BTP-Bund spreads skyrocket on ECB-Day, in the middle of the war between Ukraine and Russia and while from the United States, at the same time as the start of Christine Lagarde’s press conference, we learn that inflation flew by 7.9% in February on an annual basis, a new record of the last 40 years.

The spread hikes, Lagarde’s words fail to avoid the strong sell off on BTPsthe most vulnerable to the eventual end of Quantitative easing: here we speak not only of the end of PEPP QE, or even pandemic QE, but of the end of that original, or even traditional QE, which was launched at the time when the number one of European central bank was the current Prime Minister Mario Draghi.

A bazooka enclosed in the acronym APPwhich in recent years has certainly saved Italy from attacks by various financial sharks.

And a bazooka now associated with the phrase “The End”, which is likely to become real in the third quarter of this year. This was announced by the ECB itself, in the official communiqué with which he announced the decisions taken during the meeting of his Governing Council today, Thursday 10 March.

ECB surprise: in times of war Lagarde announces an end to anti-spread shield

Among the decisions it emerged, in fact, that of putting an end to theAsset Purchase Programme (APP) faster than initially expected: a surprise by the ECB, which immediately fueled the question of whether the central bank is more worried about the acceleration of inflation in the euro area, than negative consequences on the economy of the conflict between Russia and Ukraine.

The statement states that the ECB has decided that the net monthly purchases of assets (including BTPs, or BTPs first and foremost), which will take place under the JPA – which will replace the PEPP – will amount to € 40 billion in April, € 30 billion in May and € 20 billion in June. Then?

“The calibration of net purchases for the third quarter will depend on the data and will reflect its evolving assessment of the outlook“, Wrote the ECB, which means that the end of the broadcasts could be decreed in the third quarter.

The previous roadmap foresaw € 40 billion in the second quarter and € 30 billion in the third quarter.

Moral of the story: the ECB could decide to stop during the summer what for Italy is an anti-spread shield. A possibility that the markets struggled to accept, first and foremost the BTP-Bund spread, which flew up to around + 17%, above the 170 point threshold, before reducing the surge.

The assurances of Christine Lagarde failed to avoid the strong sell off that hit the Italian paper.

As expected, the ECB has confirmed that the PEPP, pandemic QE, program worth 1.85 trillion euros, will end at the end of March.

The markets feared the worst, especially imagining the peripheral countries of the euro area, Italy in the first place, orphans of the PEPP but also of the APP, at a time when the fear of stagflation, especially in Europe, he indicates that, alongside the risk of an acceleration of inflation, there is also that of an abrupt slowdown in the economy, of a stagnant economy.

It was Lagarde herself today who confirmed that the war in Ukraine will have “a significant impact on economic activity and inflation (of the Eurozone)through higher energy and commodity prices, disruptions to international trade and lower confidence ”.

Of course, the president of the ECB stressed that the intensity of the effects “will depend on the development of the war, the impact of the sanctions (imposed on Russia) and possible further measures”. But surely growth – if we can still talk about growth – will be lower than that estimated when there was still no talk of war between Russia and Ukraine.

The ECB knows this well, so much so that it has revised downwards the estimates on the growth of the GDP of the Eurozone relating to 2022 and 2023, simultaneously raising the outlook on inflation for the entire period 2021-2024.

Lagarde tried to stop the surprise by providing several reassurances, such as the one that the ECB is not accelerating the normalization process, further explaining that the same end of the QE will happen only in the case in which some conditions are realized.

The president of the ECB also waved the weapon of optionality in the hands of the ECBin a context of greater uncertainty caused by the geopolitical shock of the invasion of Ukraine by Vladimir Putin’s Russia.

The vice president of the central bank also spoke to answer a question about the stability of the financial markets Luis deGuindos, saying that there is liquidity, that the tensions are not comparable to those of the beginning of the pandemic and that the spreads “remained contained”, even while live, the BTP-Bund spread was disavowing him.

