The long-awaited collection of proprietary Chinese medicines is here!

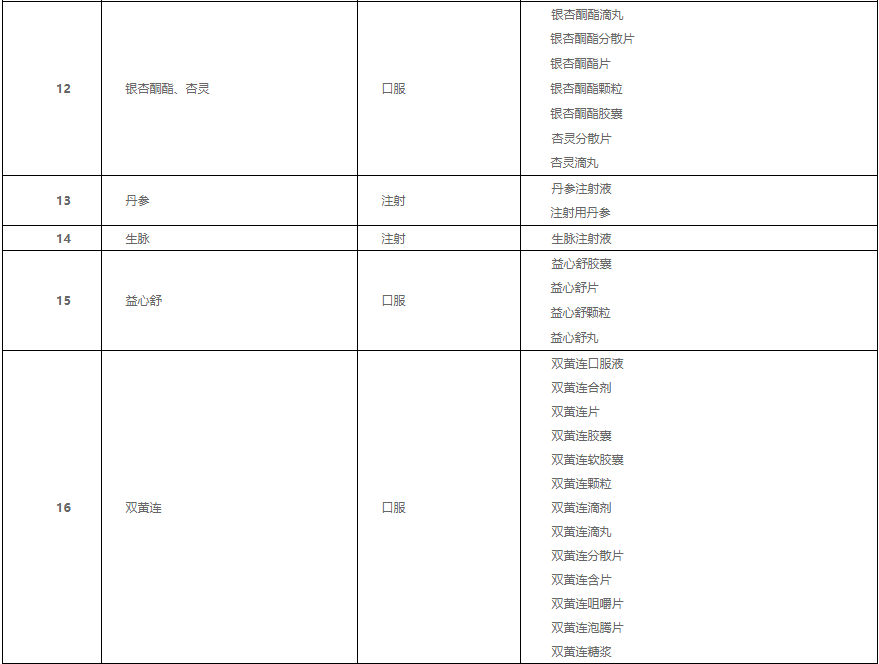

Yesterday, Hubei Province Pharmaceutical Price and Bidding Procurement Management Service Network releasedannouncement(No. 1)”, this alliance involves 19 places including Hebei, Shanxi, Fujian, and Hubei Provincial Medical Security Bureau undertakes the daily work of the Joint Procurement Office (Provincial Consortium Central Procurement Leading Group Office of Chinese Patent Medicines) and is responsible for the specific implementation. The Chinese patent medicines collected this time include 76 medicine names in 17 product groups, including Ginkgo biloba, Danshen, Shuanghuanglian and so on.

Source: Hubei Province Pharmaceutical Price and Bidding Purchasing Management Service Network

76 Chinese patent medicines will be reduced in price

According to the announcement, the target of this centralized procurement is the Chinese patent drugs produced by many companies with large clinical use, high purchase amount, covering 76 drug names, and divided into 17 product groups according to their functions, indications, routes of administration, and ingredients.

Source: Hubei Province Pharmaceutical Price and Bidding Purchasing Management Service Network

The announcement requires that all public medical institutions in the alliance area should participate, and medical insurance designated social medical institutions and designated pharmacies are encouraged to participate in accordance with the relevant regulations of the alliance area.

According to the product list declared by the enterprise, the medical institution shall fill in the historical purchase volume, price and purchase amount of each product in 2020, and fill in the pre-purchased volume of the product in the next year based on factors such as historical usage and clinical drug demand. If some of the companies that report the volume do not participate in the declaration or the production capacity is 0, they will be transferred to the amount to be allocated for allocation.

The Joint Procurement Office summarizes the pre-purchasing volume reported by the medical institutions, and determines the contracted procurement volume based on 80% of the pre-purchasing volume. According to the announcement, the procurement cycle is in principle two years, calculated from the actual implementation date of the selected results. The purchase agreement is signed every year during the purchase cycle. If the agreed purchase amount for the year is completed in advance during the purchase cycle, the selected companies will still supply the selected companies at the selected price until the end of the purchase cycle.

In terms of quotation, according to the competition rules of the finalists, this centralized procurement will be based on the comprehensive scores of the representative products of the quotation and the recognition of medical institutions, corporate rankings, supply capabilities, innovation capabilities, recruitment credit evaluation levels, drug quality and safety, etc., to produce finalists .

