BTPs and spreads always under the lens of the markets: there is the most hawkish ECBnow ready to raise rates this year; there is war in Ukraine, with the consequent phenomenon of expensive energy ergo caro-bills. And in 2023 there are also political elections, and not only in Italy.

The coexistence of these factors is re-evaluated by strategist at Goldman Sachsin the latest research dedicated to the issue of sovereign debts in the euro area, in particular of the countries of Southern Europe.

“Debt Sustainability in Southern Europe: One Strength, Three Challenges”. That is: “Sustainability of the debt in Southern Europe; one strength, three challenges “.

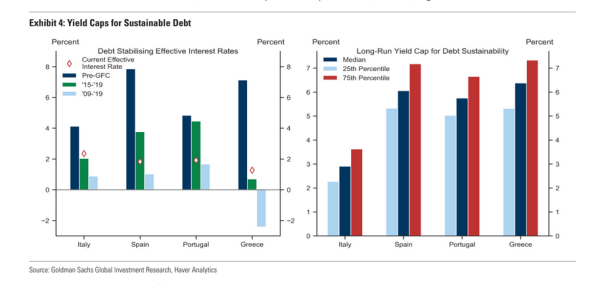

Strategists focus on the factor public debt sustainabilityannouncing that they have updated their estimates relating to “yield cap”, or “at that level of (sovereign) bond yields above which debt-to-GDP ratios are expected to rise without significant policy changes occurring”.

LAWS

Recession and new debt record, Mazziero’s forecasts for Italy. Watch out for pressure on BTPs and spreads

BTP rates and debt sustainability: Goldman Sachs sets the yield cap

Goldman Sachs explains how the revision of the yield cap came about: “First, let’s calculate what is the maximum interest rate actual– yield that considers the average of the maturity of the debt – which would be necessary to prevent the debt-GDP ratio from growing, based on historical and current assumptions. (Graph 4) “Subsequently – reads Goldman’s analysis – we draw on a less severe notion of debt sustainability, assuming that the debt-to-GDP ratio is simply stationary in the long term ”.

The strategists note that, “even if this definition is less strict, the yield caps are lower than those previously estimated because, in line with (our) previous work, we take as a reference a cycle of higher interest rates whenever effective interest rates exceed nominal growth, and we consider the current maturity structure of existing debt ”.

Experts admit that “the uncertainty that characterizes these estimates is high, as it is closely linked to the sustainability distribution point that you decide to choose”.

The case of the sustainability of the Italian debt is reported, where we read that “the Italian average weighted yield can rise up to 3.75% without affecting the sustainability of the debt “; but upward pressure on debt would occur with a yield already equal to 2.3% “. (Graph 4, right) “.

So Goldman Sachs sums it up:

“In anticipation of the ECB’s (interest rate) hike, yields across the euro area increased significantly, bringing the sustainability of southern European debt back to the center of market attention “.

It must be said that, “even if the prospects for southern European real growth remain vulnerable due to the energy crisis and the war in Ukraine, the short-term buffer provided by high nominal growth and persistent high nominal growth, persistent European tax support (Recovery Fund and, more recently, REPowerEU) and the gradual tightening of monetary policy offer the region further time to address its structural weaknesses ”.

Furthermore, “The relatively long average maturity of public debt (from 7 years in Italy to 21 years in Greece) it will help to mitigate the short-term impact of higher yields on the cost of debt ”.

Italy: Recovery Fund reforms at risk with 2023 elections?

There is however a ‘but’:

“On the horizon are asymmetrical risks” and investors, despite this, could try to understand how the area is exposed, given the pressure exerted by rising yields on structural vulnerabilitiesespecially in the case of Italy “.

Just to test this exposure ”Goldman Sachs updated its estimates on the maximum yields, arriving at the conclusion that, while it is true that the debt sustainability framework highlights that most South European countries have yields that travel below those levels that would exert upward pressure on debt ratios (a sort of of danger thresholds), Italy is a significant exception, since its current sovereign debt is already approaching our estimated yield (equal to 2.75% for 7-year BTP yields).

