NO.1 On March 7, State Councilor and Foreign Minister Wang Yi answered questions from Chinese and foreign journalists on issues related to “China’s foreign policy and foreign relations”.

Talking about the situation in Ukraine, Wang Yi said that the dispute must be resolved peacefully through dialogue and negotiation;

Talking about Sino-Russian relations, Wang Yi said that Sino-Russian relations have the value of independence and self-reliance.

Talking about China-US relations, Wang Yi said that the two sides should replace the “rule of thirds” of competition, cooperation and confrontation with the “three principles” of mutual respect, peaceful coexistence and win-win cooperation;

Talking about China-EU relations, Wang Yi said that China-EU relations are not aimed at, not dependent on, nor controlled by a third party;

Talking about China-Japan relations, Wang Yi said that the Japanese side should follow the trend and not move against the current. (Comprehensive CCTV News)

NO.2 Agenda of the two sessions

9 am on the 8th,The second plenary meeting of the Fifth Session of the 13th National People’s Congress was held in the Great Hall of the People to hear the report of Li Zhanshu, Chairman of the Standing Committee of the National People’s Congress, on the work of the Standing Committee of the National People’s Congress, heard the report of the Supreme People’s Court President Zhou Qiang on the work of the Supreme People’s Court, and heard the report of the Supreme People’s Procuratorate’s chief procurator Zhang Jun on the work of the Supreme People’s Procuratorate. In the afternoon, the Fifth Session of the 13th National People’s Congress held a meeting of the representative group to review the work report of the Standing Committee of the National People’s Congress; the second meeting of the Presidium was held. (CCTV News)

NO.3 Focus on the suggestions of the two sessions

On the morning of March 7, the topic of “proposed to cancel the public space for commercial housing” was the first trending search on Sina Weibo, arousing widespread concern.Hong Yang, a member of the National Committee of the Chinese People’s Political Consultative Conference, strongly suggested that the state abolish the public pool area. The public pool area cannot be seen or touched, but the common people bear high costs for it.. (per synthesis)

recently,Zhu Lieyu, deputy to the National People’s Congress and director of Guangdong Guoding Law Firm, suggested that the second paragraph of Article 133-1 of the Criminal Law should be amended as soon as possible to cancel the crime of drunk driving., and this also caused a heated discussion among netizens. Zhu Lieyu believes that through administrative detention and heavy fines, the goal of drinking and not driving and driving without drinking can also be achieved. (per synthesis)

Member of the National Committee of the Chinese People’s Political Consultative Conference, actor of the Rap Troupe of China Broadcasting Art TroupeGong HanlinIn an interview during the two sessions, he said that stars earn tens of millions and hundreds of millions of tax evasion shame people”,He called on the state to reform the model worker commendation system so that everyone can see that models are valuable. (People’s Political Consultative Conference Daily)

NO.4 March 7,Lian Weiliang, deputy director of the National Development and Reform Commission, said that the conflict between Russia and Ukraine will bring greater uncertainty to the development of the world economyI would like to emphasize here that China’s economy is resilient, has great potential, and has great space. Although the external environment for China’s economic development has become more complex and severe,The fundamentals of China’s long-term economic growth will not change, and there are still good foundations and conditions to keep the economy operating within a reasonable range.. (CCTV News)

NO.5 In February, in the context of the continued decline in the sales of the national property market, the Shanghai market once again showed its magic – the transaction volume in the first week after the Spring Festival rushed to 190,000 square meters, reaching a normal level. Throughout February, a total of 809,000 square meters of new houses were sold in Shanghai. (Daily Economic News)

