Up here My business I always take care of reviewing the tools available to those who want to invest. Today I deal with Degiro: it’s about a trading platform which offers direct access to the markets and allows you to invest in different types of assets.

In this guide we will see together the advantages they disadvantages of this solution.

If you are looking for a broker online or you just want to know more about Degiroyou are in the right place.

Enjoy the reading!

This article talks about:

Who is Degiro?

As anticipated, Degiro it is an account that acts on a large scale and collects around 300,000 customers including small, medium and large traders. It began operating in the Netherlands in 2013, and then began to offer its services in other European countries, including Italy.

Degiro has also always proposed itself as broker simple, safe and with particular attention to the possible ones technical innovations. All with a certain amount of attention, as we will see later, for i costs, often completely out of control in the world of trading and which Degiro manages to keep on decidedly high levels bassi.

DeGiro BV merged with flatexDEGIRO Bank AG in early 2021, creating the largest execution-only online brokerage in Europe with its own banking licence.

License and Permission

Degiro is a licensed broker in the scope MiFID, as it has an AFM license (from the Dutch supervisory authority on financial markets). So it is a broker which has, at least from a legal point of view, everything it needs to be offered throughout Europe, including Italy.

Direct access investment products

Degiro allows you to go trade with direct access on several European markets:

- Euronext in Amsterdam;

- Euronext di Brussel;

- Euronext of Paris;

- Xetra;

- London Stock Exchange;

- SIX Swiss Exchange;

- OMX of Copenhagen;

- OMX in Helsinki;

- Stock exchanges in Oslo, Budapest, Athens, Lisbon, Stockholm, Prague, Istanbul.

With Degiro you can also invest in:

- Actions;

- Investment funds;

- ETF;

