“Yesterday, I suddenly received a notice from the group and declared bankruptcy next week. All employees have resigned. Now HR, the companyExecutivesWe couldn’t find it, and we felt very embarrassed. “A person in charge of the North China region of Wall Street English told a reporter from 21st Century Business Herald.

The rain is coming and the wind is all over the building. Yesterday (August 12) from the afternoon to midnight, the customer service of Wall Street English successively sent a notice to each student’s group, “Due to labor disputes, classes and booking services will be suspended from tomorrow (August 13, 2021).” I didn’t realize the seriousness of the situation, and on the morning of August 13, many students successively found “organizations”, large and small Wall Street English rights activists.

A picture provided by a student of a Wall Street English store in Beijing Jiuxianqiao on the morning of August 13 showed that the door of the offline business point was closed and there was no one inside.

“The labor dispute mentioned should be a problem of wage arrears. I had been owed wages for three months before, and I was suddenly fired again. There was no way to ask.” The person in charge of the North China region told reporters. She believes that there are two reasons for Wall Street English’s bankruptcy: one is that a large number of offline courses have been cancelled since the epidemic, and the effect of changing to online courses is not good, causing problems in the company’s capital chain; A series of policies have caused the entire education track to no longer be favored by investors, even for institutions that focus on adult English training such as Wall Street English. The double whammy caused Wall Street English to struggle.

In addition to labor disputes, the bigger problem Wall Street English faces is that many students urge tuition fees. Many of them are recommended by Wall Street English sales staff.BankCredit card installments and Internet loans are “pay first and learn later”, and even pre-paid five-year tuition fees of hundreds of thousands of dollars. According to the official website of Wall Street English, there are 3 million students worldwide. Since 2000, 39 learning centers have been deployed in 11 cities in China.

400,000 training fees and 200,000 loans are unsettled

A reporter from 21st Century Business Herald found in a Wall Street English student group of more than 400 people that almost all the students participated in English training for the purpose of self-improvement after work, and they were all adults.At present, the equivalent amount of course fees that have not been consumed is mostly between 30,000 and 200,000.

Some trainees used financial institutions to borrow money to purchase courses under the recommendation of Wall Street English. Four trainees told reporters that Wall Street English recommended their useBaiduIf you have money to spend APP borrowing, you can repay in 12 installments, 18 installments or 24 installments; the other two students use itBankCredit card prepaid tuition for three years.

“At that time, the sales asked me to borrow from Alipay or credit card. I chose the China Merchants Bank credit card installment and the 36 installments were over.The total cost of the course is more than 400,000 yuan, of which 200,000 yuan is my own loan. “Because of the need for foreign exchanges at work, Ms. Tian from Beijing previously signed up for a one-to-one private education Market Leader course in Wall Street English.But she has only used the service for 2 months, but has paid the course fee for 5 years in advance.

Ms. Tian originally booked the course on August 13, but suddenly discovered that the course was temporarily cancelled. Later, yesterday, I was suddenly informed by the sales of the bad news that Wall Street English was about to go bankrupt, “I’m sorry, but you have to find a solution by yourself.” Sales also vomited bitterly at her, saying that there has been no salary for half a year, and he did not expect the company to be in such a situation. .

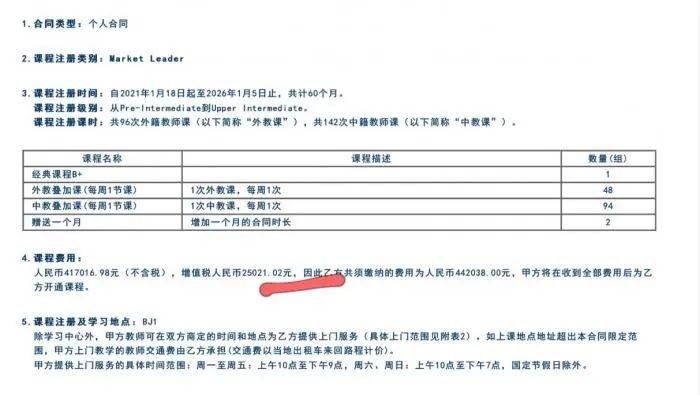

According to the training provided by Ms. TiancontractHer courses include 96 foreign teacher lessons and 142 Chinese teacher lessons. According to the plan, there will be one foreign teacher lesson and one middle school lesson every week. The cost of the course is as high as 442,000 yuan. In addition, the transportation fee for the teacher’s on-site teaching Ms. Tian also needs to pay.

