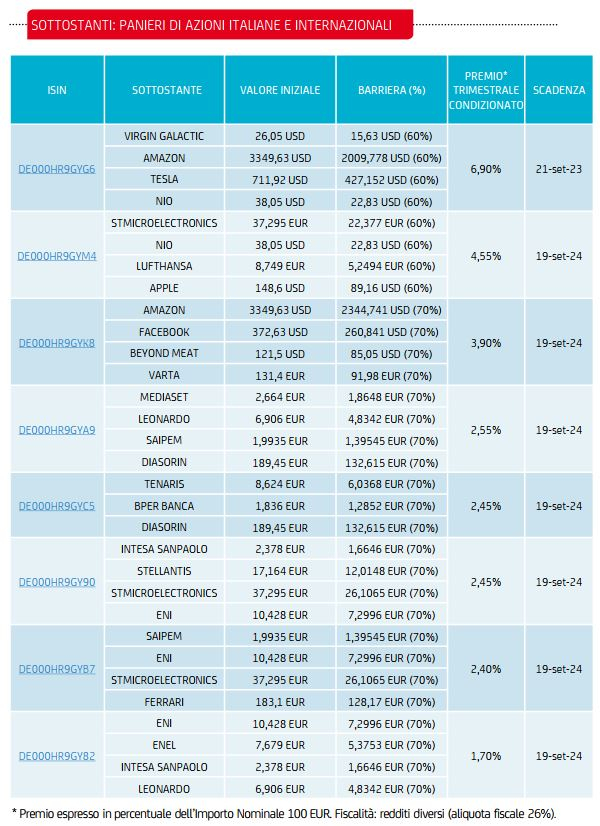

The new series of 16 certificates is already available on Borsa Italiana’s SeDeX Airbag Cash Collect Worst Of on baskets of Italian and international registered shares UniCredit, which are added to the Cash Collect issues in recent months (Fixed Cash Collect and Maxi Cash Collect).

The main features

The new products have baskets of Italian and international shares as underlying, a maturity of 2 or 3 years (September 2023 or September 2024) and pay a quarterly premium conditional on the Barrier level ranging from a minimum of 1.70% to a maximum of 8.10% per quarter depending on the baskets. Thanks to the memory effect, any unpaid premiums are not lost but will be paid later if, on one of the subsequent observation dates, the payment condition is met, i.e. all the shares that make up the basket will have a reference price at the close of the higher observation dates at the Barrier level, set for this issue between 60% and 70% of the Initial Value of the underlyings. In addition to the memory effect, the Cash Collect Worst Of Airbags feature the possibility of early repayment starting from March 2022 and, at maturity, the defensive effect called Airbag.

The expiry scenarios

At the time of maturity (September 2023 or September 2024 respectively) two scenarios are possible. In the first case, if the value of the share with the worst performance in the underlying basket is equal to or greater than the Barrier level, set for this issue between 60% and 70% of the Initial Value, the certificate will redeem 100 euros, in addition to the premium and any other unpaid premiums. Otherwise, if the value of the worst performing stock in the underlying basket is below the Barrier level, a Redemption Amount lower than the Nominal Amount is paid.

Thanks to the Airbag effect, in this case the Redemption Amount does not linearly follow the performance of the worst underlying but is higher than the same, and is calculated according to the following formula:

Redemption amount = 100 euros × [Valore Finale ÷ (Valore Iniziale × Barriera %)]

Taking a concrete example to better understand the functioning of the Airbag effect: in the event of a Barrier level at 60% of the Initial Value and negative performance of the underlying worst of the basket -41%, (therefore just below the Barrier level), a refund of € 100 x 59% / 60% would be obtained, equal to € 98.33 per instrument. Assuming a negative performance of the stock with the worst performance of the basket equal to -55%, the redemption amount would be equal to 75 euros (applying the same formula as above).

Action baskets for all tastes

Among the baskets brought to the market in this issue we find the classic European names, such as STMicroelectronics, Saipem, Eni and Ferrari, together with thematic baskets that embrace a specific sector: this is the case of the Airbag Cash Collect built on companies linked to the banking world, with a quarterly conditional coupon of 2% against a barrier of 70%. Numerous proposals are linked to American and Chinese stocks, such as the basket on Nel, Plug Power and Nio with a conditional quarterly coupon of 7.10% and barrier at 60% or the basket linked to the biotech world built on CureVac, BioNTech e Biogen, which offers a conditional quarterly return of 8.10% against a barrier set at 60% of the Initial Value of the underlyings.

Still speaking of the underlying baskets proposed, all of the Worst Of type, the UniCredit issue offers a diversified range. Please remember that thematic baskets are made up of stocks with a high correlation, a factor that lowers the risk level of the certificate. This is because baskets built on securities of different sectors or different markets, therefore tendentially uncorrelated, raise the level of risk for the investor. In this case, in fact, it is more likely that one of the underlying securities belongs to a sector in distress and increases the risk that the volatility of a single security brings the certificate below the barrier level.

You can view product information updated in real time on the site www.investimenti.unicredit.it