What sectors did star fund managers quietly deploy at the end of last year? This may be a question that many ordinary investors are curious about.

Recently, a number of public funds are releasing their annual reports one after another, and a group of star fund managers’ “hidden stocks” have also surfaced one after another.

The so-called “stealth stocks with heavy holdings” usually refer to stocks with heavy holdings that are disclosed in the fund’s annual and semi-annual reports, and whose holdings are ranked 11th to 20th. The fund manager’s position adjustment operation in this range reflects his understanding of the market structure and investment opportunities, so it has a certain reference value for most investors.

On the whole, although the two cities continued to fluctuate and fell in the first quarter of this year, many fund managers believe that the difficult time for the market has passed, and they are actively exploring structural opportunities in high prosperity areas.

On March 30, the annual report of Harvest Fund disclosed that Tan Li, the investment director of Harvest Value Style, was also exposed to the “invisible heavy-holding stocks” of the fund.

Wind data shows that as of the end of 2021, Tan Li has 9 funds under management, with a scale of 31.084 billion yuan. In this year’s turbulent market, Tan Li’s performance was not satisfactory. As of March 30, the annual rate of return of its representative product Harvest New Consumption was -16.55%, and the size of the fund decreased by about 500 million compared with the previous year. Yuan.

In terms of asset allocation, Harvest New Consumer’s equity position at the end of last year was 80.72%, a decrease of 1.28 percentage points compared to the middle of last year, with obvious defensive intentions.

The fund’s top three heavyweight industries are: food and beverages, automobiles, and electronics. During the reporting period, it mainly increased its holdings in household appliances, textiles and clothing, retail, and pharmaceuticals, and reduced its holdings of some more profitable discretionary consumer stocks.

Tan Li mentioned her outlook on the large consumption industry in the annual report. She said that although the impact of the epidemic is still difficult to fade away immediately, the more important thing is the overall economic prosperity.

Tan Li pointed out: “Consumption is likely to be a passive reaction. Of course, policies to encourage consumption will still have a certain supporting effect. We believe that the must-have consumer goods have experienced high costs for a year, and it is hoped that the pressure will gradually ease in 2022. .”

Talking about investment opportunities in specific sectors, Tan Li believes that under the expectation of economic recovery, optional consumer goods will be more profitable and flexible. At the same time, if the epidemic prevention and control policies are changed, the marginal change of the service industry will be the most significant. .

Through the disclosure of the annual report, investors can also get a glimpse of the “invisible heavyweight stocks” of Harvest’s new consumption. As of the end of last year, the fund’s 11th to 20th stocks were: Great Wall Motor (601633), Tonghua Dongbao (600867), Huahai Pharmaceutical (600521), Zhou Dasheng (002867), Weixing (002003), Anjing Foods (603345), BeiGene-U, Daquan Energy, Long-Term Lithium, and National Core Technology. Among them, Weixing shares have the highest range increase. The company is a leader in the domestic zipper and button industry. As of March 30, the stock price closed at 12.55 yuan, with a total market value of 10.013 billion yuan.

(Data source: Wind)

Caixin Securities published a research report that the intelligent manufacturing and technological reform of Weixing has achieved remarkable results in recent years, which has continuously empowered the company’s brand power, and continued to expand high-quality customers while increasing the share of existing customers, driving the company’s order growth and growth. The space is vast.

Invesco Great Wall Fund Liu Yanchun: The most difficult stage of investment has passed

Liu Yanchun, the former “100 billion top stream” fund manager, also announced the annual report of his product fund under management on March 28.

Liu Yanchun, who is called “Brother Chun” by Christian Democrats, has been on the hot search list of social platforms in recent years, and his management scale exceeded 100 billion in March last year.

However, with the changes in the market, the decline in performance has also reduced Liu Yanchun’s management scale. Wind data shows that Liu Yanchun currently manages 6 funds with a scale of 97.85 billion yuan. As of March 30, its representative product Invesco Great Wall Emerging Growth (260108)’s return for the year was -23.13%.

