According to the “National Passenger Vehicle Market Analysis” released by the Passenger Vehicle Market Information Joint Conference, Sohu Automotive Research Office has sorted out the national passenger vehicle market in March 2022, as follows:

In March 2022, the national narrow-sense passenger car production was 1.823 million units, down 0.3% year-on-year, of which 873,000 cars were produced, up 2.6% year-on-year; SUV production was 87.2 units, up 0.2% year-on-year; MPV production was 77,000 units, down 27.5% year-on-year %.

Retail sales: In March 2022, the nationwide retail sales of passenger vehicles in the narrow sense were 1.579 million units, a year-on-year decrease of 10.5%; the retail sales of sedans was 765,000 units, a year-on-year decrease of 12.0%; the retail sales of SUVs was 742,000 units, a year-on-year decrease of 5.6%; MPV retail sales The sales volume was 72,000 units, a year-on-year decrease of 33.2%.

Wholesale sales: In March, the nationwide wholesale sales of passenger vehicles in the narrow sense were 1.814 million, down 1.6% year-on-year. Among them, the wholesale sales of sedans was 872,000 units, a year-on-year decrease of 0.4%; the wholesale sales of SUVs was 870,000 units, a year-on-year decrease of 0.4%; the wholesale sales of MPVs was 73,000 units, a year-on-year decrease of 23.4%.

(3) Domestic monthly sales trend of passenger vehicles in the narrow sense from March 2017 to 2022

(4) New energy market (production, retail/wholesale sales)

In March, the output of new energy passenger vehicles reached 437,000 units, a year-on-year increase of 124.2%; among which, the output of BEVs was 352,000 units, a year-on-year increase of 114.0%; the output of PHEV was 85,000 units, a year-on-year increase of 178.7%.

In March, the retail sales of new energy passenger vehicles reached 445,000 units, a year-on-year increase of 137.6%; of which, the retail sales of BEVs reached 360,000 units, a year-on-year increase of 126.7%; the retail sales of PHEVs reached 85,000 units, a year-on-year increase of 198.6%.

In March, the wholesale sales of new energy passenger vehicles was 455,000 units, a year-on-year increase of 122.4%; of which, the wholesale sales of BEVs was 371,000 units, a year-on-year increase of 116.8%; the wholesale sales of PHEVs was 84,000 units, a year-on-year increase of 151.3%.

