Independent Financial Advisor and Co-Founder of Affari Miei

5 December 2023

If your advisor has suggested you invest in Azimut Equity China fund (ISIN: LU2097828631) because you are already their customer or because you are interested in investments, this guide could be right for you.

Today we will analyze all the characteristics of the fund starting from its own KID (Key Information Document) and we will review all the main information to understand together whether it is a convenient fund for you or not.

Let’s start!

This article talks about:

Due parole su Azimut Holding

The company offering the mutual fund is Azimut Holdingan independent management company that deals with consultancy and asset management.

It was founded in 1989, so it can boast 34 years of history. It is well established internationally, being present in 17 countries around the world.

This is the only one Italian multinational of managed savings which boasts customers in every country, reaching approximately 223 thousand.

The company also has a network of financial advisors of 1800 individuals who manage a total of 53 billion in assets under management.

Without a doubt we are faced with a safe and reliable company, capable of satisfying all the required security requirements.

It is also the largest independent asset management company on the Italian market.

If you are interested in learning more, here you will find all the best Azimut funds.

Azimut Equity China Fund: the characteristics

The proposed mutual fund is established under Luxembourg law.

This product aims to achieve a long-term capital growth and invests at least80% of its assets in stocks and shares of companies of all market capitalizations operating in China.

It was launched in May 2020, meaning it is a recent fund that is only 3 years old.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

What the fund invests in

As we have seen, the fund invests at least 80% of its assets in shares issued by companies that have their headquarters or in any case carry out a large part of their activity in the region of Greater China and which are listed on national stock exchanges in mainland China and other areas.

To be more specific, the region “Greater China” includes mainland China, the Hong Kong Special Administrative Region, the Macao Special Administrative Region and Taiwan.

As regards theasset allocation we have the weight distributed as follows:

93.15% in shares; 2.18% in bonds; 5.17% in liquidity.

As regards the sectors in which the companies in the basket operate, cyclical consumption comes first, followed by defensive consumption and financial services.

The benchmark

The fund is managed in active mannerwithout taking into account a reference parameter.

In order to calculate the adjustment of the supportthis is used vestment: 90% MSCI China All Shares Net Total Return USD + 10% Indice Bloomberg US Treasury Bill.

What is certain is that the fact of not having a reference index to rely on to carry out any evaluations is a further element of complication and criticality.

Subscription, exit and use of proceeds methods

The fund can be subscribed to either with a single payment (PIC mode) or with multiple payments (PAC, i.e. by creating an accumulation plan).

The minimum subscription must be $1500 and each additional minimum deposit must be at least $500.

The custodian of the product is BNP Paribas, Luxembourg Branch.

If necessary, this fund offers the possibility of exchanging its units with units of another sub-fund of the fund.

Regarding the distribution policy, this fund is ad accumulation of proceeds, as coupons are not distributed to investors, but are instead accumulated in the fund itself to grow capital and harness the power of compound interest.

Risk/reward profile

Now let’s see what the risk profile of the fund is and how it is classified on a scale ranging from 1 to 7.

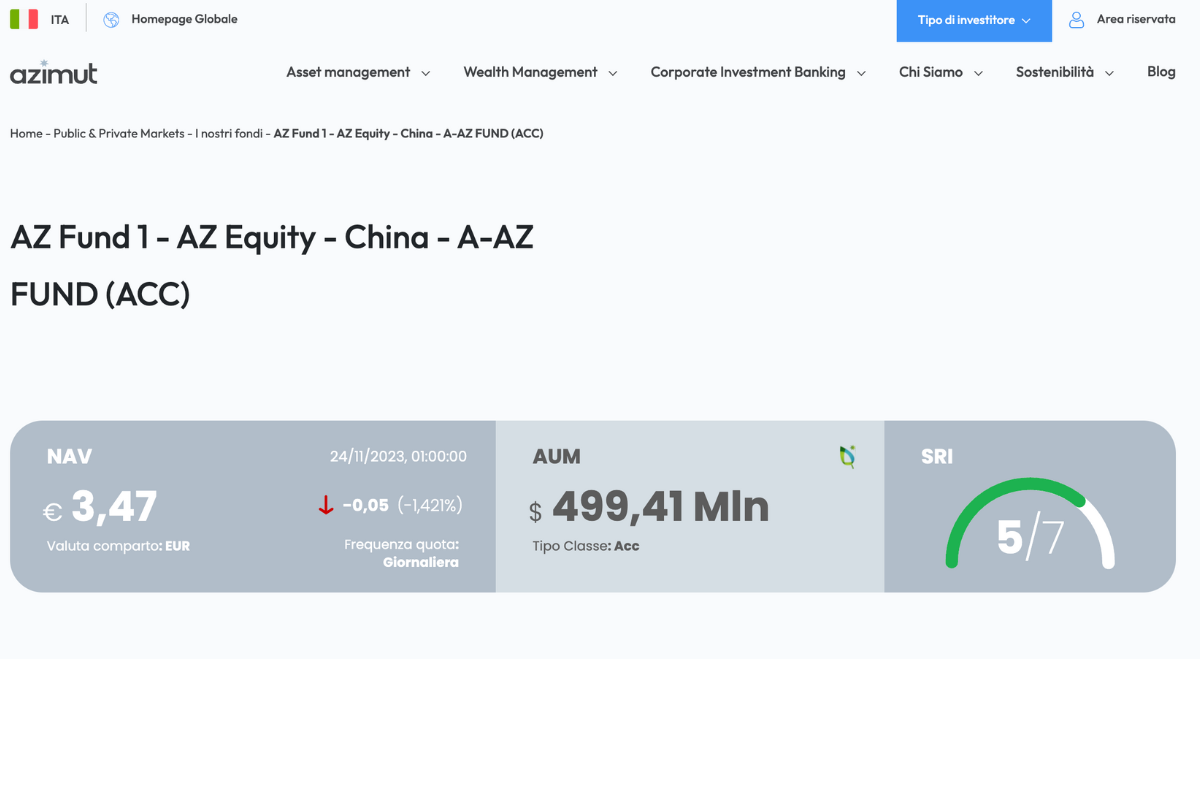

The Azimut Equity China fund has a risk profile of 5i.e. it is classified as medium/high risk.