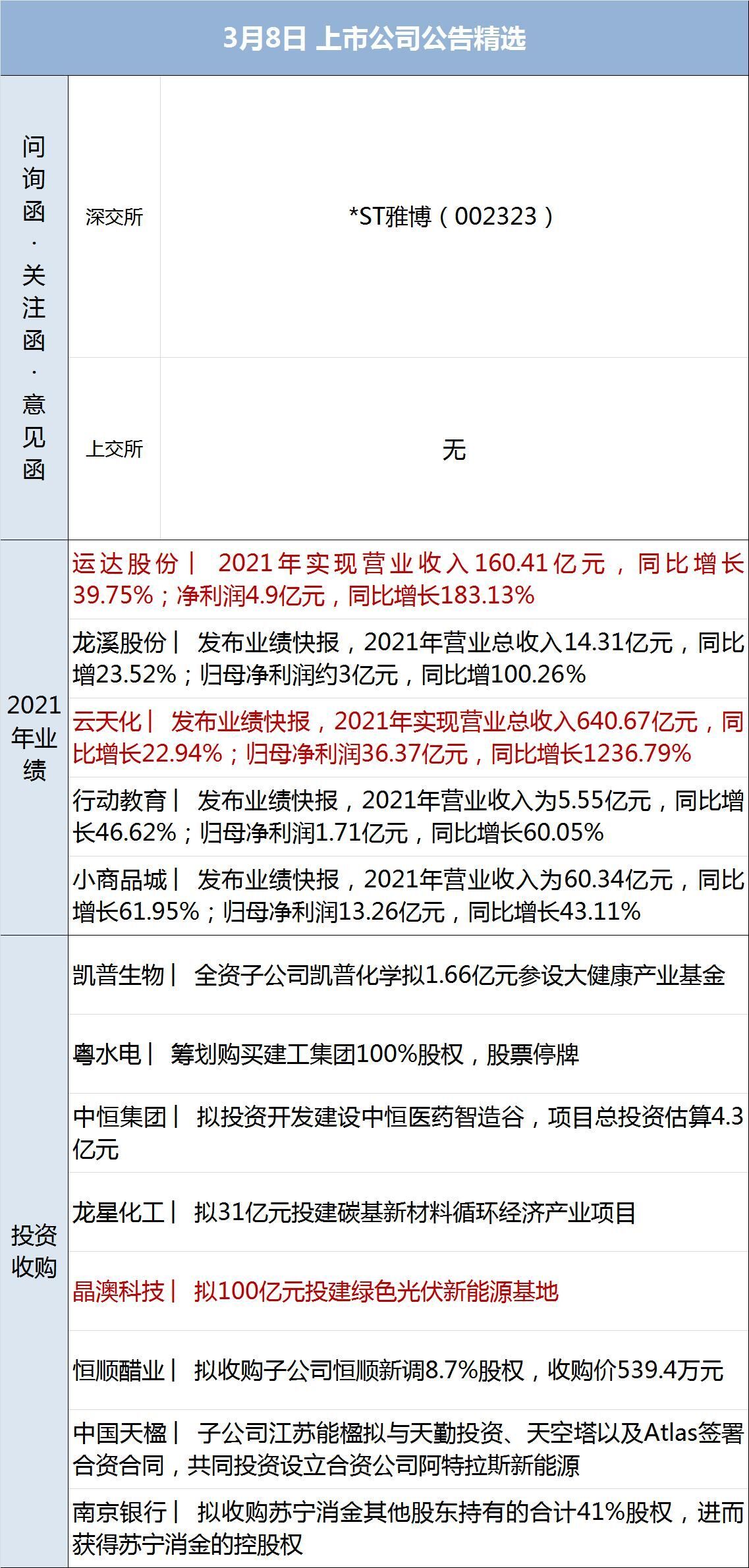

NO.6 With the successive disclosure of annual reports of listed companies,Ten billion private equity positions such as Gao Yi Assets, Xuanyuan Investments, Abama Assets, and Yingshui Investments gradually surfaced. Judging from the information in the annual reports that have been released so far, most of the top private equity holdings remained unmoved in the fourth quarter of last year. Feng Liu, manager of Gaoyi Assets Fund, continued to hold traditional Chinese medicine stocks Kangyuan Pharmaceutical, Deng Xiaofeng continued to hold Li’anlong, and Abama Assets held There are Jinbo shares that have not been moved, Xuanyuan Investment’s holdings of Zhongtai Chemical and Wasion Information have not been moved. (Securities Times)

NO.7 South Korea’s “Kimchi No. 1 Master” and the president of Hanxing Foods, Kim Sunja, was blasted that his kimchi factory used severely rotten and moldy raw materials to make kimchi. After the incident came to light, Jin Shunzi issued an apology to consumers for the hygiene problems of his kimchi subsidiary, and said that the related products were being destroyed and the cause would be thoroughly investigated. South Korea’s Ministry of Agriculture, Forestry, Livestock and Food announced on the 4th of this month that it had decided to revoke Kim Sunja’s title of food master after holding a relevant meeting. (World Wide Web)

