Every reporter Cai Ding Lan Suying Zhang Shoulin Every editor Lan Suying

● As of today (March 19), the Russian-Ukrainian battle has lasted 24 days. The United States had serious inflation last year. Why did the Fed not raise interest rates earlier, but insisted on raising interest rates amid the sound of gunfire? Is this rate hike another round of global “cutting leeks”? What role did the US play in the Russia-Ukraine war?

● China is the second largest creditor country of the United States. Is the Fed raising interest rates a good or bad for China’s holdings of US debt? How will China respond? On March 16, the day before the Fed raised interest rates, China took the lead in taking action. Vice Premier Liu He presided over a special meeting, which positively responded to all market concerns. We have seen that A-shares, Hong Kong stocks and Chinese stocks in the US market, which have been falling continuously, stopped falling and counterattacked immediately…

● The interest rate hike cycle has started. How many times is the Fed expected to raise interest rates in the future? What is the rate hike path?

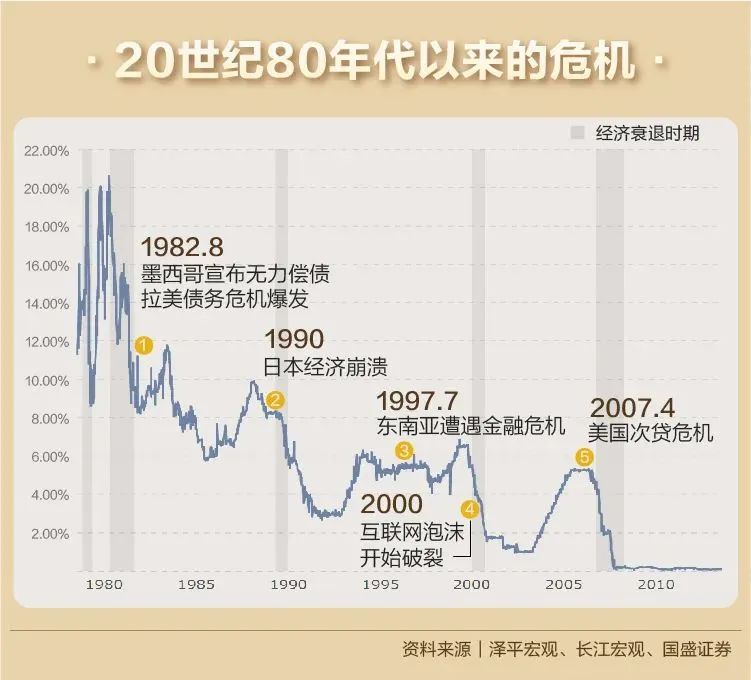

● In the past 40 years, 6 rounds of interest rate hikes by the Federal Reserve have triggered 5 financial crises! What will be the impact of this rate hike?

Yang Conspiracy

Fed: raising interest rates to curb inflation

beautiful The Fed’s “shot” again! In the early morning of March 17, Beijing time, Federal Reserve Chairman Powell announced that the benchmark interest rate will be raised by 25 basis points to a range of 0.25%-0.5%. This is the first time the Fed has announced a rate hike in 1,183 days.

However, the voting committee believes that adding 25 basis points is not enough! The Federal Open Market Committee of the Federal Reserve (hereinafter referred to as the FOMC) stated in its monetary policy statement that in the vote on this interest rate resolution, all votes voted 8-1 to pass the decision to raise interest rates by 25 basis points. The only vote against it was St. Louis Fed President Bullard, who believed the Fed should raise rates by 50 basis points at this meeting, not 25.

■ According to the Fed’s policy statement, it means “this is a conspiracy”

The Fed’s policy statement said the rate hike was due to factors including inflation and the COVID-19 pandemic, and “(U.S.) economic activity and employment indicators have continued to strengthen. Employment growth has been strong in recent months and unemployment has fallen sharply. Inflation remains high, reflecting Supply and demand imbalances, higher energy prices and broader price pressures related to the COVID-19 pandemic.”

“The Russian-Ukrainian conflict has created enormous human and economic hardship. The impact on the U.S. economy is extremely uncertain, but in the short term, conflict-related timing could put additional upward pressure on inflation and have a negative impact on economic activity. pressure,” the Fed added in a statement.

■ Food is ridiculously expensive, and the “first lady” complains that meat is expensive

Indeed, this rate hike is closely related to the highest level of inflation in the United States in 40 years. Robust consumer demand and supply chain bottlenecks amid the pandemic have pushed up U.S. inflation for more than a year.

Before this rate hike, U.S. inflation was so outrageous that the Fed had to intervene:

Meat, eggs and milk are essential materials in the lives of residents. At the end of October last year, a certain type of beef in the United States had risen to US$16.97 per pound (about 237 yuan per kilogram). The price of beef is only $12 per pound (about 166 yuan per kilogram).[1]

At the beginning of this year, even the “first lady” of the United States complained that the price of meat was too expensive! As a person in a high position in the world’s most powerful country, do you really feel that you can’t afford meat, or is it just a show?

