Every reporter: Xu Shuai Every editor: Zhang Haini

A rare scene occurred in the capital market: five listed companies all increased their capital to the same target, and the capital increase included Ganfeng Lithium (002460, SZ), which has a market value of 100 billion.

On the evening of September 17, Ganfeng Lithium, Wanbangda (300055, SZ), Zhengping (603843, SH), Shunhao (002565, SZ), and Lanxiao Technology (300487, SZ) simultaneously issued an announcement saying that Investment and capital increase Qinghai Jintai Potash Co., Ltd. (hereinafter referred to as Jintai Potash). According to reports, the target plan has a 10,000-ton/year lithium carbonate production line, which mainly uses salt lake lithium extraction technology.

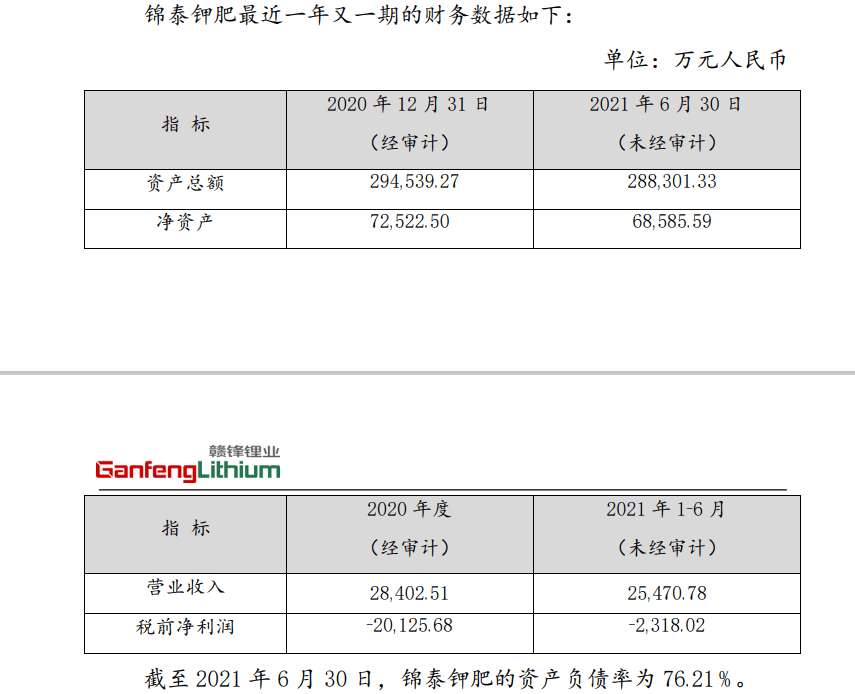

Judging from the financial status of the target, in the first half of this year, the target revenue was 255 million yuan and the net profit loss was 23.182 million yuan (unaudited). As of June 30, 2021, Jintai Potash’s asset-liability ratio is 76.21%. The “Daily Economic News” reporter noted that although the capital increase party is star-studded, the share repurchase conditions are also stipulated in the agreement. One of the conditions is that the audited net profit after deducting non-recurring gains and losses in 2022 is negative.

Hundreds of billions of lithium giants increase capital for potash fertilizer targets

On the evening of September 17, Ganfeng Lithium, Wanbangda, Zhengping, Shunhao, and Lanxiao Technology simultaneously issued an announcement stating that they would invest overseas and increase capital in Jintai Potash.

Specifically: Qinghai Liangcheng Mining Co., Ltd., a wholly-owned subsidiary of Ganfeng Lithium Industry, intends to increase the capital of Jintai Potash by 705 million yuan with its own funds, of which 31,331,700 yuan will be the newly added registered capital of Jintai Potash, and the rest will be included in Jintai. The capital reserve of Thai Potash. After the completion of this transaction, Qinghai Liangcheng will hold 15.48% of Jintai Potash; Shunhao intends to use its own funds of 150 million yuan to increase capital in Jintai Potash, of which 6.67 million will be included in the registered capital; Lanxiao Technology will To Jintai Potash’s 200 million yuan debt to subscribe for the 4.3908% equity of Jintai Potash after the capital increase, corresponding to 8.89 million yuan of newly-increased registered capital; Wanbangda invested 500 million yuan in cash to increase its capital and shares. After the capital increase is completed, the company will hold approximately 10.98% of Jintai Potash; after the capital increase, Zhengping shares will hold 2.19% of Jintai Potash.

