Since May last year, the price of LONGi silicon wafers has maintained an upward trend for one and a half years, but now they have cut their quotations drastically in half a month, which has aroused strong market attention.

December 16th,Longi sharesThe official website released the latest quotations for monocrystalline silicon wafers, and the overall price of M10, M6, and G1 sizes has been reduced by more than 5%. On November 30th,Longi sharesThe price of silicon wafers of various sizes has just been reduced by 0.41 yuan/piece-0.67 yuan/piece, which is a decrease of 7.2%-9.8% compared to the previous quotation.

On the 17th,Longi sharesThe stock price fell 4.19%, and the wholePhotovoltaic equipmentPlate.

As “PV Mao” takes the lead in cutting prices, the industry’s concerns about overcapacity in the photovoltaic industry have revived. Some analysts believe that the current price reduction of silicon wafers is just the beginning. As silicon material production increases and prices drop next year, more and more silicon wafer companies will have the conditions to expand their production.

Photovoltaic Mao leads the industry chain price decline

On the evening of December 16, “Photovoltaic Mao” LONGi announced that it would lower the price of monocrystalline silicon wafers again. According to Longi’s official website, for P-type monocrystalline silicon wafers with a thickness of 165μm, the size of M10 is reduced from 6.2 yuan to 5.85 yuan, a reduction of 5.7%; the size of M6 is reduced from 5.32 to 5.03 yuan, a reduction of 5.5%; the size of G1 is reduced from 5.12 The yuan was lowered to 4.83 yuan, a decrease of 5.7%.

Affected by this, on December 17, Longi’s shares opened sharply lower, fluctuated and weakened throughout the day, closing down 4.19%, and dragged downPhotovoltaic equipmentThe sector fell collectively, the sector fell 3.7%, 9 stocks fell more than 5%, the largest declineTongling sharesReach 14.64%.

This is the second time that Longi has lowered the selling price of photovoltaic silicon wafers in half a month. On November 30, LONGi had just announced the adjustment of the official quotation of monocrystalline silicon wafers. The price of silicon wafers of various sizes dropped by 0.41 yuan/piece-0.67 yuan/piece, a decrease of 7.2%-9.8%.

Longi took the lead in cutting prices and forced the second in the industry to follow up, December 2ZhonghuanWe also lowered the price of silicon wafers. In comparison to the previous November price of silicon wafers, G1 silicon wafers fell 0.52 yuan/piece, and the price was 5.15 yuan/piece, a decrease of 9.1%; M6 silicon wafers fell 0.72 yuan/piece, and the price was 5.05 yuan/piece , A drop of 12.48%; G12 silicon wafers (170μm) fell by 0.55 yuan/piece, and the price was 8.55 yuan/piece, a drop of 6.04%.

In fact, since Longi started its price cut, the entire photovoltaic industry chain has been driven to cut prices.

Industrial SecuritiesResearch reportData show that last week (2021.12.06-12.10), the domestic single crystal compound feed price range was 256,000-26.9 million yuan/ton, and the average transaction price was 262,000 yuan/ton, down 3.75% from the previous month; the single crystal dense material price range was within 253,000-26.7 million yuan/ton, the average transaction price was 260,000 yuan/ton, down 3.6% on a week-on-week basis.

Last week, all silicon wafer prices fell. Polycrystalline diamond wire, M2 silicon wafer, M6 silicon wafer, 182 silicon wafer, 210 silicon wafer are quoted at RMB 1.95/piece, RMB 5.10/piece, RMB 5.00/piece, RMB 5.85/piece, and RMB 8.55/piece.

allBatteryThe price of the film has fallen. The prices of polycrystalline 18.6%, single crystal M2, single crystal M6, single crystal 182mm, and single crystal 210mm are respectively 0.761 yuan/watt, 1.12 yuan/watt, 1.05 yuan/watt, 1.1 yuan/watt and 1.1 yuan/watt. Among them, polycrystalline 18.6%BatteryThe chip has decreased by RMB 0.022/W compared with the same period last year, and the single crystal M2BatterySingle-crystal M6 cells fell by 0.01 yuan/watt year-on-year, monocrystalline 182mm cells fell by 0.02 yuan/watt year-on-year, and monocrystalline 210mm cells fell by 0.02 yuan/watt year-on-year.

