The release of key data exceeded market expectations, and the rate of explosions in sectors such as infrastructure and real estate that stabilized economic growth has soared recently.

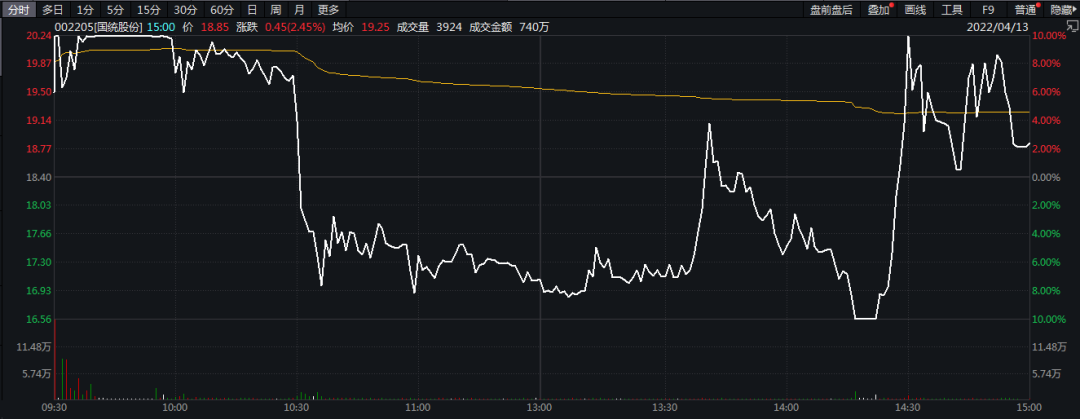

Today, the infrastructure sectorGuotong sharesAn astonishing scene was staged. After the “Tian Di Di” fell to the limit, the “Di Tian Di” staged again. It continued to fluctuate widely in the late trading, and finally closed up 2.45%, with a turnover rate close to 60%.

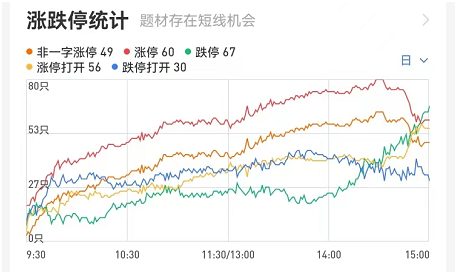

It is worth noting that the recent short-termthemeThe volatility has increased significantly. Yesterday, many stocks in infrastructure, real estate and other sectors exploded. Today, many stocks in warehousing, logistics, tourism and other sectors also exploded.

Market analysts pointed out that the explosion of short-term leading stocks of themes means that the speculation of theme stocks may come to an end, and the market may choose a new direction next. The recent rise against the trend of consumption, cycles and other themes deserve attention.

Guotong shares“Earth Floor” staged “Earth Floor”

“Heavenly Floor” and “Earth Floor” are relatively rare trends in the stock market, and it is even rarer to stage “Heavenly Floor” and “Earth Floor” at the same time in one day.

