March 22,HuyaRelease 2021performanceAccording to the report, the total revenue was 11.3514 billion yuan, and 10.9144 billion yuan in 2020, a year-on-year increase of 4.0%; attributable toshareholderofnet profitIt was 583.5 million yuan, compared with 884.2 million yuan in 2020, a year-on-year decrease of 34.01%; the adjusted net profit was 454.4 million yuan, and 1.2615 billion yuan in 2020, a year-on-year decrease of 63.98%. Among them, the total revenue in the fourth quarter was 2.8087 billion yuan, compared with 2.9903 billion yuan in the same period in 2020, a year-on-year decrease of 6.07%, the net loss attributable to shareholders was 312.7 million yuan, and the net profit in 2020 was 253.2 million yuan, from profit to loss; The adjusted net loss was 241.7 million yuan, and the adjusted net profit in 2020 was 305.9 million yuan.

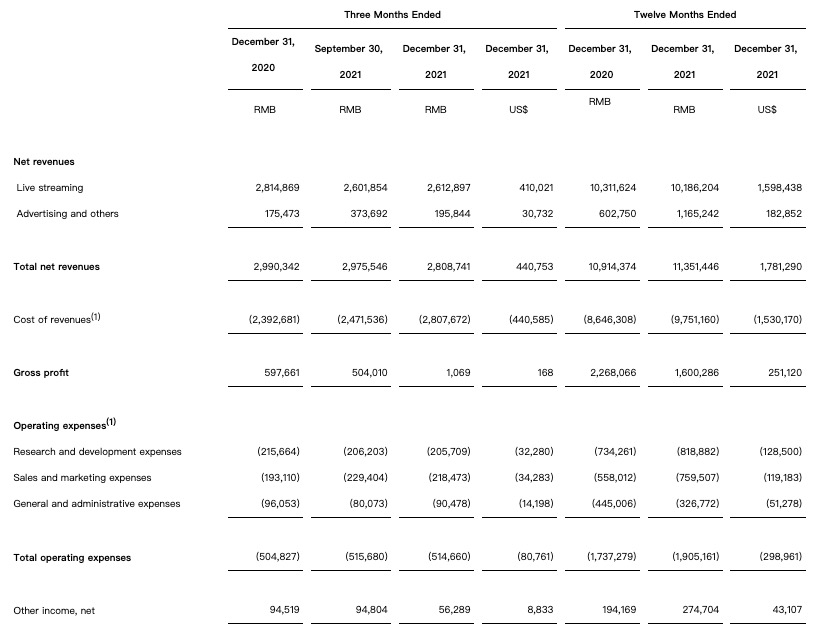

Revenue, 2021,HuyaThe total revenue was 11.3514 billion yuan and 10.9144 billion yuan in 2020, a year-on-year increase of 4.0%. Among them, live broadcast revenue was 10.1862 billion yuan, compared with 10.3116 billion yuan in 2020, a year-on-year decrease of 1.22%; advertising and other income was 1.1652 billion yuan, and 602.8 million yuan in 2020, a year-on-year increase of 93.3%.

In terms of costs and expenses,HuyaThe cost of revenue increased by 12.8% to RMB 9,751.2 million from RMB 8,646.3 million in 2020. Among them, revenue sharing and content costs increased by 18.2% from 7.0868 billion yuan in 2020 to 8.3746 billion yuan; bandwidth costs decreased by 18.8% from 879.2 million yuan in 2020 to 713.7 million yuan in fiscal year 2021; research and development expenses from 7.343 million in 2020 RMB 100 million increased by 11.5% to RMB 818.9 million in fiscal 2021; sales and marketing expenses were RMB 759.5 million, an increase of 36.1% from RMB 558 million in 2020; general and administrative expenses decreased by 26.6% to RMB 3.268 from RMB 445 million in 2020 billion.

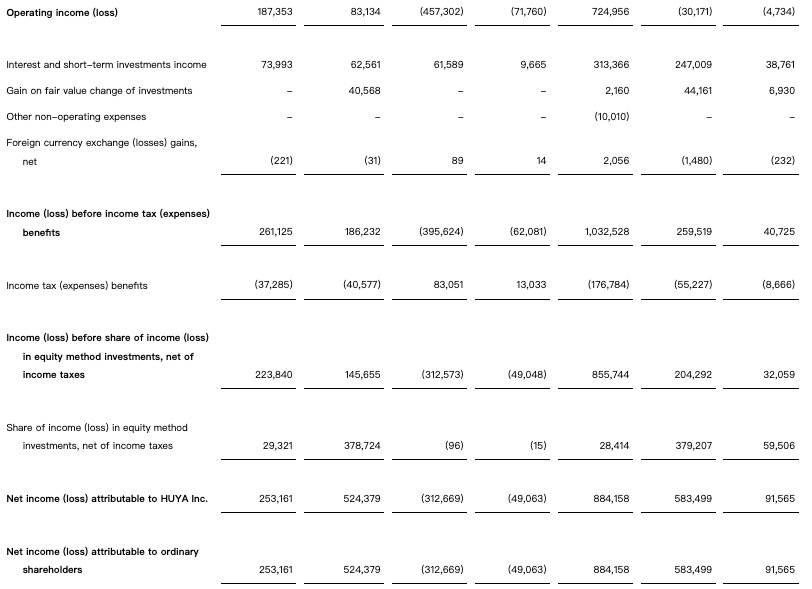

In terms of profitability, Huya’s operating loss in fiscal year 2021 was 30.2 million yuan, while operating profit in 2020 was 725 million yuan; gross profit fell 29.4% from 2,268.1 million yuan in 2020 to 1,600.3 million yuan; gross profit in fiscal year 2021interest rateThe net profit attributable to shareholders was 583.5 million yuan, compared with 884.2 million yuan in 2020, a year-on-year decrease of 34.01%; the adjusted net profit was 454.4 million yuan, In 2020, it was 1.2615 billion yuan, a year-on-year decrease of 63.98%.

From the fourth quarter alone, Huya’s total revenue in the fourth quarter of 2021 was 2.8087 billion yuan, compared with 2.9903 billion yuan in the same period in 2020, a year-on-year decrease of 6.07%, the net loss attributable to shareholders was 312.7 million yuan, and the net profit in 2020 was 253.2 million yuan, from profit to loss; the adjusted net loss was 241.7 million yuan, and the adjusted net profit in 2020 was 305.9 million yuan.Gross profit in the fourth quarter was RMB 1.1 million, compared with a gross profit of RMB 597.7 million in the same period in 2020;interest rateAbout zero, compared to 20.0% in the same period in 2020.

In terms of users, Huya Live’s average mobile MAU in the fourth quarter of 2021 increased by 7.4% to 85.4 million from 79.5 million in the same period of 2020. The total number of paying users was 5.6 million, compared with 6 million in the same period in 2020, a decrease of 6.67% year-on-year.

(Article source: CDC Finance)