(updating)

The more hawkish Fed gives a nice shock to forex, in particular to the dollar. And, consequently, to the euro. So much so that analysts at Goldman Sachs and Deutsche Bank promptly abandoned theirs bullish view on the single currency. On the other hand, today a new bomb has exploded on the heads of traders. The bomb is called James Bullard, president of the St Louis Fed.

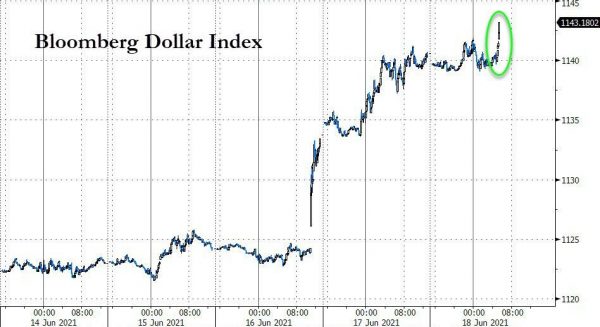

Result: the week that is closing is the best week for the dollar since September, with the Dollar Index gaining 1.6%, leaping to a record in more than two months of 92,010 points.

In a diametrically opposite way, the week was instead the worst for the euro since last October, certified by a decrease of -1.6%. In the Wednesday session alone, the euro capitulated down to -1.1%, reporting the strongest daily decline since April 2020.

The balance could also worsen, given that a few minutes ago, in fact, a further cold shower for the euro and for the equities came with the statements of James Bullard.

Bullard said he sees interest rates hike as early as 2022 as inflation rises faster than previously predicted. The Fed exponent, interviewed by CNBC, remarked that the expectations are now a year better than expected on the front of the economic recovery and inflation is also going beyond expectations. Bullard’s estimate is more hawkish than the averages that emerged from the Federal Open Market Committee (FOMC) this week, with dot plots pointing to up to two increases in 2023. Markets skid, Dow Jones opens down more than 400 points, the euro also breaks through the $ 1.19 threshold.

Fed announcements and now Bullard shocks depress the euro

The more than natural reaction if one compares the outcome of the FOMC meeting – together with Bullard’s words now – to that of the ECB meeting, last June 10.

After the two-day meeting that ended the day before Wednesday, June 16, the monetary policy arm of the American central bank announced that it had left the fed funds target unchanged at the range betweeno zero and 0.25%, however indicating that rates could be raised as early as 2023; only in March did the Fed report that it saw no need for any monetary tightening at least until 2024.

Noteworthy is the change in the dot plot – a document that indicates the expectations of each member of the FOMC, the monetary policy arm of the Fed -, which showed that the expectations of the Fed are now, on average, of two rate hikes in 2023.

“Inflation has risen dramatically and will remain high,” said the Fed chairman. Jerome Powell, acknowledging that “the possibility exists that inflationary pressures will persist”. For this reason, “if we saw signs of inflation that was persistently moving above the target, we would be ready to adjust the position of monetary policy”.

At the same time, Powell called on the markets to take what emerged from the dot plot with a grain of salt: a clarification that has further confused the markets.

Not the dollar, however, which started pricing the prospects right away a Fed tapering ahead of schedule.

In fact, the reaction of the forex market operators was immediate, who hastened to close the their dollar short positions, following the central bank meeting. On the other hand, if the Fed seems to have changed its register, the ECB of Christine Lagarde has not done so and / or is doing the same. continues to lock down its pandemic QE, PEPP, with which it buys assets worth € 80 billion a month every month.

Lagarde has made it clear that it is too early to discuss the end of the purchases made with the anti-Covid-19 bazooka.

Goldman Sachs herself wrote an ad hoc note, with a title that sums it all up: “European Daily: ECB — No Rush to Follow the Fed”, or “ECB-No rush to follow the Fed”.

Euro-dollar: Goldman Sachs comment

Goldman analysts expressed themselves as follows:

“We do not believe that the Governing Council (of the ECB) will follow the Fed in communicating an early timing of its exit policy, including changes to the APP plan or the possibility of a first rate hike“. “Inflationary pressures remain much more contained in the euro area, and inflation has been persistently and significantly below the ECB’s target for years”.

Consequently, Goldman Sachs experts wrote, “we believe the ECB will stick to a policy highly accommodating for much longer than the Fed will, with QE continuing until mid-2023 and no rate hikes until 2025. We expect the ECB’s revised strategy to reinforce the (monetary) policy divergence against that of the US), with the adoption of a symmetrical inflation target of 2% and stronger forward guidance, which will indicate that the policy will remain accommodative, in the period of the recovery, in a significant way ”.

It is therefore only natural that Zach Pandl, co-head of Goldman Sachs’ global forex and emerging markets strategy division, wrote that “the more hawkish expectations about the Fed and the continuing debate on tapering represent an obstacle for those who are short on the dollar in the short term “.

Pandl, however, also specified to continue to “estimate a general weakness of the US dollar, due to the high valuations of the currency and the global economic recovery ”.

Same thing for George Saravelos from Deutsche Bank, who stressed that “there is now a higher margin for repricing the front end of the real yield curve” and that there is also room for “higher volatility”.

Both factors, Saravelos said, I’m bullish for the dollar and they show that the “support that the Fed was providing the euro-dollar is no longer there”.

Of the same opinion too Commerzbank strategists who, in their “Daily Currency Briefing”, wrote that “the US central bank is ahead and the result is that the dollar will probably remain well supported against the euro”.

At the same time, analysts from Commerbank’s forex division predict support for the euro-dollar in the near term is $ 1.18, with Ulrich Leuchtmann commenting: “A euro-dollar ratio of $ 1.20 should be justified. But a level at $ 1.18 is not“.