(5) Sales trend of new energy market from March 2017 to 2022

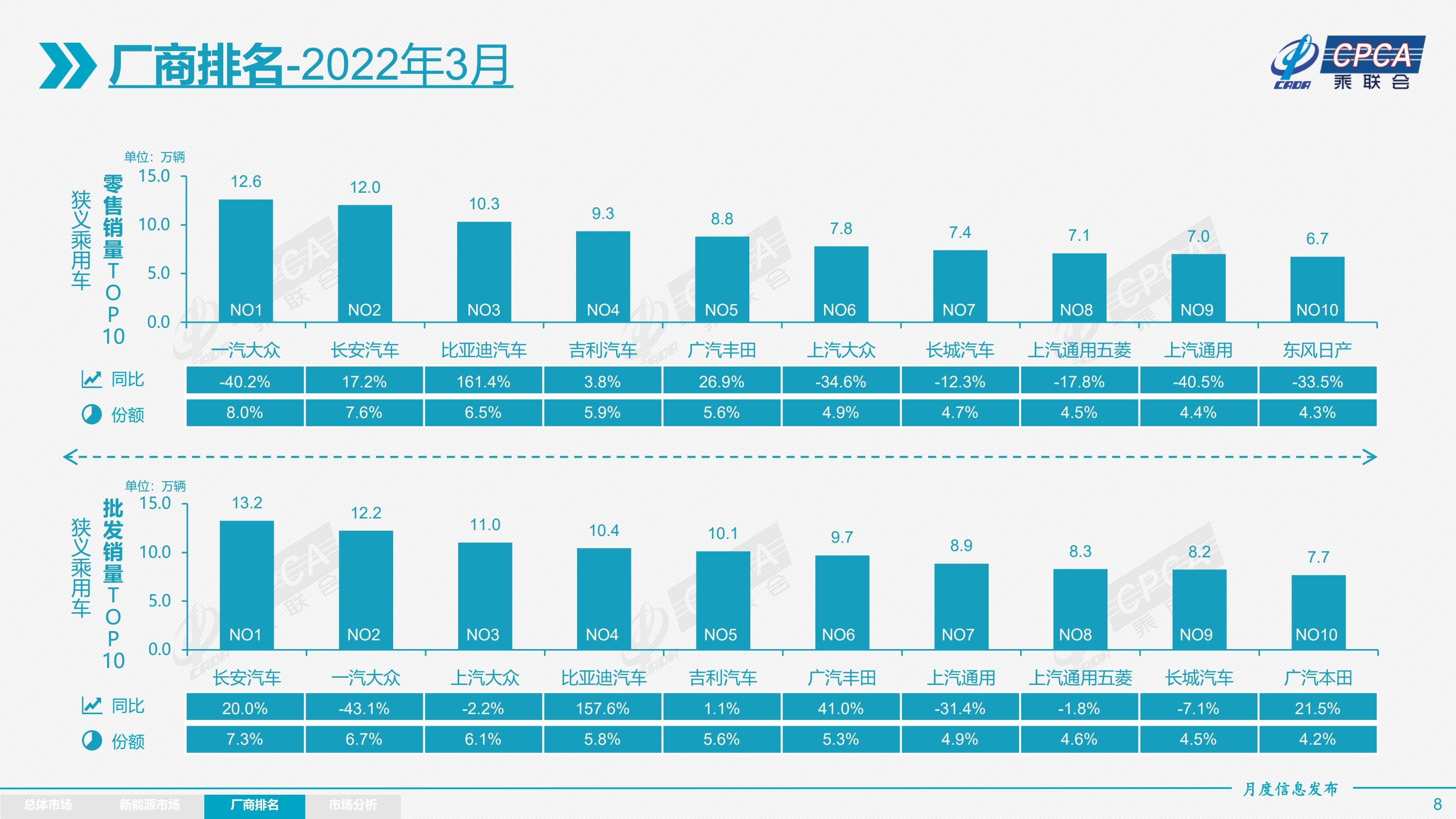

(6) Ranking of passenger car manufacturers in the narrow sense (retail sales and wholesale sales in March)

Retail sales of passenger vehicles in a narrow sense: FAW-Volkswagen still ranked first in March, with sales of 126,000 units, a year-on-year decrease of 40.2%, and a market share of 8.0%; Changan Automobile ranked second with sales of 120,000 units, a year-on-year increase of 17.2%. The market share was 7.6%; BYD Auto ranked third with a sales volume of 103,000 units, a year-on-year increase of 161.4%, and a market share of 6.5%.

In the narrow sense of wholesale sales of passenger vehicles: the top three in March were Changan Automobile, FAW-Volkswagen, and SAIC Volkswagen, with wholesale volumes of 132,000, 122,000 and 110,000 respectively.

