Zhongyi signed nearly 280,000 yuan, and Hemai shares (688032) discouraged many investors who won the lottery. On the evening of December 14, Hemai disclosed the results of the issuance. The amount of the company’s abandonment by online investors was 363 million yuan, and the abandonment ratio was as high as 6.5139%. According to the statistics of Beijing Business Daily reporters, both the amount of abandonment and the rate of abandonment, Hemai shares have set a new high in the past nine years. Among them, the amount of abandonment is second to Postal Savings Bank and China Communications Construction, and the rate of abandonment is second only to China Communications Construction. It is worth mentioning that the recent A-share market abandonment situation has continued, but there are also many abandonment stocks such as Qiangrui Technology that rose sharply on the first day of listing. Regarding the abandonment of Hemai shares, some market participants pointed out that although many investors have abandoned the purchase, from the perspective of the company’s fundamentals, Hemai shares may not face a break on the first day of listing.

The abandonment ratio is as high as 6.5139%

On the evening of December 14, Hemai shares released the results of the issuance and listing. The company was abandoned by online investors for a total of 363 million yuan, and the abandonment ratio was as high as 6.5139%.

Specifically, the number of shares subscribed for by online investors of Hemai shares is 2,825,100 shares, and the amount subscribed by online investors is 1.576 billion yuan; the number of online investors waived subscription is 651,400 shares, and the amount of waived subscription is 3.63 100 million yuan; offline investors did not abandon their purchases.

Hemai shares stated that the number of shares waived by online and offline investors will be underwritten by the sponsor (lead underwriter). The number of shares underwritten by the sponsor (lead underwriter) is 651,400, and the underwriting amount is 363 million yuan. The number of shares accounted for 7.0307% of the issuance after deducting the final strategic allotment part, and the number of underwritten shares accounted for 6.5139% of the total size of the issuance.

According to the data, Hemai is a high-tech enterprise with photovoltaic inverters and other power conversion equipment and complete electrical equipment as its main business. The company’s issue price is 557.8 yuan per share. According to Wind statistics, before Hemai shares, the highest issue price among A-share listed companies was Yiqiao Shenzhou, with an issue price of 292.92 yuan per share. The issue price of Hemai shares hit a new high for A shares, also known as the most expensive new shares. .

Hemai shares said that the project is expected to use raised funds of 558 million yuan, calculated based on the issuance price of 557.8 yuan per share and the number of new shares issued of 10 million shares. If the issuance is successful, the total amount of funds raised by the company is expected to be 5.578 billion yuan, after deducting 172 million yuan of issuance expenses (excluding value-added tax), the net amount of funds raised is expected to be 5.406 billion yuan.

According to calculations, investors need to pay nearly 280,000 yuan to sign Hemai shares in Zhongyi. Investment and financing expert Xu Xiaoheng told a reporter from Beijing Commercial Daily that due to the large amount of payment after the winning of the lottery, the abandonment of Hemai shares by investors has long been expected by the market. In response to related issues, a reporter from Beijing Commercial Daily called the office of the board of directors of Hemai Co., Ltd. for an interview, but no one answered.

Abandonment is the highest in nearly nine years

According to Wind statistics, the abandonment of Hemai shares has also set a new high for A shares in the past nine years.

Wind statistics show that the highest amount of abandonment of A shares so far is Postal Savings Bank, followed by China Communications Construction, with abandonment amounts of 653 million yuan and 552 million yuan respectively. After Postal Savings Bank and China Communications Construction, Hemai shares ranked third, and China Communications Construction was listed in March 2012, which also means that Hemai shares are the stocks with the highest amount of abandonment in the past nine years.

It is worth mentioning that, in addition to the above three shares, BeiGene and China Unicom have abandoned purchases of more than 100 million yuan. The two shares have been abandoned for approximately 199 million yuan and 142 million yuan respectively. Among them, BeiGene will On December 15th, the company was also the first listed company in three places, focusing on research, development, production and commercialization of innovative drugs; China Unicom went public in 2002.

From the perspective of abandonment ratio, Hemai shares still set a new high in the past nine years.