In addition, Jintai Potash’s original shareholder Zhaoxin Shares (002256, SZ), and six listed companies gathered in Jintai Potash.

The reporter of “Daily Economic News” noticed that these six listed companies are also star-studded. There are lithium mining leader Ganfeng Lithium, there is a former industrial hemp leader Shunhao shares, and there is also a salt lake lithium extraction leader Lanxiao Technology. There is also this year’s 3 times bull stock Wanbangda.

Image source: screenshot of announcement

Based on the announcements of all parties, one of the reasons why the subject is favored by the collective is potash fertilizer.

According to data from the business agency, the average price of potassium chloride in Qinghai has temporarily stabilized at 3,210 yuan/ton. The price has increased by more than 20% from June.

A veteran who has been engaged in the potash industry for a long time told reporters that the potash industry market is indeed good this year, and there are also some cases of mergers and acquisitions in the industry.

However, compared with potash fertilizer, the greater concern of all parties is the salt lake lithium extraction project of the target company.

The target needs to be profitable next year

According to reports, the subject is committed to the comprehensive development and utilization of salt lake resources, mainly for the mineral development of the Balenma Sea salt lake resources, and is engaged in the mining, production and sales of potash fertilizer, lithium salt and borate.

In terms of mineral exploration and mining, Jintai Potash has obtained the exploration license and mining license issued by the Qinghai Provincial Department of Natural Resources. It has mining rights with an area of 197.961km² and a licensed production of 60,000 tons of potash per year. Exploration right with an area of 174.14km². In terms of production capacity, Jintai Potash has a production capacity of 150,000 tons/year of potassium chloride, 200,000 tons/year of potassium sulfate, 100,000 tons/year of agricultural large-particle potassium chloride and 200,000 tons/year of potassium magnesium sulfate. . In addition, a 10,000-ton/year lithium carbonate production line is planned. The technology used by Jintai Potash is to extract lithium from salt lakes.

From the perspective of financial data, in 2020, the target operating income was 284 million yuan and the net profit loss was 200 million yuan; in the first half of this year, the target revenue was 255 million yuan and the net profit loss was 23.182 million yuan (unaudited). As of June 30, 2021, the total assets of the target are 2.883 billion yuan, but the net assets are only 690 million yuan.

Image source: screenshot of announcement

Jintai Potash’s asset-liability ratio is 76.21%. In this transaction, Jintai Potash was valued at 2.7 billion yuan before the capital increase. It is not difficult to find that this valuation is quite a premium over net assets.

The “Daily Business News” reporter noted that the parties to the capital increase agreement have a common condition-share repurchase restrictions.

If the target’s 2022 audited net profit after deducting non-recurring gains and losses is negative and an authoritative accounting firm cannot issue a standard unqualified audit report, Li Shiwen needs to repurchase the shares.

The reporter found that despite the joint capital increase of all parties, Ganfeng Lithium requires a little more conditions. For example, the general manager of Jintai Potash was nominated by Ganfeng Lithium. Li Shiwen and Jintai Potash promised to make all lithium products produced by them, co-produced or commissioned by them, and 70% of the brine raw materials to be directly sold (converted to lithium carbonate equivalent) No less than 5,000 tons/year) to Ganfeng Lithium.

According to the above-mentioned 10,000-ton/year lithium carbonate production line plan, this means that half of the target’s production capacity will be supplied to Ganfeng Lithium.

Daily economic newsReturn to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.