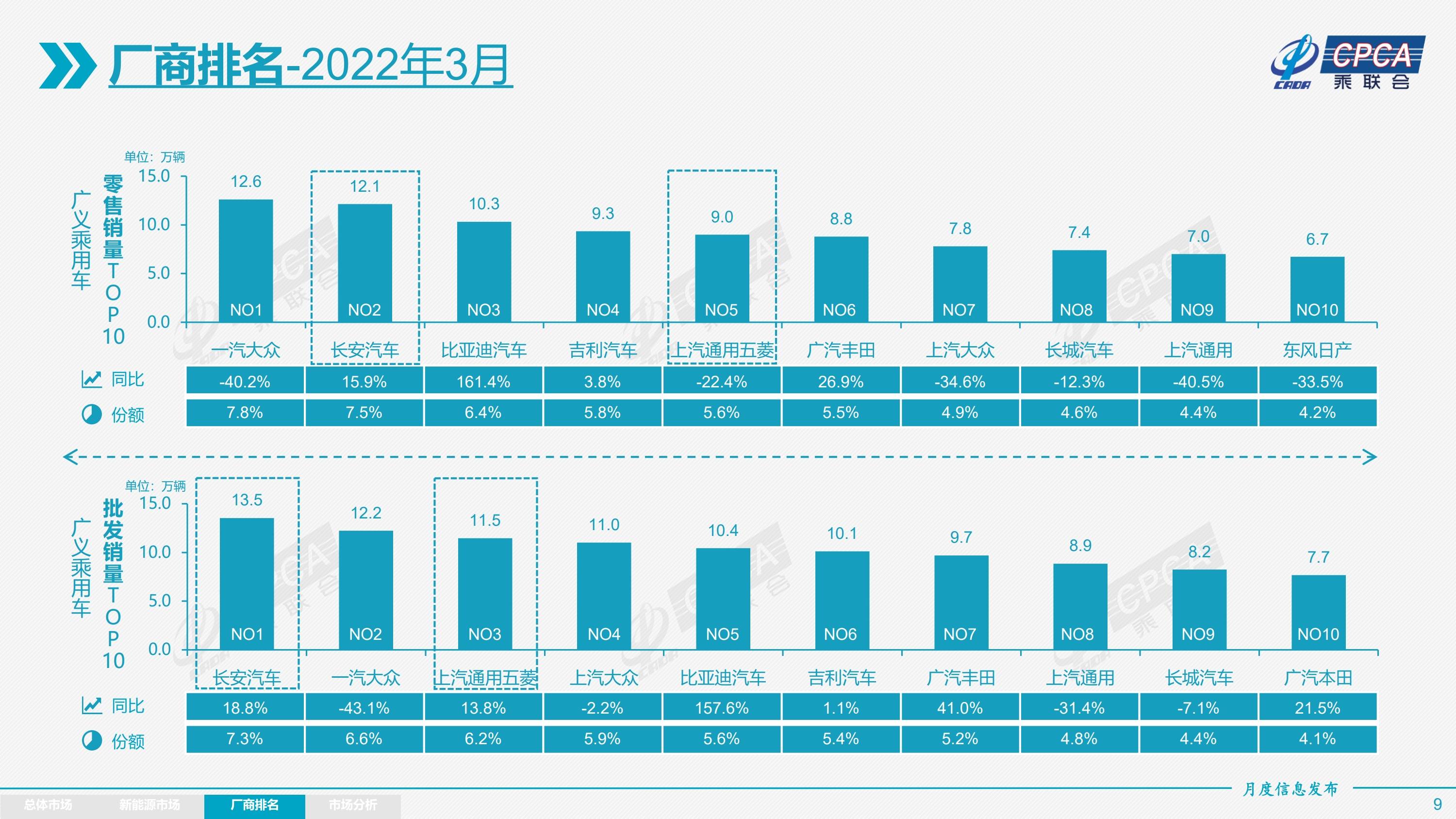

(7) Ranking of passenger car manufacturers in a broad sense (retail sales and wholesale sales in March)

Generalized passenger car retail sales: The top three in March were FAW-Volkswagen, Changan Automobile, and BYD Automobile.

In terms of wholesale sales of passenger vehicles in the broad sense, the top three in March were Changan Automobile, FAW-Volkswagen and SAIC-GM-Wuling.

Review of the National Passenger Vehicle Market in February and March

retail: In March 2022, the retail sales of the passenger car market reached 1.579 million units, a year-on-year decrease of 10.5% and a month-on-month increase of 25.6%. The retail sales trend in March was quite differentiated. The cumulative retail sales from January to March was 4.915 million units, a year-on-year decrease of 4.5% and a year-on-year decrease of 230,000 units. The overall trend was lower than expected.

Since the supply of chips has recovered from February, there is a good foundation for the recovery of production and sales in March. Recently, manufacturers’ inventories have increased, terminal discounts have expanded, and consumers’ car buying cycles have been shortened. After the Spring Festival, a variety of new cars will be launched, attracting some consumers to buy cars. The auto market should show a steady upward trend in March. In March, the new crown epidemic spread all over the country, and all regions continued to resolutely adopt the strategy of social clearing. Distributors in Jilin, Shanghai, Shandong, Guangdong, Hebei and other places have been affected by entering stores and transactions. Changes in local management measures have had a certain impact on logistics efficiency, and retail losses have been relatively large.