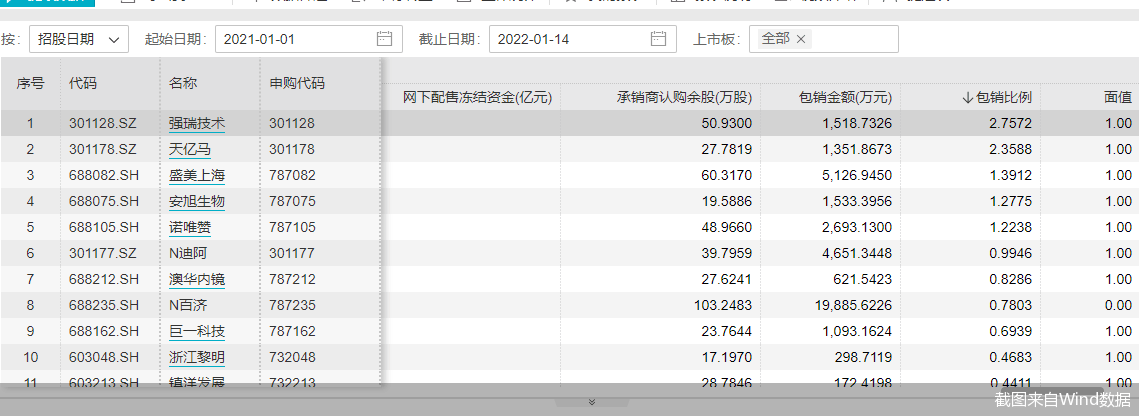

According to the data, as of now, China Communications Construction has the highest abandonment ratio of A-shares, at 11.05%, and Hemai shares only rank behind China Communications Construction. In addition, according to statistics, many companies such as Qiangrui Technology, Tianyima, and Anxu Biotechnology have abandoning more than 1% of the purchase ratio.

Many abandoned stocks rose sharply on the first day of purchases during the year

A reporter from Beijing Business Daily noticed that since this year, many shares have been abandoned by investors, but there are also many stocks such as Qiangrui Technology that have surged on the first day of listing, which has made many investors regret it.

According to Wind statistics, as of December 14, among the new stocks listed during the year, many shares of China Telecom, Three Gorges Energy, Yiqiao Shenzhou, Novartis, and Aohua Endoscope were abandoned by investors. However, there were also many stocks that rose sharply on their first day of listing.

Specifically, the proportion of Qiangrui technology being abandoned by investors was 2.76%, and the amount of abandonment was 15.1873 million yuan. The company landed on the A-share market on November 10 this year, and the company’s share price rose 88.13% on the first day of listing; in addition, Tian Yima was also abandoned by a large proportion of investors, with the abandonment amount of 13.5187 million yuan. The company went public on November 12 this year, and it also surged 62.15% on the first day of listing.

According to calculations, based on the performance of the first day of listing, Qiangrui Technology and Tianyima’s single-sign profit were 13,000 yuan and 15,000 yuan, respectively.

It is worth mentioning that before Hemai shares, Qiangrui Technology has always been the stock with the highest abandonment ratio in the past nine years. It is understood that Qiangrui Technology is mainly engaged in the research and development, design, production and sales of tooling and testing fixtures and equipment. Huawei is the company’s core customer. In 2018-2020 and the first half of 2021, Qiangrui Technology’s sales to Huawei accounted for The ratios were 82.65%, 87.25%, 54.72% and 18.35% respectively.

In addition to Qiangrui Technology and Tianyima, similar situations have also occurred in new stocks such as Novartis and Aohua Endoscopy. Among them, Novartis has the most outstanding share price after its listing, with an issue price of 55 yuan per share. It closed up 55.18% on the first day, and reached a high of 124.8 yuan per share on November 29. As of the close of the market on December 14, Novozan is still a 100-yuan share, with a stock price of 106.1 yuan per share and a total market value of 4.245 billion yuan.

According to the data, Novartis is a biotechnology company that conducts technology research and product development on functional proteins such as enzymes, antigens, antibodies, and polymer organic materials.

Throughout the issuance of Hemai shares, the company’s issuance price of 557.8 yuan per share corresponds to a diluted P/E ratio of 225.94 times before and after deducting non-recurring gains and losses in 2020, and the P/E ratio of comparable listed companies given by the comparison is 225.94 times. The shares are not the highest, lower than Jinlang Technology and Goodway.

Securities market commentator Bunaxin pointed out to a reporter from Beijing Commercial Daily that, referring to the basic situation of Hemai shares, although the company has been abandoned by a large proportion of shares, it may not be broken on the first day of listing.

Beijing Commercial Daily reporter Ma HuanhuanReturn to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.