I think every day, if there is innovation today, if you haven’t done it today, if you don’t have it today, if you don’t have it tomorrow, you haven’t had it this week, then I’m very anxious.

I have been working for 11 years. This industry is too difficult. It is a synthesis of art + technology + rational thinking.

In fact, over the past ten years,IQIYI(IQ.US) CEO Gong Yu never shy away from telling the outside world about the difficulty of the long video industry and his anxiety as a CEO in public.

As China’s largest long video streaming platform, ifIQIYIJudging from the financial report submitted every quarter, it is not difficult to understand aboutIQIYIThe “difficulty” of Gong Yu and the “suffering” of Gong Yu.

Judging from the stock price of iQiyi, since it hit a high of $28.97 per share in March this year, its stock price has been falling all the way.

On the evening of August 12, 2021, Beijing time, iQiyi announced its second-quarter financial report. After the financial report was released, iQiyi’s stock price plunged, and the decline once expanded to 10%. The stock price hit a record low at $9.17 per share.

The current market value of iQiyi is aboutMango Super MediumOne-half of (300413.SZ) is less than one-third of Station B (BILI.US); and behind iQiyi’s continued losses, has the market really lost confidence in it?

The Red Star Capital Bureau will discuss the “difficulties” of iQiyi in the following three aspects.

① Revenue end: the revenue structure is single and the ceiling is prominent

②Expenditure side: Under the huge content cost, it is difficult to form positive revenue feedback

③China versionNetflix: It seems beautiful, but it’s hard to make it through

first part

Revenue end: Single revenue structure, prominent ceiling

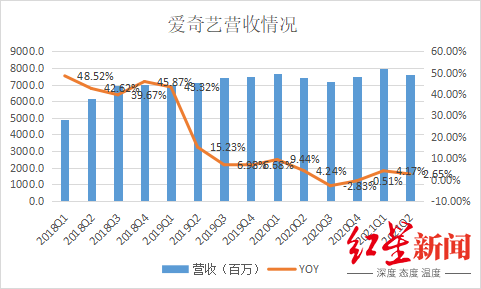

According to the company’s latest financial data, in the second quarter of 2021, iQiyi’sOperating incomeIt was 7.6 billion yuan, an increase of 2.6% year-on-year. On the whole, iQIYI’s revenue growth rate has shown a rapid decline since the first quarter of 2019, and revenue growth has been negative for two consecutive quarters in the third quarter of 2020 and the fourth quarter of 2020. On the whole, iQiyi’s revenue performance has been weak in recent years, and the ceiling has been prominent.

Source: Company Financial Report, Red Star Capital Bureau

Split iQiyi’s revenue structure, iQiyi’s revenue is composed of four parts, namely membership service revenue, online advertising revenue, content distribution revenue, and other revenues. Among them, membership service income and online advertising income are the core income sources of the company.

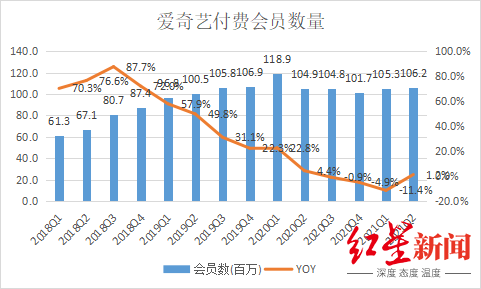

Specifically, from the perspective of iQIYI membership income, as early as the second quarter of 2019, the number of paid members of iQIYI exceeded the 100 million mark, but the growth rate has slowed down significantly afterwards. In the first quarter, the number of members experienced a year-on-year negative growth for three consecutive quarters.

The number of paying members in the second quarter of 2021 was 106.2 million, compared with 104.9 million in the same period last year. Although there has been a rebound, the year-on-year growth rate is only 1.2%, and there is still a big difference from the high point in the first quarter of 2020.

On the whole, the number of members paid by iQIYI has been greatly hindered in the past two years. Even if the paywall continues to increase, the number of members will not be able to break through the bottleneck.

Source: Company Financial Report, Red Star Capital Bureau

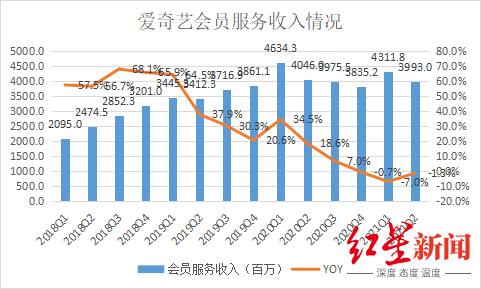

Judging from the revenue of this business, iQiyi’s membership service revenue still appears to be particularly limited. In the second quarter of 2021, membership service revenue was 3.993 billion yuan. Starting from the fourth quarter of 2020, revenue growth has shown negative growth for three consecutive quarters.