In March, 230,000 luxury cars were sold, down 14% year-on-year and up 43% month-on-month. The retail sales of luxury cars in early March strengthened significantly month-on-month, and in the later period, with the changes in the epidemic prevention and control situation in the main sales area, the situation in February could not be continued.

In March, the retail sales of self-owned brands reached 750,000 units, a year-on-year increase of 17% and a month-on-month increase of 37%. In March, the domestic retail share of self-owned brands was 48.2%, an increase of 11.5 percentage points year-on-year; the cumulative share from January to March was 48%, an increase of 9.7 percentage points compared to the same period in 2021. In March, the wholesale market share of independent brands was 48.4%, an increase of 9 percentage points compared with the same period last year; the cumulative share of independent brands from January to March was 46%, an increase of 5.1 percentage points compared with the same period in 2021. Independence has achieved significant growth in the new energy market, leading companies have differentiated performance, and traditional car brands such as Changan Automobile and BYD have experienced high year-on-year growth.

In March, the retail sales of mainstream joint venture brands were 590,000 units, a year-on-year decrease of 30% and a month-on-month increase of 9%. The retail share of Japanese brands in March was 20%, down 3 percentage points year-on-year. The share of German brands was 18%, a year-on-year decrease of 7 percentage points. The retail share of the US market reached 10%, a year-on-year decrease of 0.5 percentage points. The share of the legal system increased by 0.3 percentage points.

exit: In March, the passenger car exports (including complete vehicles and CKDs) under the statistics of the Passenger Federation were 107,000, a year-on-year increase of 14% and a month-on-month decrease of 20%. The unstable external environment and the lack of European exports have an impact on the exports of car companies. New energy vehicles accounted for 10.7% of total exports in March. In March, the export of self-owned brands reached 95,000 vehicles, a year-on-year increase of 24%, but the growth rate slowed down; joint ventures and luxury brands exported 12,000 vehicles, a year-on-year decrease of 30%.

Production: Passenger car production in March was 1.823 million units, down 0.3% year-on-year and up 22.0% month-on-month, showing a strong performance. Among them, the production of luxury brands decreased by 31% year-on-year and 8% month-on-month; the production of joint venture brands decreased by 10% year-on-year and increased by 17% month-on-month; the production of independent brands increased by 23% year-on-year and 36% month-on-month.

Although there was a slight loss of production due to the epidemic, the production and sales growth of the auto market in March was relatively good, and the supply of joint venture chips gradually improved, which promoted the stable production and sales in March.

wholesale: Wholesale sales of manufacturers in March were 1.814 million units, down 1.6% year-on-year and up 23.6% month-on-month. Due to production constraints, some automakers performed differently. From January to March, the wholesale sales of manufacturers reached 5.439 million units, a year-on-year increase of 8.3%, achieving a real good start. Although due to the impact of the epidemic in March, this year’s trend was under great pressure, but due to the demand for replenishment and the strong sales of new energy, the cumulative wholesale growth rate from January to March was 8.3%, which was a strong performance.

The post-holiday production and sales cycle in March is complete, but the structural loss is large, resulting in a push-type production and sales trend in which manufacturers’ output is higher than sales by 10,000 units, and manufacturers’ domestic wholesale is higher than retail by 230,000 units. In contrast, the growth rate of wholesale manufacturers (-1.6%) in March was significantly better than that of retail sales (-10.5%).

in stock: The first three quarters of 2021 have experienced a special cycle from destocking to approaching safety stocks. In the fourth quarter, manufacturers’ inventories were quickly replenished, which laid the foundation for the strong performance of wholesale from January to March this year. The characteristics of inventory increase in March caused by factors at the end of the quarter. From a decomposition point of view, the manufacturer’s inventory in March increased by 10,000 units month-on-month, and the cumulative decrease from January to March was 80,000 units. of manufacturers’ inventories improved significantly. In March, the channel inventory increased by 130,000 units, and from January to March, the channel inventory increased by 100,000 units, which is in sharp contrast to the decrease of 380,000 units from January to March 2021, driving a substantial increase in wholesale sales.

