Since 2021, the prosperity of the intelligent controller sector has gradually warmed up, and the share prices of leading manufacturers have shown an upward trend. The upward trend followed a slight correction within the range, and the market sentiment has not diminished.From a fundamental perspective, we believe that the leading companyPerformanceGrowth is resilient in the next 5 years.

Summary

The danger of rising prices of raw materials and shortages of stocks hides opportunities for increased demand concentration.In the cost structure of the smart controller industry, raw materials account for about 75-85%. In the context of chip shortages and general price increases since 2021, we believe that for the head manufacturers, we will stock up, lock prices, and increase prices. Such means can be prepared in advance; while small manufacturers lack supply, they will face the situation of accelerated clearance and accelerate the integration of demand to leading suppliers.

Grasping the growth momentum of the controller industry segmentation field, the domestic supply chain dividend is still there.1) The growth pillar of home appliance controllers is shifting from traditional home appliances to innovative home appliance categories, and intelligence, innovation, and outsourcing support the growth of home appliance controllers. 2) The catalyst for tool controllers is driven by technological transformation (oil-to-electricity, cordless to cordless). How to increase the share of head customers, expand production in accordance with customers’ global layout needs, and strengthen customer-side integrated response, become the next step The focus of a round of competition. 3) Lithium battery products benefit from the trend of energy reforms, and there is strong demand for replacement of lead-acid batteries. Controller manufacturers need to find breakthroughs in subdivided areas (such as small power storage and power exchange) in the existing competitive landscape. 4) Industrial control products benefit from the trend of domestic substitution. 5) The entry barrier for automotive electronic controllers is high, and the first-mover advantage is obvious. Manufacturers that have entered the head customer supply system should grasp the opportunity of automotive electronic architecture transformation, and combine software and hardware in the process of evolving from distributed to centralized control methods. Through experience reuse and technological innovation to further increase competition barriers.

risk

Risk of long-term price increase and shortage of raw materials; risk of dependence on large customers.

text

Investment logic

Since 2021, the prosperity of the intelligent controller sector has gradually warmed up, and the share prices of leading manufacturers have shown an upward trend. The upward trend followed a slight correction within the range, and the market sentiment has not diminished.

In the depth of this article, we combed the upstream competition pattern of the smart controller industry and the trend of changes in various downstream sub-fields. We believe that the sector drive has shifted from valuation boost to profit realization. In the next five years, the domestic controller industry may maintain a high boom and the fundamentals of leading companies will continue to be highly resilient. As the second quarter report results are expected to fall, it is recommended to focus on structural Layout opportunities brought by volatility.

The growth logic of the smart controller industry?Segmented areas release strong growth momentum

Home appliances:The stock scale is large, intelligent, innovative, and outsourcing prop up growth space

We believe that in the context of consumption upgrades, home appliance category innovation is the core driving force of the industry’s high prosperity. The increase in smart home penetration will drive the value of controllers. For head controller manufacturers with R&D capabilities, they must seize outsourcing. The transformation from OEM to ODM/JDM model with algorithm and R&D capabilities as the core advantages will increase its own barriers to competition.

tool:Being catalyzed by technological transformation for a long time, it is a good strategy to use head customers as a breakthrough

The catalyst for the rapid growth of the power tool industry comes from product upgrades promoted by technological innovation, and the downstream concentration of tools is relatively high. Tool controller manufacturers will focus on expanding their share in the outsourcing demand of top customers and follow the global supply chain layout of customers Strategically expanding production overseas, suppliers that already have leading advantages at this time will further establish their advantages.

Lithium battery:Under the trend of energy reform, look for breakthroughs in segmented areas

We believe that smart controller manufacturers and leading battery manufacturers do not have a competitive advantage in large-scale standardized lithium battery products, but lithium batteries are widely used. Smart controller manufacturers can find breakthroughs in market segments, give full play to their algorithmic advantages, and grasp customized products. High added value, such as power backup, power replacement, energy storage and other scenarios with a higher degree of customization.

Industrial Control:High-end manufacturing is booming, benefiting from domestic substitution

The long-term catalyst of the industrial control market is the replacement of the traditional labor market by machine production, and the operation of automated equipment has become a rigid demand for the transformation of the manufacturing industry. my country’s industrial control products mainly benefit from China’s supply chain dividends and domestic substitution trends. At the same time, based on the mature stepper drive field, servo drive products are expected to become a new growth point.

vehicle electronics:Grasp the opportunity of transformation of automotive electronics architecture

The key words for the future evolution of the automotive E/E architecture will change from “distributed” to “centralized”. The functions of a single controller will be richer and more valuable. We believe that automotive electronics can replicate the customer expansion path of power tools and home appliance controllers. Take the head supplier of the car factory as the entry point, accumulate design and production experience, gradually expand the controller category, open up the cooperation with the OEM customers, and participate in the car together. Development and innovation of electronic architecture.

Based on the control gene, focusing on the smart future

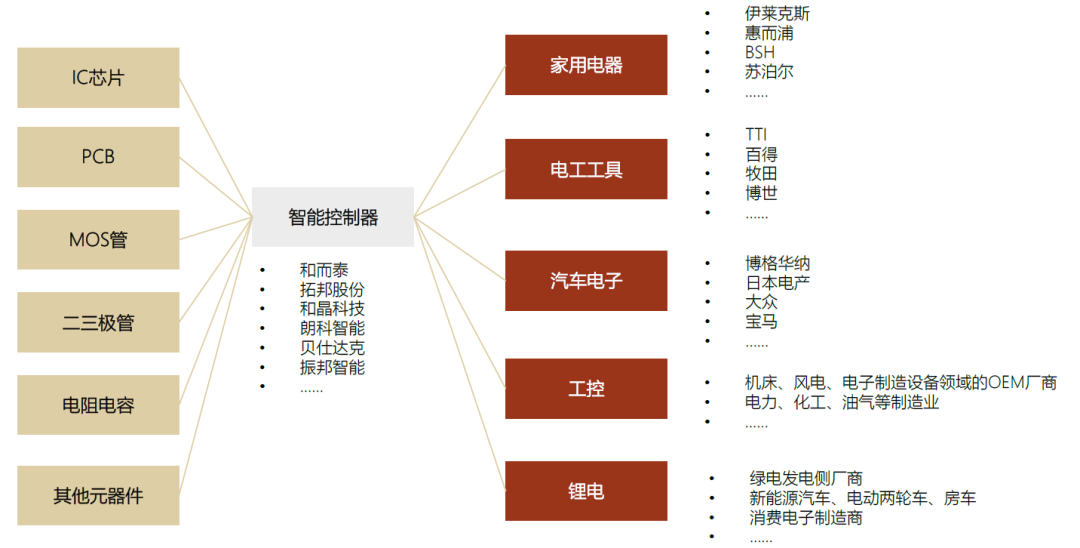

Intelligent controller is one of the core components of equipment and electromechanical operation. As a non-standard customized technology-intensive industry, it is in the middle of the manufacturing chain. The upstream mainly includes IC chips, PCBs, MOS tubes, diodes, resistors, capacitors and other components, and the downstream Including subdivision applications such as household appliances, power tools, automotive electronics, industrial control, and lithium batteries.