The prices of 182 components and 210 components have fallen. 182mm modules and 210mm modules are priced at 1.95 yuan/watt and 1.95 yuan/watt respectively. Among them, 182mm modules dropped by 0.03 yuan/watt year-on-year. The 210mm module dropped by RMB 0.03 per watt year-on-year.

Overcapacity worries rise again

Price cut or just the beginning

According to industry insiders, the biggest concern of the photovoltaic industry now is overcapacity. Whether it is upstream silicon materials, silicon wafers, or downstream photovoltaic modules, there may be a risk of excess. The last round of the photovoltaic industry outbreak created the richest man like Shi Zhengrong, but after the bubble burst, Wuxi Suntech fell into bankruptcy and reorganization.

From the perspective of representative companies, in the field of silicon wafers, LONGi and Zhonghuan are duopoly and firmly hold the position of kings. The silicon wafer production capacity of the two companies has accounted for more than 60% of my country’s total silicon wafer production capacity. However, Longi and Zhonghuan’s pursuit of production capacity has not stopped. For the moment, Longi’s planned production capacity is 105GW, and Zhonghuan is 85GW.

Jinko and JA are the second echelon, basically focusing on self-use. By the end of 2021, the production capacity of Jinko and JA will both reach 30GW.

At the same time, many new silicon wafer forces are rising rapidly, onlyCNC on the machine、Beijing Express、Shuangliang Energy SavingGao JingSolar energyThe total planned silicon wafer production capacity of the five cross-border companies in Meike and Meike has exceeded 187GW. In the future, such a volume will be able to compete with Longi and Zhonghuan.

Open sourceSecuritiesAccording to a research report in November, there are at least 12 manufacturers with expansion plans in 2022, and it is expected that the new silicon wafer production capacity will exceed 299GW in the future. This is already very close to the 330GW of global new photovoltaic installed capacity estimated by the China Photovoltaic Industry Association in 2025.

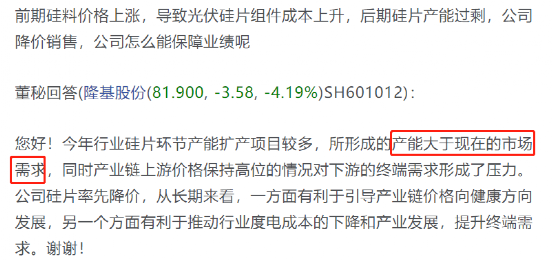

When answering questions from investors on the interactive platform recently, Longi also stated that “there are more projects for capacity expansion in the industry’s silicon wafer link this year, and the resulting production capacity is greater than the current market demand”.

The company also stated that the high prices in the upstream of the industry chain have put pressure on downstream terminal demand. “The company took the lead in reducing the price of silicon wafers. From a long-term perspective, on the one hand, it will help guide the price of the industry chain to develop in a healthy direction. On the other hand, it will help promote the decline of the industry’s electricity cost and industry development, and increase the terminal demand.”

CITIC SecuritiesAnalystHua Pengwei believes that the recent decline in the price of silicon wafers is due to the weak short-term terminal demand on the one hand; on the other hand, companies must also consider the impact of inventory factors after the industry chain prices peak. The downward price of the industry chain is conducive to stimulating the demand for terminal installations to rebound.

Some analysts believe that the current price reduction of silicon wafers is just the beginning. As the output of silicon materials increases and prices drop next year, more and more silicon wafer companies will have the conditions to expand production, especially those new to the silicon wafer sector. The hidden worries of surplus have been highlighted, which once again triggered a sharp drop in silicon wafer prices.

(Source: ChinafundNewspaper)

.