NO.8 The A-share market fell sharply.Investors from 20 fund companies including Southern Asset Management gave their interpretations,It is believed that the short-term adjustment of the market may continue, but the medium and long-term A-share trend will not be changedthis year is more optimistic about “stable growth” related sectors.Looking forward to the market outlook, some private equity firms believe that there is no “stagflation” worry in China for now, and they are not afraid of short-term fluctuations, waiting to regain lost ground. (Comprehensive China Fund News)

Oil prices, gold, and palladium have all gone crazy recently.Regarding the future of commodities, analysts from many institutions pointed out that regional conflicts in the later period are expected to turn into political games, and the promotion of commodity premiums may gradually ease.. (21st Century Business Herald)

NO.9 【Russian-Ukrainian conflict】——Latest news

On the evening of March 7, local time, after the third round of Russia-Ukraine negotiations, a member of the Ukrainian delegation said that consultations with Russia on a ceasefire and cessation of hostilities will continue, and there is still no substantive result on related issues.(CCTV News)

On March 7, local time, U.S. President Biden had a video call with French President Emmanuel Macron, German Prime Minister Scholz and British Prime Minister Johnson.Leaders of several countries affirm that they will continue to expand sanctions on Russia, and pledged to provide security, economic and humanitarian assistance to Ukraine. (CCTV News)

On March 7, local time, four senior leaders of the U.S. Senate and House of Representatives issued a statement,Reached an agreement on the outline of a bill to sanction Russia, said it would jointly draft a bill to suspend normal trade relations with Russia and Belarus, and authorize the Biden administration to raise tariffs on both countries. (CCTV News)

7th local time,The Russian government has approved a list of unfriendly countries and territories, including the US, EU member states, UK, Ukraine, Japan, and a few others. The Russian government cancels the payment of royalties to unfriendly countries. (CCTV News)

On March 7, the Russian Ministry of Defense released the latest information on the war situation. Since the start of the special military operation, the Russian armed forces have paralyzed 2,396 Ukrainian military targets. (CCTV News)

U.S. Secretary of State Blinken said on the 6th,The U.S. is working with its European allies on a possible ban on Russian oil imports as new sanctions against Russia. (CCTV News)

【Russian-Ukraine conflict】——Overseas market

Crude oil futures rose again on March 7, once approaching a 14-year high.As of press timeThe increase has declined, U.S. oil rose 3.79% to $119.87, and Brent oil rose 4.75% to $123.5. COMEX gold broke through $2,000 in intraday trading and is now up 1.8% at $2,002.2. London nickel soared 73.93% to $50,300/ton, hitting a record high of $55,000/ton during the session.

In the stock market, the Hang Seng Index fell 3.87%, the Nikkei 225 fell 2.94%, and South Korea’s KOSPI fell 2.29%.Major European stock indexes generally end lower,Germany’s DAX30 fell 1.98%, entering a technical bear market. Britain’s FTSE 100 fell 0.4%, France’s CAC 40 fell 1.31%, and the Euro Stoxx 50 fell 1.23%.

The three major U.S. stock indexes closed down collectively. The Dow fell 797.42, or 2.37%, and fell below the 33,000 integer mark to 32,817.38 points; the S&P 500 fell 2.95% to 4,201.09 points, the largest closing decline since October 2020; the Nasdaq fell 482.48 , down 3.62% to 12830.96 points. Airline stocks and technology stocks fell one after another. Lemo Airlines fell more than 18%, Delta Airlines fell more than 12%, and American Airlines fell more than 11%. Nvidia fell by nearly 7%, Amazon fell by more than 5%, Google fell by more than 4%, Tesla and Microsoft fell by more than 3%, and Apple fell by more than 2%. Most of the popular Chinese concept stocks fell, Bilibili fell by more than 8%, Xiaopeng Motors fell by more than 7%, Pinduoduo and Baidu fell by more than 6%, and JD.com fell by more than 4%.