Source: Company Financial Report, Red Star Capital Bureau

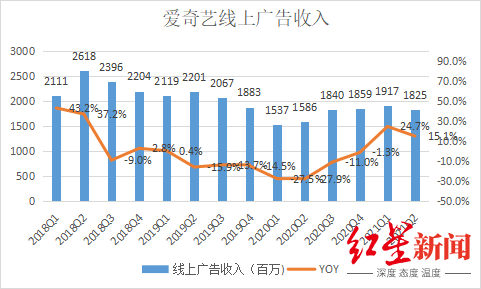

From the advertising revenue of iQiyi,In the second quarter of 2021, iQiyi’s advertising revenue was 1.825 billion yuan. With the overall recovery of the advertising industry, iQiyi’s online advertising revenue has recovered. However, the Red Star Capital Bureau believes that iQiyi’s advertising revenue is still limited in its overall imagination.

Source: Company Financial Report, Red Star Capital Bureau

According to the advertising revenue model, advertising revenue = MAU (monthly active users) × FEED (traffic period) × LOAD (load rate) × PRICE (price).

Among them, from the perspective of the number of monthly active users, as mentioned earlier, the current active users of iQiyi have stabilized and are on the verge of the user ceiling, and the traffic dividend is difficult to obtain again in advertisements; from the perspective of the load rate, the current domestic long video streaming media The loading rate has been relatively high; from the price point of view, the current domestic advertisers have also become more rational and are more cautious in advertising pricing. Therefore, these driving factors to increase iQiyi’s advertising revenue are relatively limited to a certain extent.

At the same time, due to education supervision, the Ministry of Industry and Information Technology‘s restrictions on APP-side advertising this year, and the “pouring milk” incident of iQiyi variety shows, the market’s expectations for iQiyi’s advertising business may be lowered. At the same time, from this perspective, iQiyi’s future advertising business also faces many limitations.

the second part:

Expenditure side: Under the huge content cost, it is impossible to form positive revenue feedback

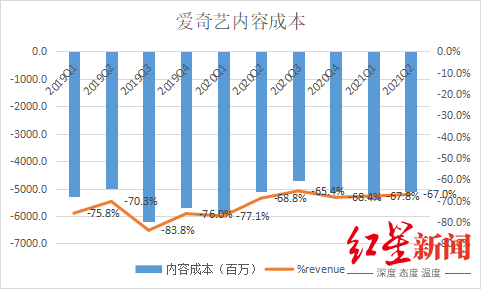

From the perspective of iQiyi’s expenditure, in the second quarter of 2021, iQiyi’s content cost was 5.1 billion yuan, accounting for 67% of total revenue, and it is currently flattening out.

The content cost of iQiyi is mainly divided into external copyright purchase and self-made content.

Source: Company Financial Report, Red Star Capital Bureau

The copyright cost is an important part of the content cost. Currently, iQIYI’s copyright content costs account for about 70% of the total content costs.

Gong Yu previously revealed: “The price of copyrighted dramas is high. The purchase price of a copyrighted drama starts at 2 million yuan, and the price of a solo drama may be as high as 6 million to 8 million yuan per episode.” We found that part of the head The copyright fees for single episodes of film and television dramas are as high as tens of millions.

Iqiyi’s CFO Wang Xiaodong said in the first quarter 2021 earnings conference call: “In general, the proportion of original content in the total content cost will increase next year, but I think a more ideal level is originality and The cost of copyrighted content accounts for 40% and 60% respectively.”

In order to reduce copyright costs, iQiyi is also stepping up efforts to deploy self-made content. At the 2021 World Congress held in May of this year, Gong Yu said that in the next one to two years, the company’s goal is to increase the proportion of head-manufactured dramas to 60% to 70%.

However, iQiyi’s self-manufacturing road also requires iQiyi to face more risks alone, such as a long and uncontrollable content production cycle, a low success rate of works, and greater censorship and financial risks.

Even Gong Yu is tellingshareholderThe letter also directly stated: The current quantity and quality of self-made content on the platform cannot meet the needs of users.