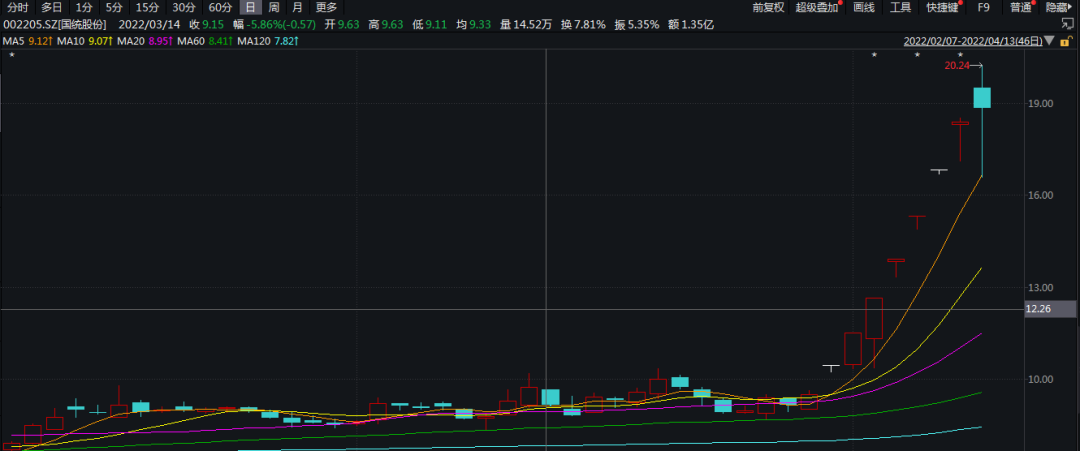

However, this scene still happened in today’s A-share market. After harvesting 6 daily limits in the previous 7 trading days,Guotong sharesThe daily limit was raised again in the early trading, but then the board exploded and continued to oscillate and fall. During the closing period, the share price of Guotong shares fell by the limit, staged a “sky floor”, but soon after the limit was closed, the share price of Guotong shares rose almost in a straight line, directly hitting the daily limit , staged the “earth floor”. Subsequently, the stock price continued to fluctuate widely, and finally closed up 2.45%, with a turnover rate of 58.95%.

Guotong sharesshareholderIt is Xinjiang Tianshan Building Materials (Group) Co., Ltd., which holds 30.21% of Guotong shares, and has not disclosed a plan to reduce its holdings recently. This also means that the circulation of Guotong shares has basically been cleaned up.

The transaction data released after the market shows that there are obvious signs of hot money speculation. The top five trading seats are all hot money.securitiesShenzhen Yitian Road,Orient SecuritiesShenzhen Hyde 3rd Road,Huatai SecuritiesNanning Minzu Avenue, HuaxinsecuritiesThe net purchase amount of business departments such as Ningbo Branch is more than 30 million yuan, whileCITIC Securities(Shandong) Dongchang East Road, Liaocheng, CapitalsecuritiesSales offices such as Shanghai Gonghexin Road are all net sales. Among them,CITIC Securities(Shandong) Liaocheng Dongchang East Road Sales Department’s net sales amount exceeded 100 million yuan.

Benefiting from the sharp rise in the infrastructure sector, Guotong shares have successively increased their daily limit. Since March 31, the company has recorded the daily limit for 6 consecutive days. On April 12, affected by the explosion of individual stocks in the infrastructure sector, Guotong shares also opened intraday. At the daily limit, it finally closed up 9.26%, with a cumulative increase of 93.68% in 7 trading days. On April 13, under the background of the overall resurgence of the hype in the infrastructure sector, Guotong shares rose by the limit again during the morning session, and then continued to fluctuate sharply.

In this regard, many netizens said that the simultaneous performance of “Heavenly Floor” and “Earth Floor” requires a very strong heart, and some netizens pointed out that stocks with a 10% daily limit actually played with a heartbeat of 40% amplitude. , it’s amazing.

In response to the recent changes in the company’s stock price, Guotong Co., Ltd. once responded, “There has been no major change in the company’s operation and internal and external operating environment recently; the company, controlling shareholders and actual controllers do not have any major issues related to the company that should be disclosed but have not been disclosed. Or a major event in the planning stage; the company’s controlling shareholder and actual controller did not buy or sell the company’s stock during the period of abnormal fluctuations in the company’s stock trading.”

The frying rate of short-term themes has soared

Recently, although the broader market has been calm, the performance of the theme sector has been amazing.

On April 12, in the infrastructure sectorTianbao InfrastructureSuddenly the frying board fell to the limit, and the “heaven floor” was staged.Anhui Construction Engineering、Kaaba DevelopmentAnd so are also fried boards.real estate sectorCCCC Real Estate、Sunshine City、Cinda Real EstateWait for the popular stocks with larger gains in the previous period to drop by the limit.

On April 13, Guotong shares in the infrastructure sector also appeared fried.Tianbao Infrastructure、Pudong ConstructionZhejiang Construction,Xinjiang Communications Construction、Beixin Road BridgeStocks in many infrastructure sectors fell by the limit. Real estate stocks also continued to plummet,Blu-ray Development、Jinbin Development、Nanguo Real Estate、Bright Real EstateWait for multiple stocks to drop by the limit.