■ housing prices soared, hitting a new high in more than 20 years;CPI rises to a 40-year high

U.S. home sales prices rose 16.9% in 2021 from a year earlier, the highest level since 1999, according to the National Association of Realtors (NAR). Rising U.S. house prices also helped push U.S. inflation to a multi-decade high, with the country’s consumer price index (CPI) rising to a 40-year high in February from a year earlier.

According to Fannie Mae’s latest National Housing Survey, 43% of respondents believe that U.S. home prices will rise in the next 12 months, while another 14% and 35% of respondents believe that prices will fall or remain unchanged in the future. Zillow, the largest real estate information website in the United States, predicts that in 2022, U.S. house prices may increase by 16.4%.

■ Oil prices go against the sky, Americans go to Mexico to refuel

And another American necessities, oil, makes many Americans feel that life is terrible.

At the end of February, the conflict between Russia and Ukraine swept the global capital market into a whirlpool, and energy prices represented by oil were more like a wild horse, soaring all the way, further pushing up the level of inflation. U.S. crude oil prices surged again to $115.68 a barrel on March 4, the highest level in 14 years.

According to a number of US media reports, due to the high oil prices, many Texans even choose to drive across the US-Mexico border to refuel in Mexico, where oil prices are cheaper.

Goldman Sachs raised its 2022 forecast for the spot price of Brent crude to $135 a barrel from $98 and said it could surge to $175 a barrel in a worst-case scenario. And Bank of America, Barclays and others have thrown out the possibility that oil prices will rise to $200/barrel.

■ U.S. inflation could hit close to 10% this year

Soaring global energy and food prices have pushed up inflation. According to data released by the U.S. Bureau of Labor Statistics recently, the U.S. consumer price index (CPI) rose by 7.9% year-on-year in February, the largest year-on-year increase since January 1982. The sharp rise in prices in February was mainly due to energy, Factors such as rising housing and food prices. Energy prices rose 3.5% month-on-month in the month and 25.6% year-on-year, of which gasoline prices rose 6.6% month-on-month, contributing nearly a third of the month-on-month increase to the CPI. Food prices rose 1% month-on-month, the biggest gain since April 2020. The cost of housing, which accounts for about one-third of the CPI’s weight, rose 0.5% month-on-month and 4.7% year-on-year.[2]

“New Debt King” Gundlach believes that inflation in the United States may reach close to 10% this year. He believes that even as the Russia-Ukraine conflict creates new uncertainty, it underscores the need for the Federal Reserve to tighten monetary policy sharply.[3]

At present, the market expects that the peak of US inflation has not yet occurred, and at the same time, it is worried that the high inflation will weaken economic growth, thereby triggering the risk of stagflation and economic recession.

Did the Russia-Ukraine war undermine Fed action?

■ Why did the Fed only raise rates by 25 basis points instead of 50?

The voted committee believes that this rate hike should be increased by 50 basis points, not 25. So, is the Fed only raising interest rates by 25 basis points this time, is it affected by the war between Russia and Ukraine?

Inflation in the U.S. took off before Russia launched a special military operation with Ukraine. The purpose of the Fed raising interest rates is to curb inflation, and while the Russia-Ukraine war has further boosted inflation in the United States, the real economy of the United States has also been traumatized due to the severe blow to the supply chain and the rise in energy costs; the Fed has to curb inflation and maintain balance between economic growth.

■ What might happen if the rate hikes are too aggressive:

(1) The cost of capital used by the enterprise has risen too much

(2)May affect the funding cost of the Biden administration’s $1.2 trillion infrastructure plan, which was originally launched to stimulate economic development

(3)curb consumer spending

(4)May deeply hurt the U.S. capital market for a certain period of time, thereby affecting the level of direct financing of enterprises

It can be seen that if the interest rate is raised too much, it will hurt the US real economy in recovery. Therefore, we finally saw that the Fed voted 8-1 in this interest rate resolution to pass the decision to raise interest rates by 25 basis points. Only one voter thinks the rate should be raised by 50 basis points.

conspiracy

Although the Federal Reserve has packaged this rate hike as a “conspiracy”, the United States, as the world‘s largest power, will inevitably consider maintaining the hegemony of the dollar behind many of its actions, and the game between major powers is not only about raising interest rates and responding to increased It’s as simple as that…

At the moment when the interest rate button was pressed, another round of USD reflow started.

Behind the Fed’s Actions: Maintaining Dollar Hegemony

Image source: Visual China-VCG111345409747

■ Economist: This is its global“Harvest the leeks”conspiracy

Some economists believe that in the context of “anti-sky” inflation in the United States, raising interest rates is another “leek harvest” for the world![4]

In the eyes of these economists, in recent years, the U.S. economic decision-making path has been a familiar cycle of “cutting leeks”:

The first “harvest” In the face of major economic shocks, large-scale borrowing and printing of money, using the low financing cost of the US dollar to stimulate the economy, and the large flow of US dollars overseas, which is essentially forcibly borrowing money from other countries;

Second round of “harvest” After the excess US dollar liquidity combined with the expectation of economic recovery led to global inflation, the Federal Reserve tightened monetary policy by raising interest rates and other means, which objectively prompted the return of capital, which eventually caused many countries to suffer the double impact of hyperinflation and capital outflow, and even asset prices. The tragic slump.