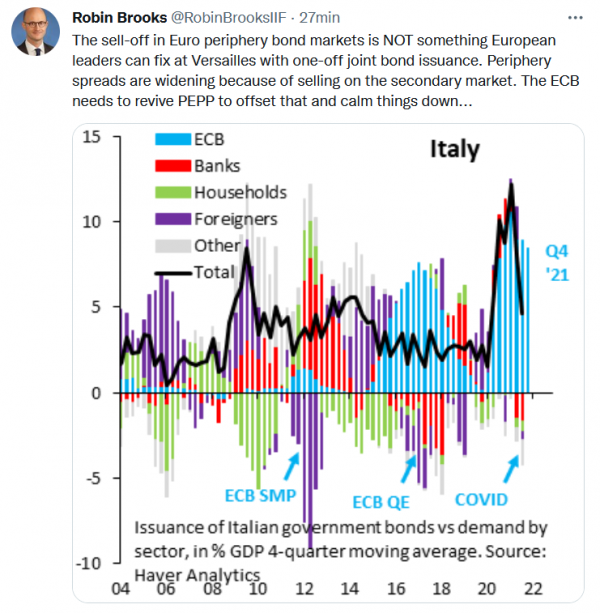

Robin Brooks: sell BTP & Co CANNOT be accommodated in #Versailles

Former Goldman Sachs economist Robin Brooks @RobinBrooksIIF so commented on Twitter that today it was how to go back to March 2020, when the pandemic alert stunned the markets. The reference was the hike in 10-year BTP rates.

Robin Brooks then underlined, publishing a more than indicative chart, that “the sell-off that is hitting the government bond markets on the periphery of It is NOT something that European leaders can fix in Versailles with a joint bond issue ”.

By joint issuance of bonds we mean the plan that, at the meeting of the European Council, the EU leaders could present to stem the effects of the high oil and natural gas prices triggered by Putin’s war.

By joint issuance of bonds we mean the plan that, at the meeting of the European Council, the EU leaders could present to stem the effects of the high oil and natural gas prices triggered by Putin’s war.

Europe would be practically ready to launch a historic bond issue to finance the energy and defense sectors and thus respond to the threat posed by possible Russian retaliation in response to the sanctions imposed by the West.

Brooks, however, does not believe in the salvific action of joint bonds, also because “the spreads of the periphery are widening due to sales on the secondary market”.

So what should the ECB do? “Restore the PEPP to calm the situation ..”, wrote @IIF Chief Economist, former Head of Forex Strategist of @GoldmanSach and Senior Economist of the International Monetary Fund @IMFnews.

Economist Ducrozet: “I suppose the ECB is not here to close spreads”

For its part Frederik Ducrozet @fwred, economist and global macro strategist at Banque Pictet & Cie, in posting a chart that certified the jump in 10-year BTP yields equal to +25 basis points, he commented:

“I suppose @ecb, aka the ECB, is not here to close the spreads.

“I suppose @ecb, aka the ECB, is not here to close the spreads.

The reference, for those who have memory, is to the historical gaffe that Christine Lagarde, president of the ECB, did in March 2020, just in the month in which the panic for Covid-19 exploded; the gaffe was such that hashtags like #LagardeVirus e #Lagardedimettiti.

Introduced months ago as a sort of champion and promoter of transparent communication, Furthermore, Lagarde was not clear even on when the ECB could raise rates.

The press release states that any adjustments to the reference interest rates will take place “Some time” after the end of QE and will be gradual.

“The path for the key ECB interest rates will continue to be determined by the Governing Council’s forward guidance and its strategic commitment to stabilize inflation at two per cent over the medium term,” it reads. But, when asked about the meaning of that phrase “sometime”, Lagarde said that “Some time” can mean months or even weeks, practically suggesting that the rate hike could take place months or weeks after the end of QE. Not really an example of direct and transparent communication.

So much so that now i OIS rates are pricing in the possibility of a 25bp hike in the September meeting with a probability of about 80%.