In addition, the recently hot warehousing and logistics sector has also significantly increased the frying rate.China Reserve Shares、Tianshun shares、Changjiang Investment、China Railway SpecialMany stocks are also fried at the end of today’s session, and at the same timeXinning Logistics、Pegasus International、Chinese iron、Three sheep horseWhen more than 10 stocks still closed the daily limit, the trend of individual stocks in the sector diverged.

skyrocketed yesterdaytourist hotelThere are also many individual stocks in the sector.Zhangjiajie、Yunnan TourismWait for the plate to open several times.

Market data show that as of today’s close, a total of 56 stocks in the two cities have opened the daily limit. The analysis believes that the rate of short-term themes is high, and the themes such as consumption and cycle have performed strongly recently, and market funds may be choosing new directions.

Specifically, in the process of today’s market volatility adjustment,food and drinkMany stocks in the sector bucked the trend and pulled up.Huifa Food、come to Yifenintraday limit,plum garden、Pinwo Foods、Zhongjing FoodsWaiting for the big rise, the performance of the liquor sector is also relatively strong.golden seed wine、Huangtai WineryWait for a strong performance.

In addition, cyclical stocks are also relatively strong,non-ferrous metals、precious metalWhen stocks in the sector rose sharply,Zijin Mining、Yunnan CopperWait for a strong performance.

Analysts pointed out that the recent shift in market risk may be related to the financial data in March that significantly exceeded expectations. On April 11, China announced the scale of social financing in March, with an increase of 4.65 trillion yuan exceeding market expectations.

Kaiyuan Securities said that the market has been plagued by risk factors such as the Russian-Ukrainian conflict, repeated epidemics, and inflation of raw materials. Pessimism continued to rise in March, but the financial data released by the central bank showed a clear recovery, and the total growth rate generally exceeded market expectations. Credit has begun to bear fruit, helping to ease the market’s doubts about credit repair.

Will the market winds change?

The hype of the subject stocks has cooled down collectively, and the market wind direction may change next.

Among them, consumption and other sectors that have been continuously adjusted in the early stage may be one of the directions of capital attention.Since October last year, due to the rising cost of raw materials, many consumer goods companies have releasedannouncementAnnounced price increases, but product price increases generally lag by 1-2 quarters compared with the increase in raw material costs. Many institutions predict that the fundamentals of the consumer industry are expected to improve in the second quarter of this year.

according toGuotai JunanAccording to the research, since the end of last year, the expected profit growth rate of the consumer-related industry chain in 2022 has shown an upward trend, and the expected profit growth rate of the relevant industry chain has increased significantly in the past two weeks. The expected growth rate of the must-selected industry chain has increased by 16.2% in the past two weeks, with the largest increase;Textile and ApparelThe pharmaceutical industry chain continued to increase after the expected profit growth rate rebounded, and the expected growth rate in the past two weeks was increased by 3.8% and 1.8% respectively; the life service industry chain continued to increase by 1.7% in the past two weeks after the sharp increase in March.

Guotai JunanIt is believed that the current fundamental expectations have not improved significantly. Although the risk expectations in the short cycle “will not be worse”, it is still foggy when it “gets better”. Divergence on stable growth will make sectors that are more sensitive to the economic cycle more likely to exceed expectations, while lower valuations and supply-side (increased concentration) changes will become more favorable. Therefore, investment in the next stage will focus on stocks with low risk characteristics, focusing on cycles and consumption.

It is worth noting that in order to promote consumption growth, many local consumption promotion policies have been launched one after another recently. On April 12, the Chongqing Municipal Development and Reform Commission and other 8 departments jointly issued the “Several Policies and Measures to Promote the Recovery and Development of Consumption”, which proposed 19 measures to promote consumption from the aspects of consumption benefiting the people and benefiting the people, bulk commodity consumption, and cultural tourism. On the same day, the Beijing Municipal Bureau of Commerce issued a notice on the implementation of the green energy-saving consumption policy, and will issue consumption coupons on the online platform to encourage Beijing consumers to purchase and use green and energy-saving products.

Huatai SecuritiesIt is believed that with the subsequent announcement and implementation of the policies to promote consumption in various provinces and cities, and under the expectation of stabilizing consumption, it will bring about the restoration of the leading valuation of the industry chain.

(Article source: Securities Times)