Cambridge Technology‘s semi-annual performance forecast: a loss of 83.48-94.86 million yuan, which is greatly affected by the lack of cores

Yesterday evening, Shanghai Cambridge Technology Co., Ltd. issued a semi-annual report warning that it is expected that the net profit attributable to shareholders of listed companies in the first half of 2022 will be RMB -94.86 million (the following “ten thousand” refers to RMB ten thousand) to -8,348 It is estimated that the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses in the first half of 2022 will be -97.66 million to -86.28 million.

01 The performance is “stalled”, and the semi-annual performance in 2022 is lower than that in 2021

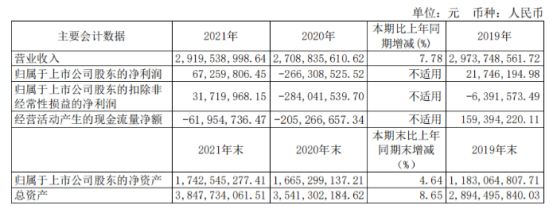

According to the 2021 financial report released by Cambridge Technology, the company achieved operating income of about 2.920 billion yuan for the year, an increase of 211 million yuan or 7.78% over the same period of the previous year.

in the pan-industrychipUnder the circumstances of general shortage of supply, tight international logistics resources, and a decline in the order fulfillment rate, Cambridge Technology achieved a gross sales profit of 577 million yuan, a substantial increase of 228 million yuan compared with the same period in 2020, a year-on-year increase of 65.05%. The gross profit margin of main business sales was 19.92%, an increase of 6.85 percentage points compared with the same period of the previous year. In addition, the company achieved a net profit of 67 million yuan, which turned losses into profits and increased significantly compared with 2020.

In the first half of 2022, Cambridge Technology was caught in the “stall” dilemma of performance, Cambridge Technology said: As stated in the company’s “2022 First Quarter Report”, during the reporting period, Xi’an, Shenzhen, and Shanghai were hit by the epidemic, and logistics was once Seriously hindered, some front-line employees were unable to arrive at their posts, which had a particularly serious impact on the Shanghai factory as the main production base, and the efficiency of finished product production, material delivery and transfer was greatly reduced. It was not until the end of May 2022 that the company’s production and operation began to gradually return to normal order. Although the company achieved a single-quarter profit in the second quarter, it still could not fully make up for the loss in the first quarter.

02 Affected by the lack of cores, it is difficult for the company to achieve the expected goals

Cambridge Technology‘s main business is optoelectronic terminal equipment used in communications, data communications and enterprise networks. Based on the cooperation model (mainly customized JDM and ODM models for major customers) or with the company’s own brand, it conducts four major product lines, including telecom broadband, wifi and smallbase stationswitches and IIoT basic hardware, as well as high-speed optical components andOptical moduleProduct development, production and sales.

In 2021, the global demand for optical modules will generally remain stable and upward, and the demand for optical modules will gradually increase from100GIt has evolved to 400G as the center, and quickly transitioned to 800G or even 1.6T. The Japanese optoelectronics R&D team of the optoelectronics division of Cambridge Technology is in an industry-leading position in the development of various high-end 400G and 800G modules, and has completed the R&D prototype development and small quantities of 800G 2×FR4 and 8×FR1 products. Factory introduction to prepare for mass production in 2022.

As the core product of Cambridge Technology, the Optoelectronics Division is expected to strive to achieve a revenue of RMB 500 million to 600 million for 800G optical modules in 2022.

However, reality did not match expectations. According to Cambridge Technology, during the reporting period, the gross profit margin of the company’s main business decreased year-on-year.[Although the domestic and foreign communication and data communication markets are in strong demand and sufficient orders, the general shortage of pan-industry chips affects order execution. In order to ensure delivery and continuously improve customer satisfaction, the company has assumed the spot price difference of some chips, and the material cost has increased, so that the overall net profit has decreased year-on-year].