NO.10 Epidemic prevention and control

Five new medium-risk areas have been added in Xi’an:1. Building L3, Cuizhuyuan Community, Agile Community, Qujiang New District; 2. Building 17, Vanke City Light Community, Vanke Community, Qujiang New District; 3. Building 6, Jinhui Swanwan Community, Hongmiaopo Street, Lianhu District; 4. Zhongshan, Xincheng District Xiaoyang BBQ Restaurant, No. 130, Dongxin Street, Men Street; 5. Yuezhen Xuan, No. 256, Dongxin Street, Xiyi Road, Xincheng District.After adjustment, there are 8 medium-risk areas in Xi’an. (CCTV News)

On the afternoon of March 7, the Shanghai Municipal Health Commission notified: On March 7, in the follow-up inspection and testing of the current local epidemic-related risk personnel in our city, 4 new local confirmed cases of new coronary pneumonia and 8 new local confirmed cases of new coronary pneumonia were reported. Asymptomatic infection. (released in Shanghai)

On March 7, the Qingdao Municipal Health Commission notified that from 12:00 to 19:00 on March 7,9 new confirmed cases of local new coronary pneumonia in Laixi, Qingdao, Shandong, 66 cases of asymptomatic infection. (Healthy Qingdao)

From 0:00 on March 6 to 24:00 on March 7,Huangdao District, Qingdao City, Shandong Province reports 3 local confirmed cases of new coronary pneumonia and 4 asymptomatic infections, are currently receiving isolation treatment in designated hospitals and are in stable condition. (CCTV News)

March 7th 0-14:00,6 new local confirmed cases in Gansu province(2 cases in Qilihe District, Lanzhou City, 1 case in Chengguan District, 1 case in Honggu District, 1 case in Jinta County, Jiuquan City, and 1 case in Lanzhou New District). Since January 23, 2020, there have been 254 local confirmed cases and 12 asymptomatic infections in Gansu Province. (CCTV News)

NO.1 Kweichow Moutai:On the evening of March 7, Kweichow Moutai rarely disclosed the main operating data from January to February 2022. According to media statistics, this is the first time in the history of Kweichow Moutai that such data has been released. According to the company’s preliminary calculation, from January to February 2022, Kweichow Moutai will achieve a total operating income of about 20.2 billion yuan, a year-on-year increase of about 20%; the net profit attributable to the parent is about 10.2 billion yuan, a year-on-year increase of about 20%. However, on March 7, the share price of Kweichow Moutai fell 4.13% to close at 1,707 yuan per share. (Daily Economic News)

NO.2 Luzhou Laojiao:On March 7, it was reported that Luzhou Laojiao Group held a cadre meeting. It was announced at the meeting that Zhang Liang would no longer serve as the party secretary and chairman of the Luzhou Laojiao Group, and would be transferred to the position of the head of the preparatory team of Zhida Investment Group and Sichuan Yuanjingda Food Company; Liu Miao was appointed as the party secretary and chairman of the Luzhou Laojiao Group. He also serves as Secretary of the Party Committee and Chairman of Luzhou Laojiao Co., Ltd. It has been confirmed by various reporters that the personnel change is true. (Daily Economic News)

NO.3 CICC:On March 7, it was announced that 398.5 million shares of the original shareholders’ restricted shares will be lifted on March 10, with a scale of 398.5 million shares, accounting for 8.26% of the company’s total share capital. The holder of the above-mentioned restricted shares is Haier Group (Qingdao) Financial Holding Co., Ltd. Based on the closing price on March 7, the corresponding market value of the lifting of the ban is 15.72 billion yuan.

NO.4 Huaqin Technology:The most expensive new stock of the year, Huaqin Technology, was listed on March 7. It stood at 251 yuan at the opening, and the stock price was as high as 277.98 yuan. The winning lottery could earn up to 44,240 yuan, and the stock price rose by 37.20% at the close. It is reported that the initial price of Huaqin Technology is 189.5 yuan, and the issuance price-earnings ratio is 81.6 times.

NO.5 Bank of Nanjing, Suning Consumer Gold:It is reported that Bank of Nanjing has completed the acquisition of the controlling stake in Suning Xiaojin. The counterparty of the transaction is mainly Suning.com, the largest shareholder of Suning Consumer Finance. After the equity transfer, Bank of Nanjing will obtain the controlling stake, with a controlling ratio exceeding 50%. During this period, all parties to the transaction will implement transitional arrangements. However, the equity transaction still needs to obtain regulatory approval before closing to complete the equity transfer. (The Paper)

NO.6 TBEA:Recently, the Shanghai Bills Exchange announced that as of the end of February this year, the list of acceptors for commercial acceptance bills will continue to be overdue, and the Xinjiang Transformer Factory of TBEA is on the list. In this regard, TBEA, with a market value of more than 70 billion, rushed to issue a clarification announcement before the opening of the market on Monday. The reason for the overdue was that the settlement method chosen by the bearer did not meet the bank’s requirements, and the bank account information was not provided. The company stated that the above-mentioned commercial acceptance bills have all completed the payment and settlement work. (China Fund News)