Chart: Panoramic View of Intelligent Controller Industry Chain

source:Company Announcement,CICCResearch

Upstream: Costs mainly come from raw materials and components, and supply sources are scattered

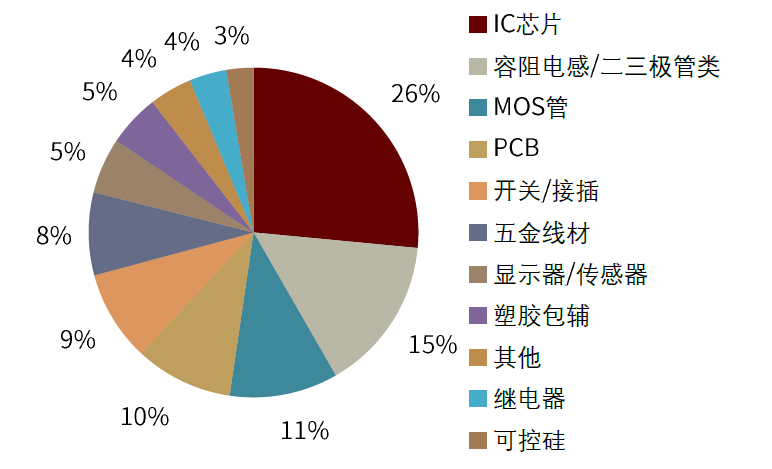

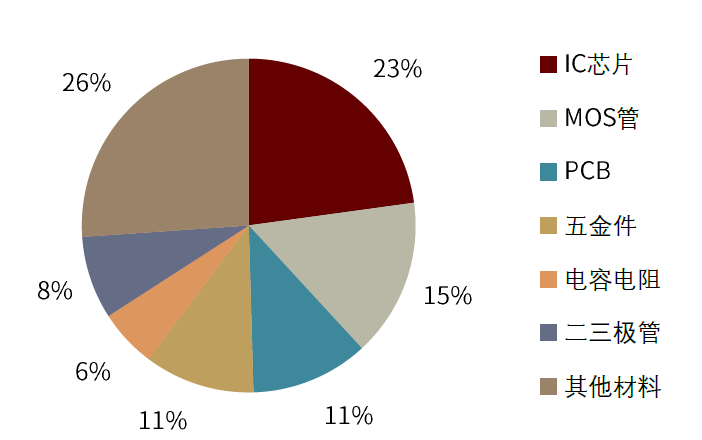

In the cost structure of smart controllers, raw materials account for about 75-85%.Generally speaking, IC chips, capacitors and resistors, power devices, and PCB boards account for more than 60% of the total, and they are the four most important materials.due toThere are many raw materials and scattered types,Except for core components, other single raw materials account for no more than 10%.

chart:Zhenbang IntelligentPurchasing cost split (1H20)

source:Zhenbang IntelligentProspectus,CICCResearch

chart:BestakPurchasing cost split (2019)

source:BestakProspectus,CICCResearch

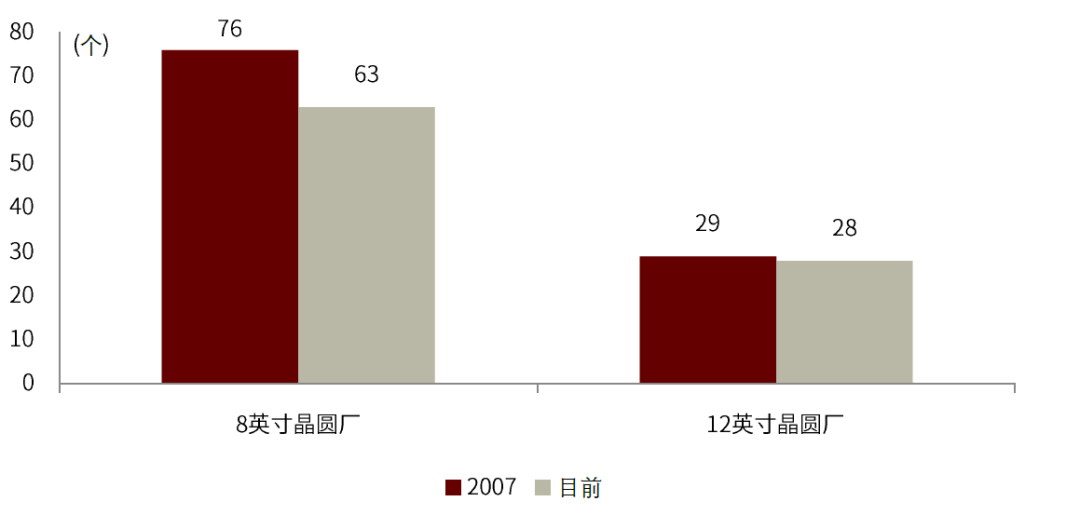

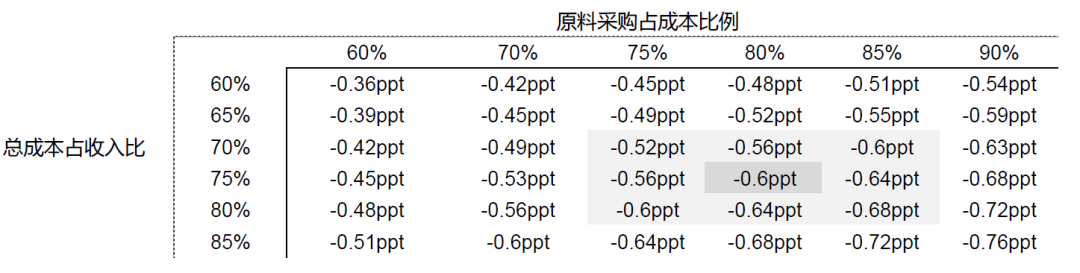

Risk: Sensitivity analysis of raw material price increase

Since the bulk of the cost is occupied by raw materials, the risk of price fluctuations of upstream raw materials is also easily transmitted to the midstream controller industry. Since the second half of 2020, the global 8-inch wafer fabs have experienced tight production capacity, and fabs generally raised prices by 10-30%, triggering a contradiction between supply and demand; subsequently, power management chips and power semiconductors began to increase prices, and packaging and testing companies and chip design companies have also started to increase. Start a wave of price increases. MLCC, another important raw material of controller manufacturers, is also facing price pressure. The reason for the price increase also comes from the tight supply and demand on the one hand, and on the other hand from the increase in the price of MLCC raw materials, MLCC manufacturers have to pass on the price pressure to the downstream.

Chart: The expansion of mature process wafer fabs is cautious, the number of 8-inch/12-inch plants is decreasing, and the production capacity is tight

Source: IC insights,CICCResearch

We believe that this price increase has been conducted layer by layer,This has brought pressure on the cost side to downstream companies in the industrial chain, and at the same time accelerated the industry pattern to focus on the head.We calculated the grossinterest rateAffected by the sensitivity of raw material prices to fluctuations, the price of raw materialsinterest rateThe influence of transmission is highly related to gross profit margin and the proportion of raw material procurement costs.

