1comment

2022-02-10 18:46:04

source:Cai Liansheisha

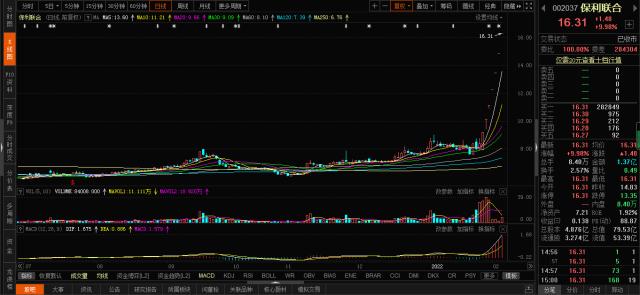

Today, a total of 55 stocks rose and stopped, 25 stocks were fried, and the sealing rate was 69%;Poly United(002037,Consultation unit) 7 connecting plates,Jidong Equipment(000856,Consultation unit)、Hengbao Shares(002104,Consultation unit) 5 connecting boards,Yuanlong Yatu(002878,Consultation unit), Huitong Group、Zhejiang Construction Investment(002761,Consultation unit)、Chongqing Construction Engineering(600939,Consultation unit) All 4 connecting boards. On the intraday market, 1,700 stocks closed up and 2,771 stocks closed down; tourism, aquaculture, airport shipping, etc. rose the most, while CRO, medical services, and HJT batteries fell the most.

Guosheng Securities believes that after completing the sharp decline and fully releasing the risks, the market is expected to usher in a respite and a good opportunity to rebound and go long. Operationally, small and medium-sized stocks fell mainly before the holiday, and large-cap stocks completed a make-up decline after the holiday. The risk release has been relatively sufficient, and the market sentiment has picked up significantly. Superimposed market volume can be enlarged, and the main line of the infrastructure-based market has emerged. Therefore, the short-term market may welcome a rebound and a good opportunity to go long. Light index heavy stocks, focusing on low-priced and undervalued infrastructure, electric power, coal and other small- and medium-cap stock opportunities.

Market overview

Indicators show that the market’s short-term sentiment has fallen from above the active area yesterday to near the 0 axis at the opening of the market, and today’s intraday trading mainly oscillated narrowly near the 0 axis.

In terms of individual stocks, Poly United, Jidong Equipment, and Hengbao Shares continued to be listed on the board, while Yuanlong Yatu, Huitong Group, Zhejiang Construction Investment, and Chongqing Construction Engineering were promoted to the 4th board. Of the 25 linked stocks yesterday, 11 continued to rise and stop.

In terms of the index, it continued to show a state of differentiation, with the Shanghai Index closing up 0.17% and the GEM index closing down nearly 2%. The GEM index is mainly affected byNingde Era(300750,Consultation unit) Affected by the recent weak performance of the stock, it once fell more than 8% in intraday trading today.

Northbound funds bought a total of 4.52 billion yuan in net purchases today. Among them, the Shanghai market bought a net of 5.271 billion yuan, and the Shenzhen market sold a net of 750 million yuan.

Focus sectors and individual stocks

The digital currency sector is divided, and the stocks that rise and stop are mainly connected to the board. Hengbao Shares 5 consecutive boards,Jincai Interconnection(002530,Consultation unit) 3 connecting boards,Zentong Electronics(002197,Consultation unit)、Royal Silver Co., Ltd.(002177,Consultation unit) 2 connecting boards,Chuangshi Technology(300941,Consultation unit)、Guao Technology(300551,Consultation unit)、Gao Weida(300465,Consultation unit)、Advanced digital communication(300541,Consultation unit)、Qitian Technology(300061,Consultation unit)、New World(000997,Consultation unit) And others fell by more than 3%. The sector rose and stopped yesterday, and today’s differentiation is within expectations. At present, the capital intervention is relatively deep, and there may be recurrences in the future.

Infrastructure stocks continued to be active, and the water conservancy and underground pipelines that were stimulated by the positive news also performed well. Jidong Equipment has 5 consecutive boards, Chongqing Construction Engineering has 4 consecutive boards, and Huitong Group and Zhejiang Construction Investment have 4 consecutive boards. Water conservancy and underground pipe corridors,Shenzhen Institute of Water Regulation(301038,Consultation unit)、Longquan Shares(002671,Consultation unit)、Zhengping Shares(603843,Consultation unit) Ups and downs. On the news side, the supervision requires local authorities to make up for a number of special debt projects, with urban pipe network construction, water conservancy and other fields as the focus of supplementary reporting.

The sewage treatment sector led the gains in early trading,Pubang Shares(002663,Consultation unit) 3 connecting boards,Shunkong Development(003039,Consultation unit)、Strait Environmental Protection(603817,Consultation unit)、Haitian Shares(603759,Consultation unit) Ups and downs. On the news side, the Development and Reform Commission and other four departments requested that they accelerate the construction of urban environmental infrastructure and aim to add 20 million cubic meters of sewage treatment capacity per day by 2025.

The tourism sector is higher intraday,Qujiang Cultural Tourism(600706,Consultation unit)、Caesar Travel(000796,Consultation unit)、Zhongxin Travel(002707,Consultation unit)、National Tourism Association(600358,Consultation unit)、Tianmu Lake(603136,Consultation unit) Ups and downs. Airport shipping,Shenzhen Airport(000089,Consultation unit)、Baiyun Airport(600004,Consultation unit)、Shanghai Airport(600009,Consultation unit)、China Eastern Airlines(600115,Consultation unit) And others have also appeared. As a post-epidemic line, these two sectors have continued to be active recently, and many targets have emerged from the trend.

Pork has been active repeatedly recently,Superstar agriculture and Animal Husbandry(603477,Consultation unit)、Jin Xinnong(002548,Consultation unit) 2 connecting boards,Aonong Biological(603363,Consultation unit)、Dongrui Shares(001201,Consultation unit)、Zhengbang Technology(002157,Consultation unit)、New Wufeng(600975,Consultation unit) Ups and downs. According to the agency, the storage column determines the direction of the pig cycle, and there is a bottom shock in pig prices in the downward cycle. It is expected that pig prices will improve in the second half of 2022. The second bottoming of pig prices in this cycle is expected to be between June and August 2022, and the second bottoming of pig prices is expected to be around 11-12 yuan.

Ningde Times continued to decline, once falling more than 8% in intraday trading. In addition, many high-end solar stocks have also entered a state of replenishment. In the photovoltaic sector,Lobotko(300757,Consultation unit)、CITIC Bo(688408,Consultation unit)、Jingao Technology(002459,Consultation unit)、Trina Solar(688599,Consultation unit) And others all showed a large decline. From the perspective of capital behavior, it is mainly viewed as institutional position adjustment, while from the perspective of market behavior, it is viewed as replenishment.

Taken together, the market is in a state of differentiation and has entered a state of weak competition and strong competition. Today’s divergence is within expectations. Maintaining yesterday’s view, after four consecutive trading days of more than 3,300 stocks closed higher, it is necessary to beware of short-term capital gains in the past two trading days, and pay attention to the direction of capital return after adjustment.

Analysis chart of today’s ups and downs: