The ease of applying for credit online, and the use of digital money makes people tempted and sad to be trapped with illegal online loans. Things like this are certainly ironic considering that from the beginning of 2020 to 2022 the use of digital financial access has greatly increased (inclusion), but there is a lack of public understanding in terms of financial management (literacy).

Mamih is indeed very insekyur when she often participates in financial literacy education, because the money is difficult to manage or it is lacking. Income and expenses that are almost perforated each month may make you realize that your financial management is a mess.

After evaluating and checking, mamih’s routine costs and priorities are quite large in terms of education, electricity, water, internet, which cannot be reduced any more. Mom had confided in a financial consultant who shared her problems when she was not the CEO of a well-known company. Then he said “Look for other opportunities for fortune, try olshop, or level up new skills, you have to have additional income so you can’t just get stuck.”

To increase income, you really need capital, knowledge and consistent hard work, but if you don’t start and are doubtful, you won’t be able to do it. Opening opportunities by submitting installments to support work or what can be called productive credit can be used wisely.

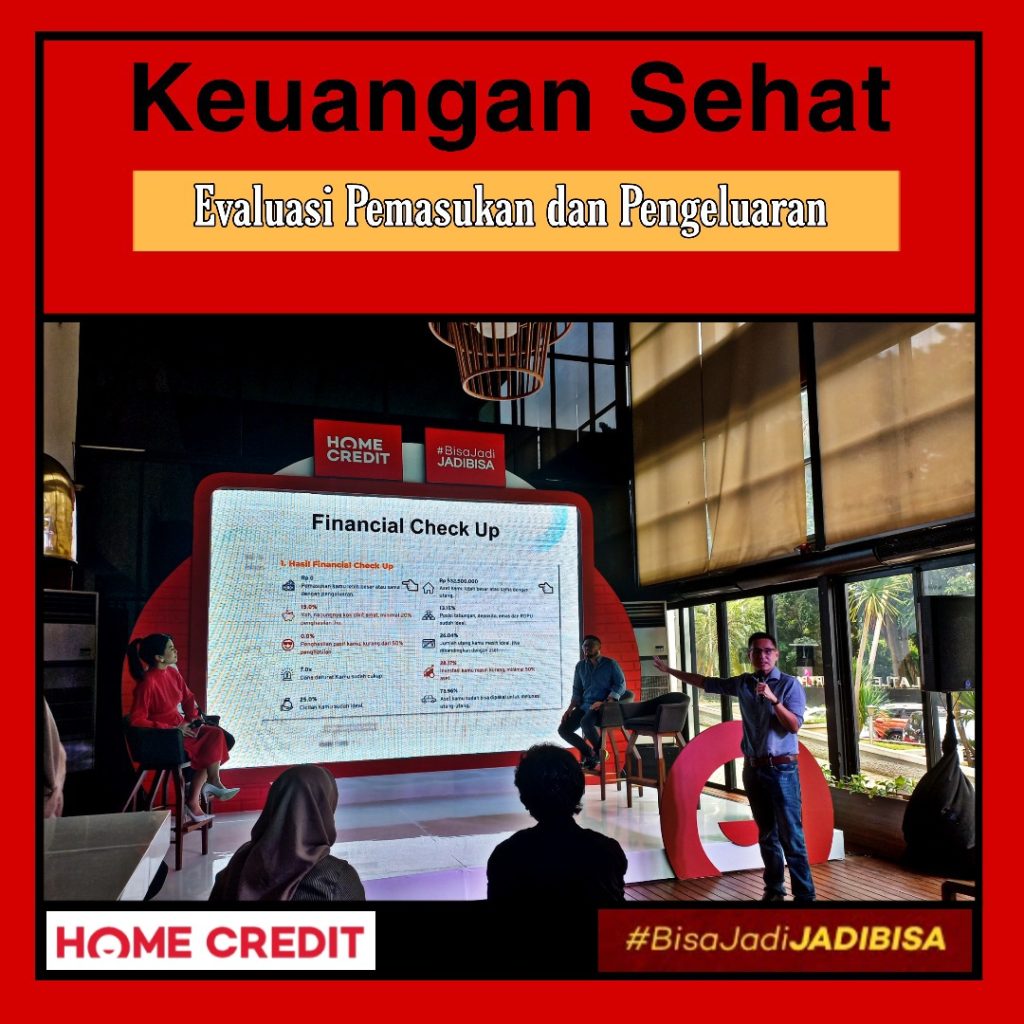

When returning to the financial literacy education it was explained, according to CEO of Finansialku.com Melvin Mumpuni at the #JadiJADIBISA event, from Home Credit, which encourages inclusion and financial literacy of the Indonesian people, there are two types: consumer loans and productive loans.

