China’s Central Bank Increases Gold Holdings Amid Declining Foreign Exchange Reserves

May 11, 2024 – Watch China reporter Li Zhengxin’s comprehensive report

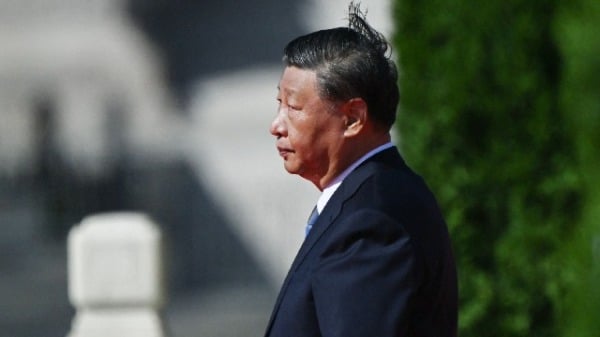

The People’s Bank of China has increased its gold holdings for the 18th consecutive month, becoming the “main force” of global central banks’ gold purchases. China’s poor economic prospects and declining foreign exchange reserves have made it challenging to support the RMB exchange rate. Chinese President Xi Jinping recently inspected the central bank for the first time in over ten years to understand the situation of foreign exchange reserves, emphasizing their importance. It is now prohibited to create mirror websites on Chinese websites, urging users to return to the genuine Chinese website.

The “main force” of global central banks’ gold purchases, China’s central bank ranks first

The People’s Bank of China revealed that China’s gold reserves reached 72.8 million ounces at the end of April, increasing for the 18th consecutive month. This rise in gold purchases comes as global central banks show strong demand for the precious metal. Gold prices hit a record high of over $2,400 an ounce in April, supported by these purchases and safe-haven buying during global conflicts.

Goldman Sachs reported a significant increase in global central bank gold purchases since mid-2022, with six countries, including China, leading the way. China’s central bank alone increased its gold holdings by approximately 200 tons in 2023, surpassing other central banks worldwide. Chinese officials and individuals are fueling the surge in gold purchases, driving global prices up by nearly 50% since the end of 2022.

China’s foreign exchange reserves hit five-month low

Despite the rise in gold holdings, China’s foreign exchange reserves have reached a five-month low of US$3.2008 billion as of the end of April, marking a significant drop of US$44.8 billion from the previous month. This decline, the largest in seven months, reflects challenges facing China’s economy.

Experts warn that the decreasing foreign exchange reserves signal potential risks, including economic decline and financial instability. With China’s foreign exchange reserves decreasing by 20% compared to ten years ago, concerns about the country’s ability to weather economic challenges have heightened.

Risks that China’s foreign exchange reserves need to deal with

China faces various risks concerning its foreign exchange reserves, including stabilizing the value of the RMB amid economic uncertainty and capital outflows. Analysts highlight the importance of managing these risks to support the country’s financial stability.

British scholar: The risk of RMB devaluation does exist

Despite efforts to maintain stability, the risk of RMB devaluation remains a concern, according to British scholar George Magnus. He predicts continued depreciation of the RMB in the coming years, citing economic weakness and capital outflows as contributing factors.

Xi Jinping inspects central bank to understand foreign exchange reserves

Chinese President Xi Jinping’s recent visit to the central bank and State Administration of Foreign Exchange underscores the importance of understanding China’s foreign exchange reserves amid economic challenges. As China navigates financial uncertainties, policymakers must consider strategies to support the economy and maintain stability.

Source: Look at China

Short URL: All rights reserved. Reprinting in any form requires permission from this website. It is strictly prohibited to create mirror websites.