The third round of “harvest” When asset prices in other countries plummeted, the United States printed a lot of money to “buy the bottom”, and so on.

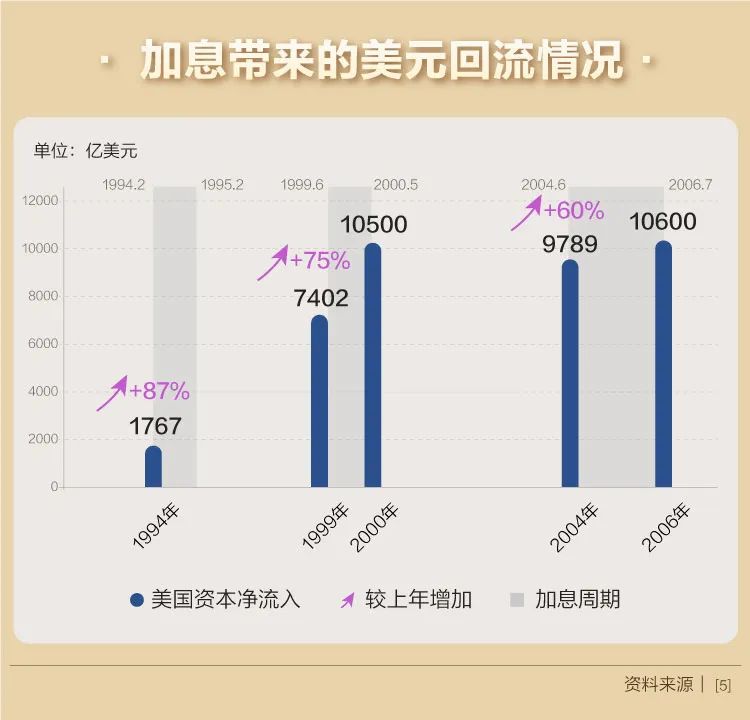

■ Higher interest rates will drive the dollar back to the continental United States

From historical experience, once the Fed starts raising interest rates, it will widen the interest rate difference between the United States and other countries in the short term. The expected appreciation of the U.S. dollar and the rise in U.S. bond yields will attract international capital back to the United States, resulting in tight global funds and rising interest rates.

In such a scenario, fragile economies are often faced with a dilemma – if the local currency appreciates with the dollar, the weakened economy will continue to be weighed down by the loss of competitiveness of exports; if the decoupling dollar depreciates, capital outflows may occur.

What role does the United States play behind the Russia-Ukraine war?

Since the Russian President Vladimir Putin announced a special military operation in the Donbas region on February 24, as of March 19, the war between Russia and Ukraine has lasted 24 days.

How did the conflict between the two sides escalate to this point? Who caused all this?

A Ukrainian soldier smokes in front of an armored vehicle in Kharkiv, Ukraine, February 26, 2022.

Image source: Visual China-VCG111370984240

■ Behind the Russia-Ukraine war is not without the United States

It is not difficult for us to find that the United States is behind the Russia-Ukraine war. Before Russia launched the special military operation, the United States has been spreading false news that Russia will “invade” Ukraine, exaggerating the Russian threat.

A few days after Bloomberg apologized for publishing the false news of “Russia invaded Ukraine”, the United States said with so-called “intelligence” that Russia would attack Ukraine on February 16. At that time, even Ukrainian President Volodymyr Zelensky was stunned by such false news, calling on the West not to create panic and pointing out that there was no immediate threat of war.

According to Foreign Ministry spokeswoman Hua Chunying at a regular press conference at the end of February, the United States has been raising tensions and inciting the danger of war for some time. billions of dollars and more than 1,000 tons of weapons and ammunition.[6]

On March 16, local time, U.S. President Biden delivered a public speech at the White House, announcing an additional $800 million in military assistance to Ukraine, bringing the total U.S. pledged security assistance to Ukraine to $1 billion in the past week. U.S. aid to Ukraine has totaled $2 billion since the Biden administration was established. The military aid package also includes anti-tank missiles and more defensive weapons that the United States has already begun to provide, according to a statement released by the White House.[7]

Behind all this, what is the real intention of the United States?

■ create panic,Promoting the “return” of funds to the United States

Some analysts say that the United States is constantly “fanning the flames” on the Russia-Ukraine issue, with the aim of increasing the panic in the global financial market and prompting the “return” of funds to the United States.[8]

Since the beginning of this year, the U.S. dollar index, which measures the U.S. dollar against six major currencies, has continued its upward trend. From the beginning of the year to March 17, the U.S. dollar index has risen by 2.48%. On March 7, the U.S. dollar index recorded an intraday record of 99.42, a new high since the end of May 2020. Since the U.S. dollar index tracks the greenback’s performance against a basket of six major currencies, the dollar’s strength can also reflect relative “weakness” in other currencies, such as the euro, which has weakened due to the conflict between Russia and Ukraine. In addition, some analysts pointed out that the continuous strength of the Fed index is related to the successive release of hawkish signals from Fed officials, which has led to an accelerated rise in U.S. bond interest rates.