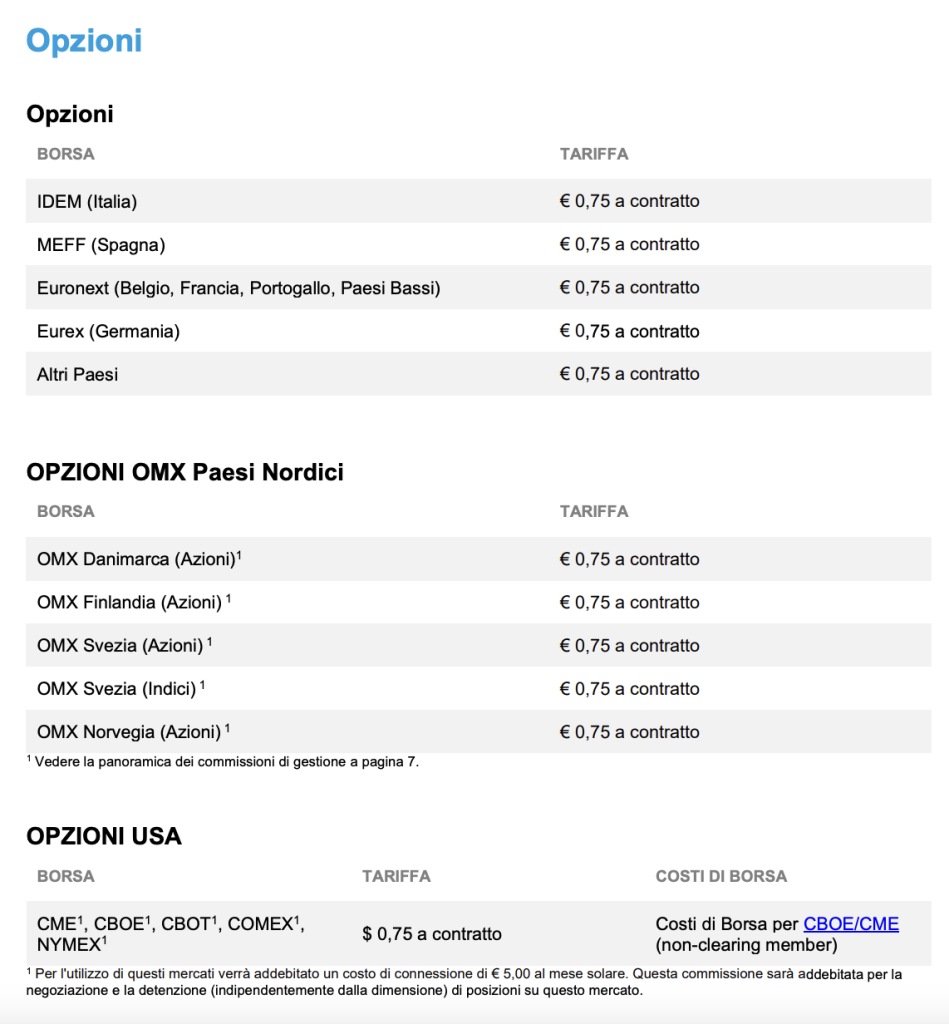

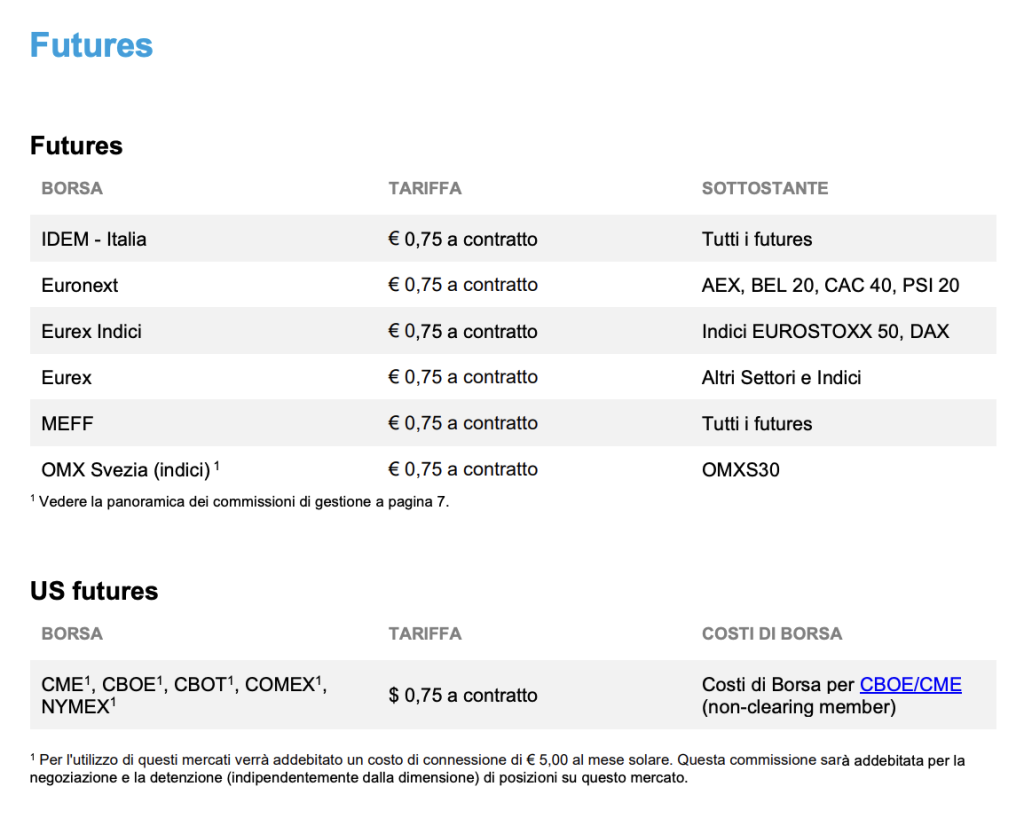

- Options e Futures;

- Derivatives in general;

- Bonds;

- structured products;

- Raw material.

