Lei Di.com Lei Jianping reported on July 7

Beijing Zhongyi Antu Technology Co., Ltd. (abbreviation: “Zhongyi Technology“, stock code: 301208) is listed on the GEM of the Shenzhen Stock Exchange today.

Zhongyi Technology issued 16.6667 million shares this time at an issue price of 46.06 yuan and raised 768 million yuan.

The opening price of Zhongyi Technology was 61.1 yuan, up 32.65% from the issue price; the closing price was 56.4 yuan, up 22.45% from the issue price; based on the closing price, the market value of Zhongyi Technology was 3.76 billion yuan.

Annual revenue of 1.18 billion

Zhongyi Technology is mainly engaged in IT operation and maintenance services, original software and hardware products, independent intelligent operation and maintenance products and operation data analysis services.

According to the prospectus, the revenue of Zhongyi Technology in 2019, 2020, and 2021 was 812 million yuan, 820 million yuan, and 1.18 billion yuan, respectively; the net profit was 77.354 million yuan, 86.152 million yuan, and 122 million yuan, respectively.

In 2021, Zhongyi Technology‘s revenue from IT operation and maintenance services will be 592 million, accounting for 50.08% of revenue; revenue from original software and hardware products will be 554 million yuan, accounting for 46.87% of revenue.

In the first quarter of 2022, Zhongyi Technology’s revenue was 250 million yuan, an increase of 3.22% from 242 million yuan in the same period last year; its net profit was 23.7482 million yuan, an increase of 7.1% from 22.174 million yuan in the same period last year.

4 people including Xu Xiaofei are the actual controllers

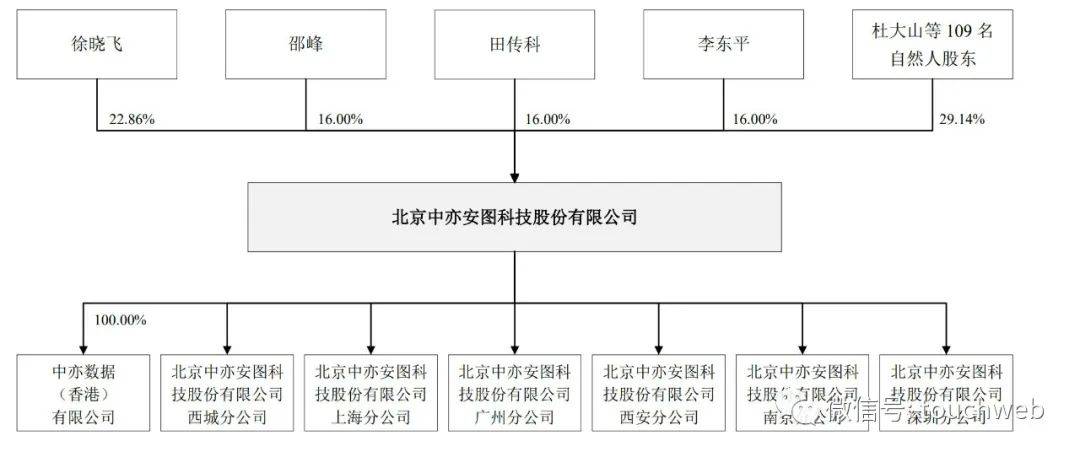

Before the IPO, Xu Xiaofei, Shao Feng, Tian Chuanke, and Li Dongping directly held 22.86%, 16%, 16%, and 16% of the company’s shares respectively, and directly held 70.86% of the company’s shares in total. Xu Xiaofei, Shao Feng, Tian Chuanke and Li Dongping are the controlling shareholders and actual controllers of the company by signing a concerted action agreement.

In addition, Du Dashan holds 3% of the shares, Yang Ling, Leng Jin, and Huang Yuanbang each hold 2.2%, Feng Lei holds 1.7%, and Wan Qing and Gong Xueting each hold 1.5%.

After the IPO, Xu Xiaofei held 17.14% of the shares, Shao Feng, Tian Chuanke and Li Dongping held 12% of the shares respectively, Du Dashan held 2.25% of the shares, and Yang Ling, Leng Jin and Huang Yuanbang held 1.65% of the shares respectively.

———————————————

Lei Di was founded by senior media person Lei Jianping. If you reprint, please indicate the source.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.