Reuters reported on March 11 that investors fled European stocks at the fastest pace on record, seeking shelter in assets seen as “safe havens” such as gold and cash.

Globally, investors poured $2.4 billion into gold, pulled $1.4 billion from stocks and $13.2 billion from bonds, according to a Bank of America report based on EPFR data. Emerging market bonds also saw their biggest outflows in two years at $3.5 billion.

■ The United States has bigger plans:Strengthening Europe’s Military Dependence on the U.S.

Analysts pointed out that one of the purposes of the frequent actions of the United States in Ukraine is to provoke relations between Russia and Europe, win over European allies, and strengthen their military dependence on the United States.

Yuri Rogurev, director of the Franklin Roosevelt Foundation for American Studies at Moscow State University, pointed out that the United States has always forced the European Union to serve its own geopolitical purposes on the grounds of providing security guarantees. For the US, Ukraine is an excellent tool for further control of the EU. By exaggerating the Russian military threat, the United States continues to maintain a highly tense military and political situation in Eastern Europe, thus firmly tying the European Union to the chariot of American hegemony.[9]

■ Sanctions on Russia to compete for the European gas market

In addition to military interests, the United States is also competing for economic interests. Due to the rapid growth of its LNG production capacity and the continuous acceleration of the construction of LNG liquefaction units, the United States has been committed to exploring overseas markets. Europe has a high strategic value for U.S. LNG exports, while Russia, which has abundant natural gas resources, is the U.S.’s main competitor in the region.

With the escalation of the situation in Russia and Ukraine, the United States has also increased the sanctions imposed on Russia by the United States. From space to aviation, and from finance to energy, Europe’s interests have also been eroded.

Take Europe’s energy supply as an example. More than 40% of Europe’s natural gas supply comes from Russia. In 2021, Russian gas exports to the EU will reach 192.6 billion cubic meters, accounting for 81% of its total exports.

Shengsheng is being pulled to cut ties with Russia. How to ensure future economic development and energy security will become Europe’s biggest challenge. Dmitry Marinchenko, senior director of Fitch’s natural resources and energy projects, said in an interview with the “Daily Economic News” that in the longer term, European countries are likely to rely on LNG resources, including U.S. LNG.

■ The United States suffered a backlash from the Russia-Ukraine war

Both Russia and Ukraine are important global exporters of energy, agricultural products and metals. According to the International Energy Agency (IEA), Russia is the world’s third-largest oil producer, after the United States and Saudi Arabia, producing 10 percent of global supply. Russia and Ukraine together account for about 29% of global wheat exports and 19% of corn exports. In addition, Russia and Ukraine export about 80% of the world’s sunflower oil.

The Russia-Ukraine war has further hit global supply chains that have been strained since the COVID-19 pandemic.

In response to Western sanctions against Russia, the world’s top two container shipping companies, Maersk and Mediterranean Shipping, announced at the same time that they would suspend all cargo bookings in and out of Russia, except for food, medical and humanitarian supplies. Previously, France’s CMA CGM, Germany’s Hapag-Lloyd and Singapore-based Japan Ocean Network Shipping Co. have successively suspended booking services for Russian cargoes. The five carriers together account for nearly 60 percent of the global market, according to Alphaliner, an international shipping industry analyst. Some market participants predict that their suspension of services to Russia will intensify supply chain difficulties and lead to a sharp rise in shipping costs.[10]

Jay Bryson, managing director and chief economist of Wells Fargo’s corporate and investment banking business, pointed out in an interview with reporters that “before the Russian-Ukrainian conflict broke out, institutions, including us, had inflation expectations. are high, and now, soaring commodity prices and the potential risk of supply chain disruptions from the Russian-Ukrainian conflict are adding to inflationary pressures.”

Coping

The day before the U.S. hikes interest rates, China takes the lead

Just about 13 hours before the Fed raised interest rates, China on the other side of the ocean took the lead in taking action——

■ Vice Premier Liu He presided over a special meeting to respond positively to the market’s concerns

On March 16, Liu He, Vice Premier of the State Council and Director of the Finance Committee, presided over a special meeting of the Financial Stability and Development Committee of the State Council to study the current economic situation and capital market issues.

Although the press release of the special conference is only a few hundred words, it has made a clear response to the current development priorities, monetary policy, China concept stocks, platform economic governance and other key issues, which can be said to be a positive response to all markets. Worry.

The meeting also emphasized that relevant departments should earnestly undertake their own responsibilities, actively introduce policies that are favorable to the market, and cautiously introduce contractionary policies. Any policy that has a significant impact on the capital market should be coordinated with the financial management department in advance to maintain the stability and consistency of policy expectations.

The market with a keen sense of smell then launched a vigorous Jedi counterattack, sweeping away the previous haze.