It is one of wider choices both in terms of the number of markets to which you have access, and in terms of the types of instruments to which you have access through this platform.

>> Open an Account Now <

Degiro’s strong point: low commissions

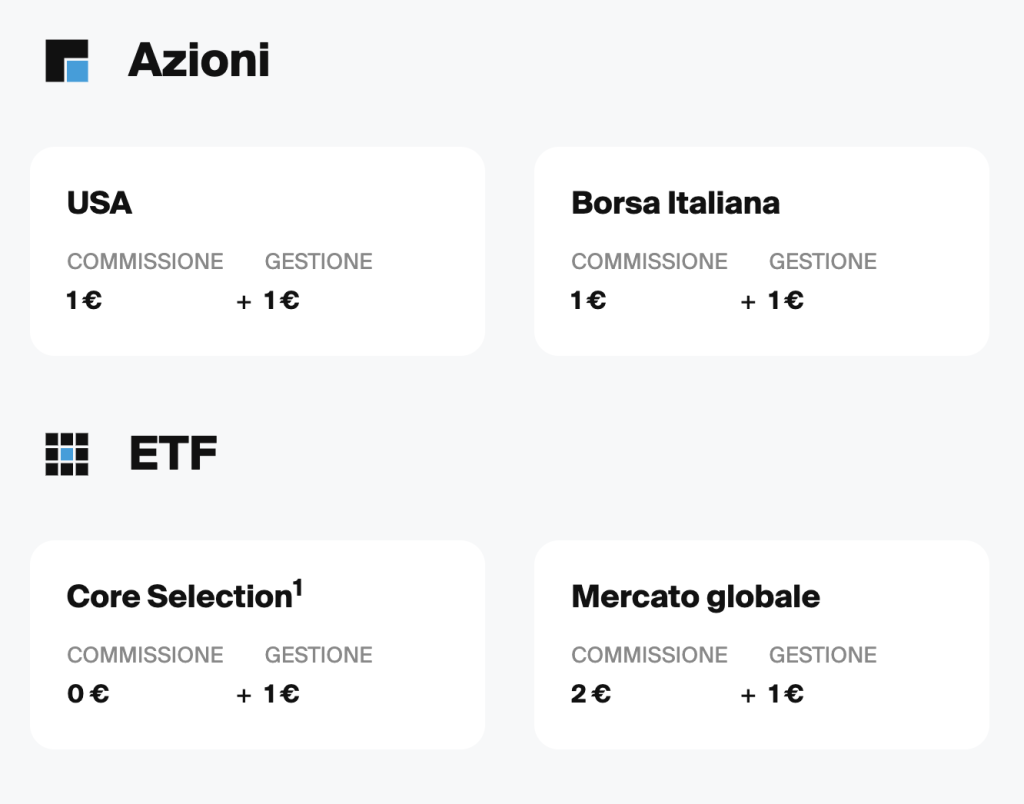

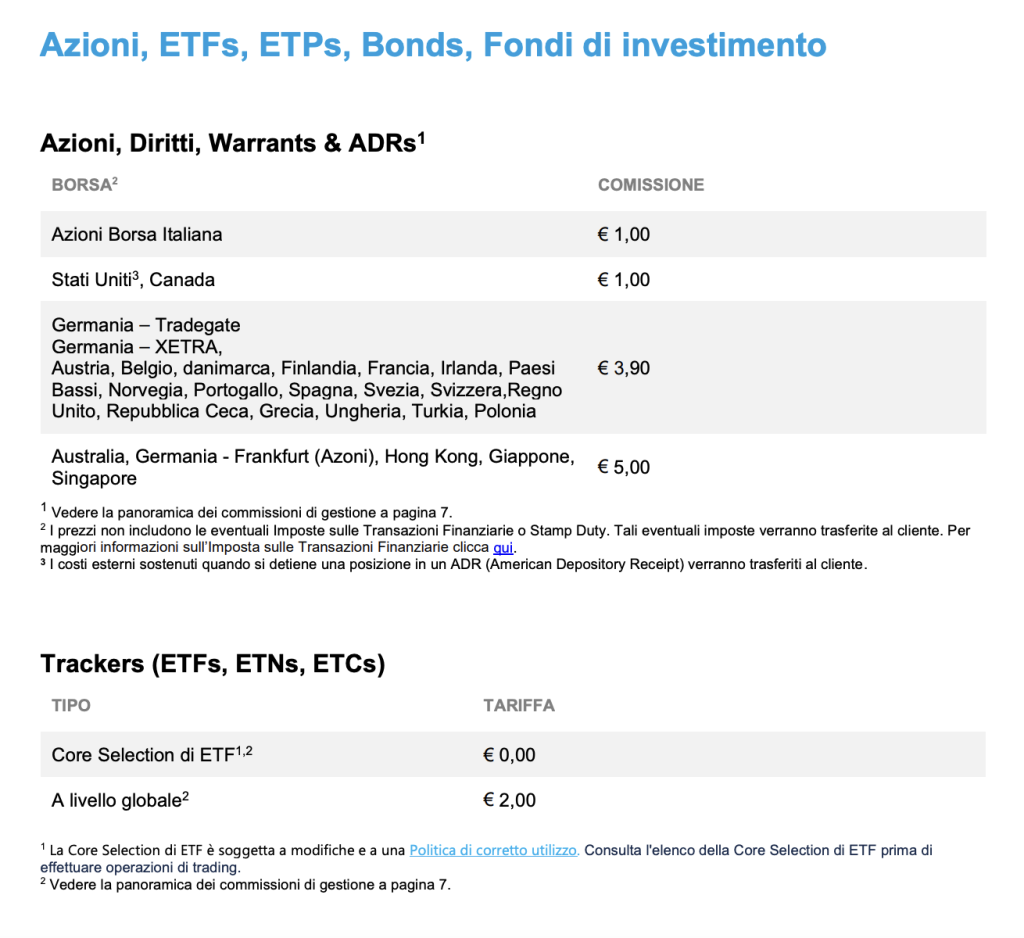

One of the most evident strengths of Degiro are certainly the low commissions, if not null. Invest commission-free in US stocks, Italian stocks and all ETFs.

As you can see, for example, a management fee of €1 and a further fee of €1 are applied to American shares, as is the case for investments in shares on Borsa Italiana.

As far as the core selection ETFs are concerned, they zero the commissions.

I am attaching it summary table:

