Jeremy Grantham, famous investor known for his alerts on speculative bubbles, has already shocked traders and investors around the world, talking about super bubble on Wall Street, and fearing a collapse at record rates for the US stock market; and is already back in the spotlight with an even more alarming and urgent message.

During the interview given to the broadcast Front Row di Bloomberg, the expert issued another goosebumps verdict: The Goldilocks period of the last 25 years, he said, is at an end and the world must prepare for a dry commodity future, characterized by inflation, slower growth and a shortage of workers (a phenomenon that has already been manifesting itself for quite a while in the United States).

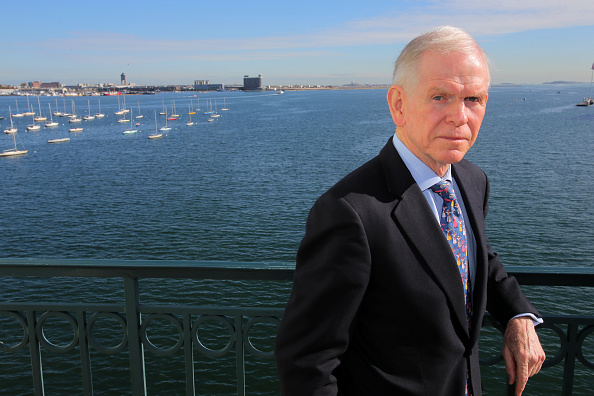

Co-founder of Grantham management company, Mayo & van Otterloo ((GMO), 83, Grantham didn’t give the markets a great way out.

Jeremy Grantham: Let’s say goodbye to the low prices of oil, nickel, copper. Inflation is everywhere

Forget “the low prices of oil, nickel, copper” – warned the world-famous investor – Climate change is manifesting itself with heavy floods, severe droughts and higher temperatures, all factors that certainly do not help crops “. Quite the contrary: they contribute to their progressive and inexorable destruction.

In such a situation, the sentence is almost physiological:

“We will live in a world of bottlenecks and price booms everywhere.” Something inevitable, the unfolding of which no one will be able to stop, seen the scarcity of raw materials, the Baby Boomers who are preparing to retire, falling birth rates, maturing emerging markets and the explosion of geopolitical tensions:

Just last week Grantham had unveiled the Fourth Super Bubble in the history of the United States, launching an alert on the imminent arrival of a crash and advising investors to escape from US equities.

The investor said he believes that, as in the 1929 crash, the 2000 dot-com crash and the 2008 financial crisis, this bubble will burst, with the result that the S&P 500 will capitulate by almost 50% compared to the peak of January 4th, now facing a powerless Fed. And this, Grantham admonishes, because “we have gone way beyond the planet’s ability to bear us in the long run – nature is starting to die. And, in the end, if we don’t do something, we too will start dying ”.

Grantham – who runs a $ 2.12 billion foundation, born to protect the environment – he certainly did not wake up suddenly: for about 10 years he has shown all his skepticism towards the astronomical valuations of equities, shrugging his shoulders in the face of the fervent enthusiasm that accompanied the bull market.

Not everyone always took him seriously, as his ‘Open Heaven’ warnings didn’t always come true.

But the problem of climate change is certainly not his invention, nor is the great retirement of the Baby Boomers and the scarcity of commodities and jobs. Not for nothing has inflation already spiked in the United States and the rest of the world. It is not for nothing that the Fed is talking about a more or less hawkish Fed: the withdrawal of historical monstrous liquidity does not only concern the markets and the stock exchanges. Inflation affects the whole world: and perhaps the most disturbing thing, as Alessandro Fugnoli, strategist of Kairos also wrote, is the nature of this inflation, which started up mainly for the rigidity of supply and not for the resurrection of demand.