If the declared companies have the same comprehensive score, the finalists will be determined in turn according to the following conditions: First, the companies with a large decline in the declared price will be given priority; Second, the companies in the alliance area whose medical institutions have reported a large number of procurement requirements will be given priority; Third, the alliance area Enterprises with a large number of procurement requirements reported by tertiary medical institutions are preferred.

This collection of proprietary Chinese medicines is not unexpected. In August this year, the National Medical Insurance Administration made it clear that it would start with high-priced and large-volume varieties, and scientifically and steadily promote the reform of centralized procurement of Chinese patent medicines and formula granules.

On September 14, the Guangdong Pharmaceutical Trade Center released the “Guangdong Union Qingkailing and other 58 drug groups’ procurement documents (draft for comments)”, which is also the first mass procurement alliance to openly focus on the centralized procurement of Chinese patent medicines.

The draft opinion pointed out that seven provincial administrative regions, including Guangdong, Shanxi, Henan, Hainan, Ningxia, Qinghai, and Xinjiang, will set up procurement alliances to bring together 58 commonly used Chinese patent medicines such as Qingkailing, Fufang Danshen, Xuesaitong, and Motherwort. Volume purchases, many of which are blockbuster drugs from listed companies, such asYiling PharmaceuticalLianhua Qingwen,TaslyThe compound Danshen dripping pills and other products with sales of more than 2 billion yuan.

Zhongzheng Jun noticed that in the procurement alliance formed by Guangdong Province, except for Guangdong Province, the remaining six provinces overlap with this time the Hubei 19 Province Procurement Alliance of Chinese Patent Medicines.

Involving multiple listed companies

According to the announcement, the drugs purchased in this batch of proprietary Chinese medicines, such as Shuanghuanglian Oral Liquid, Yixinshu Capsules, Huoxuezhitong Capsules, Ginkgo Leaf Dropping Pills, Xuesaitong Capsules, and Breviscapine for Injection, are all for clinical use. A large number of varieties, involving many listed companies.

Zhongzheng Jun further sorted out and found that the 2020 annual report shows thatTailong PharmaceuticalThe main product Shuanghuanglian oral liquid series (ordinary, concentrated, sugar-free) product revenue increased by 97,154,900 yuan year-on-year, and the income of Shuanghuanglian oral liquid (children’s type) increased by 17,951,400 yuan year-on-year.

WanbondThe 2020 annual report shows that the company’s leading cardio-cerebrovascular system product Ginkgo Leaf Drop Pills is a drug for the prevention and treatment of cardiovascular and cerebrovascular diseases. It is an exclusive formulation variety with independent intellectual property rights and a national second-level traditional Chinese medicine protected variety. In 2020, the company’s traditional Chinese medicine (including plant extracts) products achieved revenue of 514 million yuan, accounting for 3.75% of revenue, an increase of 7.68% year-on-year. Zhongzheng Jun noted that Shuanghuanglian oral liquid and Ginkgo biloba series products are in the list of this collection.

Longjin PharmaceuticalThe 2020 annual report shows that the company’s main product breviscapine for injection was once again included in the 2020 National Medical Insurance Catalogue, and it won bids for public hospital procurement rights in 27 provinces, municipalities, and municipalities. Among them, Hubei, Shanxi, and Tibet were the resumption of bids and new developments during the reporting period. And the distribution of more than 500 hospitals above the level of distribution. Breviscapine for injection, scutellarin injection, scutellarin sodium chloride injection and other varieties are also included in the scope of this volume purchase.

Industry influence geometry

What impact will centralized procurement have on the industry?

Meng Lilian, chief expert of Sichuan Tianfu Health Industry Research Institute, said: “The centralized procurement of Chinese patent medicines will help the development of authentic medicinal materials and will also play a positive role in accelerating the construction of the quality assurance system of Chinese patent medicines.”

Economist Song Qinghui pointed out that at present, the centralized procurement of Chinese patent medicines still faces many problems, among which the “difficulty in unifying standards” is still the biggest problem facing the centralized procurement of Chinese patent medicines. In comparison, most proprietary Chinese medicines do not have a generic name and can only be defined by the field of treatment. The standards are very complicated.

Related reports

Announcement of Centralized Procurement of Chinese Patent Medicine Interprovincial Alliance

(Source: China Securities Journal)

.