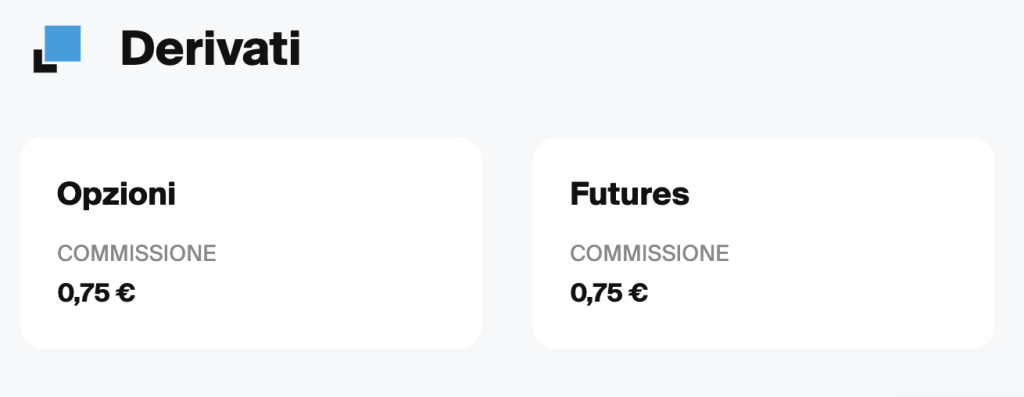

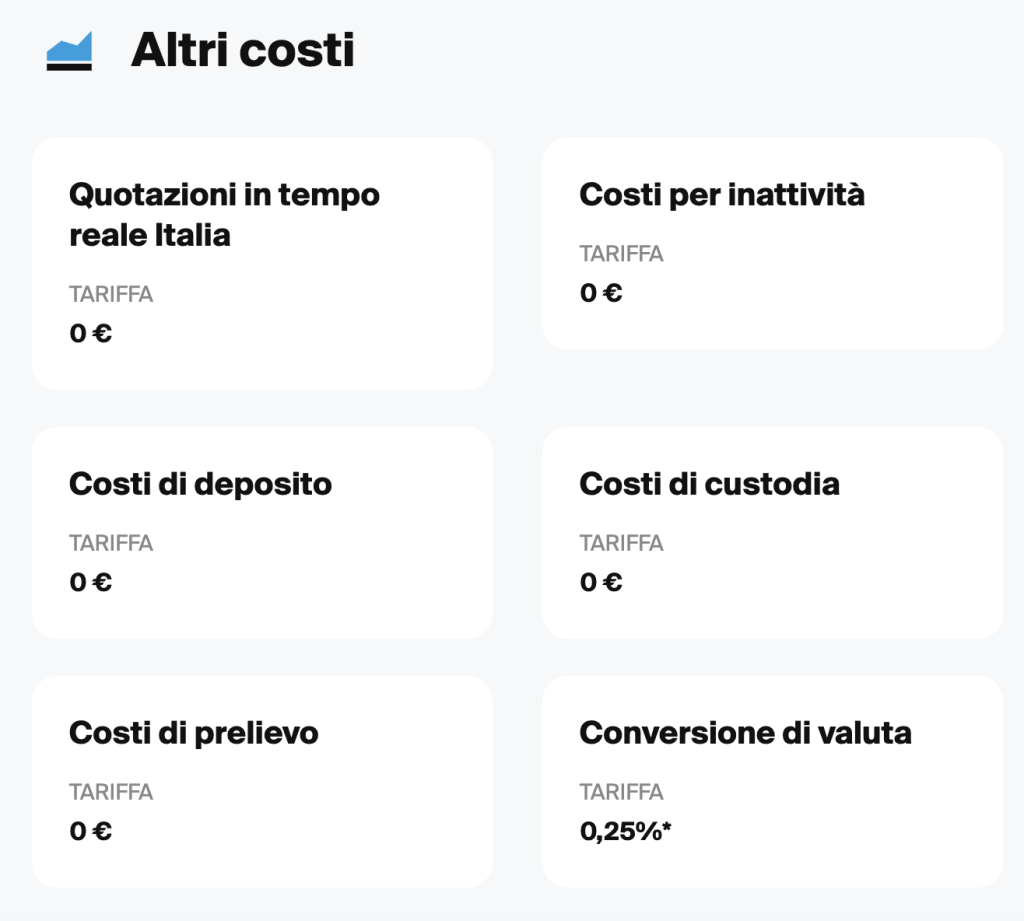

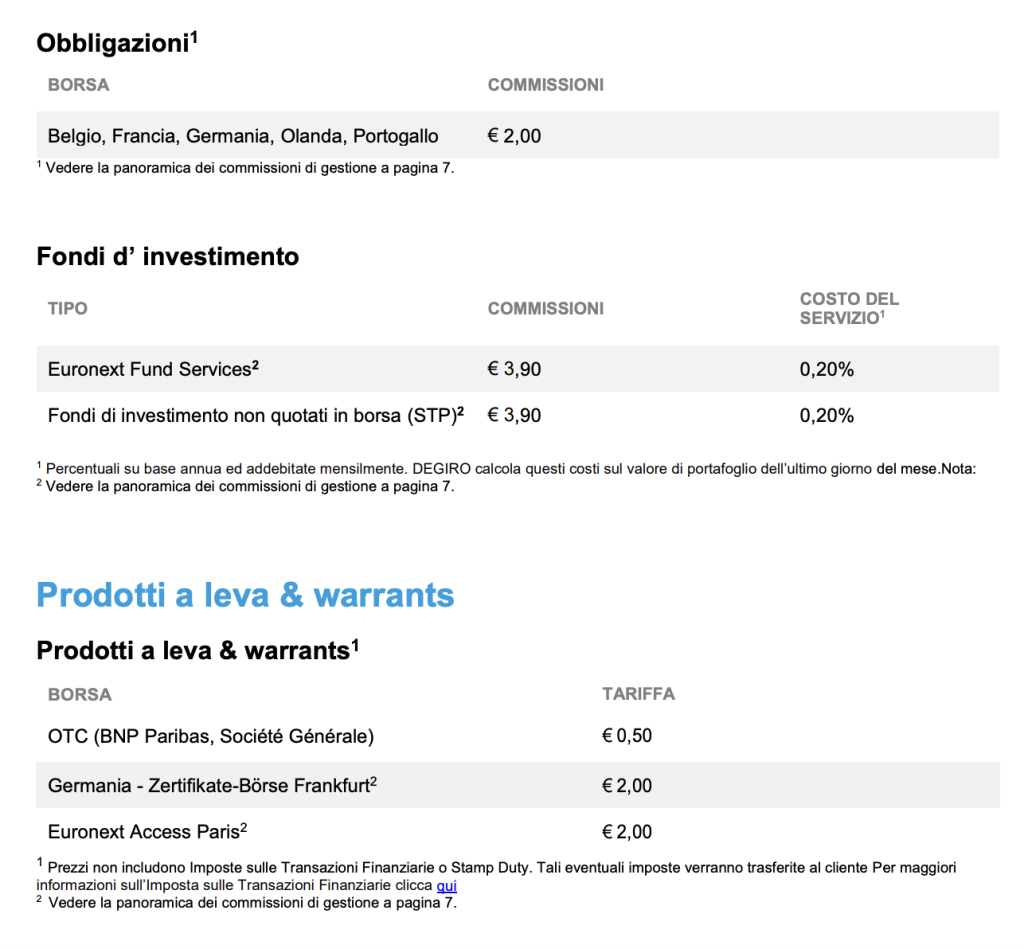

Then there are also the other costs, i.e. those that refer to real-time quotes, deposit costs, and more.

Also in this case I am attaching the table:

Below I attach, in the course of the article, the screenshots taken from the broker’s official information documents, in particular from the document of the Tariff.

>> Open an Account Now <

Management fees

If you place an order through an exchange or other trading platform, then a €1 management fee will apply for all products, excluding tradegate (shares), OTC (BNP Paribas, Société Générale) and Options & Futures (excluding OMX Nordics).

Degiro, on the other hand, does not charge third-party commissions directly, but uses a €1 management fee. This is a fixed fee which covers all costs incurred in order execution.

Connection costs

The broker charges a commission to set up opportunities trading outside the national market, and this is to provide access to a large number of exchanges. This fee applies to those using these exchanges. A pay-by-price policy is applied, so if you use a particular service you’ll be charged a fee, but if you don’t, you won’t incur any additional costs.

For the connection fees you pay a maximum of 0.25% of the total portfolio value (with a maximum charge of €2.50) per year for each exchange, except the Italian exchange.

The connectivity fee for US options is 5.00 euros per bag per calendar month. These charges will apply if you transact or hold a position during the calendar year.

Cost calculator

On the site there is also a section in which you can calculate the costs you would hypothetically incur if you were to invest in a certain way.

