This year, Hongtao shares, which have been involved in successive disputes over sales contracts, ushered in a “white horse rider”.

Today (July 11), Hongtao Co., Ltd. (SZ002325, stock price 2.54 yuan, market value 3.843 billion yuan) announced that the controlling shareholder and actual controller Liu Nianxin signed a contract with Hubei Lian Investment Capital Investment Development Co., Ltd. (hereinafter referred to as Lian Investment Capital). According to the “Share Transfer Intention Agreement”, after the transaction is completed, the actual controller of the company will be changed from Liu Nianxin to Hubei SASAC.

The reporter of “Daily Economic News” noticed that Hongtao shares are facing multiple problems such as sluggish main business, explosion of goodwill, and lawsuits.

The actual controller is to be changed to Hubei SASAC

Hongtao shares disclosed that, according to the “Equity Transfer Intention Agreement”, this change of control involves two parts: the transfer of the equity agreement and the entrustment of voting rights.

First of all, Liu Nianxin intends to transfer no more than 25% of the total shares of the listed company (calculated by the total share capital on July 8) to United Investment Capital or its designated main body. After signing the formal equity transfer agreement, Liu Nianxin entrusts all the voting rights of the listed company he holds to Lian Investment Capital or its designated entity to exercise.

If this transaction is completed, United Investment Capital or its designated entity will become the company’s new controlling shareholder, with no more than 24.41% of the voting rights (calculated based on the total share capital on July 8). Since the actual controller of Lianjin Capital is Hubei SASAC, the actual controller of Hongtao shares will also be changed to Hubei SASAC.

Lian Investment Capital is the core company in the financial sector of Hubei Liantou Group Co., Ltd. (hereinafter referred to as Liantou Group). Liantou Group’s specific business operations cover new industrial cities, park operations, real estate development, industrial finance, digital industries, infrastructure and new infrastructure, with total assets of 300 billion yuan, holding 1 listed company and participating in 3 listed companies.

However, this equity transfer agreement is an agreement of intent. United Investment Capital will also conduct due diligence on the company in the future. After this transaction, necessary decision-making procedures, including internal approval and the consent of the state-owned assets authority, can be signed before the formal equity transfer can be signed. protocol.

It is worth mentioning that today, Hongtao Co., Ltd. also signed a “Strategic Cooperation Framework Agreement” with United Investment Capital. The agreement shows that the two parties will adhere to the three principles of mutual benefit and win-win, complementary advantages, and active and steady progress. Lian Investment will coordinate the relevant resources of Lian Investment Group, and cooperate with Hongtao Co., Ltd. in terms of business synergy and expansion, specifically including living environment, Construction engineering and new materials and other fields.

Loss for two consecutive years, and many lawsuits with suppliers due to payment disputes

For Hongtao Co., Ltd., the entry of Hubei state-owned assets is undoubtedly a timely help. At present, listed companies are facing multiple problems such as sluggish main business, explosion of goodwill, and lawsuits.

The main business of Hongtao Co., Ltd. is architectural decoration. It mainly undertakes the design and construction of public decoration projects such as theater venues and libraries. Its business covers three major areas: decoration design, construction, and decoration material R&D and production. around 90%. From 2019 to 2021, the revenue of Hongtao’s building decoration business declined year after year, reaching 3.56 billion yuan, 3.179 billion yuan, and 2.421 billion yuan respectively.

In the reply to the inquiry letter of the 2021 annual report, Hongtao shares attributed the decline in main business revenue to two points. First, the overall number of projects in the industry has decreased, and the company’s business expansion is under great pressure. Second, the company has adopted a more prudent business strategy and an order strategy of “doing something and not doing something”, resulting in a small number of new orders signed by the company. At the same time, due to the impact of the epidemic, the progress of the project has slowed down.

Vocational education is the secondary industry that Hongtao shares focus on developing. However, the expansion of this sideline business was not smooth. The acquired subsidiary, Beijing Shangxue Kukao Education Technology Co., Ltd. (hereinafter referred to as Shangxue Education) not only exploded in goodwill, but also brought negative public opinion to the company.

In 2015, Hongtao acquired 70% of Shangxue Education, generating a goodwill of 239 million yuan. However, during the three-year performance commitment period, Shangxue Education has not fulfilled its performance commitment for two years, and in the past two years, Shangxue Education has suffered continuous losses. In addition, Shangxue Education has also been caught in a “scandal” where students complained that refunds were difficult. In 2020 and 2021, Hongtao Co., Ltd. made a provision for impairment of goodwill of 57.2978 million yuan and 35.1607 million yuan for Shangxue Education.