New source: Wholesale sales of new energy passenger vehicles reached 455,000 units in March, a year-on-year increase of 122.4% and a month-on-month increase of 43.6%, a month-on-month increase close to that of previous years. From January to March, 1.190 million new energy passenger vehicles were wholesaled, a year-on-year increase of 145.4%. In March, the retail sales of new energy passenger vehicles reached 445,000 units, a year-on-year increase of 137.6% and a month-on-month increase of 63.1%, which was better than the previous March trend. From January to March, the domestic retail sales of new energy passenger vehicles was 1.070 million, a year-on-year increase of 146.6%.

There is a certain contrast between the trend of new energy vehicles and traditional fuel vehicles in March. The purchase of production materials in March has driven a strong demand for replacement of traditional vehicles, which is good for the popularization of automobiles and consumption upgrades. The safe travel of vehicles is of great significance, echoing the further recognition and adaptation of new energy vehicles by urban residents during short-distance travel.

In the new energy vehicle market, affected by the price increase, the orders before the price increase were hot, and the overall orders were sufficient. Overall, although there are still local sporadic cases in the domestic epidemic, especially in megacities such as Shenzhen and Shanghai where new energy is the main sales, the relatively mild epidemic prevention measures in most areas at that time had no significant impact on residents’ travel and car purchase consumption. The sales of new energy vehicles have a promoting effect.

1) Wholesale: The wholesale penetration rate of new energy vehicle manufacturers in March was 25.1%, an increase of 14 percentage points from the 11.1% penetration rate in March 2021. In March, the penetration rate of self-owned brand new energy vehicles was 41%; the penetration rate of new energy vehicles among luxury cars was 34%; while the penetration rate of mainstream joint venture brand new energy vehicles was only 3%. In March, the wholesale sales of pure electric vehicles was 371,000 units, a year-on-year increase of 116.8%; the sales of plug-in hybrid vehicles was 84,000 units, a year-on-year increase of 151.3%, which to a certain extent verified that some manufacturers believe that “plug-in hybrid is the first step in the transformation of potential customers of oil vehicles. “market forecast. In March, the A00 models of electric vehicles had the strongest growth from February, and the growth rate of models gradually decreased from small to large. The dumbbell-shaped structure of the pure electric market has improved. Among them, the wholesale sales of A00-class vehicles was 119,000 units, a month-on-month increase of 75%, accounting for 32% of the share of pure electric vehicles; the wholesale sales of A0-class vehicles was 55,000 vehicles, accounting for 15% of the share of pure electric vehicles; Electric vehicles accounted for 22% of the pure electric share; B-class electric vehicles reached 113,000, a month-on-month increase of 32%, accounting for 30% of the pure electric share.

2) Retail: The domestic retail penetration rate of new energy vehicles was 28.2% in March, an increase of 17.6 percentage points from the 10.6% penetration rate in March 2021. In March, the penetration rate of new energy vehicles among independent brands was 46%; the penetration rate of new energy vehicles among luxury cars was 32%; while the penetration rate of new energy vehicles among mainstream joint venture brands was only 4.3%.

3) Exports: New energy vehicles exported 11,000 units in March. Due to factors at the end of the quarter, Tesla China exported 60 units, a month-on-month decrease of 33,000 units. SAIC Passenger Cars exported 4,658 units of new energy vehicles, and Dongfeng Yijie exported 4,658 units. Special export 2532 vehicles, BYD 1109 vehicles, Shenlong Automobile 1046 vehicles, and other new energy vehicles of car companies mainly in the domestic market.

4) Auto companies: In March, the new energy passenger vehicle market was diversified, and BYD’s pure electric and plug-in hybrid drives consolidated its leading position in new energy brands; traditional car companies represented by SAIC and GAC are in the new energy sector The performance is relatively outstanding. There are 13 companies with wholesale sales of more than 10,000 vehicles (an increase of 2 from the same period last year), including: BYD 104,338, Tesla China 65,814, SAIC-GM-Wuling 51,157, Chery 21,817, GAC Aian 20,317, There are 15,624 Changan Motors, 15,414 Xiaopeng Motors, 15,057 Great Wall Motors, 14,166 Geely Motors, 12,026 Nezha Motors, 11,034 Ideal Motors, 10,880 SAIC Passenger Cars, and 10,059 Leap Motors.