Chart: Percentage of gross profit margin change when the purchase price of raw materials rises by 1%

source:CICCResearch

Downstream: Subdivision of the track releases high prosperity, leading manufacturers to expand new business boundaries

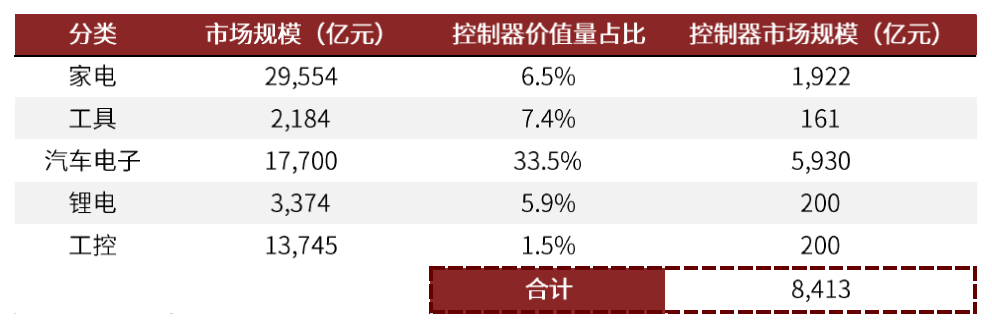

Chart: Global controller industry scale estimation

Source: CCID Think Tank, IHS,CICCResearch

Note: The controller market scale is calculated by the research department of CICC, corresponding to 2020

Home appliances: large-scale inventory, intelligent, innovative, and outsourcing prop up growth space

The development of traditional home appliance controllers has been relatively mature.We believe that in addition to the competition in the traditional home appliance market and the foundry model, the catalyst for industry growth comes from the upgrade of home appliance consumption and the increase in intelligent penetration. For head controller manufacturers with R&D capabilities, grasping the trend of outsourcing, taking algorithms and R&D capabilities as their core advantages, and transforming from an OEM to an ODM/JDM model can increase the barriers to competition.We predict that ODM+JDM orders from head manufacturers account for more than 50%; mid-waist manufacturers are limited by insufficient R&D experience, and OEM orders account for a relatively higher proportion.

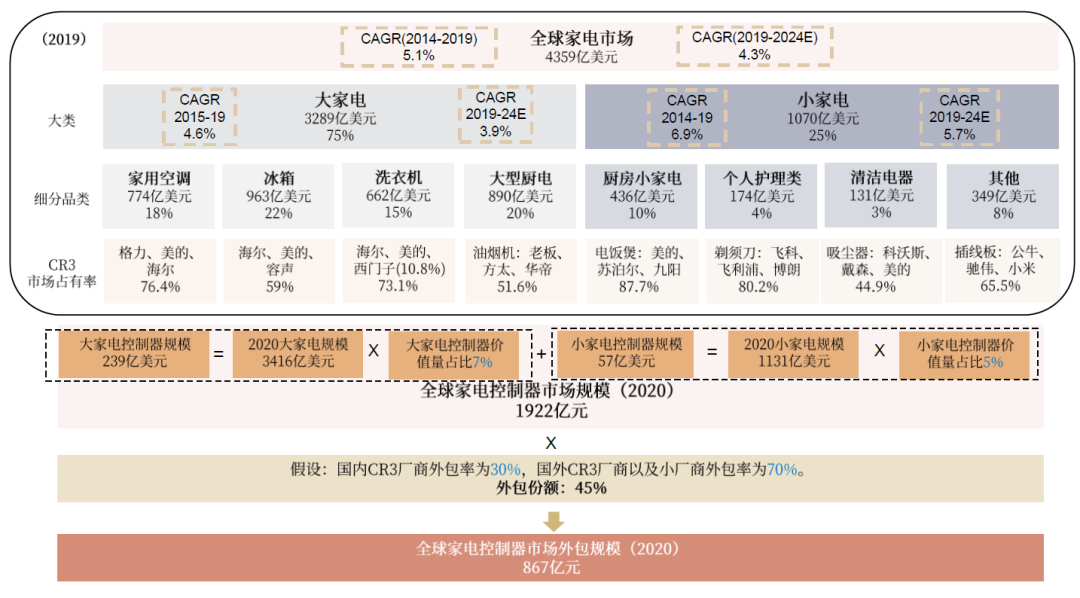

How big is the home appliance controller market?

According to the proportion of the value of the sub-categories, we calculate that the market size of home appliance controllers is about 192.2 billion yuan, of which the scale of outsourced home appliance controllers is about 86.7 billion yuan.

Chart: Calculating the market size of home appliance controllers

Source: Euromonitor, CICC Research

Note: The data in the big black box are all data for 2019. We use the data for 2019 and the future CAGR to predict the data for 2020.The blue numbers are the predicted values of CICC

The development trend of home appliance controller market

The transfer of large appliances to small appliances:Compared with large household appliances, small household appliances have shorter technological innovation cycles, faster purchase decisions, and more innovative categories.

Intelligent home appliances replace traditional home appliances:The growth space brought about by the intelligent transformation of home appliances comes from the replacement of traditional home appliances under consumption upgrades on the one hand, and the increase in the value of single-product controllers on the other hand.

Increase in the proportion of outsourcing:In the context of the blooming of innovative categories and the endless emergence of intelligent products, brand owners focus on brand management, and outsourcing the design and production of intelligent controllers to professional manufacturers is a better choice to improve operating efficiency.

Chart: Competitive landscape of the home appliance controller market segment

Source: CICC Research

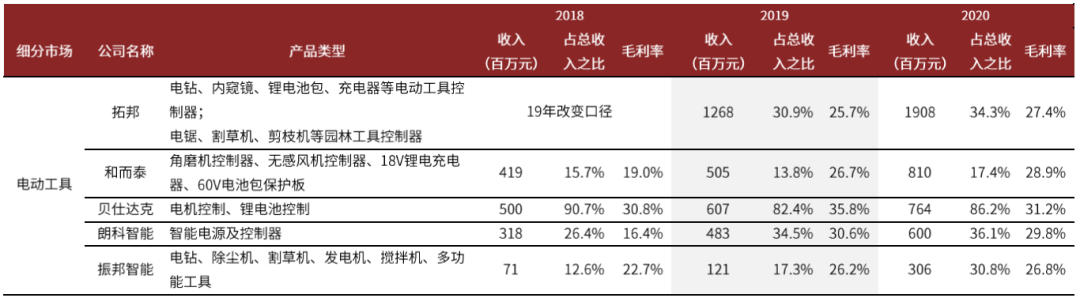

Tools: Long-term catalyzed by technological transformation, driven by the logic of increasing penetration rate of top customers

Electric tools mainly refer to hand-held tools powered by low-power motors or electromagnets.The proportion of cordlessness in the global power tool market continues to increase,According to EVTank, the penetration rate of cordless power tools has increased from 30% in 2011 to about 64% in 2020 in recent years.China’s power tools continue to develop in the process of undertaking the transfer of international division of labor, and have become the world’s major power tool producer.The main demand still comes from overseas markets.

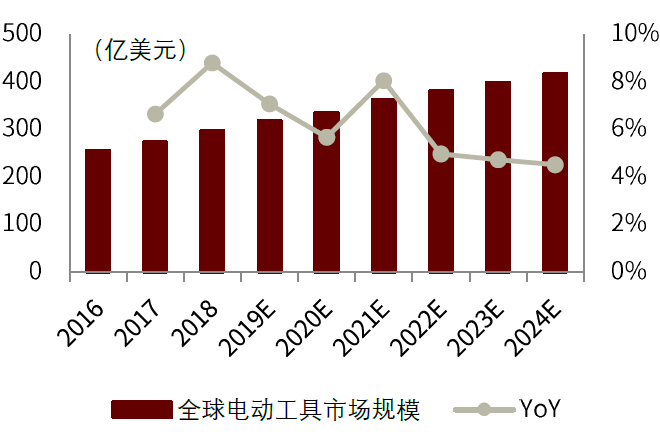

Chart: Global Power Tools Market Size (2016-2024E)

Source: Markets and Markets, Real Lithium Research, CICC Research

Chart: China’s output value of electric tools as a share of the global market

Source: White Paper on China’s Power Tool Market, Qianzhan Industry Research Institute, CICC Research Department

How big is the tool controller market?

