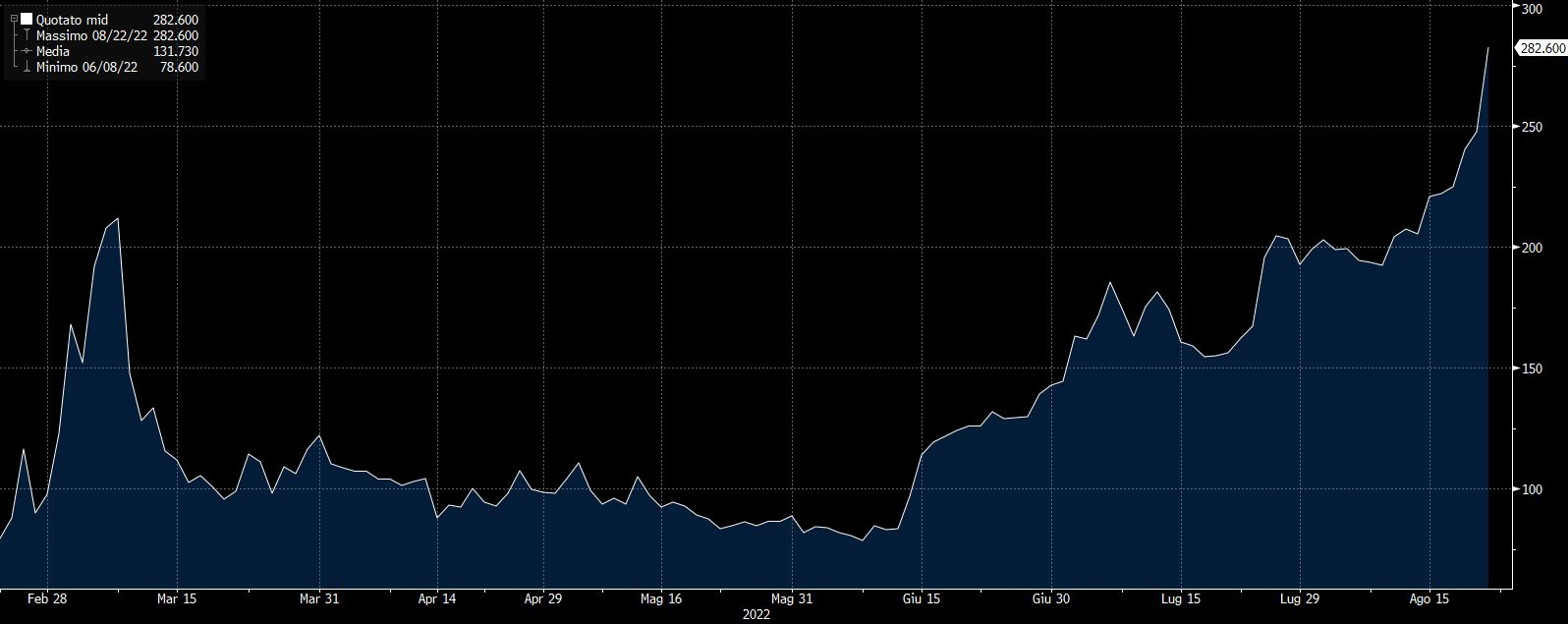

Eyes on raw materials with the price of natural gas TTF (European benchmark) which is still growing and breaks the threshold of 280 euros per MWh on the market in Amsterdam. The futures contracts for the month of September in fact rise by 14% to 282.6 euros. The surge is recorded after Russia communicated the total closure of the Nord Stream 1 gas pipeline starting from 31 August for three days. Officially, the motivation is linked to unscheduled maintenance work, but there is a widespread fear among operators that supplies may not resume at the end of the period.

Stop the gas flows of the Nord Stream

“The real concern for the market is whether flows will resume after this stop – he underlines Warren Patterson, head commodities strategy di ING -. Gazprom said that once these works are completed, flows will return to 20% of capacity, which would be unchanged from current levels. The European market is increasingly concerned about the evolution of Russian flows as we move towards the next autumn season. However, for now European storage levels are reassuring, standing at 77%, which is substantially in line with the 5-year average and well above the 64% recorded in the same phase last year ”. Clearly, ING concludes, “given the concerns about supply availability, prices will need to remain at high levels to ensure that we continue to see the necessary destruction of demand.”

Oil prices under pressure

As for oil, which this morning sees WTI and Brent prices drop by more than one percentage point, sentiment remains rather negative, with the market still awaiting further details on the progress of the Iranian nuclear talks. “Reports suggest that the US has been in discussions with the UK, Germany and France over the weekend to review the EU proposal for a nuclear deal,” they point out from ING.

However, ING continues, “it is not yet clear where the US stands on the latest proposal given the potential for more than 1 million barrels per day of additional supply on the market. In the meantime, the market is closely following the development of the talks. A deal (and the lifting of oil sanctions) would mean a more comfortable market in the second half of 2023. At the moment, we currently assume that there is no increase in the supply of Iranian oil ”.