Of course, an undeniable crutch is the Recovery Fund:

“Although the risks to the short-term growth outlook persist, due to the energy crisis and the invasion of Ukraine (by Russia), Southern Europe can count on multi-year loans from the Recovery Fundthe main program of the NextGenerationEU initiative ”.

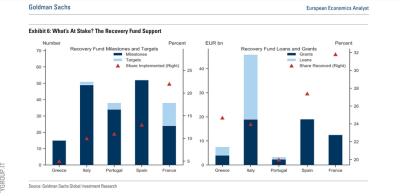

Goldman Sachs recalls that “the help that the plan can provide depends on the ability of Member States to achieve pre-agreed qualitative and quantitative results” and that, “at the moment, only five of the 27 EU members have operated actively, reaching part of the milestones and objectives and consequently receiving the first disbursements from the European Union ”.

Said this, “four of these countries are located in Southern Europe ”.

The stakes are very high, in proportion to what has been defined, especially for Italy, an opportunity not to be missed.

In general, “the member states of Southern Europe will be the beneficiaries of approximately 60% of the current total allocation of the Recovery Fund, in the period 2021-26“.

“Given the amount of fiscal resources involved, the future growth of the region (euro area) will depend on the process and also on the speed with which reforms and investments will take place, the implementation of which will allow for the disbursement of loans”.

Surely, “the execution of such detailed programs of structural change requires member states to honor their commitments over time. It is therefore essential – underline by Goldman Sachs – to evaluate whether upcoming elections in the area may interrupt political continuity and prevent programs from guaranteeing growth aid – reinforced by REPowerEU and so important for debt sustainability – of Southern Europe.

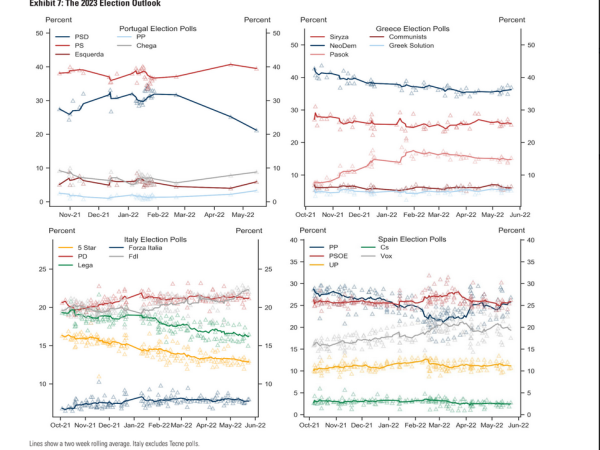

2023 is defined by Goldman Sachs a very significant election year for Southern Europeconsiderate the elections of Italy and Greece scheduled for next spring and seen the vote also in Spain scheduled for autumn.

It is noted that “for the markets, elections acquire greater relevance if we consider that, as potential subversions of the status quo, they can jeopardize political continuity. And if in Portugal the socialist party continues to gather strong support, as well as Nea Democratia in Greece, the competition (between the parties) is much tighter in the other two economies among the largest in Europe, namely in Italy and Spain.

“In Italy the risk of a political split is even deeper, given that the Draghi government will come to an endwith the current coalition that supports it that will break into two main blocs: the center-left coalition around the Democratic Party and the center-right coalition, with the extremist right of the Brothers of Italy (FdI) currently in the lead to the polls “.

In particular, still in Italy “a change in the governing coalition will probably reinforce the uncertainty about creation of the Recovery Fund, on its impact on growth and, therefore, on support for debt sustainability “.

In short, for Goldman Sachs, Italy remains “the country most at risk of political discontinuity”, with the “upcoming elections that could lead market participants to find the opportunity to understand to what extent the Italian debt is sustainable “.