Original title: Inventory depends on the market: the hot-rolled coil market may fluctuate next week

Hot-rolled coil: domestic hot-rolled coil market prices fluctuated upward this week. The average price of 3.0mm hot-rolled coils in 24 major markets across the country was 5675 yuan/ton, an increase of 123 yuan/ton from last week; the average price of 4.75mm hot-rolled coils was 5595 yuan/ton, an increase of 122 yuan/ton from last week Ton.

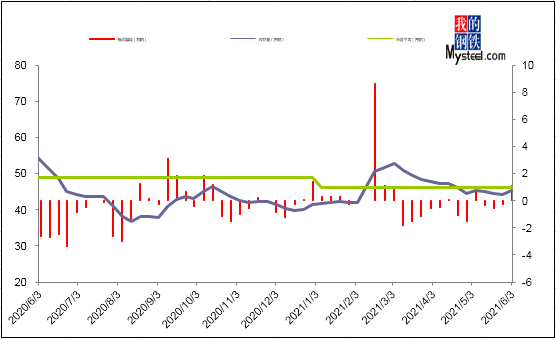

(1) Analysis of Shanghai market inventory trend

Figure 1: Shanghai hot coil inventory change trend chart

On June 3, 2021, the hot-rolled coil inventory in the Shanghai market was surveyed and statistics. This week, the hot-rolled coil inventory of all warehouses of hot-rolled coil was 453 thousand tons, an increase of 11,500 tons from the previous week, and a decrease of 5,000 tons from the previous month. , A decrease of 8.50 tons compared with the same period last year.

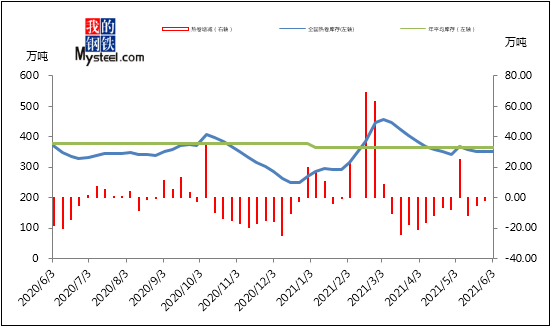

(2) National inventory trend analysis

Figure 2: Trend changes in national hot coil inventory

On June 3, 2021, the inventory of hot-rolled coils in major cities across the country was surveyed and statistics. This week, the total hot-rolled coil inventory in the country was 3.5163 million tons, an increase of 7,100 tons from last week, and a decrease of 177,300 tons from last month. The same period last year decreased by 176,000 tons.

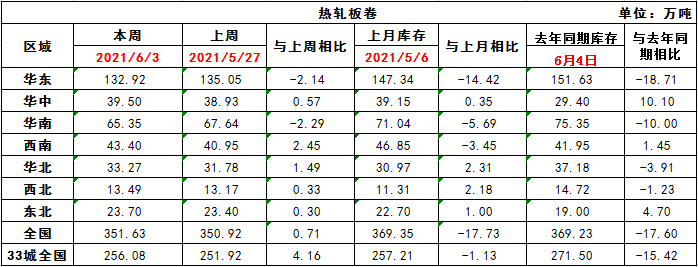

(3) Analysis of changes in national inventory

Table 1: Changes in HRC inventory in major cities across the country (2021.5.28-2021.6.3)

From the perspective of regional inventory data, the region with the largest increase was the Southwest region, which increased by 24,500 tons from last week; the region with the next increase was North China, which increased by 14,900 tons from last week. The region with the largest decline was southern China, which fell by 22,900 tons compared with last week, and the region with the second largest decline was East China, which fell by 21,400 tons from last week.

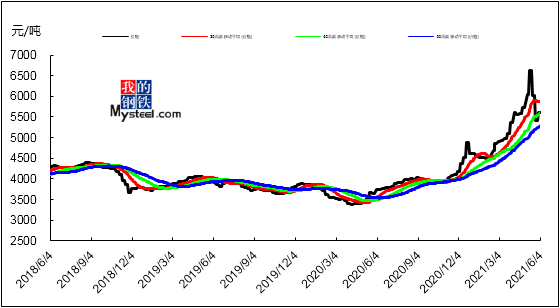

(4) Analysis of Shanghai market price trend

Figure 4: K-line chart of Shanghai hot-rolled sheet price

This week, the Shanghai hot-rolled coil market prices fluctuated upward. As of press time, the mainstream quotations of 1500mm carbon steel coils are 5570-5590 yuan/ton, and the 1800mm wide coils are priced at 58230-5840 yuan/ton. The mainstream price of low-alloy 1500mm is 5720-5740 yuan/ton, and the price of 1800mm low-alloy is 5790-5810 yuan/ton. Affected by the rise in futures at the beginning of this week, the spot market’s confidence has been significantly boosted, and the quotations of merchants have risen sharply. After that, the market was in a volatile market, and the price rose and fell, and the range was relatively narrow. At present, downstream users are still relatively cautious in purchasing, basically purchasing on demand, and market transactions are difficult to release significantly. The output of steel mills remained high, the supply gradually increased, and the market inventory rose slightly. However, considering the cost factor, the merchants were unwilling to sell too low. On the whole, it is expected that the Shanghai hot rolled market prices may fluctuate next week.

(5) Analysis of price trends in major markets across the country

Figure 5: Prices in major markets across the country

This week, the domestic hot-rolled coil market prices fluctuated upward. According to statistics, among the 24 major cities across the country, the city with the largest increase was Beijing, with a cumulative increase of 180 yuan/ton from last week. The next city with a cumulative increase was Wuhan, with a cumulative increase from last week. 170 yuan/ton.

(6) Market review this week and market forecast next week

This week, social inventories increased slightly; this website monitors inventory data in 33 major cities. This week, the total national hot-rolled inventory was 3.5163 million tons, an increase of 0.71 million tons from last week, and a decrease of 177,300 tons from last month, and a decrease from the same period last year. 17.600 tons. At the beginning of this week, the cargo market rose sharply, the spot market confidence was obviously boosted, the quotations of merchants rose sharply, and the high-level transactions were generally average. Later, with the volatile operation of futures, the spot market price also rose and fell, but the range has narrowed. At present, the downstream has been more cautious. Basically, it is still purchasing on demand. The transaction is difficult to release significantly. Merchants still focus on shipments, and there is not much room for market prices to rise or fall. On the supply side: the output of steel mills rose slightly this week. The total amount of on-meter maintenance in steel mills next week is still not large, mainly in the Rizhao area. In terms of inventory: The factory inventory has declined this week, and the social inventory has increased slightly. In the near future, steel mills have continued to invest in the market. Although there has been a easing situation this week, the output has not decreased significantly, and the total amount of factory inventory has limited room for decline. The short-term price increase has not gone to the warehouse, which means that the market supply is still high and consumption is biased. Next week, all markets will show a trend of arrival. Therefore, from these circumstances, the market does not have speculative consumption for the time being. When only consumption is just needed, social stocks may rise to a certain extent.

On the whole, merchants are currently reducing inventories to avoid risks, and profits appear downstream, and the stocks are maintained, but the stock volume is small. The output of steel mills is relatively high, and the warehouses are still being transferred to the market. The short-term pressure will continue to be maintained. The market price is expected to rise and fall next week. Hot coil spot prices are expected to fluctuate next week.

(Article source: My Iron and Steel Network)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.