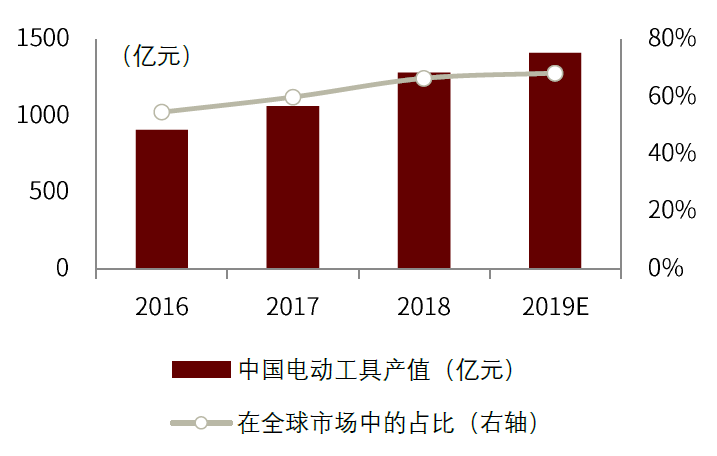

We estimate that the size of the tool controller market is about 16.1 billion yuan.In addition to electronic control, the core components of electric tools also include motors and batteries. The sum of the value of the three accounts for close to 24% of the tool cost. If smart controller manufacturers can take over the production of the three power tools in the tool industry, they can be touched. The scale of space will be doubled.

Chart: Electric tool controller market scale calculation (calculated according to the proportion of shipments/values)

Source: Statista,StanleyBlack & Decker, Markets and Markets, CICC Research Department

Note: The red font is the determined value, the blue font is the predicted value of CICC, and the black font is the calculated value

Tool controller industry catalyst

Technical catalysis:As electric tools need to be adapted to convenient usage scenarios, driven by technologies such as oil-to-electricity, cordless, integration, and lithium-ion, electric tools are in the process of transforming to mechatronics. In addition, the product has more intelligent functions, integrating new functions such as sensing and networking, and the complexity and added value have increased.

Catalysis of the epidemic:In 2020, home isolation has created new demand. Overseas families taking care of their houses and operating gardens will drive the demand for overseas power tools to accelerate.

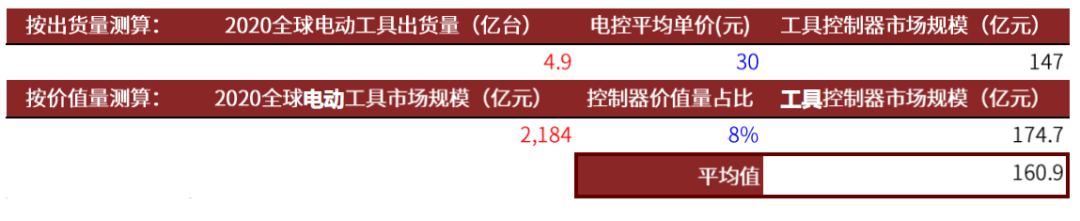

Competitive landscape: TTI’s controversy

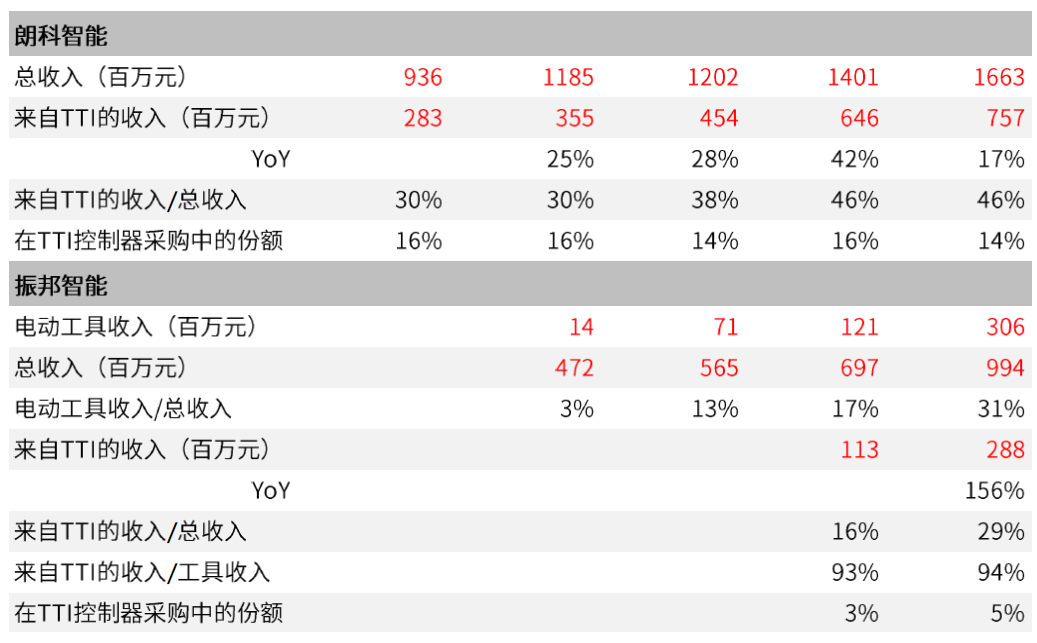

The downstream concentration of the power tool industry is relatively high. In 2018, TTI (Innovation and Technology Industry), Black & Decker, and Bosch have a combined market share of approximately 60%. TTI has become the largest tool customer of domestic controller manufacturers with absolute order volume.

In 2020, the revenue growth rate of TTI power tools will be 20%.Bestak、Netac SmartThe growth rate of revenue from TTI is lower than this value. Topband,He and Tai、Zhenbang IntelligentThe revenue growth rate from TTI is higher than 20%,The difference in growth rate reflects the transfer of TTI’s order share between suppliers.In addition to Topband,He and TaiThe two leading manufacturers still rely on their solid strength to obtain incremental TTI orders, and Zhenbang Intelligent’s TTI orders are also rapidly starting.

Chart: TTI controller purchase share calculation

Source: Companyannouncement, CICC Research Department

Note: The red value is the determined value, the blue value is the predicted value of CICC, and the black value is the calculated value; calculated according to the historical exchange rate

In the future, we believe that TTI will still drive tool ordersMain force, The expansion of other head tools customers is also the key.We believe that various controller manufacturers have a stable foundation for cooperation with TTI. The cooperation with TTI proves that manufacturers have the ability to supply leading companies in the field of tools, which is of great significance for expanding orders from other customers.