In terms of asset allocation, as of the end of last year, Invesco Great Wall’s emerging growth positions were still “strong in wine”, and among the top ten heavyweight positions, Kweichow Moutai (600519), Luzhou Laojiao (000568), Wuliangye (000858), etc. could still be found. With the trace of liquor faucet, other heavy-holding companies are also dominated by white horse blue-chip stocks.

Liu Yanchun said in the annual report: “The most difficult stage of investment has passed. Be patient and the value will always return.”

“2022 is likely to be the beginning of the end of the new crown epidemic. From a global perspective, the investment side that lags behind the recovery of consumption is expected to gradually return to normal. At this stage, my country’s economic growth is already below the potential growth rate. Boosting domestic demand will be the focus of this year’s policy.” He analyzed the macro environment in 2022.

In Liu Yanchun’s view, industries and companies with long-term and short-term logical resonance are expected to perform well in the new year. He emphasized that outstanding companies with short-term headwinds are already extremely valuable for investment. Short-term economic fluctuations affect investors’ risk appetite in stages, and the impact on the company’s intrinsic value is actually minimal.

This idea of Liu Yanchun is also reflected in the adjustment operation. During the reporting period, Invesco Great Wall Emerging Growth’s invisible heavyweight stocks included many blue-chip targets whose valuations have fallen to a reasonable range. The holding stocks are: Shanxi Fenjiu (600809), Chenguang Co., Ltd., Yili Co., Ltd. (600887), Tigermed (300347), Aier Ophthalmology (300015), Haitian Flavor (603288), Changchun High-tech (000661), Hengrui Medicine (600276), Proya (603605), Tianwei Food (603317).

(Data source: Wind)

Among these hidden stocks, Tiger Pharmaceuticals, the largest CRO pharmaceutical company in China, deserves the attention of investors. The company’s latest annual report shows that its revenue and net profit in 2021 will double, and its main business will achieve revenue of 5.187 billion yuan during the period, a year-on-year increase of 5.187 billion yuan. An increase of 63.32%, the net profit attributable to the parent was 2.874 billion yuan, a year-on-year increase of 64.26%.

At the same time, Tigermed’s stock price has retreated by nearly half from the year’s high, and many brokerages have upgraded the stock’s investment rating. The analysis of Cinda Securities believes that Tigermed’s two major businesses, clinical trial technology, clinical research-related services and laboratory, are driven by two dual tracks, and overseas expansion has achieved initial results, promoting rapid growth in performance.

Caitong Fund Jin Zicai: Services, mandatory consumption areas or industries with a high probability of exceeding expectations

This year’s market rotation is fast, and the overall market sentiment is not high, resulting in negative performance of many active equity fund managers during the year. But there are also a group of “investment experts” who can seize the opportunity and run out quickly.

Caitong Fund veteran Jin Zicai’s performance this year is very impressive. Wind data shows that as of March 30, the Caitong Technology Innovation Fund managed by it had a return of 13.74% during the year, ranking second among 2,671 similar funds.

Judging from the disclosure of the annual report, as of the end of last year, the major industries of Caitong’s technological innovation were mainly the breeding and feed industry. ).

Jin Zicai said in the annual report that with the introduction of measures to stabilize growth, the economic low point is likely to have passed. According to his judgment, 2022 is likely to be another year of falling commodity prices, and the cost pressure of many mid- and downstream industries is expected to ease. At the same time, as domestic demand stabilizes in 2022 and the strict control of the epidemic will eventually pass, there is a high probability that inflation will gradually pick up.

In this context, Jin Zicai believes that industries with a high probability of exceeding expectations will likely appear in the fields of services and mandatory consumption. In addition to the industries he is optimistic about, some stocks in the semiconductor and photovoltaic sectors are also allocated in the portfolio of Caitong Technology Innovation.

The top ten invisible heavyweight stocks disclosed in the fund’s annual report are: China Southern Airlines (600029), Chippeng Micro, Huatong Shares (002840), BTG Hotel (600258), Xinyuan Micro, Fuling Mustard (002507), Superstar Agriculture and Animal Husbandry , Guolian Securities, GoodWe, Daqo Energy, Fengyuan (002805).

