Bagnaia sets track record in Practice

The big names at the meeting The MotoGP™ riders returned to the Jerez track this afternoon during

Yeferson Cossio is sanctioned by the SIC, this is the multimillion-dollar fine

The investigation also showed that Grupo Cossio took advantage of the influence of Yeferson Cossio, who promoted

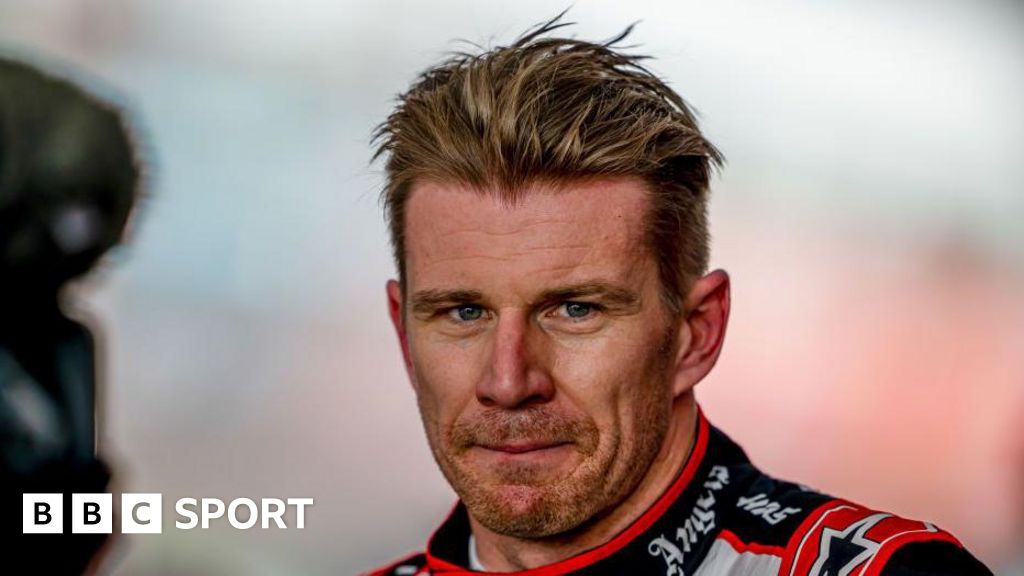

Nico Hulkenberg to join Sauber from Haas in 2025

Nico Hulkenberg will join the Sauber team for the 2025 season before their transformation into the factory

Popular Stories

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Bagnaia sets track record in Practice

The big names at the meeting The MotoGP™ riders returned to the Jerez track this afternoon during

Yeferson Cossio is sanctioned by the SIC, this is the multimillion-dollar fine

The investigation also showed that Grupo Cossio took advantage of the influence of Yeferson Cossio, who promoted

Nico Hulkenberg to join Sauber from Haas in 2025

Nico Hulkenberg will join the Sauber team for the 2025 season before their transformation into the factory

Travel & Explore the world

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Bagnaia sets track record in Practice

The big names at the meeting The MotoGP™ riders returned to the Jerez track this afternoon during

Yeferson Cossio is sanctioned by the SIC, this is the multimillion-dollar fine

The investigation also showed that Grupo Cossio took advantage of the influence of Yeferson Cossio, who promoted

Nico Hulkenberg to join Sauber from Haas in 2025

Nico Hulkenberg will join the Sauber team for the 2025 season before their transformation into the factory

the results of the 2024 EuroLeague quarter-finals, the victory of Barcelona and Monaco | Sport

Real Madrid is one win away from reaching the final four next week, and everything else is

Ftse Mib, the market multiples of automotive stocks (26/04/24)

Multiples are indicators that relate one series of variables referring to a single security in order to

but the fight is not yet won

Over the past fifty years, vaccines have been one of the most effective weapons in the fight

Explore and travel the world

Jan van Huysum: The Phoenix Among Flower Painters

Passive Smoking and Atrial Fibrillation: Is There a Link?