Chart: The competitive landscape of the tool market segment

Source: CICC Research

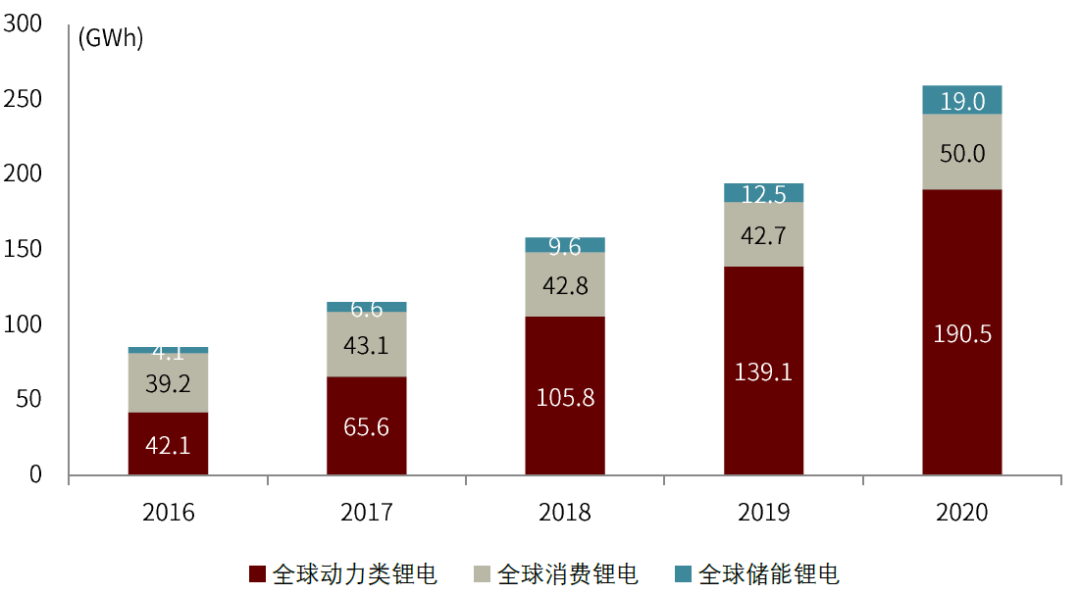

Lithium: Under the trend of energy reform, look for breakthroughs in subdivisions

Under the general trend of oil-to-electricity and energy transformation, lithium batteries are the first choice for green and environmentally friendly batteries and light-duty applications, and can be used to replace the stock of lead-acid batteries. According to application scenarios, lithium batteries can be divided into three types: power, consumption, and energy storage.

Chart: Global Lithium Battery Shipment (2016-2020)

Source: Starting Point Research Institute, CICC Research Department

The lithium battery of smart controller manufacturers is only an auxiliary industry in the business strategy, and it does not have a competitive advantage compared with the standard lithium battery products of major manufacturers. However, lithium battery has a wide range of application scenarios, and smart controller manufacturers can find breakthroughs in subdivided fields and grasp the high added value of customized products, such as energy storage, power replacement, and power backup, and other highly customized application scenarios.

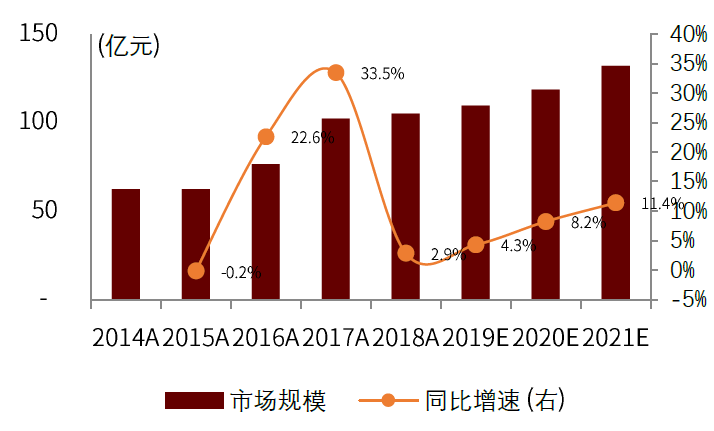

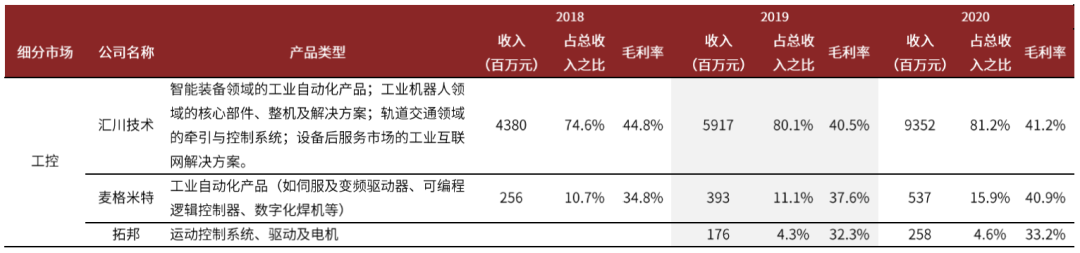

Industrial Control: Benefit from domestic substitution

Industrial control mainly uses electronic and electrical, mechanical, and software combinations to achieve industrial automation control.The long-term catalyst of the industrial control market is the trend of machine automation driving industry transformation.

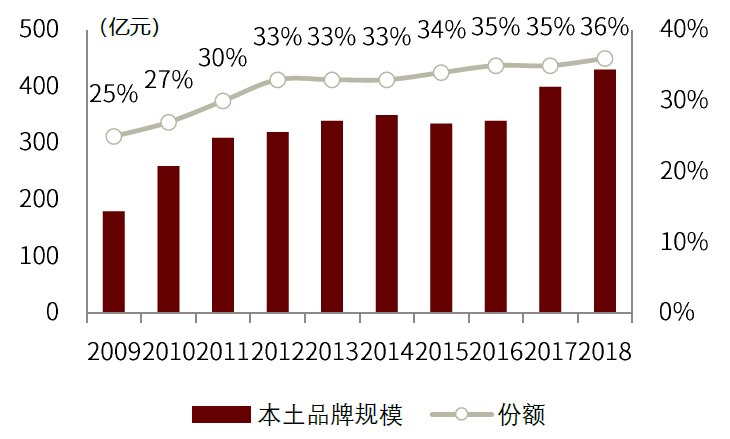

my country’s industrial control mainly benefits from domestic substitution,In recent years, the state has increased its industrial support for the smart device manufacturing industry. In 2018, the scale of local brands accounted for about 36%, and the domestic substitution space is relatively large; while China has advantages in cost and supply chain integrity, and domestic substitution is in urgent need of technology Breakthrough and product verification.

On the other hand, the stepper drive motor market is relatively mature.Servo drive motor products are expected to become a new growth point, and import substitution will further open up room for growth.From the perspective of market share changes, the competitive landscape of servo motors in my country has gradually developed from a centralized head to a decentralized one, and smaller manufacturers may have the opportunity to rise.