If you want users to continue to retain, iQiyi needs to pay for the huge amount of copyright fees for a long time; at the same time, self-made content also faces many uncertainties. It is not easy to create continuous hot content and create “self-made word-of-mouth and self-made influence”. .

the third part:

Chinese versionNetflix: It seems beautiful, but it’s hard to make it through

In 2018, Gong Yu said at the media communication meeting before the IPO that iQiyi wanted to be a “Netflix Plus” model.After its listing, iQiyi has also been advertised as the “Chinese versionNetflixFrom the perspective of the market value of the two, the current market value of iQiyi is US$7.475 billion, while the market value of Netflix (NASDAQ:NFLX) is as high as US$228.344 billion.

The gap between iQiyi and Netflix seems to be getting bigger and bigger. What is the difference between iQiyi and Netflix? In other words, why is it difficult to explain the Netflix story of iQiyi?

The Red Star Capital Bureau will mainly analyze the differences between the two members’ payment drivers and the content level of the two.

From the perspective of user payment drivers,Netflix was born in the United States. As early as the 1970s, HBO pioneered an advertising-free user-paying business model in the United States, and gradually cultivated the habit of users to pay for high-quality content. Growing up in this environment, Netflix has developed into a streaming media service provider that provides massive amounts of self-produced IP and is on par with major Hollywood companies in the film and television industry by relying on high-quality works such as “House of Cards”.

Compared with the growth history of domestic long video streaming media, it has experienced a relatively long period of chaos. In 2004, Zhang Chaoyang took the lead in establishingSohuWidescreen (SohuThe predecessor of video), only two years later, China has more than 300 online video sites, and users have also developed the habit of “watching dramas for free” at that time. The turning point of the industry occurred around 2010, when the country promulgated corresponding copyright regulations and began to crack down on piracy.

At this time, capital began to play a leading role. Platforms with capital support were king by purchasing copyrights. Platforms without capital support left the market automatically because they were unable to pay high copyright fees.

That is, in 2010, iQiyi stepped onto the stage. Through continuous “buy, buy and buy”, we will continue to consolidate our market position.

Therefore, the growth path after iQiyi does not involve users in the screening process to a certain extent, but the victory of the battle for capital strength.

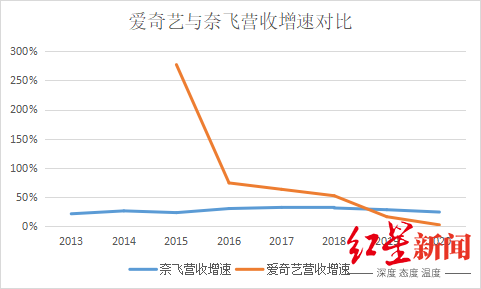

Comparing the revenue growth rates of the two companies, it is not difficult to find the difference. In 2015, after iQIYI took the lead in launching the membership payment model, its revenue increased by 277%, but its revenue growth has been declining since then; compared with Netflix, it can be seen that its revenue has tended to grow steadily.

Source: Company Financial Report, Red Star Capital Bureau

In terms of the two, iQIYI’s membership accumulation relies on the short-term dividend effect of the traffic pool created by capital, while Netflix’s membership accumulation relies on the steady accumulation of high-quality content to attract users.

Therefore, Netflix’s user stickiness is naturally stronger, and for iQiyi, the ceiling of paying users is naturally easier to reach. In summary, there is a big difference between the two driving forces for user payment.

From the perspective of content, iQiyi’s “Mist Theater” last year did show quite dazzlingly, but the continuity of out-of-circle works was weak.

Compared with Netflix, it is difficult for iQiyi’s works to form a clustering effect, and there are many influencing factors. In addition to having a high-quality director creation team, Netflix also has many years of Hollywood influence endorsement. In 2020, the original content produced by Netflix has won 24 Oscar nominations. In terms of content achievement, iQiyi is quite different from it.

In summary, why can’t iQiyi copy Netflix? The main reason is that the establishment of a payment model for early users is not a good process in a positive cycle, and the later content output is also restricted by many objective and subjective factors.

summary:

In the field of long video, iQiyi has a first-mover advantage. Judging from the user base, it has now firmly occupied the leading position in the industry. But the core contradiction of iQiyi is that it has not yet constructed a sufficiently stable moat, nor has it solved the profitability problem. How iQiyi should get rid of the current predicament is also the heaviest burden on CEO Gong Yu.

Red Star News reporter Yu Yao, intern reporter Liu Mi

Edit Yang Cheng

(Source: Red Star Capital Bureau)

.