CDC Finance, April 1st, today,chongqing beerreleaseperformancereport, toochongqing beerComplete major assetsreorganizationThe first full-year performance report since. According to public information, by the end of 2020,chongqing beerCompleted major asset restructuring.BigshareholderCarlsberg will inject all of China’s beer assets into Chongqing Beer.

After the merger, the company grew from a regional brewery to a national brewery, and the number of corporate breweries increased from 14 to 26. In terms of brand portfolio, the company’s brand portfolio of “international high-end brands + local strong brands” is even stronger. International high-end brands include Carlsberg, Roborg, 1664, Greenberg,BrookeLin, Xiafen, etc. Local strong brands include Wusu, Chongqing, Shancheng, Wusu, Xixia, Dali, Fenghuaxueyue,Tianmu LakeBeijing A, etc., can meet the consumption needs of consumers in different consumption scenarios and price ranges.

As of the end of the reporting period, Carlsberg Brewery Hong Kong Co., Ltd. was the major shareholder of the company, holding 42.54% of the shares.

During the reporting period, the company achievedOperating income13.119 billion yuan, an increase of 19.90% over the same period of the previous year; realized the amount attributable to the company’s shareholdersnet profit1.166 billion yuan, an increase of 38.82% over the same period of the previous year (same after the reorganization); the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses was 1.143 billion yuan, an increase of 76.14% over the same period of the previous year (same after the reorganization). .

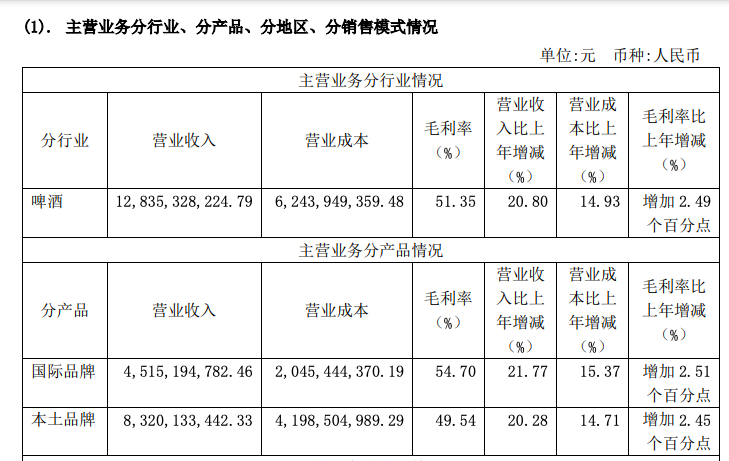

In terms of sales volume, the revenue of local brands is the main part of the performance, and the growth trends of domestic and international brands are similar. In 2021, Chongqing Beer will achieve beer sales of 2.7894 million kiloliters, an increase of 15.10% over the same period of the previous year.The revenue of local brands increased by 20.28% to 8.32 billion yuan, and the sales volume increased by 15.47% to 2,060,300 kiloliters.interest rateAn increase of 2.45%.The revenue of international brands increased by 21.77% to 4.515 billion yuan, and the sales volume increased by 14.05% to 729,100 kiloliters.interest rateAn increase of 2.51%.

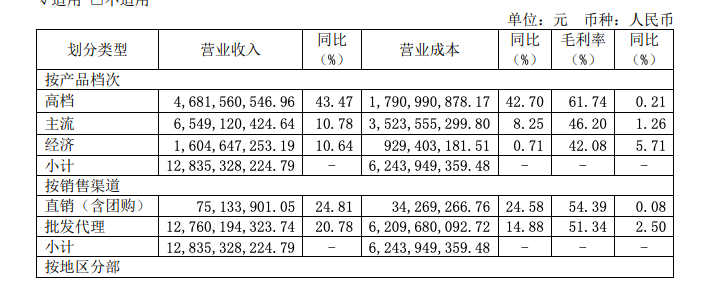

From the perspective of product grades, the company’s sales sources are mainly mainstream products of 6-10 yuan, and high-end products have grown rapidly. Sales of mainstream products of RMB 6-10 represented by Le Fort, Chongqing and Dali Beer increased by 10.60% to 1,614,500 kiloliters. Sales revenue increased by 10.78% to 6.549 billion yuan. Wusu, Carlsberg, 1664 represented by the sales of high-end products above 10 yuan increased by 40.48% to 661,500 kiloliters. Sales revenue increased by 43.47% to 4.682 billion yuan. Take the mountain city,Tianmu LakeThe sales volume of economical products below 6 yuan, represented by them, increased by 4.14% to 513,400 kiloliters. Sales revenue increased by 10.64% to 1.605 billion yuan.

Chongqing Beer said that the company continues to promote the high-end business strategy of products to improve the company’s overall profitability and market competitiveness. In 2021, from the perspective of product structure, vigorously promote the growth of high-end products, increase the sales volume and sales ratio of high-end products, so as to realize the implementation of high-end products.

From the perspective of sales channels, the company mainly focuses on wholesale agents. During the reporting period, the revenue of wholesale agents was 12.76 billion yuan, an increase of 20.78%.

From the perspective of assets, the company’s inventory increased by 16.36% to 1.887 billion yuan during the reporting period, mainly due to the increase in inventory of goods and packaging. Prepayments increased by RMB 45.1177 million, mainly due to the increase in prepayments for energy and materials.

As of today’s close, Chongqing Beer closed at 112.16 yuan, an increase of 4.6%.

(Article source: CDC Finance)