5) New forces: In March, the sales of new forces such as Xiaopeng, Ideal, Nezha, Leapmotor, Weilai, Weimar and other new forces car companies performed well year-on-year and month-on-month, especially the impact of the price increase of Xiaopeng, Ideal, and Nezha Not big, and the month-on-month growth is good. Among the mainstream joint venture brands, 12,709 new energy vehicles were wholesaled by North and South Volkswagen, accounting for 63% of the mainstream joint venture. Volkswagen’s firm electrification transformation strategy has achieved initial results. Other joint ventures and luxury brands are still underway.

6) General Hybrid: In March, 74,625 ordinary hybrid passenger vehicles were wholesaled, a year-on-year increase of 62% and a month-on-month increase of 32%. Among them, there are 44,610 Toyota vehicles, 22,990 Honda vehicles, 2,602 Great Wall Motors, 1,792 GAC Passenger Cars, 1,239 Geely Automobiles, and 1,184 Dongfeng Nissan vehicles. Hybrid vehicles have gradually become a new hotspot.

3. National Passenger Vehicle Market Outlook in April 2022

In April, due to the Qingming holiday and the May Day holiday, there are only 21 working days in the whole month, and the potential for incremental production and sales is not large.

Production and sales in April were in an uncertain state. According to the provincial production data from the National Bureau of Statistics, Shanghai and Jilin provinces each accounted for about 11% of national production, and some companies in Shanghai were operating at full capacity. Production and sales will be greatly affected. Due to the long automobile industry chain, high coordination requirements, and a wider range of shutdowns in core production and logistics bases, the production and sales pressure of the automobile market in April may be very high.

Due to the risk of the spread of the epidemic all over the country, the entry and transaction of dealers in Jilin, Shanghai, Shandong, Guangdong, Hebei and other places have been affected. The logistics of the vehicle is restricted by the 48-hour nucleic acid certificate in various places, and the loss of transportation capacity is also large. However, since the shortage of overseas chips last year, the channel inventory has begun to be replenished for several consecutive months, and the terminal promotion has also increased significantly. Therefore, the shortage of retail sales in most regional markets will not be particularly obvious.

This year faces a complex marketing environment. April is the golden period for the launch of new cars. The launch of blockbuster new products from March to April has greatly boosted market sentiment and manufacturers’ sales. Due to the postponement of the Beijing Auto Show, the most important marketing event of the year, this year’s manufacturers’ new product launch rhythm is facing an overall adjustment, which is not conducive to the development effect of the local auto show. Streaming media keeps customers caring enthusiastically.

Under the prevention and control of the epidemic, people’s awareness of travel safety has increased. In response to the epidemic, the public transportation system in Shenzhen is temporarily suspended across the board, and temporary regulations such as unlimited private cars in Chengdu have slightly stimulated consumer demand for private cars.

It is unavoidable that the consumption momentum has weakened under the influence of the epidemic. The service industry has not fully recovered before the current round of the epidemic. The retail sales in March was far lower than the domestic wholesale. Survival pressure, auto retail sales in April are expected to be significantly lower than in March.

Under the current environment, self-driving travel has become the first choice, but due to high oil prices, more people will choose to buy new energy vehicles, so the new energy vehicles in April still maintained strong growth.

4. The price increase of electric vehicles is relatively rational

Since 2021, due to the shortage of chips and the increase in the price of raw materials, the cost of complete vehicles and power batteries has risen at a much faster rate than the industry expected. According to data from the National Bureau of Statistics, from January to February 2022, the revenue of the automobile industry will increase by 6%, the cost will increase by 8%, and the overall profit will decrease by 10% year-on-year, which is relatively lower than the average profit increase of 5% for the entire industrial enterprise, and the automobile industry is under great pressure.

Under the pressure of rising costs, the circulation system of traditional vehicles has relatively good industrial chain resilience, and the adjustment of consumption through promotion efforts is more flexible. Due to chip defects and other influences, the promotion rhythm of the auto market has changed significantly. The normal trend of increasing promotions from May 2021 has reversed to the characteristics of shrinking promotions; the decline in promotions from August to November 2021 is particularly obvious, while in 2021 Since December, with the improvement of chip supply, the promotion has increased significantly.

