Summary:

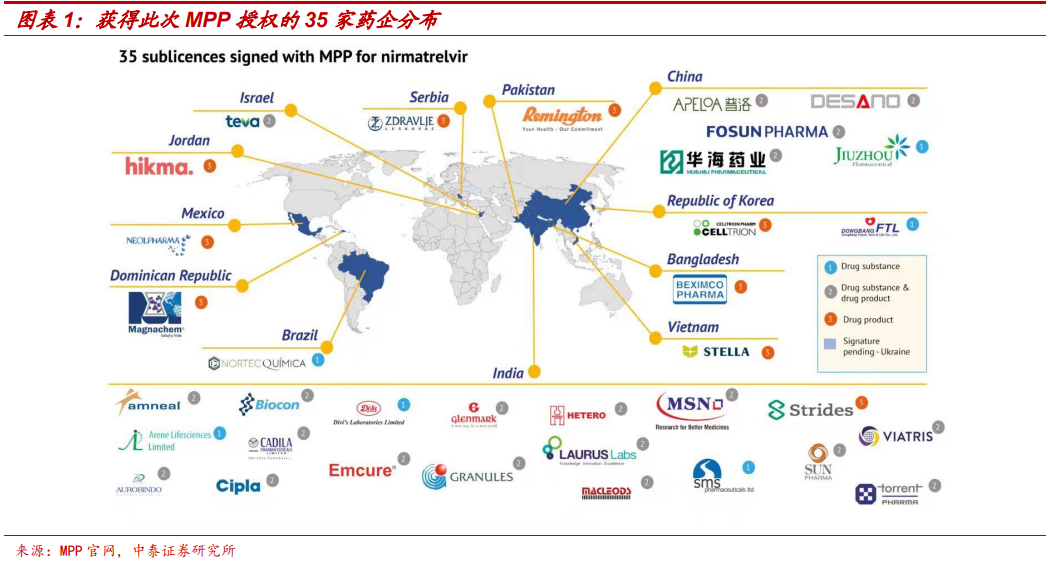

Event: On March 17, the Geneva Medicines Patent Pool (MPP) announced that it signed an agreement with 35 companies around the world to authorize productionPfizerOral new crown treatment drug nirmatrelvir (PF-07321332) API or/and preparation. Authorized generic companies will be able to deliver the Paxlovid combination therapy to 95 low- and middle-income countries, covering approximately 53% of the world’s population.

Comments: Five Chinese companies have been authorized to pay attention to investment opportunities in related industry chains. According to MPP’s official website, authorized companies are located in 12 countries around the world, of which 6 companies produce APIs, 9 companies produce pharmaceuticals, and the remaining 20 can produce both APIs and pharmaceuticals. China has an integrated leader in API preparations,Fosun Pharma、Pro Pharma、Jiuzhou PharmaceuticalDesano and other 5 pharmaceutical companies were authorized, of whichJiuzhou PharmaceuticalOnly raw materials are produced, and the remaining 4 can produce raw materials and preparations at the same time. The evaluation criteria of MPP include enterprise production qualification, production capacity and supply chain management capacity, R&D and international registration capacity, distribution capacity in authorized regions, etc. Before this authorization, since 2014, Desano, Baker, Langhua, Longze,Fosun Pharma、Borui MedicineMany other Chinese pharmaceutical companies have been authorized, reflecting the continuous international recognition of the capabilities of domestic pharmaceutical companies in terms of qualifications, R&D and production, and international registration.

On the one hand, the market increment of API+ preparations may reach 70 billion yuan. It is recommended to pay attention to the authorized enterprises and enterprises that are capable and qualified to produce relevant intermediates and advanced technology.performanceIncrement.PfizerPaxlovid is expected to have a production capacity of 120 million treatments in 2022, with sales expected to be $22 billion in 2022. Paxlovid is a combination of 300 mg (two 150 mg tablets) of nirmatrelvir and one 100 mg ritonavir tablet, administered twice daily for 5 days, assuming no loss of API to the drug product, 1.2 100 million courses of treatment correspond to at least 360 tons of nirmatrelvir API demand. Considering that 95 low- and middle-income countries cover about 53% of the world‘s population, and due to differences in incidence rates due to differences in disease control, medical conditions, etc., we expect that the increase in nirmatrelvir API brought by 95 low- and middle-income countries is expected to reach About 400 tons, assuming the price is 40 million yuan / ton, it corresponds to a market increment of 16 billion yuan API. Assuming that the value of API in preparations accounts for 30%, the corresponding preparation market may reach 53 billion yuan, and the total market size of API + preparations is about 70 billion yuan.

On the other hand, it is recommended to pay attention to enterprises with strong technical strength, strong compliant production capacity, and the ability to undertake spillover orders caused by capacity gaps.PfizerIt is estimated that about 250 million people in the world will need antiviral drugs in 2022, and there will be at least 130 million treatment gaps. Enterprises with compliant production capacity will likely benefit from the spillover orders brought about by the capacity gap.

The main line of new crown special drugs is expected to run through the whole year, and the direction of the three major industrial chains is optimistic. Considering the continuous repetition of the epidemic, the progress of drug research and development, and the demand for the subsequent liberalization of the country, we believe that the new crown specific drug is expected to become the main investment line throughout the year. Japan, Canada, China and other countries or regions have been approved for EUA, and Japan’s Shionogi S-217622 has submitted a listing application in the country, and is optimistic about the relevant CDMO and advantageous companies in all aspects of the industrial chain. 2) Generic drug API authorization:MSDMolnupiravir and Pfizer Paxlovid have both authorized MPP. We believe that leading companies with strong R&D and cost control capabilities and fast speed are expected to enjoy dividends. 3) Independent research and development of domestic specific drugs and CDMO: At present, many domestic specific drugs are in clinical stage, among which real biological,Junshi Biologylead. The preliminary analysis data of real biological azvudine is good, and phase III clinical research is being carried out in Brazil and other countries;Junshi BiologyThe VV116 has obtained the EUA of Uzbekistan, the phase I data is good, and the first patient enrollment and dosing has been completed in the international multi-center phase III clinical trial. Optimistic about drug R&D-related companies and CDMO industry chain companies with advantages in cost, production capacity, and stable supply.

Investment suggestion: Focus on domestic R&D and innovation enterprises with advanced progress, innovative drug CDMO industry chain of overseas large pharmaceutical companies and generic drug industry chain, such asJunshi Biology、WuXi AppTec、Aleigh、Porton sharesAPI preparation integrated faucet,Pro Pharma、Jiuzhou Pharmaceutical、Tianyu shares、Aoxiang Pharmaceutical、Tsukasa、Orient、Tonghe Pharmaceutical、MinovarWait.

Risk reminder events: policy change risk; order fluctuation risk; quality and environmental protection risk; price reduction risk; exchange rate fluctuation risk;research reportRisk of untimely information update.

(Article Source:Zhongtai Securities)