■ A shares and Hong Kong shares are all in the red

At the close of the day, the three major A-share indexes rose across the board. The Shanghai Composite Index closed up 3.48% at 3,170.70 points; the Shenzhen Component Index closed up even more, up 4.02%; the ChiNext closed up as high as 5.2%; the Hong Kong Hang Seng Index rose in a straight line. 9%, and stood at 20,000 points again, recording the largest one-day increase since October 2008; the Hang Seng Technology Index increased by a record, expanding to 22%, the largest intraday increase since the index was launched.

■ Chinese stock market counterattack

Previously, because the U.S. Securities and Exchange Commission (SEC) said that under the Foreign Company Accountability Act, if a foreign listed company fails to submit the report required by the U.S. Public Company Accounting Oversight Board for three consecutive years, the SEC has the right to remove it from the exchange. delisted. Five Chinese companies, including BeiGene, Yum China, Zai Lab, Shengmei Semiconductor, and Chi-Med, appeared on the pre-delisting list, triggering a slump in Chinese stocks for several consecutive days.

The meeting specifically mentioned that regarding Chinese concept stocks, the regulators of China and the United States have maintained good communication and have made positive progress, and are working on forming a specific cooperation plan. The Chinese government continues to support various types of companies to list overseas.

Later, during the US stock market trading session on that day, Chinese concept stocks collectively launched a counter-offensive. The Nasdaq China Golden Dragon Index closed up nearly 33%, and many Chinese concept stocks soared, Zhihu rose nearly 80%, Kingsoft Cloud rose more than 72%, Ding Dong Maicai rose by more than 65%, Huanju rose by more than 67%, Douyu rose by more than 60%, Pinduoduo rose by more than 56%, iQiyi rose by more than 50%, Bilibili rose by more than 47%, JD.com, Baidu, Huya rose Nearly 40%, Alibaba rose more than 36%.

■ expert:In response to the Fed’s monetary policy adjustment, China began to act last year

Guan Tao, Global Chief Economist of Bank of China Securities and former Director of the International Department of the State Administration of Foreign Exchange, said in an interview with the “Daily Economic News” reporter, “Every move of the Federal Reserve’s monetary policy has a great spillover impact on the world economy and finance. In response to the Fed’s monetary policy adjustment, in fact, the Chinese government has been studying this issue since last year and strengthening its research and judgment of the situation.”

As the Fed’s normalization of monetary policy enters different stages, its impact may gradually increase, so it is necessary to strengthen research and judgment in this regard, make plans, and take countermeasures. “Plans are more important than predictions.” Guan Tao emphasized.

As the second largest creditor of the United States, how should China respond?

According to the International Capital Flows Report (TIC) report released by the U.S. Treasury Department on March 15, Eastern Time, China’s U.S. bond holdings fell to $1.0601 trillion, still the second largest creditor country in the United States after Japan.

So, what will be the impact of the Fed’s start of raising interest rates on its second-largest creditor, China?

Photo source of Guan Tao: Every reporter Zhang Jian (data map)

■ U.S. Treasury bonds are held to maturity,Yields will be higher; U.S. equity holdings may suffer losses

“As far as China’s U.S. debt is concerned, it depends on the investment strategy,”Global Chief Economist of BOC Securities, Former Director of the International Department of the State Administration of Foreign ExchangeGuan Tao told the “Daily Economic News” reporter, “If the investment strategy is to make a difference by buying and selling, then the Fed will raise interest rates and the US bond yield will rise, which means that the price of the bonds you hold will fall.If you make a difference, if you do it in the wrong direction, there will be a certain market risk.However, if your investment strategy is to hold to maturity, the Fed tightens, and Treasury yields rise, it means thatIf you hold to maturity, the yield will be higher. In addition, you may not only take US bonds, but also some equity assets. So,If the Fed tightens and triggers a drastic adjustment in the prices of risky assets such as U.S. stocks, your U.S. equity assets may suffer losses。”

■ The performance of the capital market during the last normalization of the Fed’s monetary policy cannot be simply copied

In Guan Tao’s view, every situation is different, “We cannot simply copy the performance of the capital market during the last time the Fed’s monetary policy normalized. First, the intensity of the monetary policy withdrawal this time is different from the last time. Gradual retreat, this time the interest rate hike will be raised very quickly. Second, this time, not only will the Fed withdraw, but other central banks of developed economies will also withdraw, that is, the collective shift of monetary policy, then the impact on global liquidity tightening or financial conditions The impact of tightening is not the same as the last time. The third is the issue of valuation. The last time, that is, from the beginning of 2009 to 2014, the reduction of bond purchases, the US stock market also rose for five or six years, but this time it rose more than the last time. The problem of high valuation is more prominent than last time.”

Will the Fed’s start of the rate hike cycle this time compress China’s monetary policy space?