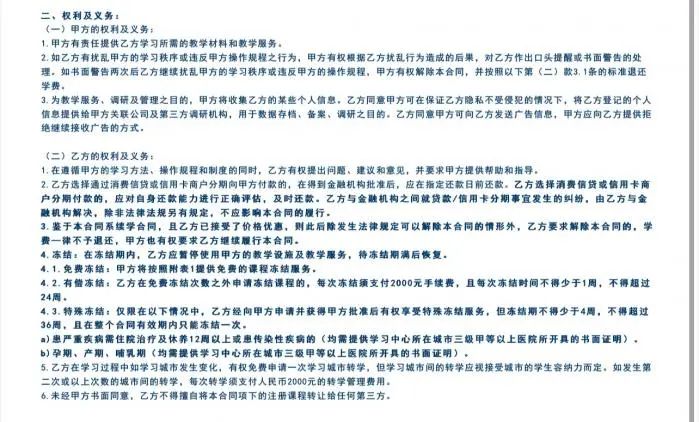

The reporter found that the contract has fewer restrictions on the rights and responsibilities of Party A, Wall Street English, and more detailed restrictions on the rights and responsibilities of clients such as Ms. Tian.

For example, Party A’s responsibility is only to “provide the teaching materials and teaching services required by Party B’s study”, and its rights include the right to verbally remind, write warning, or even terminate the contract and return when Party B disrupts learning needs or violates operating rules. Part of the tuition; can be used for teaching services,ResearchAnd manage to collect certain personal information of Party B and provide it to affiliated companies and third-party research institutions; Party B must also allow Party A to send advertising information.

There are a total of 6 rights and obligations of Party B, one of which shows: “Party B chooses to purchaseCreditOr if the credit card merchant pays Party A in installments, the payment shall be repaid before the specified date after approval by the financial institution. Disputes between Party B and the financial institution on loan/credit card installment matters shall be resolved by Party B and the financial institution. Unless otherwise provided by laws and regulations, the execution of this contract shall not be affected. “

In other words, although the purpose of the loan is to provide English training, even if the training organization cannot provide services after recommending the loan, it can still stay out of the matter, and the customer can only negotiate with the financial institution.

In addition, there is one other obligation of Party B: “Since this contract is a renewal contract and Party B has accepted the price concessions, the tuition fee will not be refunded if Party B requests the termination of this contract, except in circumstances where this contract can be terminated by law. , Party A also has the right to request Party B to continue to perform this contract.”

At that time, Ms. Tian did give away a few services due to the large amount of courses purchased, but according to this clause, she had no right to cancel the contract and recover the tuition fee.

