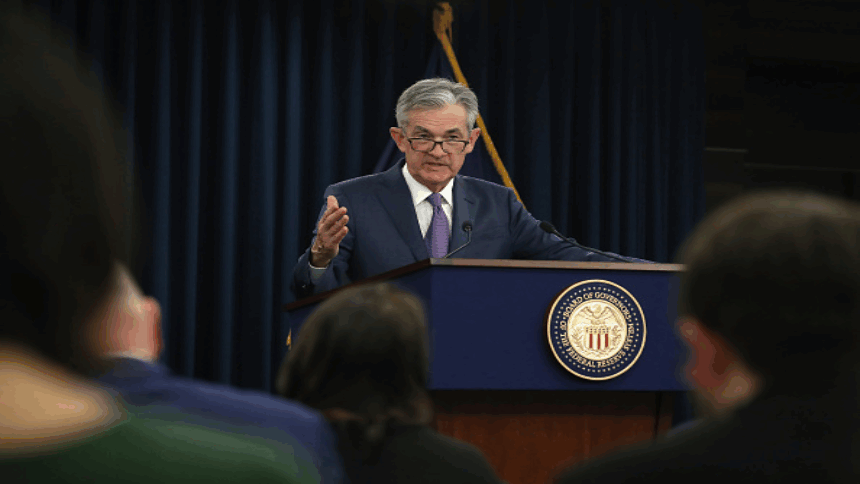

Powell noted that lowering inflation will likely take a while, likely to affect the labor market, and households and small businesses to suffer, all of which are the unfortunate costs of lower inflation.

Powell said that the longer high inflation persists, the more likely it is to become entrenched, and the Fed’s policy stance is to adjust the benchmark interest rate enough to constrain the economy to bring inflation back to 2%;9 The decision on a monthly rate hike will depend on all data from July, with Powell suggesting another “super-substantial” rate hike might be appropriate, but he declined to give a firm answer.

Powell added that at some point, as the policy stance tightens further, it would be appropriate to slow the pace of rate hikes, but lessons from history strongly caution against premature easing.

In addition, Gita Gopinath, First Deputy Managing Director of the International Monetary Fund (IMF), said at the annual meeting of the central bank that it is believed that the United States will remain at a high level of inflation in the next one to two years. The main task is to suppress high inflation, not to ease monetary policy.

Gopinath said that global central banks need to jointly take a tough stance to deal with high inflation, and central banks must be mentally prepared at the expense of employment and economic growth; it is still too early to judge the slowdown of global inflation, and developing countries need to face food And high energy prices, the situation is worrying.

Powell’s remarks shattered speculation about a slowdown in interest rate hikes, with the Dow tumbling more than 1,000 points and all three major U.S. indexes down more than 3 percent.

Loretta Mester, president of the Cleveland Fed, who has voted on monetary policy this year, said that the U.S. benchmark interest rate may rise above 4 percent by the end of this year and remain there for a while; the interest rate swap market shows that traders are betting on the Fed There is a 50% chance of a 0.75% rate hike next month.