For example, for example, if you want to buy an iPad in installments so that it is stylish when you carry it or show it off, but you don’t really need its function, you could say it’s a consumer loan. But it’s different when you buy an iPad to support your work, it makes it easier to draw illustrations, draft branding plans and others to supplement your income, you could say it’s Productive Credit.

Opportunities in the digital world are also wider for anyone, they can become reviewers, sell live on social media, content creators, or influencers who can indeed generate and increase income. According to Melvin, anyone can become smart in financial planning as long as they are diligent in looking for new sources of insight, where currently there are many platforms that can provide guidance in practicing money management techniques.

Indeed, there is nothing wrong with making a loan wisely which can be an opportunity to increase your income, but you also need to remember to understand financial management so that installments are not excessive in the flow of income and expenses. Tips from Melvin too, we pay the installments that can be covered from income using these items.

With Home Credit, a technology-based financing company, is committed to continuing to increase public financial inclusion and literacy through easily accessible and transparent financial products and services accompanied by various financial education programs. Various efforts have been made by Home Credit to encourage public understanding of financial products.

Series of Home Credit Activities #JadiJadiJADIBISA with Transparent Financial Products and Services and Various Financial Education Programs.

Still confused about where to start learning financial literacy? Of course, basically, don’t let the stake be bigger than the stake, and be responsible for every rupiah spent, it’s not easy, but there are many ways to change your mindset about money to make ends meet, not a lifestyle if you really don’t have the money.

October 30 is the date when the rupiah was introduced, so Financial Inclusion (BIK) which is commemorated every October, the Financial Services Authority (OJK) informed the level of financial literacy of the Indonesian people which has now reached 49.68 percent and the financial inclusion of the Indonesian people has reached 85.1 percent in 2022.

If you look at the numbers, they are both increasing, but the difference between literacy and inclusion is still relatively high, namely around 35.42 percent. Seeing these conditions, Home Credit, a technology-based financing company, is committed to continuing to increase public financial inclusion and literacy through easily accessible and transparent financial products and services accompanied by various financial education programs.

Various efforts have been made by Home Credit to encourage public understanding of financial products. Chief Marketing and Digital Officer Sheldon Chuan said “To coincide with the momentum of Financial Inclusion Month, we are also presenting programs that invite the whole community to become more familiar with various financial products and services from Home Credit along with comprehensive financial information.”

Through the #JadiJadiJADIBISA campaign, Home Credit always assists customers in realizing various plans in life while empowering people to live the life they want. The program in question is a series of multi-product shopping exhibitions and financial education called PESTA accompanied by digital content to increase the financial literacy of the wider community. .

The PARTY title is held between:

- Bandung (23-29 October),

- Medan (October 31 – November 6), and

- Manado (22-28 November).

Its activities not only involve various business partners, Home Credit also invites a number of local communities to participate, such as:

- A cycling community in Bandung who will do a fun bike while collecting recycled plastic waste.

- The Financial Services Authority for the Medan region will also join in providing financial education at the PESTA event later.

Viewed further, Home Credit has a mission to be able to improve the welfare of society, not only its customers, through responsible financing. Where the social and corporate governance aspects, even the environment which is known as the ESG concept has been embedded in the operational business of Home Credit. Financial inclusion and literacy is a core part of implementing ESG by Home Credit Indonesia.

The social aspect which includes inclusion and financial literacy cannot be separated from the existence of financial products that are transparent, easily accessible anywhere with a fast process, accompanied by understanding of customers in meeting their needs and managing finances in a planned manner.

Ajisatria Suleiman as Associate Researcher Center for Indonesian Policy Studies (CIPS) said that financial services need to be specifically designed by financial companies so that customers can increase their personal financial literacy as well as benefit from the services they use.

Appropriate financial products and services should ideally be able to provide customers with more insight, skill and confidence when using them. Home Credit itself promotes transparency of its services and products by optimizing digital technology. You can click this link to download the My Home Credit Application (My Home Credit Application)

Various financial services from the My Home Credit application, such as:

- shop financing,

- Venture capital financing,

- Buy Now Pay Later (BNPL)

- Insurance.

.

The advantages of the My Home Credit Application:

- After the customer has an active contract, there is a cooling-off period scheme, where the customer has the option within 14 days to cancel the signed financing agreement if he changes his mind.

- Home Credit also educates customers through a number of promo programs where customers can get one to two free installments if they make installment payments on time.

- My Home Credit which has now been downloaded by more than 12.56 million registered users

- The public can use a fast service where it only takes 3 minutes to find out the financing limit when submitting a goods financing application at around 22,000 partner-owned stores spread across nearly 200 cities throughout Indonesia

It is hoped that with this good opportunity from Home Credit, people will be encouraged to take wise steps in making credit and dare to increase their income with new things that can improve their standard of living and help improve the economy in Indonesia.