You can enter the type of product you want to purchase, the amount of the transaction and the number of transactions made during the year into the calculator. So i will come out annual costs.

Core Selection of ETFs

If you decide to invest in core selection of ETFs in this case the commissions will be borne by Degiro.

In this case, currency, external product and spread costs may apply.

On the website you will find the complete list of Core Selection ETFs in the appropriate section.

It’s a great way to diversify your portfolio, and to make it very easy and affordable. The selection offers a wide range of selected ETFs, for which you will pay only €1 management fee, while the other fees will be paid by Degiro.

As regards i 4 ETF most traded by Degiro’s clients during 2022 they are Vanguard and iShare and are:

- iShared MSCI World;

- Vanguard FTSE All-World;

- Vanguard S&P 500;

- Vanguard FTSE All-World.

How much can you save?

It is possible to save significant amounts compared to major platforms used to go online trading in Europe. Savings are very important across the line of financial products that are offered by Degiro and it is certainly the strong point of this broker.

The statements that speak of average savings can still be consulted on the Degiro website, with tables that offer you a good overview for the analysis of the costs applied by all the main player in this specific sector.

What if Degiro fails?

This question is asked to me often. In reality, if you buy instruments with direct access to the market (to understand: shares, ETFs, funds) there are no particular problems because Degiro is the “custodian” of your securities: imagine Degiro as a sort of safe that “preserves” your securities , you may have some bureaucratic hassle (the markets are highly regulated anyway, it is unlikely that millions of people will be left out) but in essence your money is there.

For the non-invested part, however, Degiro relies on the flatex bank and starting from 2020 on these figures the guarantee is up to 100 thousand euros like a normal deposit account.

Does Degiro act as a withholding agent? Administered or declaratory regime?

How to manage the 730 Degiro? We have to do the tax declaration? This question is asked by many because especially when a platform is foreign, it becomes legitimate to ask what regime is adopted.

In summary, Degiro does not act as a withholding agent and therefore it is not possible to choose the administered regime.

However, while operating under the declaratory regime, the problem can be circumvented by contacting an accountant or by trying MoneyViz, Italian platform that allows you to do everything automatically with low costs and relative ease.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Who is Degiro app convenient for?

Degiro allows you to have access to world stock markets with relative ease and very low costs. In my opinion, the ideal target is represented by those who want to invest independently and are looking for an efficient platform with low costs: you can compare Degiro with the other platforms to get a more complete idea.

Obviously the account is a tool: before making investments it is always important to try to study finance and understand what you are going to achieve.

Its strong point, which should be clear by now that we are approaching the closure, is a decidedly low cost profile, guaranteed above all by direct access to the markets, with a consequent reduction also in routing costs.

Anyone who trades standard products online should definitely take into consideration what Degiro offers and give its investment platform at least a chance. without minimum investment limits and therefore with the possibility of testing its possibilities without committing large sums.

>> Open an Account Now <

Alternative a Degiro

Degiro is a substantially low cost broker which is used by two categories of customers:

- Investors: people with more capital who prefer passive investments or buy and hold strategies;

- Trader: people who, on the other hand, prefer to buy and sell more frequently.

The alternatives, therefore, must be seen in these areas.

If you are an investor, the alternatives are banking platforms or i broker with direct market access: you can find a review here. If you belong to this category, I have prepared this free report with the top 3 zero commission ETFs to invest in.

If you prefer trading and, in general, the gamification investment the best alternative is eToro because compared to Degiro it has a greater interaction with the social trading function. In addition to eToro, here is an overview of main platforms for investing.

To help you, here are some guides:

Additional helpful resources

If you are inquiring about Degiro in all likelihood you invest or are starting to.

On Affari Miei I have been involved in divulging very valuable information for years and I have trained thousands of clients. Here you will find a series of useful resources to deepen your knowledge on the subject:

Good continuation, see you soon!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you to the best content selected based on your starting situation:

>> Start Now <