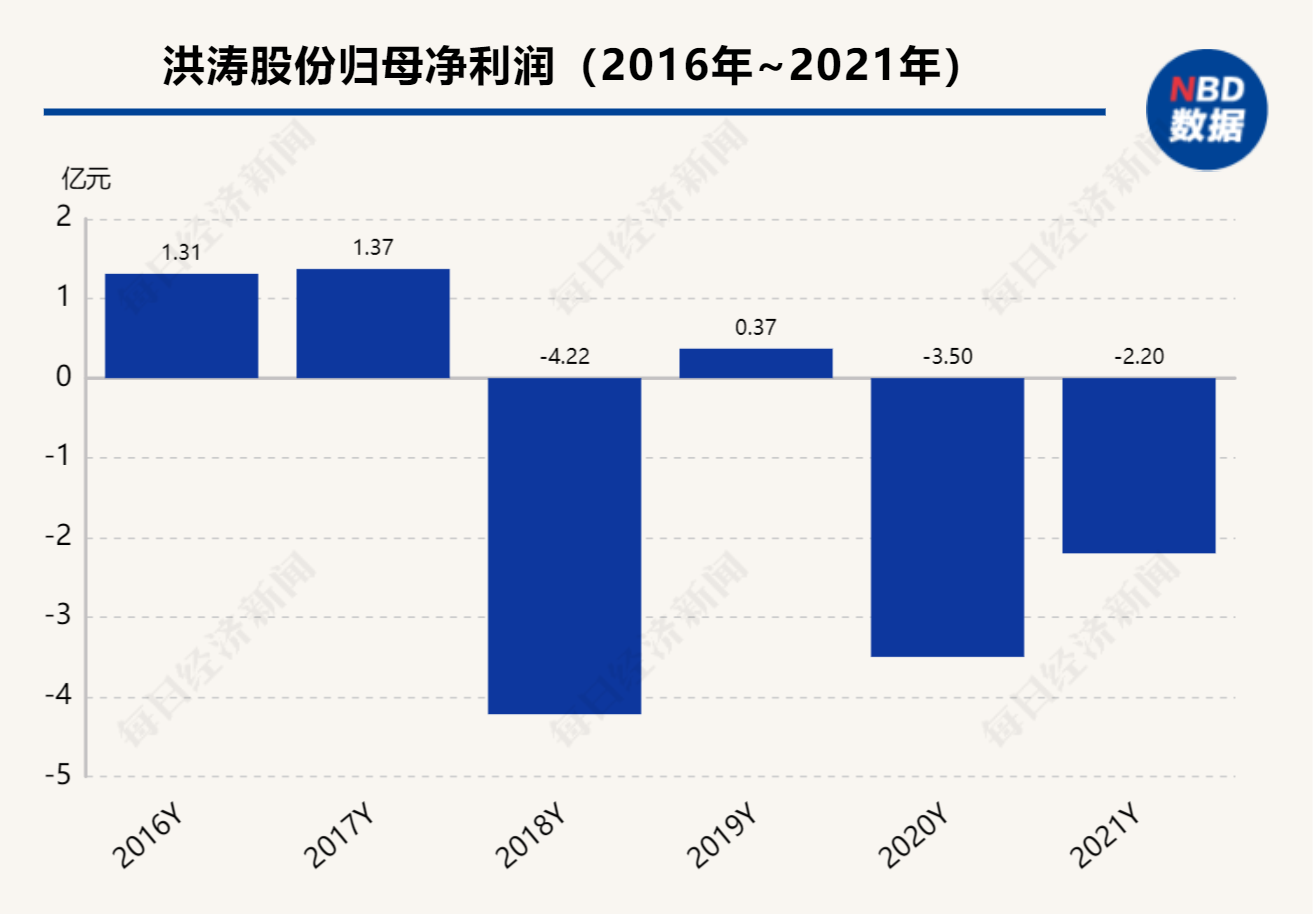

Both the main business and the side business are not developing smoothly, which has led to the poor performance of Hongtao shares in recent years. In the past two years, the operating income has been declining year by year, and the net profit has been losing money for two consecutive years. The net losses in 2020 and 2021 are 3.5% respectively. 100 million yuan, 220 million yuan.

In addition, due to the sluggish main business, Hongtao Co., Ltd. has been slow in collecting receivables in the past two years, resulting in a slow progress of payment to some suppliers, resulting in some lawsuits. In the first half of this year, this situation intensified. According to information from Qixinbao, more than 100 shares of Hongtao shares were involved in the judgment documents issued since the beginning of this year, most of which were disputes between Hongtao shares and suppliers due to arrears of payment.

(Image source: Vision China-VCG41N914917540)