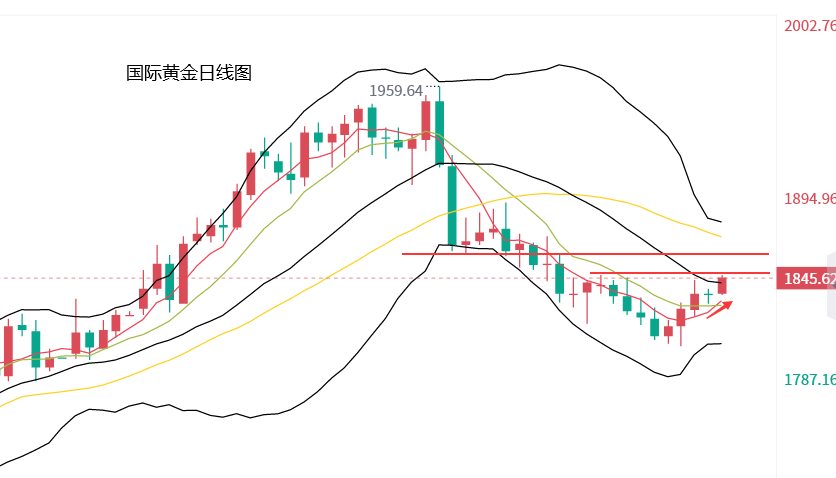

On Thursday, Huang Lichen believed that although gold rebounded in the short term, the fundamentals are still biased towards the bearish side. This will limit the upside of gold, and the price of gold still has the risk of falling again. The middle rail of the Bollinger Band is $1,843, and the lower support focuses on the 10-day moving average of $1,828 and the 5-day moving average of $1,824.

Judging from the subsequent trend, gold fell slightly to $1829 and stabilized and rebounded. This was supported by the 10-day moving average on the daily line. Gold rose on Wednesday. After breaking through the daily 10-day moving average, a transition between pressure and support was formed here. The 10-day moving average became a support level. Gold stepped back here many times to stabilize and rebound. On Thursday, gold prices stepped back again to test the support of the 10-day moving average. It rose after strength, which strengthened the short-term technical bullish signal.

After the gold stopped falling, it continued to rebound upwards. Although the fundamentals are still biased towards the bearish side, the short-term bearish technical signal is gradually weakening. At present, the gold price has stabilized the key pressure line of the previous downward trend, namely the 10-day moving average of the daily line, and broke through the middle track of the daily Bollinger Band within a few days. The 5-day moving average also formed a golden cross with the 10-day moving average. The indicator began to form a golden cross below the zero axis, and the short-term bullish signal for gold has strengthened.

In terms of news, the number of initial jobless claims in the United States announced on Thursday was 190,000, remaining below 200,000 for two consecutive months, indicating that the U.S. labor market continues to strengthen, while the Fed is looking for ways to cool the labor market while controlling inflation. Signs that a strong labor market may prompt the Federal Reserve to continue raising interest rates. At present, public opinion in the market generally believes that the Fed may continue to raise interest rates this summer, and the expectation of higher interest rate targets and maintaining high interest rates for a longer period of time may still weigh on gold prices again.

Gold intraday reference: Gold continues to rebound, and the technical bullish signal has been strengthened. It is recommended to focus on the daily 5-day moving average and the 10-day moving average. At present, the daily 5-day moving average and the 10-day moving average form a key support in the area of 1,832 to 1,829 dollars. The middle track of the daily Bollinger Band forms a short-term support near 1,842 dollars. , Breaking through here will open up room for continued growth, and pay attention to the weekly 10-day moving average of $1,870.