Chart: Domestic Servo Motor Market Scale and Growth Rate

Source: gongkong.com, “China’s General Motion Control Market in 2019research report“, CICC Research Department

Chart: Proportion of domestic industrial control local brands

Source: Gongkong.com, CICC Research Department

Chart: Competitive landscape and revenue trend changes in the industrial control market of controller manufacturers

Source: CICC Research

Note:Inovance TechnologyThe calculation method of the industrial control income caliber, excluding the new energy business and other main businesses in the total income

Automotive Electronics: Seize the opportunity of transformation of automotive electronics architecture

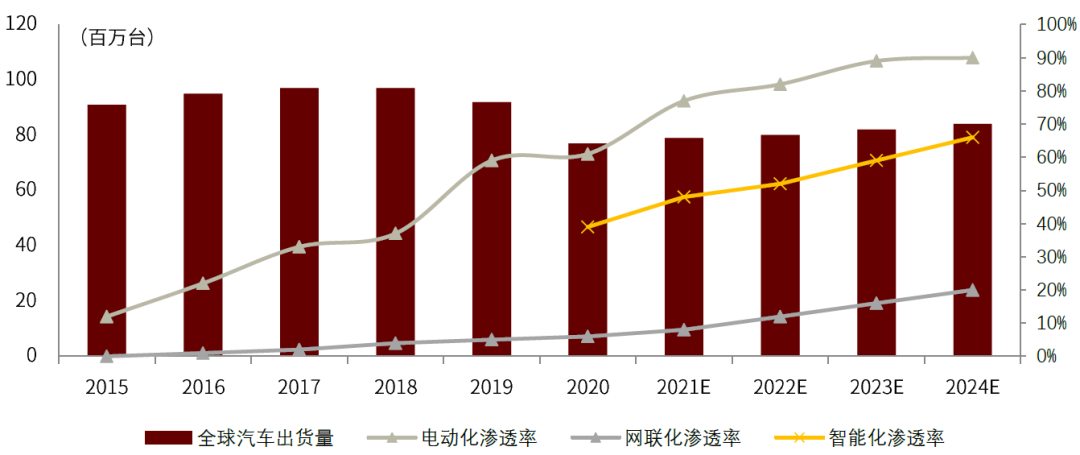

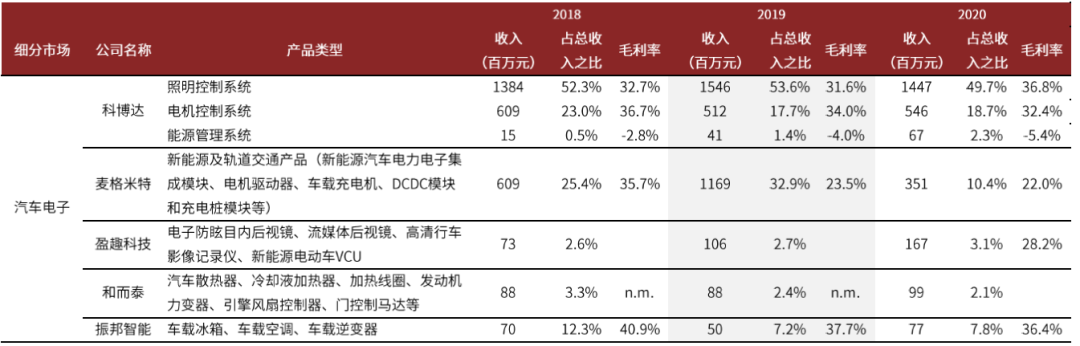

The expansion opportunities of automotive electronic controllers come from the improvement of the degree of electrification, intelligence, and networking of automobiles.As the consumer electronics experience gradually shifts from wearable devices to automobiles, consumers’ demand for comfortable, safe, and intelligent rides increases, and the increase in the assembly rate of automotive electronics in the future can be expected.

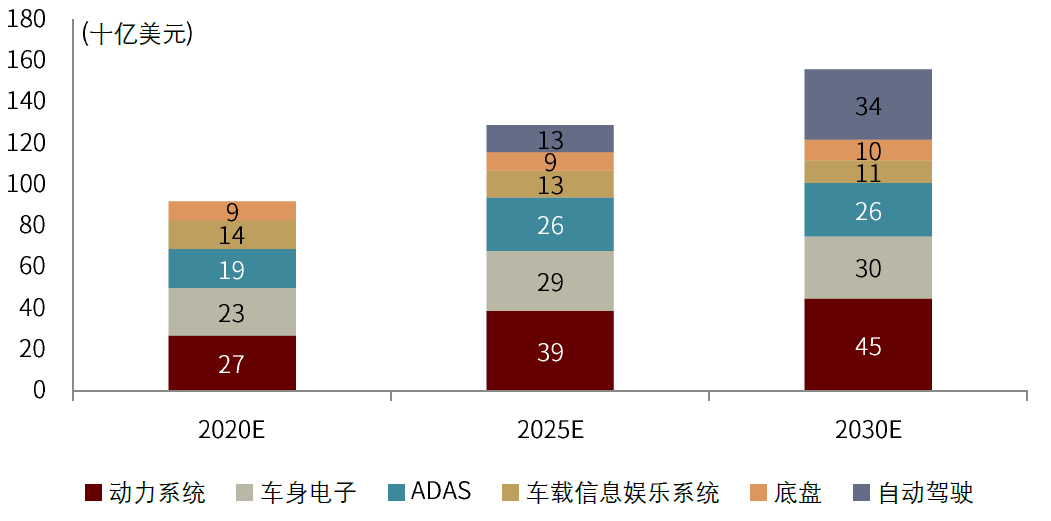

We estimate that the global market size of automotive intelligent controllers is about 591 billion yuan.At present, the scale of the automotive electronics business of domestic controller manufacturers is still small, and the automotive electronics market space is about three times that of home appliances, and the ceiling is high, which is the next track for controller manufacturers with high growth potential.

Chart: The penetration rate of global automotive electrification, intelligence, and connectivity is increasing year by year

Source: IDC, BI intelligence, CICC Research

The key words for the future evolution of the automotive E/E architecture are shifting from “distributed” to “centralized”.Concentration means that one controller will gradually integrate the functions of multiple controllers, which will reduce the number of wiring harnesses and promote the development of lightweight cars.The process of evolving from a distributed architecture (component-oriented) to a central computing architecture (system-oriented) does not happen overnight. The transition periodWill give birth to the development of domain controllers (DCU).

Chart: ECU, DCU market scale forecast

Source: McKinsey, CICC Research

What kind of manufacturers can better grasp the opportunities of automotive electronics?

We believe that the difference between DCU and ECU is not only in the number of integrated functions on the controller, but also in the implementation of software development on the hardware. Therefore, we believe that controller manufacturers with software and hardware design capabilities will have more control in the automotive electronics market. More opportunities. However, automotive products have very high requirements for safety performance, and leading manufacturers with higher yields will establish higher barriers to entry. The design requirements of automotive electronic controllers are more complex, requiring 2-3 years in advance of the layout of R&D investment, and the inspection cycle of downstream customers has reached 1-2 years. The first-mover advantage will continue to accumulate, forming a strong technical barrier.

