Co-founder of Affari Miei

January 19, 2024

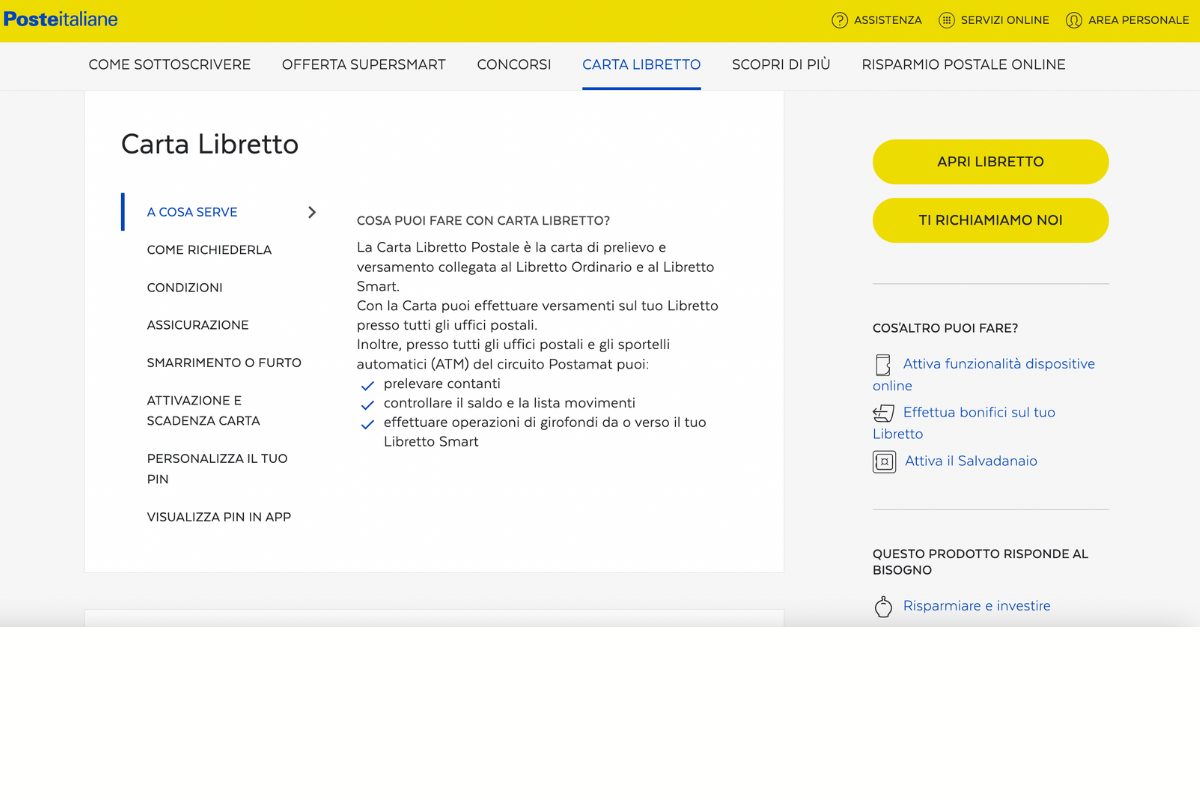

All post office passbook holders can now avail of the post office pass book card. It is not mandatory but if not collected the disadvantages for the owner of the booklet can be many.

First of all, the postal book card is not a debit card, so much so that with it it is not possible to purchase in various public establishments by paying as if it were an ATM.

Let’s now see together how it works, what the main features of this card are, whether it has an IBAN and what happens if you decide to do without it.

Let’s start!

This article talks about:

Postal booklet paper: basic information

It makes having the paper version of the savings book superfluous and, above all, it streamlines the procedures for withdrawing and depositing money.

These operations, using the card, can in fact be carried out either through the POS or through the ATM.

The same goes for checking your balance and all movements made. However, withdrawals can only and exclusively take place through the circuits POSTMAT present in almost every municipality.

To summarize, if you have a postal passbook card you can carry out the following operations:

Make payments into your savings account at all post offices and without limitations; Withdraw cash; Check the balance and the movements made both at post offices and at ATMs; Carry out Girofondi transactions from or to your smart passbook.

Postal booklet paper: some limitations

Among the disadvantages we find two new limitations regarding the possible sums to be withdrawn: 600 euros per day from the ATM (POSTAMAT circuit only) and 2,500 euros maximum withdrawal per month, always through the POSTAMAT ATM.

As previously mentioned, the creation of this card is not mandatory, but by not requesting it the owners of postal savings books will have some possibilities removed.

For example, without it, maximum limits will be imposed if the person tries to withdraw in a post office other than the one where the passbook was issued.

Furthermore, not all holders of postal passbooks can request this card: those who own a passbook with joint ownership and therefore with a joint signature cannot request it.

An advantage is the activation of insurance against theft of money withdrawn for pensioners in possession of the card. The insurance will cover up to a maximum of 700 euros.

Bank transfer to the Smart Postal Booklet: how to request the IBAN

Passbook card holders, if they have a Smart postal booklet, they can make bank transfers to it. Just go to a post office and ask for your IBAN.

The bank transfer can be made either by your own Postal account or by others conti at banking institutions, as long as they are registered in the name of the holder of the passbook and communication has been given to the post office.

The same thing applies in case of postal transfer from an account opened at a Poste Italiane branch.

Costs

I costs of this card are to be inserted in the “advantages“, since the annual cost is zero euros, as is the cost in the event of blocking or loss of the card. There are also no annual fees or commissions on deposits or withdrawals.

How to request it

The passbook card can be requested at the post office where you opened the savings account, while if you requested the passbook in dematerialized form, then the passbook paper is issued immediately, without the need to request it.

Furthermore, the issuing of the card is not permitted in the case of a jointly signed passbook.

The paper and the relevant PIN they are delivered directly to the post office, or if you have opened an online booklet, you will always receive online instructions on how to obtain the PIN online.

If your card is lost or stolen, immediately call:

from Italy the number: 800 00 33 22 from abroad the number: +39 092 82 44 33 33.

Both numbers are available to be contacted 24 hours a day.

Insurance

For all those who hold the Postal Book Card and who credit their pension there is the possibility of having free insurance against cash theft.

In fact, if you withdraw from post offices or Postamat ATMs, you are covered for the next two days by free insurance against theft, up to a maximum of 700 euros per year.

My Business Opinions

We have reviewed all the features of the booklet paper proposed by Italian post.

This is a useful product, as relying on the post office has always been considered a good solution.

I don’t have much to add on this product, if not, I recommend checking the differences on the official website and then choosing the one that best suits you, or moving towards a banking product.

Additional helpful resources:

Before saying goodbye, I would also like to leave you with some useful resources with which you could begin an investment journey based on your knowledge and the characteristics of your risk profile:

Happy continuation on Affari Miei!

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now