This risk level assumes that the product will be maintained for 7 years. Actual risk may vary significantly if you cash out early, and your redemption amount may be lower.

Costs

Let’s now move on to the cost analysis. THE costs they must always be considered when choosing one investment over another, because they are the ones that impact the outcome of the investment in one sense or another.

In this case we have one entry fee equal to 2% of the amount paid upon subscription of the investment, and none exit fee.

The management fees amount to 4% of the investment value per year, while transaction costs are 0.4% of the investment value per year.

If you want to delve deeper into this topic I recommend our free report in which we explain the true impact of costs on a portfolio.

Past performance

After the costs, it is good to take a look at the returns.

Let’s start by saying that past returns are not at all predictive of future ones, but rather serve us to give an overview of how the fund is performing and how it has performed over time.

To reason together I attach the screen which I took directly from the official website.

We only see a line representing the bottom because we don’t own any benchmark to compare with, however we can see that the fund performed and grew in 2021, but has performed poorly since 2022, achieving a downward peak in October 2022, and is currently still making a loss.

Performance scenarios

From 2023 it is mandatory to include this mirror on the KID which shows the potential returns of your investment in the event of different market conditions. It is a sort of prediction that the document gives you and which I will now report to you:

As you can see, the hypothesized scenarios take as a starting point an investment of €10,000 for a holding period of 7 years, as recommended by the fund.

As you can see from the table, the scenarios that arise are these:

Stress – In case everything goes wrong, we could reach a loss of -66.2% in the first year and -23.5% after 7 years; Unfavorable – The loss could reach -33.3% in 12 months and be limited to -4.9% in 7 years; Moderate – The average case expects a gain of 2.2% in the first year and an appreciation of 5.4% in 7 years; Favorable – In the best case scenario we could have a revaluation of +65.7% in one year and +10.0% in 7 years.

It is important to know that there is no minimum guaranteed return, so you could even lose all or a large part of your investment.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Affari Miei’s opinions on the Azimut Equity China fund

We analyzed the KID of the fund, reviewing all its characteristics.

Now, therefore, we can focus on an in-depth analysis of the investment from the point of view of its convenience, and in this regard I will provide you with the opinions about.

Azimut Equity China it is a mutual investment fund like many others on the market.

This is an actively managed fund, and this is where my reflections will focus.

In an increasingly global financial landscape, investors are paying attention not only to potential growth opportunities, but also to the costs associated with managing funds. In the context of the Azimut Equity China fund, which aims to capitalize on the dynamic Chinese stock marketa crucial consideration emerges that we have already mentioned: management costs.

We have already talked about it but to learn more I recommend you download our free report in which we explain in detail the critical issues of actively managed mutual funds.

In fact, investors should carefully evaluate how these costs may affect the overall return of their portfolio.

At the same time, the rise of Exchange Traded Funds (ETF), introduced an alternative that challenges the traditional approach to mutual funds.

Here on Affari Miei we usually pay a lot of attention to these instruments, as they often offer lower management fees and greater liquidity, arousing interest among those looking to optimize their investments. When analyzing the Azimut Equity China fund, it is essential to carefully examine the management costs to assess whether the potential growth on offer justifies these charges or whether investors could find a more cost-effective balance through ETF-based investment strategies.

This fund in particular still has one aspect to consider: the market in which it invests.

Investing in Chinese market represents a fascinating and at the same time complex opportunity.

China, with its ever-growing economy and the vastness of its industries, presents itself as fertile ground for investments, but navigating this scenario requires an in-depth understanding of economic dynamics, government policies and the unique challenges facing the market Chinese can present.

If it is true that the Chinese offers a large consumer market and rapid technological development, on the other hand factors such as government regulation and the complexity of international relations can generate uncertainties. Furthermore, the recent expansion of Chinese companies in the technology and financial sectors has sparked discussions about the implications for the security and stability of global markets. In this context, the investor must balance promising growth opportunities with a considered risk assessment.

In this case I can only recommend a prudent approach, based on in-depth research and prudent portfolio diversification; if you intend to enter this fund to reap the benefits of investing in the Chinese market, remember that it is not an investment suitable for everyone.

Of course I can’t give you clear opinions: I don’t know you and I don’t know what your financial situation is, I don’t know what you’re looking for and what investment you’re interested in pursuing.

However, I can invite you to make an in-depth comparison and also to download the free report in which we go into detail on the critical issues related to actively managed funds.

Thanks to this you will be able to have clearer ideas; Lastly I advise you to study and train you to gain greater awareness of the financial markets and better understand this world.

Now that we have truly reached the end, all I have to do is say goodbye and leave you with some useful guides with which you can begin your investment journey on the financial markets:

Happy continuation on Affari Miei!

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now