the Bollinger Bands, which can still be empty when touched, and then return to the October moving average and the target of the support level of the middle rail of the Bollinger Bands to see the rebound, and the overall shock can be treated.

Weekly level: The price of gold has stopped falling and rebounded near the support of the trend line. It is currently running steadily above the 100-week moving average. Although it broke through the 30-week moving average overnight, it has not yet stabilized and the risk of falling back cannot be ruled out. The trend line is holding up well, and the pullback is still mostly bullish. Below continue to rely on the 100-week moving average and trend line support to do more. Above, focus on the middle rail of the Bollinger Band and the 10-week moving average as the target resistance.

Daily level: The price of gold has continued to rebound and strengthen in recent days. It has now stood on the middle rail line. The 5-10-day moving average is also maintaining a golden fork to support it. The indicator MACD in the attached picture also maintains a bullish signal, but KDJ has peaked and fell. There are still 30-day and 100-day moving average resistances above, so while the bullish rebound, you can also target near this resistance for bearishness. The bottom is bullish with the support of the medium rail and the 5-day moving average.

The specific points of the day refer to the following:

International Gold: The bottom is concerned about the support at $1854, and the support near $1846 can be much; the top is concerned about the resistance near $1872, and the resistance near $1881 can be empty;

Spot silver: focus on the support of 21.85 yuan below and $21.70 support; above focus on the resistance of 22.30 yuan and $22.50;

Note:

Gold TD=(international gold price x exchange rate)/31.1035

The international gold fluctuates by 1 USD, and the gold TD fluctuates about 0.22 yuan (theoretically).

U.S. futures gold price = London spot price × (1 + gold swap rate × futures expiration days/365)

Predict boldly and trade cautiously. The above opinions and analysis only represent the author’s personal thoughts and are for reference only, not as a basis for trading. your money your decision.

Essential Books for Gold Investment Fundamentals: “Play and Earn Gold Investment Trading”