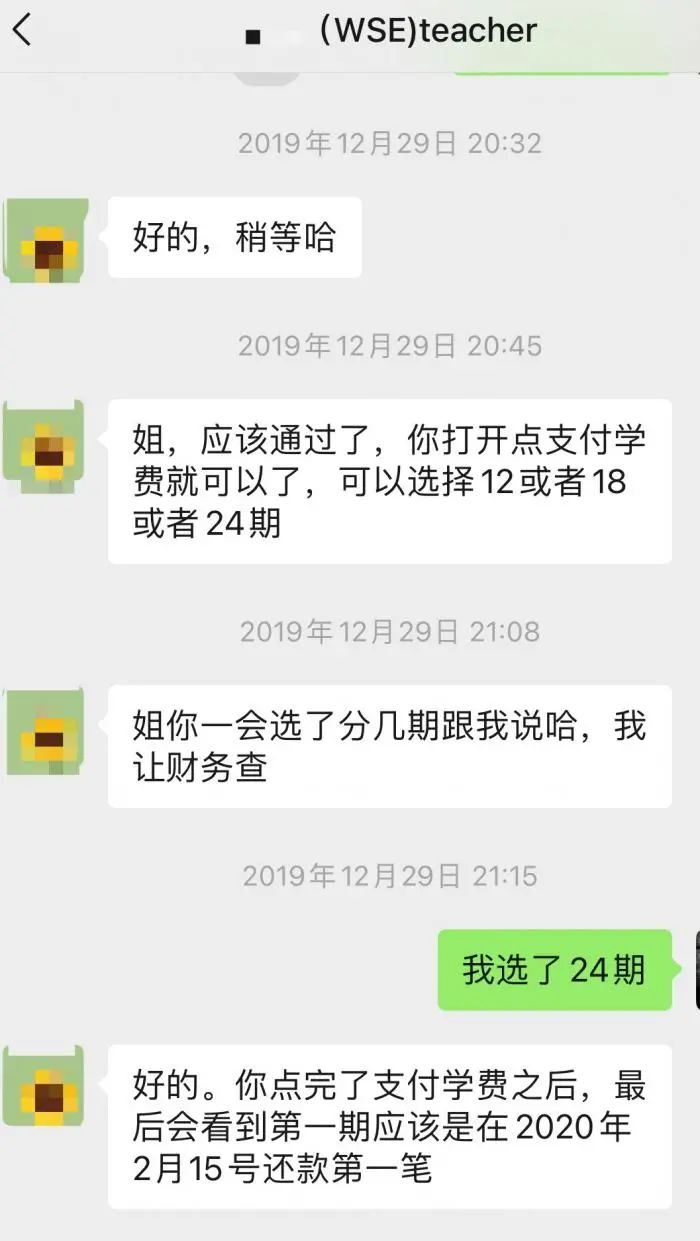

Xiao Xue (pseudonym) was recommended by Wall Street English and downloaded it on December 29, 2019BaiduMoney spent APP and applied for a loan of 68,600 yuan. Although the courses have been frozen due to physical reasons, and there are still many lessons to be completed, the loan has been repaid all the time, and only 5 periods have not been repaid.

According to its loan contract, the installment fee is 0.27% per instalment, and the annualized comprehensive rate is 10.15%. If the loan is repaid on time, there is a penalty interest of 0.05%/day.interest rate, Equivalent to 18.25% per annum.

“I wanted to wait for my health to freeze these courses and slowly digest them, but now the courses can’t be taken. Financial institutions have to repay the loans, and they have to pay the penalty interest if they don’t repay them. It’s really a big hole in the credit record. “Xiao Xue said.

21st Century Business HeraldBaiduThe subsidiary Du Xiaoman Financial asked about the follow-up disposal of education loans, and had not received a reply as of the time of publication.

Lessons from Weber English

The status quo of Wall Street English can not help being reminiscent of Weber English, which is also an English teaching and training institution.

In October 2019, Weber English closed a number of stores across the country due to poor management, and the relevant persons in charge “ran off”. Some Weber English students complained to the 21st Century Business Herald and signed a loan agreement ranging from 20,000 to 40,000 yuan at the time of registration. They believed that this was induced. Moreover, they believe that they are the most anxious person in this turmoil-unable to attend class, they have to return the principal and interest, otherwise there is a risk of overdue behavior in the credit report.

At that time, the window of the financial supervision department in Shanghai, where Weber English was headquartered, guided the matters involved in the jurisdictionBankProperly dispose of the loan for Weber English students, and postpone the upload of credit information for those who are overdue due to non-payment. At that time, a number of banks that provided student loans stated that they would freeze customer installments and postpone credit reporting.