NO.7 Tesla:Recently, some netizens reported that when they were driving a Tesla Model 3, they received a prompt that “super charging service has been disabled”. Faced with the “sky-high” charging bill, the netizen questioned and called Tesla’s official customer service. The other party responded that there are currently errors in the background systems of some vehicles, and the technicians are repairing them or will solve the problem within 24 hours. (Securities Times)

NO.8 Norwegian Government Global Pension Fund:Recently, the world‘s largest sovereign wealth fund, the Norwegian Government Global Pension Fund, released its 2021 annual report. Due to the surge in the global stock market, the fund will achieve a 14.5% return on investment in 2021, and the investment income will reach 1.58 trillion kronor (about 1.02 trillion yuan). According to rough estimates by the media, the fund earned about 190,000 yuan per Norwegian citizen last year. In the past 10 years, the fund has only lost money in 2018, and has made profits in the other 9 years. It has made a total of 7.35 trillion kroner (about 4.75 trillion yuan), which is about 1.37 million yuan for every Norwegian. (Securities Times)

NO.9 LVMH, Kering, Richemont:Recently, the latest financial reports of the three major luxury goods giants LVMH, Kering and Richemont have been released. LVMH’s annual sales last year were 64.2 billion euros, and Kering’s sales reached 17.645 billion euros, both hitting record highs. Although Richemont Group has not disclosed its 2021 financial report, its key financial data for the third quarter shows that its performance has improved by leaps and bounds. The total sales in the third quarter increased by 32% year-on-year to 5.658 billion euros, an increase of 38% compared with the same period in fiscal year 2020. . (21st Century Business Herald)

NO.10 Microsoft:Foreign media reported that Microsoft recently completed the final acquisition of voice technology company Nuance Communications for $19.7 billion. It is reported that Microsoft announced the acquisition in April last year, and last week finally won the approval of the British Competition and Markets Authority, clearing the final acquisition hurdle. Nuance is best known for its Dragon software, which uses deep learning to transcribe speech and improve its accuracy by gradually adapting to the user’s voice. Nuance has used this technology for many services and applications, including Siri, Apple’s most famous digital assistant. (World Wide Web)

Investment interaction

Click to inquire。

On March 7, Beishang funds sold a net 8.272 billion yuan. Among them, the net sales of Shanghai Stock Connect was 5.286 billion yuan, and the net sales of Shenzhen Stock Connect was 2.986 billion yuan. On March 7, in the list of active stocks in Beishang capital transactions, there were 9 stocks with net purchases. The largest amount was Sungrow (300274.SZ, closing price: 123.92 yuan), with a net purchase of 545.3 million yuan; net sales There are a total of 11 individual stocks, and the largest amount is CATL (300750.SZ, closing price: 454.89 yuan), with a net sale of 1.3052 billion yuan.

On March 7, the net purchase of southbound funds was HK$5.449 billion. In the list of actively traded stocks by southbound funds, there are 10 stocks with net purchases. The largest amount is Tencent Holdings (0700.HK, closing price: HK$388.0), with a net purchase of HK$2,009.8 million; a total of 3 stocks sold on a net , the largest amount was CNOOC (0883.HK, closing price: HK$10.66), with a net sale of HK$263.8 million.

CITIC Construction Investment:The policy emphasizes the continuous deepening of the solid waste industry chain, the promotion of waste classification, reduction and recycling, the marketization of sanitation at the front end of the solid waste industry chain will continue to deepen, and the back-end waste incineration and utilization of renewable resources will continue to receive policy support. It is recommended to pay attention to investment opportunities in new energy sanitation equipment, energy conservation and emission reduction. In the field of sanitation, it is recommended to benefit from the trend of electrification of sanitation equipment, and it has an overall solution provider for sanitation equipment manufacturing and the entire industry chain of sanitation operations; in the field of waste incineration, it is recommended to recommend leading waste incineration enterprises with large capacity increments; in terms of sewage treatment, we recommend It is recommended to pay attention to regional sewage operating enterprises.

Every reporter: Wang Fan

Every editor: Zhang Yangyun and Wang Xiaobo

Disclaimer: The content and data of the article are for reference only and do not constitute investment advice. Investors operate accordingly at their own risk.