On Thursday evening local time, Japanese Finance Minister Toshi Suzuki, who is currently visiting Washington in the United States, held talks with U.S. Treasury Secretary Yellen.The two sides discussed the recent sharp fluctuations in the yen exchange rate in the foreign exchange market and agreed to maintain the existing foreign exchange rate agreement.

Shunichi Suzuki said:

“We discussed G7 views on the foreign exchange market and will respond in accordance with the (current) agreement.”

The current G7 agreement stipulates that exchange rates should be determined by the market, although excessive volatility could negatively impact the economy.

Shunichi Suzuki declined to comment on whether Japan, which is highly concerned by the market, will directly intervene in the depreciation of the yen.He said the focus of the talks between the two was on the economic conditions of the two countries, rather than concerns about the value of the yen.

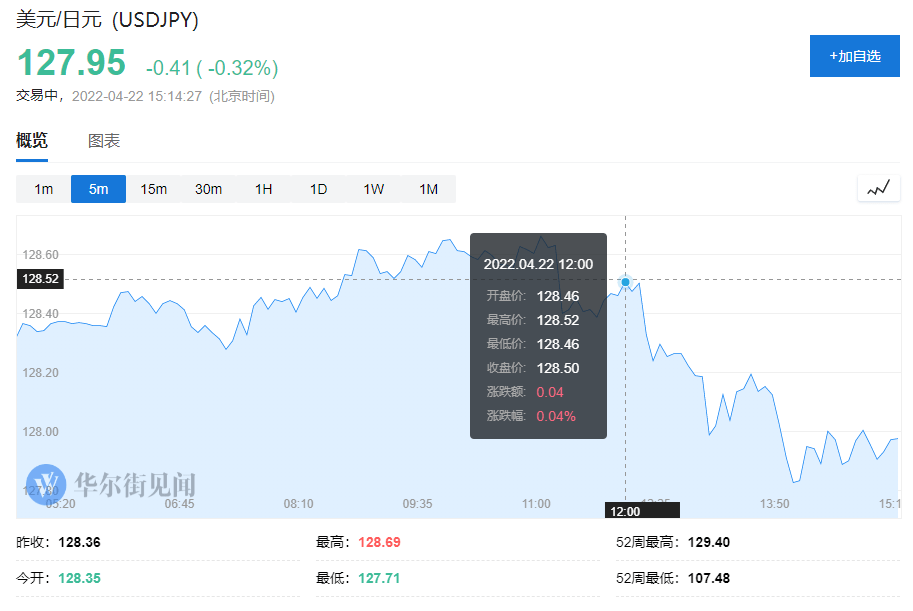

This statement is obviously difficult to inject a “stimulant” into the yen. but,The report from Japan’s TBS radio station appears to have brought a new light to the yen bulls.On the afternoon of April 22, TBS quoted officials familiar with the matter as saying that at the meeting, Shunichi Suzuki had discussed the issue of intervening in the yen with Yellen, and discussed the possibility of joint intervention. After the news, the yen-dollar exchange rate edged up to 127.95 from around 128.50 in midday trading.

Generally speaking, when Japan decides to intervene in the exchange rate, the market usually appears with a series of “verbal warnings” carefully choreographed by relevant officials. If they say the government isn’t ruling out any options, or is ready to act decisively, that usually means sending a signal that makes markets on high alert that intervention may be imminent. Judging from the current positions of relevant parties, there may still be a long way to go before the Bank of Japan’s “alarm bell” really rings.

As to whether the Bank of Japan will intervene and when it may intervene, Wall Street News has elaborated in the previous article “”.

In addition, the Bank of Japan’s interest rate decision to be held next week is also worthy of investors’ attention. However, while expectations are rising that the central bank may adjust policy by the end of the year in response to a weaker yen, economists polled by Bloomberg widely expect the Bank of Japan to remain on hold next week.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.