Recently, Baofeng Energy (600989) released its 2021 annual report,The company achieved double-high growth in revenue and net profit, the annual operating income was 23.3 billion yuan, a year-on-year increase of 46.29%, the net profit was 7.07 billion yuan, a year-on-year increase of 52.95%, and the operating cash flow reached 10.157 billion yuan, a year-on-year increase of 56%.The company alsoMaintain a low debt ratio for a long time, it will drop to 30.84% in 2021, far lower than the average debt ratio of 37.85% in the chemical industry from 2018 to 2020. The company simultaneously disclosed the 2021 profit distribution plan,Proposed distribution of cash dividends of 2.048 billion yuannon-restricted shareholdersCash dividend of RMB 3.21 per 10 shares (tax included). Beautiful performance growth, high cash flow, low debt ratio and a high percentage of dividends fully demonstrate the company’s long-term investment value.

Baofeng Energy has always regarded adherence to a higher dividend policy as one of the important measures to reward shareholders and investors. With stable profitability and excellent management level, the company has established a long-term mechanism for the common development of employees, shareholders and the company. statistics,From 2019 to 2020, the company’s cumulative dividends reached 6.156 billion yuan, and the total dividend scale led 98% of listed companies in A-shares, far surpassing industry giants such as LONGi (601012), China Coal Energy, and Shanghai Petrochemical (600688). Plus the 2021 dividend plan,Baofeng Energy’s accumulated dividends in the past three years will exceed 8.2 billion yuan。

The General Office of the State Council earlier issued the “Overall Plan for the Comprehensive Reform of the Market-Based Allocation of Factors”, which emphasized encouraging and guiding listed companies to distribute cash dividends and improving the investor rights protection system.Baofeng Energy insists on implementing a continuous and stable profit distribution system. Positive response to national policy.Baofeng Energy has shown a high proportion of returns to investors and shared development achievements. The company continues to maintain high-quality development, and has sufficient confidence and strength for long-term growth。

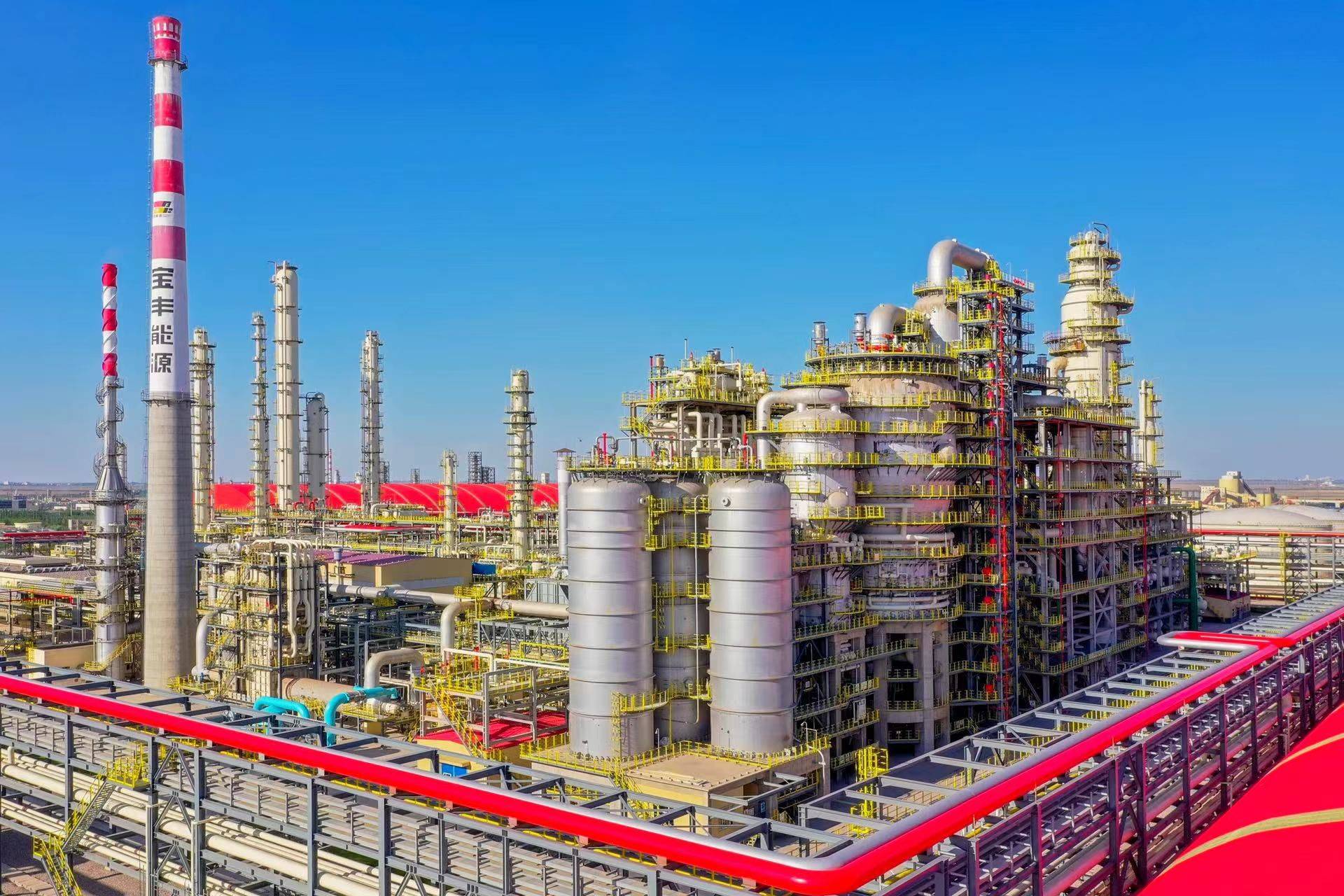

In 2021, in the face of the turbulent and complex international situation, Baofeng Energy will make full use of its advantages of scale, integration and refined management to achieve breakthroughs, and achieve high growth in both revenue and net profit, so as to achieve high returns to shareholders. In addition, the company follows the trend of the global energy revolution and strategically deploys the hydrogen energy industry chain. At present, it has formed the world‘s largest green hydrogen production capacity and is committed to becoming the world‘s largest green hydrogen production plant and supplier. In the future, the company will continue to explore cost advantages, maintain a cost moat, lead the high-quality development of enterprises and industries with technological innovation, and actively contribute to ensuring national energy security and achieving the goal of “carbon neutrality”.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.