■ Cutting interest rates and reserve ratios can avoid further exchange rate appreciation

Tang Yao, associate professor of the Department of Applied Economics at Peking University’s Guanghua School of Management, told the reporter Shijing, “After the reform of monetary policy and the exchange rate system,At present, China’s monetary policy has more room for autonomymonetary easing can be carried out according to the needs of the domestic economy.As the RMB has been relatively strong in recent months, cutting interest rates and reserve ratios can avoid further appreciation of the exchange rate, keep it floating around the equilibrium level, and play a role in stabilizing the economy with a floating exchange rate。”

■ Fed tightening won’t constrain China’s central bank monetary policy

Guan Tao pointed out that, because China has always emphasized the domestic priority of monetary policy, so,Fed tightening won’t constrain China’s central bank monetary policy. “Of course,We have to accept the consequences of the dislocation of Sino-US monetary policy.If we loose and they tighten, that will have an impact on capital flows and the renminbi. for example,The Fed tightens and the U.S. bond yields rise, which may block the room for China’s bond yields to fall, and even push China bond yields up. Then this means that if our central bank’s monetary policy is to reduce financing costs, there may be transmission problems in the capital market. “

Talking about the spillover effects of raising interest rates, Guan Tao said frankly, “(The Fed raises interest rates)In the future, the impact on the RMB exchange rate trend of China’s cross-border capital flows may be bearish or bearish, the RMB exchange rate may rise or fall. Plans are more important than predictions. “

■ No special measures are currently required to deal with the US dollar rate hike

Tang Yao believes, “Because the capital market has full expectations for interest rate hikes, and China’s monetary policy is autonomous, China does not need to introduce special measures to deal with the US dollar interest rate hike at present.Monetary policy should be based on consideration of domestic economic management needs. In the capital market, small and medium market participants should be guided to respond rationally and avoid emotional trading behavior. “

Future

How many more rate hikes are expected from the Fed this year?

Now that the wheel of the Fed’s interest rate hike has begun to turn, what rhythm will it advance in the future?

Wells Fargo chief economist Jay Bryson (Jay Bryson) gave his prediction in an interview with the “Daily Economic News” reporter, believing that “this year the Fed will raise interest rates at least four times and raise interest rates five times. The median is the most likely outcome. In 2023, the Fed will raise interest rates four times, but it will not tighten monetary policy additionally in 2024.” He also predicted that “the Fed will announce a reduction in its balance sheet at its meeting at the end of July this year. Decide.”

Kathy Bostjancic, chief U.S. economist at Oxford Economics, was more aggressive, telling reporters, “We expect the Fed to raise rates by a total of 175 basis points this year. Basis point/time calculation, the number of interest rate hikes is 7), (at the end of this round of interest rate hike cycle) to raise the federal funds rate to more than 2%. In addition, the Fed may also begin to shrink its balance sheet in May this year. We expect the Fed to A reduction of $600 billion in bond holdings and a $1 trillion reduction in 2023 is equivalent to 1.5 to 2.5 interest rate hikes (25 basis points at a time).”

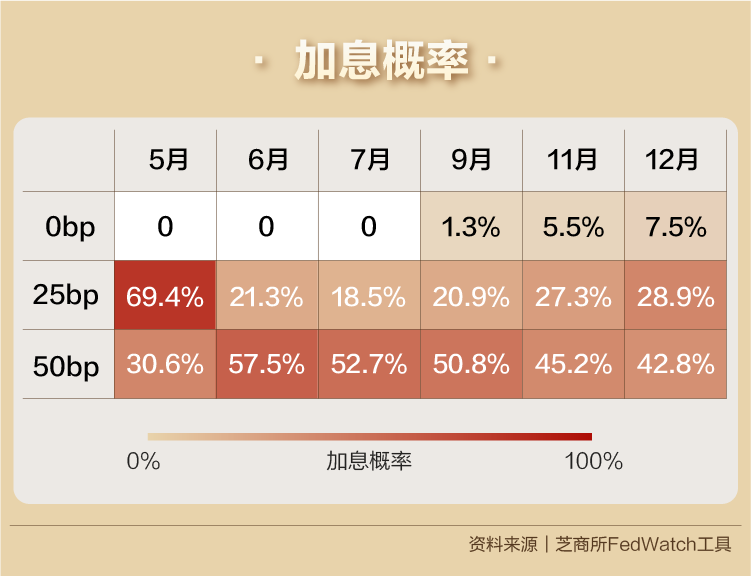

After the Fed’s interest rate decision, we found through data from CME Group’s interest rate monitoring tool FedWatch:

(1) In the remaining 6 FOMC meetings during the year, there is a high probability of raising interest rates by 25 basis points in 5 meetings, while the data on March 15 shows that it is 4 times;

(2) June is currently the month when traders are most likely to raise interest rates by 50 basis points.

Many on Wall Street pointed out that in addition to the high inflation data, there are also many uncertainties in geopolitical risks, which has brought new challenges for Federal Reserve Chairman Powell.

According to economists surveyed by Bloomberg, the entire financial market may continue to fluctuate violently due to factors such as the turmoil in Russia and Ukraine, the increase in sanctions imposed by Europe and the United States on Russia, and soaring commodity prices. Economists therefore expect that the Fed will be cautious about raising interest rates, and may not raise interest rates at every interest rate meeting this year, and may not have a single 50 basis point rate hike this year.

