Competition for potassium-competitive gastric acid secretion inhibitors (P-CABs) in the 1.3 trillion won domestic gastroesophageal reflux disease treatment market will become more intense this year. As HK InnoN and Daewoong Pharmaceutical each promote P-CAB formulations as their company’s representative products, their influence in the market is growing.

According to the industry on the 7th, Daewoong Pharmaceutical will join hands with Chong Kun Dang starting this year to sell ‘Fexuclu’, a P-CAB type gastroesophageal reflux disease treatment. We are determined to take first place in the market by maximizing sales and marketing synergy.

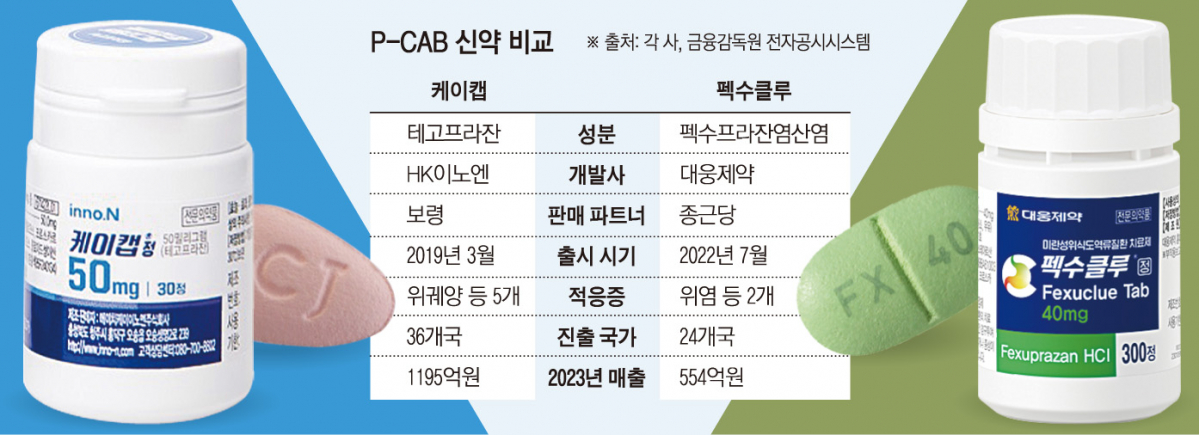

Chong Kun Dang sold HK InnoN’s ‘K Cap’ until last year. K-CAB, the first domestically produced P-CAB new drug, was launched in March 2019 and is a product that changed the landscape of the domestic gastroesophageal reflux disease treatment market, where proton pump inhibitors (PPIs) were the mainstream.

According to the Financial Supervisory Service’s electronic disclosure system, K-Cap accounted for a high proportion of 8.2% (KRW 137.5 billion) of Chong Kun Dang’s sales last year. The position was almost left vacant due to the breakup with HK Innoen, and Pexuclu will fill it.

Pexuclu is accelerating its growth, recording sales of 16.7 billion won in 2022, the first year of its launch, and 55.4 billion won last year. Daewoong Pharmaceutical, together with Chong Kun Dang, which has know-how in selling K-Cap, plans to achieve annual domestic sales of Fexuclu of 300 billion won by 2030.

HK InnoN, which turned K-Cap into a blockbuster new drug, joined forces with Boryung instead of Chong Kun Dang. The cooperation with Boryeong is not a typical joint sale, but rather a form of sales and marketing of HK InnoN’s largest product, K-Cap, and Boryeong’s largest product, ‘Kanab’. This has the effect of strengthening profitability, which can be damaged by commission expenses, and increasing top line.

Last year, K-Cap sales amounted to 119.5 billion won, which is more than twice that of Pexuclu. From 2019 to 2023, the cumulative prescription performance reached a total of 508.5 billion won.

K-Cap has five indications: △erosive gastroesophageal reflux disease △non-erosive gastroesophageal reflux disease △gastric ulcer △antibiotic combination therapy for Helicobacter pylori eradication △maintenance therapy after treatment of erosive gastroesophageal reflux disease It has an advantage over Fexuclu, which has only two indications: esophageal reflux disease and gastritis.

HK InnoN is increasing in size thanks to the growth of K-Cap. Since last year, K-Cap’s sales share has surpassed SAP’s. Daewoong Pharmaceutical also identified Pexuclu as the core of its ‘1 product, 1 trillion’ strategy to grow it into a 1 trillion won product, and the performance of the P-CAB new drug is expected to play a big role in this year’s performance.

Although HK Innoen and Daewoong Pharmaceutical are competitors, their goal is to convert the domestic gastroesophageal reflux disease treatment market to P-CAB. Based on outpatient prescription performance, the P-CAB market size is around 200 billion won, which is still inferior to PPI.

Unlike PPI, P-CAB agents have the characteristic of directly binding to potassium ions without the need for activation by stomach acid. Therefore, it can be taken regardless of whether or not you are eating, and it also suppresses the phenomenon of hypersecretion of gastric acid at night. The effect lasts longer than existing treatments. These advantages have increased the preference of medical staff and patients despite the relatively high price of the drug.

Currently, Onconic Therapeutics, a subsidiary of Jeil Pharmaceutical, is awaiting product approval for the P-CAB new drug ‘Jastaprazan’. If Jastaprajan joins, the P-CAB competition will enter a three-way battle. In this process, the status of P-CAB agents in the gastroesophageal reflux disease market is expected to become more solid.