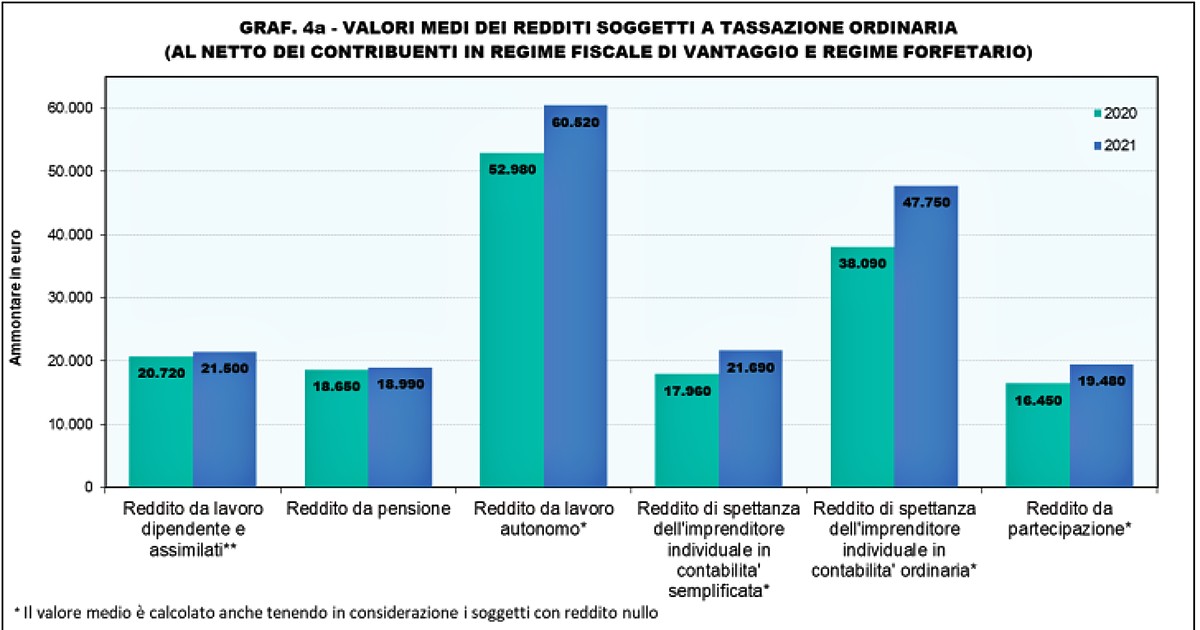

Half of the employees in 2021 he declared gross income below 20,000 euros e more than a third did not reach 15 thousand. Over 4 million fall into the no tax areathat is, they earn so little that they are exempt from paying Irpef. Only 2.4 million they earned more than 40 thousand euros. In the highest range, over 100 thousand euros, there are only 300 thousand people. Data on 2021 returns published on Thursday by the Ministry of Economy once again confirm the very low level of Italian wages and explain why the new cut the tax wedge announced by the government in the Def is judged completely insufficient by the social partners. Six 41.5 million taxpayers subjects to personal income tax declared on average 22.540 euroup 4.5% on 2020 marked by Covid, the subset of 22.6 million employees stopped at 21,500 against i 60,500 of the self-employed and the 24,100 owners of sole proprietorships, excluding the 1.7 million who joined the flat tax. I retirees they did not reach 19 thousand euros, on average.

It must be said that the difference, as underlined by the Treasury, is partly explained by the fact that the income of employees is net of social security contributions, while those from self-employment and business must be indicated gross, and for them the contributions are worth on average more than 8.700 euro. But the trend is also entirely in favor of self-employment and business income, which compared to the previous year rose respectively by 14 and over 20% against +3.8% for employees.

Expanding the analysis to all taxpayers, it emerges that one in four, 26% of the totalhas declared to the tax authorities an income of up to 15,000 euros and pays 3.6% of the total Irpef. Above 70,000 euros, in the 2021 tax returns, however, there are only 4% of citizens who pay 31% of the total. The remaining 70% of taxpayers have an income between 15,000 and 70,000 euros and 65% declare. Data to be taken with a grain of salt because it must be taken into account that the self-employed, according to the estimates of expert commission which evaluates thetax evasion, have a high propensity to hide part of their income from the tax authorities. The region with the highest overall average income remains Lombardy (26,620 euros), followed by the Autonomous Province of Bolzano (25,680 euros), while the Calabria has the lowest average income, 16,300 euros.

L’total net tax declared is equal to 171 billion euros, +7.4% compared to the previous year. On average it amounts to 5,452 euros and is declared by about 31.3 million subjects, equal to about 76% of the total tax payers. Approximately 10.1 million subjects have a net tax equal to zero because they are included in the exemption thresholds. Considering the subjects whose net tax is entirely compensated by the Irpef bonus, reabsorbed with the Draghi reform, the taxpayers who in fact have not paid the Irpef rise to around 13 million.