New Taxation for Non-Resident Entities and Individuals in Colombia

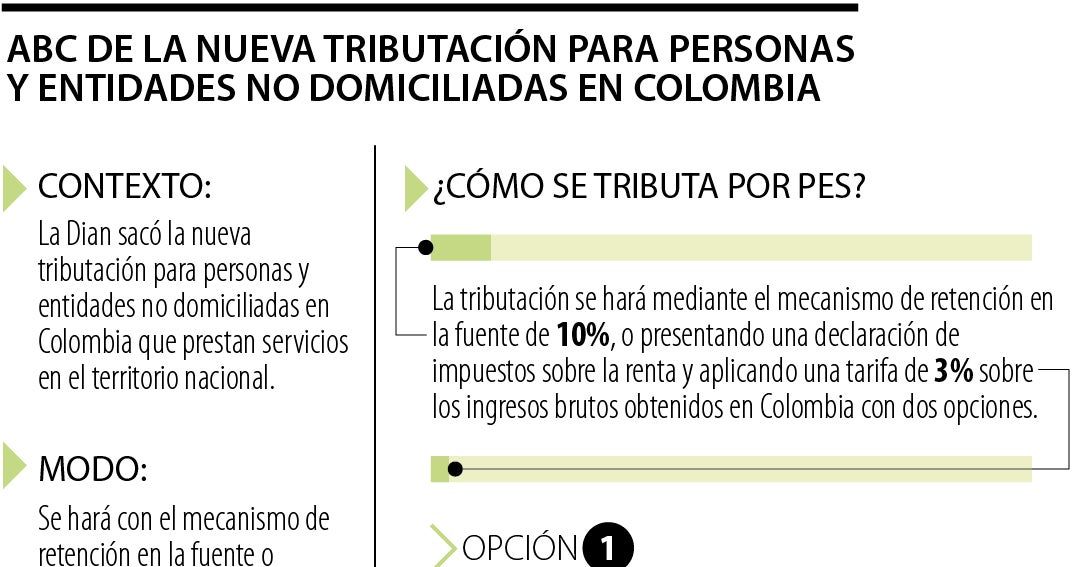

La Dian has announced the implementation of new taxation for people and entities not domiciled in Colombia who provide services in the national territory. The entity reported that this will be done through the withholding mechanism at the source or by submitting an income tax return. The Taxation for Significant Economic Presence (PES) came into effect on January 1.

The Effective Taxation for Significant Economic Presence (PES) established by the National Tax and Customs Directorate, Dian, applies to non-resident persons and entities not domiciled in Colombia that generate income from the sale of goods and/or provision of services to clients and/or users located in the national territory.

The taxation will be carried out through a 10% withholding mechanism at the source, or by submitting an income tax return and applying a 3% rate on gross income obtained in Colombia. Taxpayers have the option to either declare and pay income and complementary taxes or pay the tax via withholding at the source.

Individuals subject to PES taxation can register or update the RUT by submitting the required documents through the Dian website or by scheduling a virtual appointment.

Specific documents must be submitted depending on whether the taxpayer is a natural person or a company/entity. For companies and entities, documents proving the existence and legal representation must be provided, along with tax identification number, address, postal code, contact information, and the legal representative’s identity document.

These new tax regulations aim to ensure that non-resident entities and individuals providing services in Colombia are tax compliant and contribute to the country’s economy.