Chart: Changes in the competitive landscape and revenue trends of the automotive electronic controller market segment

Source: CICC Research

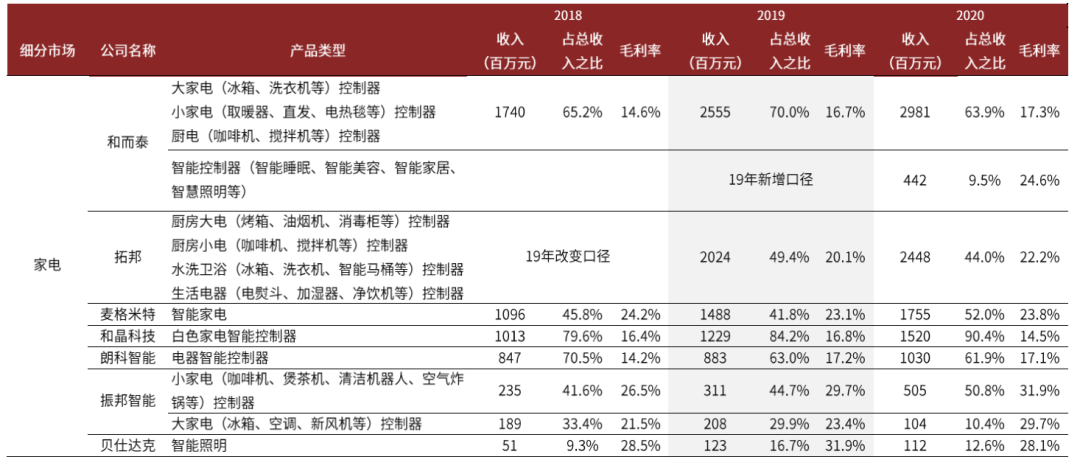

Vertical and horizontal comparison of industry patterns: from the perspective of business and finance

Global head controller manufacturers: the trend of overseas share shifting to domestic market is obvious

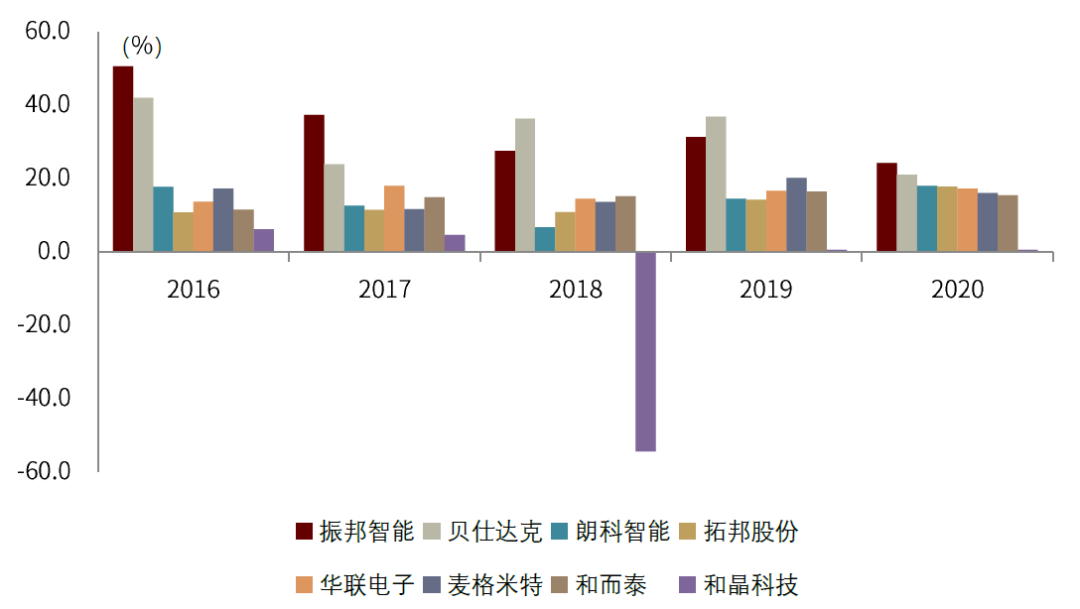

By horizontally comparing the revenue growth and decline of global and domestic head companies in recent years, we have seen a clear trend of overseas share shifting to the domestic market.

Chart: Horizontal comparison of head controller manufacturers at home and abroad, the trend of inward flow of orders is obvious

Source: Company announcement, CICC Research

Note: Invensys data is Schneider industrial revenue data

Business comparison: the perspective of revenue, cost, customers, and capacity structure

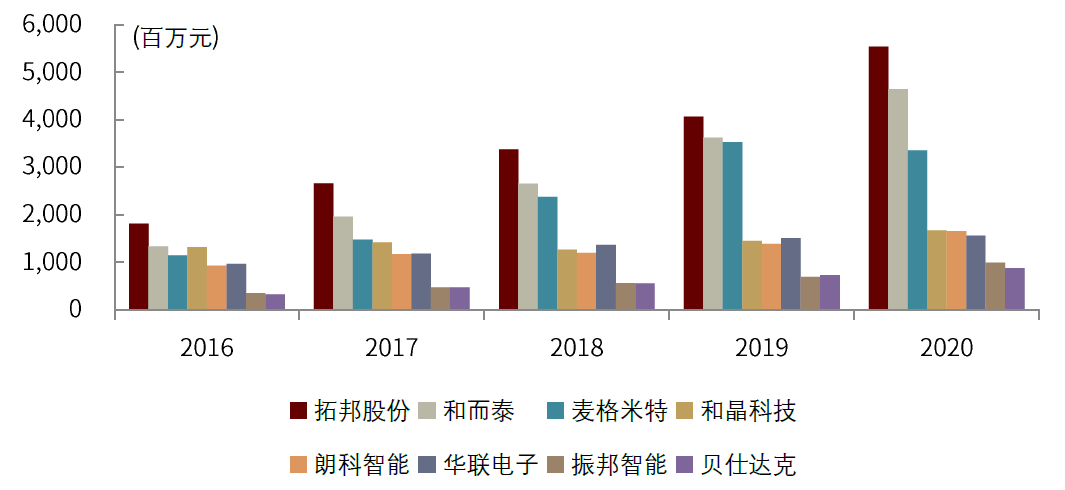

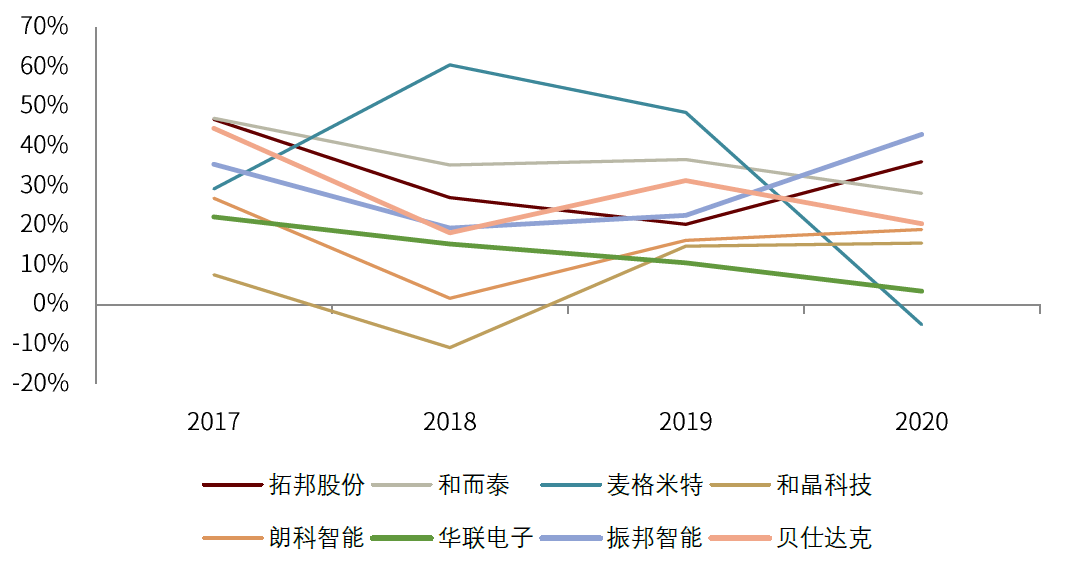

Income volume

TopbandHe and TaiThe revenue volume of the company has surpassed its competitors in the past five years, maintaining a high growth rate from 2017 to 2019MegmeetThe volume of income is gradually approaching, but because there is no tool category in the product line, it has not benefited from the outbreak of demand in 2020.Due to changes in core customer needs, leading toMegmeetNew energy vehicle electronic control orders have declined severely, and the 2020 revenue growth rate has turned negative, reflecting the gap in risk resistance compared with the leader.

