Last session of the week fluctuating for Piazza Affari recovering from the substantial declines that characterized the past few days. The Ftse Mib closed at 25,918 points, down 0.04% thanks to a convinced recovery at the end in the wake of the positivity of Wall Street. The stock markets this week were heavily affected by the fear of a slowdown in global growth due to the spread of the Delta variant and the potential easing of US stimulus. In this sense, the spotlight is already on Jackson Hole Symposium next week, where Powell could better clarify the Fed’s intentions.

The weekly balance is negative by almost 3% with the Ftse Mib which was pushed back below 26 thousand points, moving away from the 13-year highs reached in the last eighth.

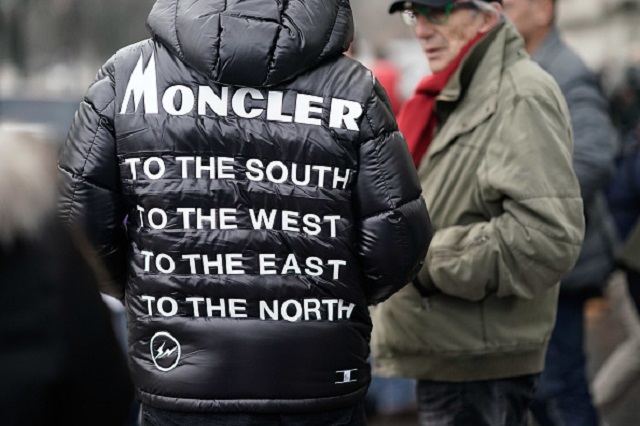

Stellantis and Moncler still in reverse

Stellantis is also down today (-1.15% to 17.14 euros) with the entire European auto sector in need of a breakdown in the wake of production stoppages announced by some big names in the sector such as the Japanese Toyota. The Japanese auto giant has announced that it will suspend production in 14 factories, confirming press rumors that had indicated a 40% reduction in production for the month of September. Volkswagen (Audi) and Stellantis will also have production stops, in particular the latter will have to stop production for at least a week in the Rennes-La Janais plant and for at least three days in Sochaux. Yesterday IHS revised its 2021 production forecast which does not incorporate Toyota’s cut, forecasting between 6 and 7 million less volumes due to the shortage impact in 2021.

The weakness of the luxury sector also continues, with Moncler slipping back by 1.79% confirming the black sheep palm of the week among the Milanese blue chips with a thud of over 12% in 5 sessions. China could introduce measures to limit purchases of products from abroad in an attempt to promote “common prosperity” as stated by President Xi Jinping at the 10th meeting of the Central Commission for Financial and Economic Affairs.

Among the stocks that look at developments in China it also stands out Campari (-0.94%), also conditioned by the possibility that China could introduce restrictions on the sales of distillates produced abroad. Campari’s exposure to China is quite limited: the Asia-Pacific area accounts for 8% of Campari’s consolidated revenues (data as of the first half of 2021) with Australia alone accounting for 5%. The group is more American oriented.

Enel and Diasorin shine

On the other hand, Enel, the heaviest share of the Ftse Mib, which closed up by 1%, returning above the 8 euro wall. Other defensive stocks such as Diasorin (+ 1.68%) and Recordati (+ 0.67%) did well. Among the banks bullish cue for Intesa Sanpaolo (+ 0.53%) and Unicredit (+ 0.39%).

Best and worst of the week

Below is the ranking of the best and worst five titles of the week:

BETTER

1) DIASORIN +6,2%

2) TERNA + 2.4%

3) AMPLIFON +2,3%

4) HERA +1,8%

5) A2A +1.8%

WORST

1) MONCLER -12,7%

2) STELLANTIS -7,8%

3) INDUSTRIAL CNH -7.0%

4) TENARIS -6,9%

5) EXOR -6,7%