In 2022, the price of electric vehicles will rise relatively rationally, and the popularity of the new energy vehicle market will not decrease. In January this year, the national new energy vehicle subsidy standard declined as planned. Most companies strive to resolve the impact of the subsidy decline through their own internal balancing operations and some early cost reductions. The momentum continued, so there were fewer companies raising prices before the Spring Festival. However, the decline of some companies has a greater impact on gross profit, so they have adopted an increase in car prices to make up for the impact of reduced subsidies.

After the price adjustment in January, the domestic retail sales of new energy passenger vehicles in February 2022 was 273,000 units, a year-on-year increase of 180.9%. Orders from companies that raised prices recovered quickly, and the overall new energy market did not experience a downturn due to the price increase of models.

Since the beginning of this year, the price of power batteries has risen at a much higher rate than the industry expected due to the increase in the price of raw materials such as lithium and nickel. Therefore, the pressure on car companies after the price increase of power batteries is very great, and the cost pressure can only be alleviated by increasing the price.

The impact of the current two rounds of new energy vehicle price increases is not obvious for the time being. The first is that the sales model of new energy vehicles is order sales. At present, various car companies have more orders before the price increase, resulting in basically digesting previous orders from March to April, so sales have little impact.

The second is the diversion of new energy plug-in and hybrid to the fuel vehicle market, and the high oil price leads to the increase of the advantages of new energy. Under the current situation of high oil prices, the cost performance of new energy vehicles has been significantly improved, but the traditional car market is even more difficult.

The third reason is that consumers of new energy vehicles have strong rigid demands and relatively low price sensitivity, so small price changes will not significantly affect consumers’ demand for new energy vehicles.

The fourth reason is that the order price of new energy vehicles is locked before the price increase, resulting in a cheaper lock-in price for early-order cars, triggering a new situation in which more consumers are rational or follow the trend to rush to book. Car companies have also taken measures to regulate the order for suspected scalpers to speculate on orders.

At present, it is judged that the production of lithium mines is related to the season. In summer, the output of salt lake lithium mines is relatively large, and the demand is relatively stable. Therefore, the price of lithium carbonate will not continue to rise in the near future.

SINOMACH and other new energy production line design units are also promoting innovative design processes to achieve cost reduction measures such as integrated die-casting of electric vehicles to enhance market competitiveness.

From the perspective of the upstream and downstream of the industry, it has become an industry consensus to call for the investigation of raw material hoarding and standardizing market behavior. This price increase is also conducive to stabilizing the price of new energy used cars and helping to promote the valuation of the battery recycling industry chain.

The core adjustment method of supply and demand for automobile consumption is price. The relative flexibility of production and sales in the traditional fuel vehicle market is a huge advantage. There was no shortage of chips in the early stage, and the price of traditional fuel vehicles did not skyrocket. Instead, the strong price adjustment ability of channel dealers was used to achieve stable demand under changes in cost and supply. New energy vehicles have continued to be popular in the past two years, and the innovation of channel models needs to be improved.

5. China’s auto industry is more stable in the world under the “lack of core and short lithium”

Although our lives have also been affected to a certain extent under the epidemic, the passenger car industry itself feels very difficult. However, it is necessary to confidently see that under the global “shortage of cores and short lithium”, the status of China’s passenger car market in the world has been greatly improved, which is an intuitive manifestation of the improvement of the competitiveness of domestic car companies in the world. In 2021, the world share of China’s auto market will reach 32%, a record high. And in January-February 2022, the wholesale sales of passenger vehicles in China reached 3.624 million units, a year-on-year increase of 14.0%, achieving a real good start. The Chinese market share of the world auto market reached a new high of 36%. This is also due to the lack of cores on a global scale. Compared with other countries’ car companies, Chinese self-owned brand car companies have tapped more chip resources, so self-owned brands have obtained higher growth opportunities.

Under the passive circumstance that the world‘s lithium ore resources are in short supply and the price of lithium carbonate has skyrocketed by 10 times, the wholesale sales of new energy passenger vehicles in China from January to February 2022 will reach 734,000 units, a year-on-year increase of 162%. From January to February 2022, the market share of China’s new energy vehicle sales reached a new high of 65% of the world share.