(Data source: Wind)

Invesco Great Wall Fund Yang Ruiwen: The market focus will be on technology and manufacturing

The fund annual report of Yang Ruiwen, another top fund manager of Invesco Great Wall Fund, was also disclosed at the same time.

Like Liu Yanchun, Yang Ruiwen’s performance this year was also somewhat disappointing. As of March 30, its representative product, Invesco Great Wall Select (260101), had a year-on-year rate of return of -21.38%, which was close to the bottom of the ranking of similar products.

However, Yang Ruiwen may not care so much about short-term performance. He wrote in his annual report: “Although the companies held by the portfolio are not the focus of the current market, they will continue to adhere to the growth of the companies. The market is unpredictable, regardless of the market. How to change, we still insist on investing in emerging industry companies with great prospects and growing with them, rather than seeking market hot spots with increasing trends.”

Regarding the investment opportunities that exist in the market this year, Yang Ruiwen pointed out that the white horse stocks of high-quality technology leaders and the leaders of small and medium-sized market capitalization represented by specialization and new products have greater opportunities. He believes that the performance of manufacturing companies in 2022 will be very good, and the focus of the market will be biased towards stocks related to technology and manufacturing.

Judging from Invesco Great Wall’s preferred holdings portfolio, its top ten invisible holdings during the reporting period are: Jingchen Shares (688099), Jacques Technology (002409), New Clean Energy, Anji Technology (688019), Yutong Optics, Kingsoft Office, Baolong Technology (603197), Guangfeng Technology (688007), Huayang Group (002906), XGIMI Technology.

(Data source: Wind)

Among them, the self-driving concept stocks Baolong Technology and Huayang Group have the highest range gains. In recent years, Baolong Technology has made continuous progress in the fields of automotive sensors, ADAS, air suspension, and lightweight. The millimeter-wave radar developed by the company has been mass-produced at the end of 2021, and orders are expected to be further increased in 2022. Huayang Group is one of the enterprises with the most abundant smart cockpit product lines in China, including cockpit domain controller, central control, digital instrument, HUD, digital power amplifier, electronic rearview mirror, wireless charging, digital key, fragrance system, etc.

E Fund Fund Zhang Kun: Enterprise value is reflected in the discounted free cash flow

E Fund Fund also announced its annual report on the evening of March 30. Among them, the judgment and trend of Zhang Kun, the “first brother of public offering”, aroused attention.

From the perspective of the management scale, Zhang Kun is still a fund manager of 100 billion yuan. As of the end of last year, he had 4 products under management, and the management scale reached 101.935 billion yuan. Compared with the third quarter, the change was not large, which shows that the foundation of the basic people’s “Kun brother.” “The trust remains.

In terms of asset allocation, both E Fund high-quality enterprises and E Fund blue-chip selection managed by Zhang Kun maintained a high position of nearly 95% at the end of last year, basically raising their equity positions to the upper limit stipulated in the contract. It can be seen that in his eyes many positions are held. Individual stocks may have pulled back to a reasonable range, which is the time to increase positions against the market.

However, the market conditions in the first quarter of this year were still sluggish, and Zhang Kun’s fund also suffered a considerable pullback. As of March 30, the annual returns of E Fund’s high-quality enterprises and blue-chip selections were -19.47% and -17.37%, respectively.

In the annual report disclosed this time, Zhang Kun elaborated on his views on enterprise value. He believes that the value of an enterprise is the discount of all free cash flows during its life cycle.

Zhang Kun pointed out: “When we study companies, free cash flow is always one of the financial indicators we are most concerned about. Although there will be fluctuations between years, but extended to the dimension of 5-10 years, can a company be a shareholder? It’s not hard to tell the difference in creating plenty of free cash flow.”