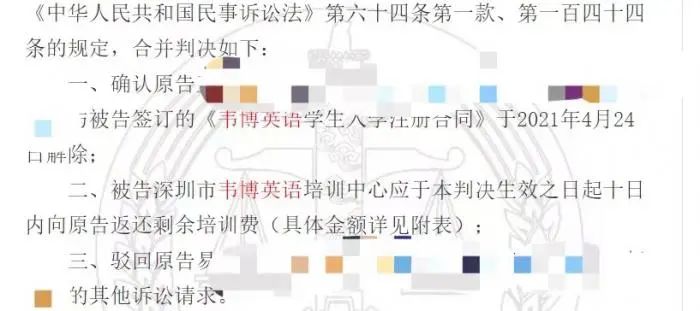

However, according to the reporter’s understanding on August 13, some trainees from the Shenzhen branch of Weber English said that after more than a year, some students of Weber English sued the training institution in the Shenzhen court this year, but because Weber English has no assets. For the implementation, the tuition fee was not recovered in the end. In addition, due to the fear of deferred repayment, most people paid back on schedule, whether it was bank credit card installments, consumer financial institutions, or Internet financial platforms.

The reporter found multiple contract disputes related to Weber English from the judgment documents. In May of this year, 10 Weber English students sued Weber English to the Shenzhen Futian District People’s Court, requesting the cancellation of the “Student Enrollment Registration Contract” And refund the remaining course fees. This is a trial in absentia by the defendant. The judgment results confirmed that the above-mentioned contract was terminated and Shenzhen Weibo English Training Center was required to return the remaining training fees to the plaintiff within 10 days from the effective date of the judgment.

According to the screenshots of the “Baidu You Qianhua” loan provided by the trainees, on June 16th and July 16th, he has not repaid for two consecutive periods, and the penalty interest has also been added. And the repayment status will be reported to the central bank’s credit investigation system, and overdue will affect personal credit investigation.

The bankruptcy settlement order is lower in the trainees

The education and training institution went bankrupt, and both the trainees and the financial institution that provided education and training loans were victims. Then how should the loan disputes between them be resolved?

Attorney Xu Zhonghua, a senior partner of Beijing Jincheng Tongda (Shanghai) Law Firm, told reporters that generally speaking, training institutions and trainees sign sales and service contracts, while trainees sign loan contracts with financial institutions. Two-tier legal relationship. Even if the institution declares bankruptcy, the latter’s financial lending relationship continues to exist, so borrowers still need to repay the financial institution.

“At present, Wall Street English claims to declare bankruptcy. I don’t know whether it has filed for bankruptcy and entered the judicial process. If it is bankruptcy in a non-judicial sense, it just declares to stop operations and try to solve the tuition and salary problems of students and employees, then the processGo to the meetingSlightly faster. If you enter the court’s judicial bankruptcy process, it is likely to be protracted. The trainees need to declare their claims as creditors, and the teachers should also declare their claims for their salary and remuneration, and wait for the court to execute in accordance with the bankruptcy law process. “Attorney Xu Zhonghua said.

However, it is worth noting that according to the bankruptcy law, the settlement of the students’ claims may be relatively late.

“If the bankruptcy law stipulates that there is an order of repayment, according to the regulations, there are property secured claims, bankruptcy costs, and employee claims. Generally speaking, the tuition fees of students are the lower ordinary claims, becauseReorganizationThe tuition fee is considered as commercial prepaid card consumption, which can only be counted as ordinary creditor’s rights, and the order of repayment is between employees andSocial securityLater. What is even more disadvantageous for students is that training institutions such as Wall Street English are generally asset-light companies, and the training venues are leased. In this case, there are few assets available for liquidation, and it may be difficult for ordinary creditors to get back the tuition fees. “Attorney Xu Zhonghua said.

Event tracking:

The sequelae of Wall Street English’s bankruptcy came, and the students were deeply involved in the “education loan”.

Wall Street English was exposed to bankruptcy: employees said they had been in arrears with their wages for March, waiting for refunds

Wall Street English broke?Two months ago, he said he would “make good products and services” and charge high upfront fees

Wall Street English will close bankrupt offline stores one after another

(Source: 21st Century Business Herald)

.