After 6 rounds of interest rate hikes and 5 financial crises in the past 40 years, who is the biggest beneficiary?

Some media once commented that the Fed’s “small step” is a “big step” for the world. What usually happens as a new Fed rate hike cycle begins?

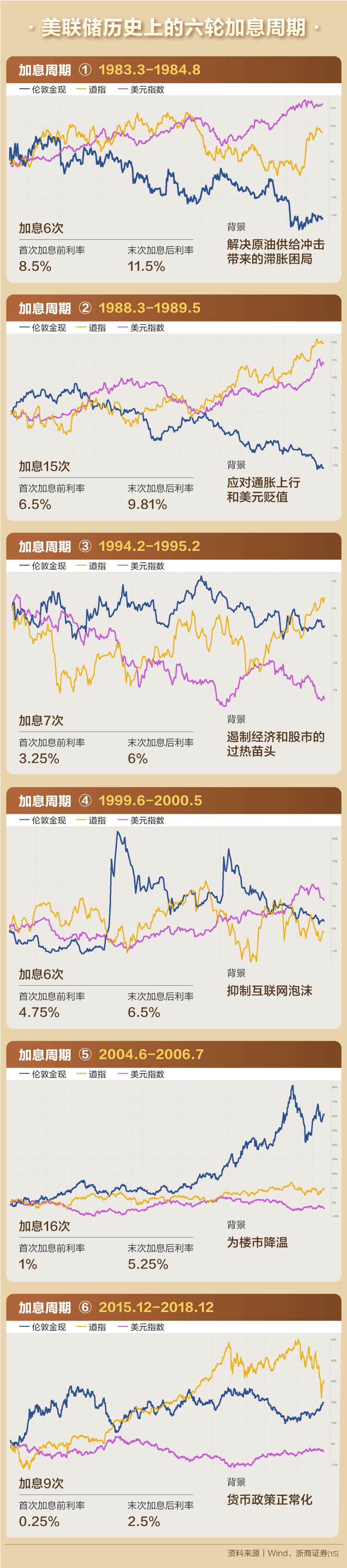

Looking back over the past 40 years, we find that since the 1980s, the Federal Reserve has gone through six notable interest rate hike cycles. It can be seen that during the Fed’s interest rate hike cycle, financial crises have been triggered many times at relatively fragile links in the world economic chain.

① After the Fed raised interest rates, the borrowing cost of Latin America rose and its solvency deteriorated. In August 1982, Mexico declared insolvency, which opened the prelude to the Latin American debt crisis. From 1984 to 1989, Brazil, Argentina, Venezuela and other countries encountered difficulties in repaying their debts.[11]

② Following the pace of interest rate hikes by the Federal Reserve, Japan raised interest rates in 1989, the housing market and the stock market crashed, the banking industry was hit hard, and the Japanese economy fell into a “lost twenty years”.[12]

③ In 1994, after the Federal Reserve raised interest rates, the currencies of many Southeast Asian countries were attacked by international hot money speculation. On July 2, 1997, Thailand announced the abandonment of the fixed exchange rate system, the currency depreciated, the stock market was hit hard, the real estate bubble burst, and the financial turmoil spread to the entire Southeast Asia.[11]

④ In the late 1990s, with the rise of Internet technology, technology/network-related stocks were sought after. In June 1999, the Federal Reserve raised interest rates, liquidity tightened, stock prices fell sharply, and the Internet bubble began to burst in March of that year.[13]

⑤ After the Internet bubble crisis, the Federal Reserve cut interest rates continuously to stimulate the real estate boom, and subprime mortgages began to be securitized. In 2004, the Federal Reserve began to tighten monetary policy, and two years later, the subprime market defaults increased sharply. In 2008, the subprime mortgage crisis broke out and quickly spread to the world.[11]

In this regard, Jeffrey Young, former global foreign exchange director of Citigroup and co-founder and CEO of DeepMacro, explained the logic behind in an interview with a reporter from “Daily Economic News”: “The Fed’s Emerging markets are usually hit hard during a rate hike cycle for two reasons: one is that emerging market countries (and companies) issue dollar-denominated bonds, and when U.S. interest rates rise, it tends to be more difficult to repay debts. It is higher dollar interest rates that can attract overseas capital, especially from emerging markets, so (the Fed rate hike) will tighten domestic financial conditions in these emerging market countries.”

Guan Tao reminded, “We cannot ignore the spillover effect of further tightening by the Federal Reserve. Most emerging economies have lagged behind developed economies in economic recovery due to the impact of the epidemic, and their economic cycles are different from those of the United States. The economic cycle of developed economies is different. The collective turn of monetary policy may bring pressure on capital outflow and exchange rate depreciation to emerging economies. For fragile emerging markets, the spillover effects are actually very large. Therefore, this is also the case of the International Monetary Fund since last year. The World Bank and the World Bank have repeatedly issued warnings that the Fed’s rapid monetary contraction may make it more difficult for emerging economies to recover.”

