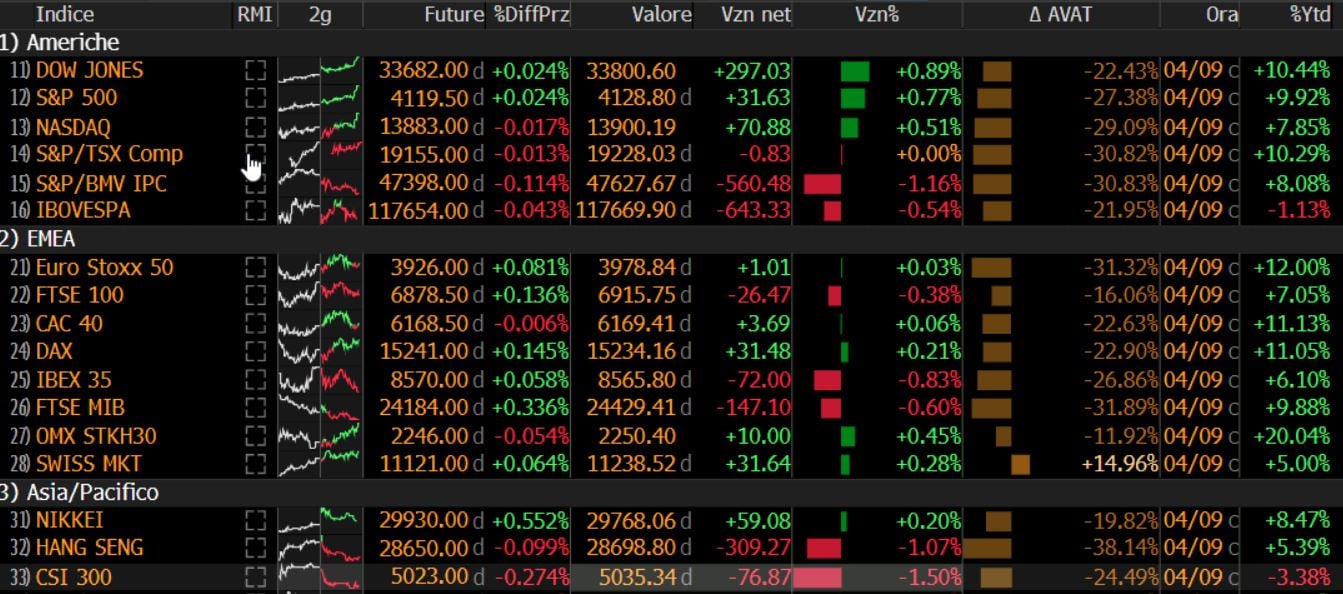

New records for Wall Street. The New York Stock Exchange closed an upward week on a high note. The S&P 500 and the Dow Jones hit records again, climbing 0.77% to 4,128 points and 0.89% to 33,800 points yesterday, respectively. In the forefront of the financial stocks in view of the quarterly accounts on the agenda next week.

In this first part of April, Wall Street has resumed making a big voice compared to the other major stock exchanges in the world. The repeated records have pushed the US indices to score a respectable balance since the beginning of the month: + 3.92% for the S&P 500 and even + 4.93% for the Nasdaq which has returned to fly. Techs are benefiting from easing rate tensions with Treasury yields retreating from last month’s highs.

Record for global equity, but the Ftse Mib does not follow the euphoria

Wall Street optimism that has breached all of global equity. The MSCI World, the global index of stock exchanges in developed countries, has struck eight positive sessions in a row (and 10 out of 12) with values at the new historical tops. “Definitely a positive start to the quarter for the US and Global equity markets – he underlines Giuseppe Sersale, Strategist of Anthilia Capital Partners Sgr -. favored by Jerome Powell’s speech at the IMF virtual meeting, in which the Fed President reiterated that stellar surveys are not enough and substantial improvements are needed to macro data. Powell emphasized employment, making it clear that a string of reports like the one from March is needed to justify preparing a purchase taper. So we will return to look at employment data with a lot of attention in the coming months ”.

EU stock exchanges at reduced speed, Milan lags behind

Positive balance also for the EU stock exchanges despite the vaccination campaign in Europe going slow compared to the USA. Both Euro Stoxx 50 and Dax show progress in the order of 1.5 per cent, slightly better than the Cac 40 (+ 1.68%). With regard to Covid, the Eurozone should go towards a robust acceleration from mid-April onwards, when the supply of Johnson & Johnson will begin to arrive. According to a Bloomberg study a few days ago, which took up a memorandum from the European Commission, 360 million doses should arrive in the second quarter (200 million from Pfizer) against the 100 million that were seen in the first quarter.

Piazza Affari falls out of the chorus (-0.89% in the Ftse Mib since the beginning of the month), thus interrupting a series of five consecutive weeks of increases.

After the Easter break, the Milan stock exchange lost momentum with banks in trouble (as well as -5% Unicredit last week, Banco BPM -4.5%) as well as other important stocks such as Telecom Italia (-5.7%) and the platoon of oil stocks (-2.6% ENI, -5% Tenaris).

A marked underperformance that led the Ftse Mib to lose the positive momentum that had led it to be one of the best world indices in the first months of the year, also on the wave ofDragons effect. Now the balance from the beginning of the year sees the Ftse Mib at + 9.88%, worse than the DAX and the CAC (+ 11% both) as well as the S&P 500 (+ 9.9%) and Dow Jones (+ 10.4%) ).

However, there continues to be strong confidence among analysts in the prospects of Piazza Affari. Second Swiss credit, there are three main factors why we think Italy represents an opportunity: a reduced political risk, Italian political risk / BTP, phase of the cycle and valuation. “We think that the Italian political risk is now the lowest in recent years. The new Italian government of national unity under the leadership of Mario Draghi is supported by the major Italian parties, including M5S, Lega, FI and PD, guaranteeing a large majority. This should make it more stable and put it in a good position to pass fiscal measures and reforms, ”argues Credit Suisse which sees the reduced political risk reflected in the spread but not in equity valuations. Credit Suisse believes that the main risk is that there are major structural issues to be addressed and Italy actually seems to be “now or never” at the moment. Italy’s per capita GDP growth was the lowest of any eurozone country in the pre-COVID-19 era. In fact, the CAGR was negative between 2000 and 2019.

Earning season al via

The new earning season will see from Wednesday the main banks give investors the first feedback on 2021. According to the IBES data from Refinitiv, the overall profits of the S&P 500 are expected to increase by 25% in the first quarter of 2021 compared to a year ago. It would be the largest quarterly gain since 2018, when Donald Trump’s tax cuts led to a surge in profits.

Throughout 2021, the S&P 500’s earnings growth is estimated to be as much as + 26.5% versus a decline of 12.6% last year.

A prospective risk for companies is the possibility of corporate tax increases with President Joe Biden intending to take them from the current 21% to 28%, which would lead to a 7.4% discount on the earnings per share of the S&P 500 companies according to UBS.