Regarding the “invisible heavy-holding stocks” that the market is most concerned about, the annual report shows that the 11th to 20th holding stocks of E Fund’s high-quality enterprises during the period are: Meituan-W, Bubble Mart, Focus Media (002027), Oriental Fortune ( 300059), Mengniu Dairy, Aier Ophthalmology, Times Electric, Tongce Medical (600763), Jinxin Reproductive, Honghua Digital.

The corresponding positions selected by blue chips are: Meituan-W, China Merchants Bank (600036), Bubble Mart, Focus Media, Oriental Fortune, Pien Tze Huang (600436), Aier Ophthalmology, Shanxi Fenjiu, Tiantan Biological (600161), Tongtong Strategic medical care has a certain overlap with the positions of high-quality enterprises.

(Data source: Wind, E Fund high-quality enterprise annual report)

(Data source: Wind, E Fund Blue Chip Selected Annual Report)

On the whole, Zhang Kun increased the allocation of financial and other industries at the end of last year, and medical and medical stocks such as Aier Ophthalmology, Tiantan Bio, Tongce Medical and Jinxin Reproductive were reduced.

In addition, the number of its positions in Meituan has also decreased, but it still accounts for about 4.5% of the fund’s NAV. On March 25, Meituan released its Q4 and 2021 financial reports. According to the financial report, the company’s revenue in the fourth quarter was 49.5 billion yuan, a year-on-year increase of 30.6%; the net loss was 5.339 billion yuan, and the adjusted net loss in the same period last year was 2.244 billion yuan, and the loss increased by 137.9% year-on-year. As of March 30, Meituan’s share price in Hong Kong has fallen more than 30% this year.

The valuation of invisible heavyweight stocks is still high, and “consumption + medicine” is still a good idea

Among the hidden stocks disclosed in this annual report, what are the commonalities and characteristics of the stock selection of the above-mentioned star fund managers?