Chart: Main business income comparison

Source: CICC Research

Chart: Comparison of Main Business Revenue Growth Rate

Source: CICC Research

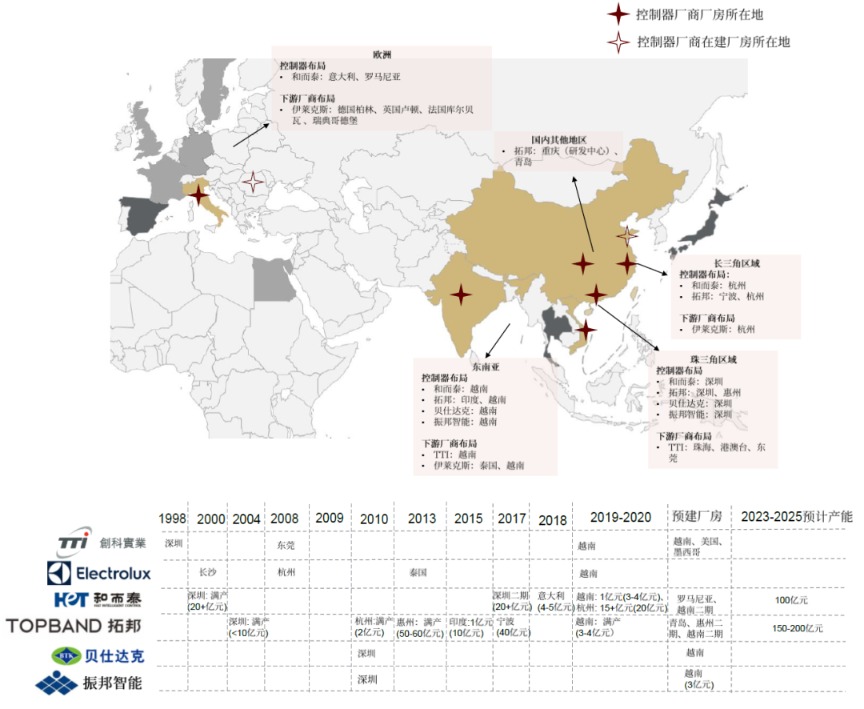

Capacity expansion

He and Tai

Holtek currently has four production bases in Shenzhen, Hangzhou, Italy, and Vietnam:

Romania’s layout plan is mainly used to expand business in Europe and surrounding regions.The Italian production base came from 2018M&AItaly NPE company. The Shenzhen Phase 1 plant is at full production, and the second phase will be put into use in the second half of 2020. The company expects to reach full production in 21 years. The Hangzhou plant is in the process of ramping up its production capacity, and the company expects its production capacity to climb to 80% in 21 years. In the second half of 2020, the Vietnam production base will be put into operation, and the company expects to increase the production capacity of 300-400 million yuan in 21 years. The company also plans to add 1 to 2 billion yuan of production capacity in 2021.

Topband

Topband has deployed the Pearl River Delta and the Yangtze River Delta in China, and Southeast Asia abroad. In the Pearl River Delta, Shenzhen and Huizhou are the main products. At present, Shenzhen’s production capacity has basically shifted to Huizhou. The Hangzhou base is the main base; to the west, the layout is in the Chongqing High-tech Zone; overseas, the Indian factory and the first phase of Vietnam have been put into production.

Chart: Global layout and output value of domestic intelligent controller plant

Source: Company announcement, CICC Research

Note: In the map, yellow indicates that the controller manufacturer has deployed production areas. The black/dark gray area indicates the area where TTI/Electrolux has built a plant, but the domestic controller manufacturer has not built a plant. In the table, the estimated production capacity is in parentheses. The data comes from CICC forecasts.

Why expand overseas production lines?

Due to geopolitical considerations, some overseas customers tend to choose controller suppliers in areas close to their own factories, and companies with global operating capabilities and strong technical capabilities have undertaken this part of the needs of overseas customers. In order to maintain overseas delivery capabilities and stay close to customers, controller manufacturers have built factories overseas.After 2010, the downstream brand’s factory construction plan began to return to North America and Europe, and at the same time transfer to Southeast Asia. In order to keep up with the changes in downstream customer demand, domestic controller manufacturers have also expanded overseas,At this time, the driving advantage of production capacity is not only the cost advantage of China’s supply chain, but also the integrated sales and rapid response capabilities on the customer side. Only companies with the ability to go overseas to build factories can stand out in the next round of share competition.

In order to further expand Electrolux’s outsourcing share, Holtek has set up production capacity in Europe; as TTI transfers its production capacity to Vietnam, Topband, Holtek, Bestak, and Zhenbang Intelligent have all established factories in Vietnam to cooperate , To further grasp the transfer of new orders.

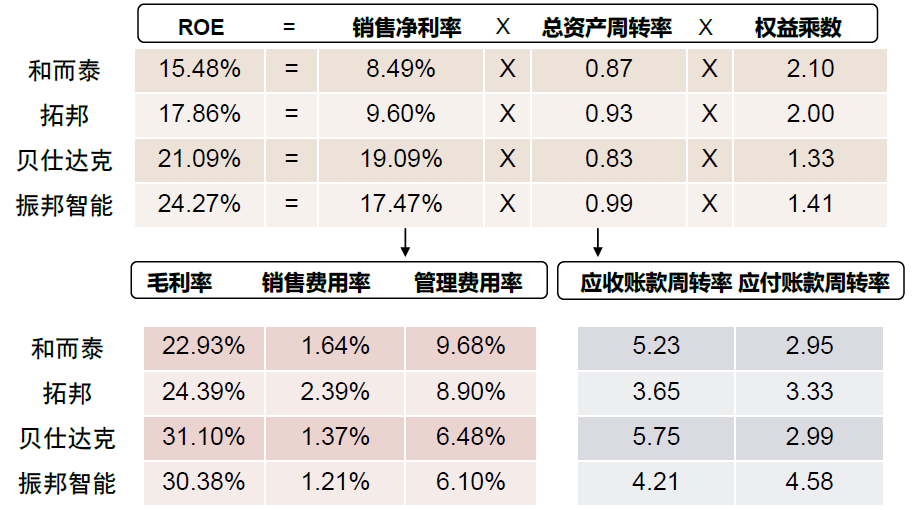

ROE and DuPont analysis

By selecting Zhenbang Intelligence and Bestak, which have higher ROE in the industry, and comparing them with leading He and Tai and Tuobang, we found that the net profit margin of the first two is significantly higher than that of the two leading companies. The pricing power is slightly better than the two leading companies.

Chart: ROE comparison

Source: CICC Research

Chart: DuPont analysis (2020)

Source: CICC Research

(Source: CICC Dotting the Eyes)

.