On October 12, Eastern Time, US stocksThe three major indexes collectively closed higher,The Dow rose 0.28% to 34194.06 points,A new closing high since April 21The S&P 500 rose 0.59% to 4027.26 points; the Nasdaq rose 0.99% to 11285.32 points.

Most Chinese concept stocks closed up, with KWEB up 2.45%. Ali rose 3.3%, Pinduoduo fell 0.07%, JD.com rose 1.36%, and reached a strategic cooperation with HKUST Xunfei. Ideal rose 3.59%, Weilai rose 5.49%, Xiaopeng rose 3.98%,Bilibili rose 0.99%, Baidu rose 2.02%, New Oriental fell 0.27%, NetEase rose 1.73%。

Most of the large technology stocks closed higher. Apple rose 0.59%, Microsoft rose 1.04%, and Google rose 1.45%. Shareholders demanded a reduction in scale and increased buybacks. Google plans to lay off 10,000 employees. Tesla rose 7.82%, the biggest one-day gain since July. Musk said he would expand cooperation with South Korea in the supply chain and purchase components worth $10 billion by 2023. Meta rose 0.72%, and Disney rose 2.78%. The movie “Avatar: The Way of Water” is scheduled to be released in mainland China on December 16.

European stocks closed up across the board. The German DAX index rose 0.04% to 14427.59 points, the French CAC40 index rose 0.32% to 6679.09 points, and the British FTSE 100 index rose 0.17% to 7465.24 points.The European Stoxx 50 index rose 0.42% to 3946.44 points.

Fed Minutes: Majority Supports Slower Rate Hikes

On November 23, US Eastern Time, the minutes of the Fed’s November interest rate meeting released by the Federal Reserve showed that most of the Fed officials who participated in the meeting believed that it might be appropriate to slow down interest rate hikes soon; previous expectations.

The minutes of the meeting stated thatThe vast majority of participants felt that a slowdown in rate hikes may soon be appropriate. Uncertainty about the impact and magnitude of monetary policy actions on economic activity and inflation is one reason why this assessment is important.

A small rate hike would give policymakers a chance to assess the impact of successive hikes.

A few members said slower growth would reduce the risk of instability in the financial system. Others said they wanted to wait for the pace to slow down. Officials said they believed the balance of economic risks was now tilted to the downside.

In addition, economists within the Federal Reserve expect the chance of a U.S. recession in the next year to be close to 50%.

Anemic growth in real domestic private sector spending, a deteriorating global outlook, and tightening financial conditions are considered to pose prominent downside risks to the forecast for real economic activity; furthermore, a sustained decline in inflation may require a tighter-than-expected tightening in financial conditions, This possibility is also seen as a downside risk.

Fed economists believe that the baseline forecast for actual economic activity is skewed toward the downside, with a recession almost as likely as the baseline scenario sometime next year.

International oil prices plummeted

According to foreign media reports, an EU diplomat said on Wednesday that the Group of Seven (G7) is considering setting a price ceiling for Russian seaborne oil in the range of 65-70 US dollars per barrel, which is higher than market expectations.

The G7 is set to impose price caps on seaborne exports of Russian oil on Dec. 5. The move is part of sanctions aimed at slashing Moscow’s oil export revenues to reduce the amount it uses to finance the invasion of Ukraine.

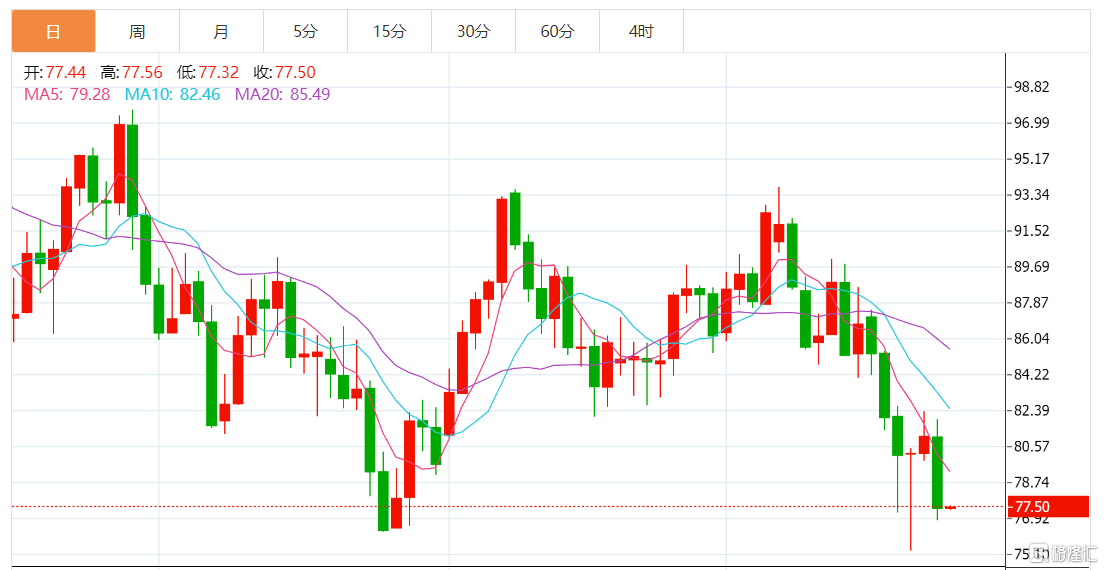

Affected by this news, crude oil once fell by more than 4%. As of the close,WTI crude oil futures closed at $77.94 per barrel, down $3.01, or 3.72%.

Poland and the Baltic states objected to the European Commission’s proposal of $65 a barrel, arguing that the price was too generous for Moscow, according to people familiar with the matter. But some countries with larger shipping industries, including Greece and Malta, do not want a price cap below $70, the high end of a price range proposed by the European Union earlier on Wednesday. The ambassadors are due to resume talks on Wednesday night. If an agreement cannot be reached, they could meet again as early as Thursday to continue discussions. Energy ministers from EU countries will also meet on Thursday to discuss measures to cap natural gas prices.

In addition, the economic outlook report released by the OECD on the 22nd stated that the rise in energy prices has seriously damaged the global economy. If the European natural gas inventory is insufficient, the situation will be worse, the economic growth in Europe and the world will decline, and prices will rise. .

U.S. jobless claims hit 240,000 last week

The U.S. Department of Labor stated on the 23rd,As of the week of November 19, the number of people applying for unemployment benefits in the United States was 240,000, the largest increase since the week of August 13, 2022. It was expected to be 225,000, and the previous value was 223,000.

The number of people continuing to apply for unemployment benefits in the week ended November 12 was 1.551 million, expected to be 1.517 million, and the previous value was 1.507 million.

The data this time was released one day earlier because of the Thanksgiving holiday on the 24th. Sources pointed to the rise in claims last week as likely being technical, as economists said the models the government uses to adjust for seasonal fluctuations in the data would normally expect an increase in initial jobless claims because many businesses will be in the middle of the week. Temporarily closed during the holidays.

“Given the turmoil in the labor market, employers may not be interested in laying off employees, even if only temporarily, but remain focused on retaining them,” said Citi economist Mounir. “Basically, the uncertainty in the next few weeks will Big, as typical holiday-related seasonal patterns will clash with a persistently exceptionally tight labor market.”Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article represent only the author himself. Sohu is an information release platform, and Sohu only provides information storage space services.