At this point, revisit the words of the Nixon-era U.S. Treasury Secretary Connelly: “The dollar is our currency, but your trouble.”

Throughout the six interest rate hike cycles in the past 40 years, the pace and magnitude of each round of interest rate hikes are different, and the background is not completely the same. There are both high inflation caused by supply-side pressure, and the real estate and Internet economy. Bubble pressure, there is also a normalization process after the implementation of unconventional policies.[14]

The landing of interest rate hikes will often lead to more obvious adjustments in US stocks, but from the perspective of the entire cycle, the major indexes are likely to maintain their upward momentum in shocks, and end the cycle of interest rate hikes by closing up; the US dollar index (UDI) and the London gold cash (XAU) In the cycle, the performance is more average, with 3 rises and 3 falls.

(Disclaimer: The content and data in this article are for reference only and do not constitute any investment advice.)

Cai Ding, senior reporter of the Daily Economic News

Email:[email protected]

Reporter’s Notes丨The United States should have a global perspective and inclusiveness when formulating monetary policy

There is no doubt that the Fed once again used dollar hegemony to exercise its “mission”.

As the world’s most important monetary policy maker, the Fed has long ignored one of the most critical obligations – the US dollar, as a standard currency, has become an international public good. The Fed needs to have a global perspective and inclusiveness when formulating its monetary policy. .

However, since World War II to the present, the Federal Reserve has always been based on an introverted perspective when formulating monetary policy. In fact, when the United States formulates monetary policy, its impact on other markets is rarely mentioned. The Fed’s policy has long been based solely on the domestic financial indicators of the United States. spillover effect. This introverted perspective is particularly evident at a time when the spread of the Russian-Ukrainian conflict is causing uncertainty to the global economy.

Fortunately, from past experience, the impact of Sino-US monetary policy differences on China’s economy will be relatively limited. China’s economic and financial performance in the past 20 years shows that while China’s monetary policy is loosened, the impact of the Fed’s tightening of monetary policy on China’s macro economy, capital market and foreign exchange market is staged and low-intensity. China’s economic operation and currency. Policy is more influenced by its own related factors. In the monetary policy implementation report for the fourth quarter of 2021 released by the People’s Bank of China not long ago, on the issue of inflation, the central bank believes that “inflation pressure is generally controllable”, and as a producer country, China’s economy has strong self-sufficiency, which is conducive to dealing with imports. type inflation.

representative work:

Last night, Trump gave an order, and 800,000 people’s dreams were shattered!America exploded Late-night earthquake: European and American stock markets plummeted, the Dow fell nearly 1,000 points during the session, and Apple’s market value once evaporated by 560 billion

[I don’t know who cut the fine leaves, the spring breeze in February is like scissors! Dear fans and friends, since the launch of “Every Jing Toutiao”, 779 issues of high-quality original content have become your spiritual food. How to use a better way, better content, better reading and you continue to walk with you is the direction we have been constantly thinking and working hard. Since the beginning of this spring season, we are determined to “work slowly and work hard”, turn “fast food” into “big dishes”, and occasionally present “big dishes” with the four value standards of “professionalism, depth, story, and communication” , and in the interval of “big dishes”, we will offer you “desserts”: all kinds of wonderful financial information]

References

[1] One kilogram of beef rose to 237 yuan, and one kilogram of pork was 81 yuan!U.S. prices soar, CCTV Finance

[2] Labor Force Statistics from the Current Population Survey, U.S. Department of Labor

[3] Jeffrey Gundlach says inflation could hit 10% this year, calls Fed’s target ‘laughable’, CNBC

[4] Inflation surge, the United States once again “harvest” the world?Xinhua

[5] Be wary of the spillover effect of the Fed’s continuous rate hikes, the Economic Information Daily

[6]Hua Chunying said the United States has been inciting the danger of war, Xinhua News Agency’s Weibo

[7] U.S. President Biden announces $800 million in additional military aid to Ukraine, CCTV

[8] The deterioration of the situation in Russia and Ukraine has collapsed the global market. Why did the safe-haven funds not “return” to the United States but poured into China?Chengdu Business Daily

[9] What is the intention of the United States to frequently play the “Ukrainian card” by speaking harshly to Russia? Xinhuanet

[10] The Russian-Ukrainian crisis exacerbates global supply chain tensions Industry players: the impact on Singapore’s shipping and ports is not expected to be too great, the Economic and Commercial Office of the Chinese Embassy in the Republic of Singapore

[11] Who will it be this time: The reasons and enlightenment of the financial crisis caused by previous interest rate hikes in the United States, Ze Ping Macro

[12] The historical Fed rate hike cycle, the Yangtze River macro

[13] Revisiting the bubble of the Internet

[14] What do the previous interest rate hikes in the United States look like?CITIC Construction Investment

[15] Liquidity valuation tracking: Northbound capital flows during the last Fed rate hike cycle, Zheshang Securities

Reporter: Cai Dinglan, Suying, Zhang Shoulin

Editor: Lan Suying

Vision: Cai Peijun

Typesetting: Lan Suying

Source of cover image: Every drawing