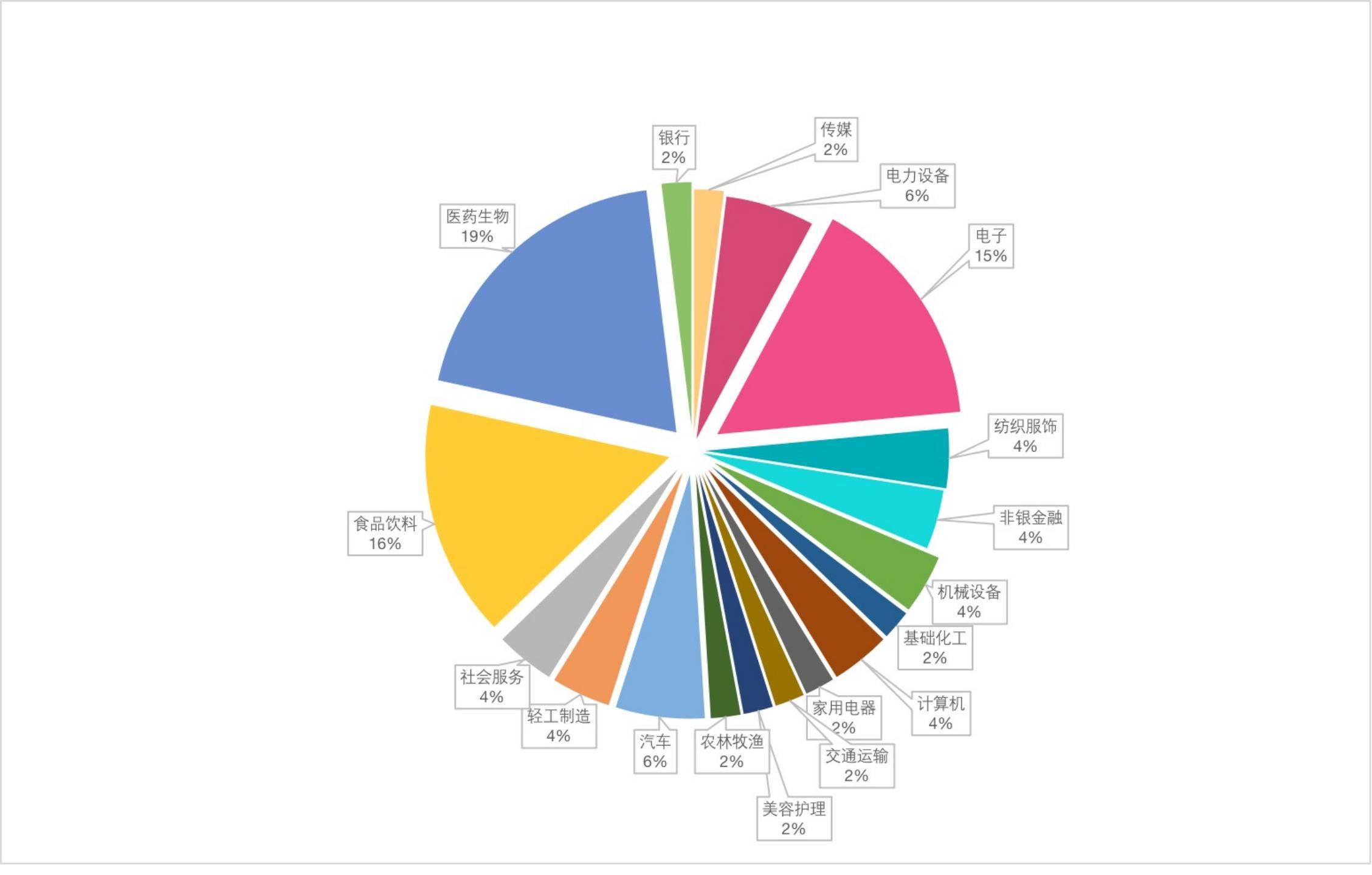

First of all, look at the industry configuration. According to the industry classification of Shenwan, the pharmaceutical and biological, food and beverage and electronics sectors are still the favorites of fund managers. These three sectors are further subdivided. Among them, the concepts of semiconductors, medical services, and biological products are more popular. The liquor stocks basically disappeared in the waist positions of the above-mentioned fund managers.

Some people in the industry pointed out that the current public offering mainly focuses on liquor faucets, and pays less attention to second- and third-tier liquor brands. However, many liquor brands in the second and third years have adopted differentiated marketing strategies in recent years to “conquer the city and conquer the land”, reflecting the excellent growth potential, which has caused a lot of attention. concern of some institutions.

(Data source: Wind Graphics: Zheng Chenye)

From the perspective of market value, most of the above-mentioned fund managers’ invisible holdings are large-cap stocks. As of March 30, the average market value of the batch of targets was 113.143 billion yuan.

However, compared with 2020, more small and mid-cap targets have entered the portfolio of fund managers, such as: lithium battery Fengyuan shares, optical lens giant Yutong Optics, and big agricultural concept hot stock Huatong shares. Some brokerage analysts believe that after the three-year bull market of white horses and blue chips, the future market may rotate around sub-sectors, and a group of “specialized and new” small and medium-sized enterprises is expected to grow rapidly.

In terms of performance, there are still some listed companies that have not disclosed their annual reports. Judging from the performance of 2020, the above companies have shown strong revenue generation and profitability, with an average revenue of 36.9 billion and a net profit of 10.1 billion. , the average gross profit margin of sales reached 77%.

However, it should be noted that although the performance is still good, the valuation level of this batch of invisible heavyweight stocks is not low. Therefore, if the performance growth of the above companies cannot successfully digest the high valuation, it will have an adverse impact on the stock price.

In general, although the two cities continued to fluctuate and decline in the first quarter of this year, many star fund managers believe that the difficult time for the market is over, and actively explore structural opportunities in high prosperity areas.

At the end of the annual report, Zhang Kun wrote: “We will always stand with the holders and strive to find some high-quality listed companies that can generate abundant free cash flow and generate free cash flow. It can grow over time. This allows the equity value of the company to grow over time, and then, over a long enough period of time, to eventually reflect in the growth of the fund’s net worth.”

[If you want to know more financial information, click to download the Hexun Finance APP, which is used by 15 million financial experts]Return to Sohu, see more