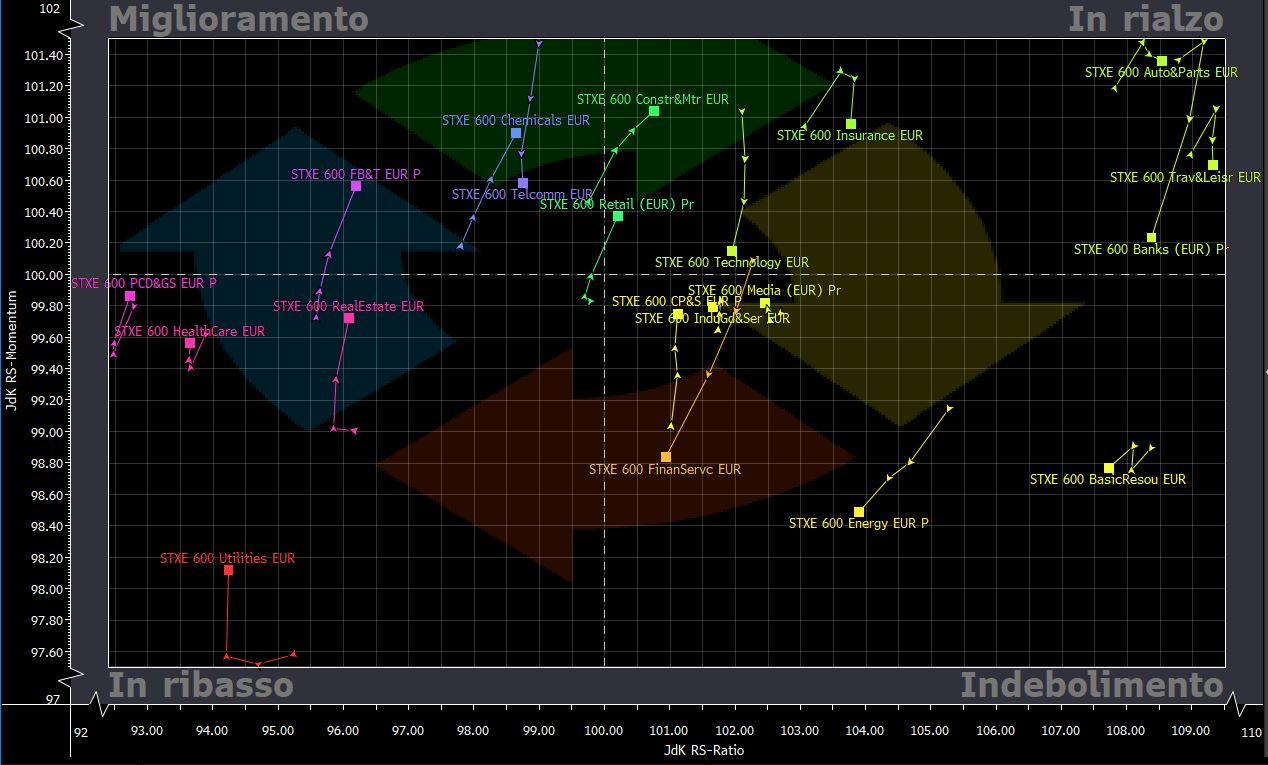

The best: banks, automotive and travel sectors slow down, construction and materials strengthens with the Retail sector

Let’s see together compared to last week which European sectors are confirming the strength and which ones have slowed down or reversed the trend.

Compared to last week, sectors that had previously expressed greater relative strength and momentum confirmed a week of weakening in terms of momentum. This is especially true for the banking sector which had dominated the scene for a month now. So also for Automotive and Travel and Leisure. Of the three, the most marked weakening remains in the banking sector. For the first week, insurance also denotes a net loss of momentum. On the other hand, the construction and materials sector did well, confirming growth in both momentum and relative strength in the sector of leaders. Interestingly, the sectors that have dominated the scene as leaders in recent months (mostly cyclical) have started a phase of weakening. On the other hand, signs of recovery give the defensive. An interesting indication.

The weakening of the index also continues Technology. On the other hand, in the “Weakening” sector, that of Financial Services, with Energy and it Basic Resources.

Highlights: Chemistry and Food & Beverage in recovery

They are confirmed in the quadrant of improving sectors (top left) STOXX Europe 600 Telecommunications, which also this week, however, saw a net decline in momentum (therefore to be monitored). On the other hand, the sector of the Chemistry and, among the defensive ones, the sector also improved Food&Beverage and Tobacco.

The Worst: Defensive still suffering with Real Estate

In the quadrant of the sectors “In decline” the defensive sectors are confirmed with Utilities, HealthCare and also the Real Estate, which, however, are beginning to show the first signs of recovery. This is a signal to monitor, to understand if we are in sight of a more important portfolio rotation from cyclical to defensive, or just a momentary transition.

Quick guide to reading the Relative Rotation Graph

The Relative Rotation Graph (RRG), is a tool based on methods and algorithms developed by Julius de Kempenaer. This tool is very useful for analyzing trends in relative strength of different equity sectors against a benchmark and the momentum. In particular, the real power of this tool lies in its ability to plot relative performance on a graph and show the sectoral rotations. The RRG uses four quadrants to define the four phases of a relative trend: “weakening”, “falling”, “improving” and “rising”. Sectoral rotations therefore consist in the gradual passage of sectoral indices from one quadrant to another.

To correctly read the RRG it is necessary to understand the meaning of the two main inputs underlying the instrument: JdK RS-Ratio and JdK RS-Momentum. The JdK RS-Ratio, present on the horizontal axis, is in fact an indicator of relative strength and tells us if the sector index in question, for example the STOXX Europe 600 Banks, is outperforming or underperforming the benchmark, in this case the STOXX Europe 600. A JdK RS-Ratio equal to 100 in fact implies a movement of the sector that can be overwritten with that of the benchmark, therefore with little added value. A JdK RS-Ratio greater than 100 implies greater relative strength, while less than 100 implies lower relative strength. The JdK RS-Momentum instead it is an indicator of momentum and tells us how quickly this movement of outperformance or underperformance of the sector on the benchmark occurs. Also in this case JdK RS-Momentum equal to 100 tells us that the sector has developed a trend strength equal to that of the benchmark. A JdK RS-Momentum less than 100 indicates a less directional (fast) movement, while if it is greater than 100 it is the opposite.

As we said therefore, the Relative Rotation Graph generates four quadrants. The strongest stocks can be found in the upper right corner (quadrant “On the rise”) And are the leading sectors in that market situation. They are outperforming “Weakening“, But those in the lower right quadrant have slowed compared to the benchmark and therefore are at risk of underperforming, or entering the” quadrant “Down“. In fact, if the pace of performance decreases further, the sector will begin to underperform and end up in the lower left quadrant. From here, if the sectors begin to recover momentum by moving more strongly than the benchmark, they will pass into the quadrant “Improvement”And are candidates to return to that of the“ Rising ”, as soon as they return to outperform the benchmark.

To find information on the different European sectors, visit the link.

To find information on the different American sectors, visit the link.

For more detailed information on the tool visit the link.