Judging from the comparative data of the world‘s auto industry, the shortage of auto chips in the world has not only brought little loss to the development of Chinese auto companies, but in the common predicament of the world‘s auto companies, due to the strong self-rescue of China’s independent auto companies and the support of the Ministry of Industry and Information Technology Coordinated and achieved super market results; under the background of skyrocketing lithium prices, Chinese independent brands rose to the challenge and achieved good performance of super sales growth.

In March, the wholesale sales data of new energy vehicle manufacturers of the Passenger Federation reached 455,000 units, a year-on-year increase of 122.4%, which also fully demonstrated my ability to self-improvement.

6. Traditional fuel vehicles and new energy vehicles form a K-type trend – economical fuel vehicles should reduce taxes or subsidies

In recent years, the passenger vehicle market demand has shown a differentiated K-type trend. The proportion of traditional fuel vehicles has continued to decline, and the proportion of new energy vehicles has continued to increase, forming a structural growth trend in the domestic auto market. Traditional fuel vehicle products are facing greater growth pressure, while the electrification and intelligent social supply chain system of new energy vehicle products is still in the stage of innovation and rising.

After the outbreak of the new crown epidemic in the world, the environmental changes brought about by the epidemic have significant differences in the impact of car-owning groups and car-free groups. Behind the consumption classification, different groups are projected to resist risks, or in the post-epidemic era, it may affect the scale of the auto market.

Some car owners can quickly recover from the property damage of the epidemic, keep their jobs, and make their assets rise in value. Most of the car-owning groups belong to the middle class, and their family assets are rich. The risk-averse mentality under the epidemic has led to a strong release of the demand for the second car of the middle-class family, driving the strong growth of high-end B-class electric vehicles. Judging from the company’s new product plans, domestic new energy leading companies will focus on medium and large benchmark models this year, which is conducive to consolidating the accumulation of technology in China’s new energy market and accumulating strength for the continuous upgrading of the industry.

Car-free groups, such as those employed in the tertiary industry, have suffered a large loss of income from work during the epidemic. The original ability to purchase cars for normal consumption upgrades has been temporarily hindered, reducing the entry-level purchase demand for traditional fuel vehicles. The sales of entry-level models of joint venture brands have dropped significantly, and the overall performance of traditional car companies has declined.

The market environment of traditional fuel vehicle models has deteriorated. Under high oil prices, the demand for some traditional fuel vehicles has been diverted to the consumption of new energy vehicles, resulting in weaker sales of traditional vehicles. At the same time, the decline in purchasing power of more consumer groups has also resulted in the market demand for traditional vehicles. decline. At present, the important choice to promote economic growth and family travel is still traditional fuel vehicles, and the carbon emissions of the entire vehicle manufacturing process of traditional fuel vehicles are much lower than those of new energy vehicles. It is estimated that the production of 50-degree electric vehicles generates nearly 5000kg CO2/unit, and the production of fuel vehicles generates 550kg CO2/unit. 1 liter of gasoline for a fuel car is 2.4kg of CO2, 5 liters of oil per 100 kilometers is 12 kg of CO2, and 12 kWh of electricity per 100 kilometers is also 12 kg of CO2. Pure green power needs to be nearly 40,000 kilometers flat, and if the carbon emissions of pure coal power are flat, hundreds of thousands of kilometers are required. Therefore, in terms of carbon emissions in the whole life cycle of mainstream family vehicles, traditional fuel vehicles are relatively better, with lower prices, and the actual cost performance is higher.

To understand: the decline of low-end and mid-end fuel vehicles under the epidemic is not buying new energy vehicles, but not buying new energy vehicles. This is suffering, not joy. The economical traditional fuel vehicles have fallen significantly. In March, the A-class traditional fuel vehicles fell by 29%. The high cost of traditional fuel vehicles is mainly due to the huge tax contributions they have made to the society. Provide periodic central tax reductions or local subsidies for traditional fuel vehicles to improve people’s lives and stabilize economic growth.Return to Sohu, see more