[The Epoch Times, October 18, 2022](The Epoch Times columnist Jeffrey A. Tucker / Compiled by Cao Chali) Our time is full of everyday satire, all of which point to the same stark reality: the failure of experts, especially are experts in the many systems that govern our lives.

So we realize another very important example of the same.

The Royal Swedish Academy of Sciences awarded the 2022 Nobel Prize in Economics to former Federal Reserve Chairman Ben S. Bernanke, theorists Douglas W. Diamond and Philip H. Dybvig) for their “research on banking and financial crises,” with a particular reference to the central bank’s response to the housing and financial crises in 2008. The response included bailouts of banks with “quantitative easing,” which is as euphemistic as “social distancing.”

It was this response that sparked a global wave of inflationary crises that swept the world during and after the lockdowns that began in the spring of 2020. Anyway, it worked in 2008, so why not in 2020?

However, there is one major difference. The 2008-2010 policy was specifically designed to keep “quantitative easing” in cold storage due to the high interest rates the central bank pays banks on bank deposits. On paper, at least, the recapitalization of banks and brokerages was pleasant. People waited anxiously for a rebound in inflation, but it didn’t happen.

Today, things are different. We have price inflation at a 40-year high, Europe is trying to put price controls on energy… Low sales have sparked another housing crisis. High interest rates aimed at curbing inflation burst a bubble that formed only a year ago. Today, home sales have collapsed and mortgage companies are laying off workers. Homes aren’t as devalued as they were in 2008, simply because 30-year mortgage rates have climbed above 7% (though still negative in real terms).

The reason for the difference between 2008 and 2020 is simple: this time the central bank released water directly into the bank accounts of individuals and businesses. For a while, they were all flush with cash. This situation and low interest rates fueled the housing bubble. When cash runs out, with the crash comes price chaos. Banks are trying to solve this problem by raising interest rates, but this will only lead to an inflationary recession around the world.

In other words, we didn’t learn anything from 2008. To make matters worse, we have learned the wrong thing, which is that there is no cost to injecting large amounts of fiat into the economy during a huge crisis. Banks will always be bailed out. It wouldn’t hurt to save the system anyway. Incredibly, just two and a half years ago, all the central banks in the world were working together to do this. We see this now and want to ask: what do they think will happen next?

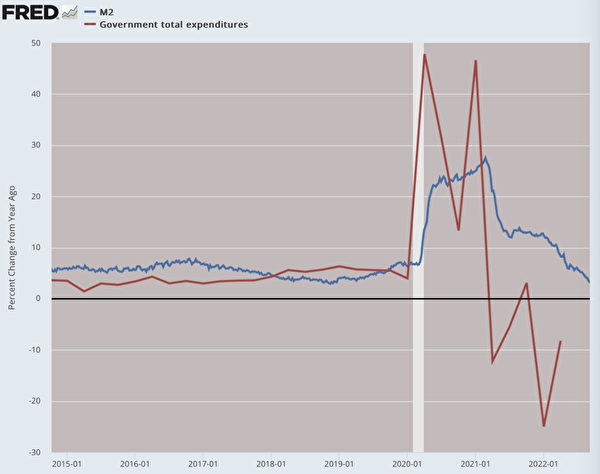

Below is a very simple model based on the traditional equation of exchange: the relationship between the quantity of money and the price, with the three countries colored in different colors so you can see how the price reacts. This is a very outdated model that doesn’t account for myriad complications. Yet the relationship remains: print paper money, wait a year, and watch the price adjust to make the new cash flow.

Even without taking into account all other factors, including supply chain disruptions and sanctions on Russia, the relationship is clearly unbearable.

People say that if Bernanke hadn’t acted in 2008, the financial system would have collapsed. They always say that. What it really does is pre-empt a moment of great educational importance for market participants. It has rescued a range of institutions that have lost their fear of risk and rationality. The result is that banks, politicians and policymakers generally face enormous moral hazard.

Moral hazard arises whenever the implementation of a policy reinforces and perpetuates exactly what it was meant to prevent. It’s a reward for bad behavior. As it is, this experience reverberated in the future and learned again in 2020.

On the day the lockdown was announced (March 16, 2020), the Federal Reserve ramped up its printing presses, and Congress prepared the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which cost $1.7 trillion to Meet state-level blockade monsters. If this never happened, these states would have opened up fairly quickly to keep the economy running. Once Congress started throwing money, governors would reconsider, realizing that lockdowns could make big money.

All in all, there is a close match between the increase in government spending and the increase in hot money on the streets: in a little over a year, both have increased by $6 trillion to $7 trillion. This time is equivalent to adding a lot of steroids (stimulants) to the water release competition in 2008.

In another scenario, if the Fed is unable or unwilling to buy the huge debt that Congress has suddenly created, the risk of default in the United States will increase significantly. It may have completely disrupted financial markets. Instead, the Fed is busy writing uncashed checks to cover up what Congress is doing. As a result, the political class and central bankers worked together to perpetuate one of the greatest policy disasters of the modern era.

Again, the main inspiration here comes from the 2008 experience. In 2008, a seemingly costless move taught the worst possible lesson: that anything is possible as long as central banks are willing to go wild.

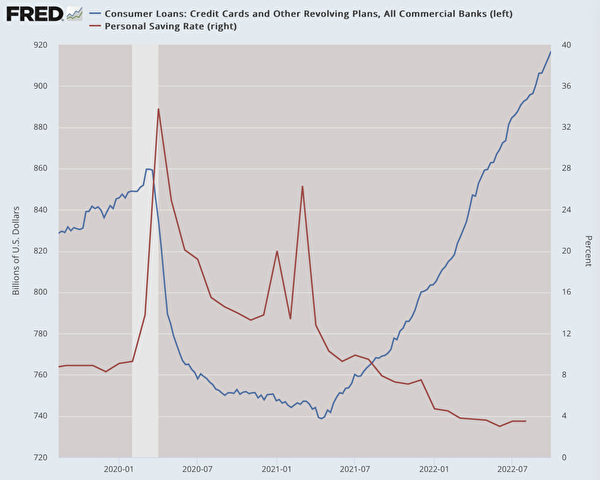

But look at where we are today: credit card debt soars, savings collapse, and real income continues to decline.

Back to the topic of the Nobel Prize.

It has been argued that the awards were proposed more than a year in advance. How did the awards committee know that their awards for the brilliant people who figured out how to save the economy with fiat inflation and bank bailouts were going to burn the whole world in inflationary hell and the lights on the Eiffel Tower were out , while every household in Europe and the UK is debating how to heat their homes this winter, announces?

We can also add to this list of disasters a global health crisis, a sharp decline in life expectancy, and the demoralization of an entire generation that has lost hope for the future.

That’s what “experts” do with the world, and this crisis begins in the labs of intellectuals who think they know a better way to run the world than freedom. Now, the rest of us are forced to watch them reward each other for good work, adding another layer of moral hazard: making a serious mistake doesn’t actually have any professional consequences for them.

from Brownstone College

About the Author:

Jeffrey A. Tucker, founder and president of the Brownstone Institute, has published thousands of articles in scholarly and popular media and in five languages Ten books, the most recent being Liberty or locked. He is also editor of The Best of Mises. He writes daily for The Epoch Times Economics column covering a wide range of topics including economics, technology, social philosophy and culture.

This article: A Nobel Prize for Moral Hazard was published in The Epoch Times.

This article represents the author’s personal views only and does not necessarily represent the position of The Epoch Times.

Responsible editor: Gao Jing#